Report Overview

Piezoelectric Sensor Market - Highlights

Piezoelectric Sensor Market Size:

Piezoelectric Sensor Market, growing at a 5.98% CAGR, is forecasted to achieve USD 3.808 billion in 2031 from USD 2.687 billion in 2025.

Piezoelectric Sensor Market Trends:

The piezoelectric sensor market is poised for steady growth, driven by increasing demand for sensing technology across various industries. Piezoelectric sensors detect mechanical changes, such as pressure, force, or vibration, and convert them into electrical signals. These sensors are widely used in ultrasonic applications, healthcare, and industrial automation due to their high reliability and precision.

In healthcare, piezoelectric sensors are critical for medical imaging and patient monitoring, enabling accurate diagnostics. In industrial automation, they support process control and vibration monitoring, enhancing operational efficiency. The rise of ultrasonic technology in applications like non-destructive testing and sonar further fuels market growth. The sensors’ ability to operate in harsh environments and deliver consistent performance drives their adoption.

Key growth factors include advancements in sensor technology and the expansion of smart manufacturing. The integration of piezoelectric sensors in Internet of Things (IoT) devices and automotive systems, such as tire pressure monitoring, also boosts demand. The Asia-Pacific region, particularly China and Japan, leads due to rapid industrialization and technological innovation. As industries prioritize automation and precision sensing, the piezoelectric sensor market is set to grow, supported by its versatility and reliability.

Piezoelectric Sensor Market Drivers:

Surging healthcare sector bolsters the piezoelectric sensor market growth.

Piezoelectric sensors, due to their high sensitivity and accuracy, play a vital role in healthcare applications such as pressure sensing, ultrasound imaging, and pulse monitoring. The growing technological innovations to enhance ultrasound imaging, coupled with the booming healthcare infrastructure and medical facilities establishments, have provided a positive market outlook.

The rise in aerospace applications drives the piezoelectric sensors market growth.

Piezoelectric sensors are suitable for many aerospace applications, which deliver a range of functionality in airplanes. Due to their measurement capabilities and accuracy, piezoelectric sensors are in demand and significantly growing in the aerospace sector. Piezo accelerometers, flow meters, gyroscopes level sensors are in demand for aerospace. Various product innovations are taking place, for instance, APC International APC 850/855 for aerospace applications. It is a soft ceramic piezoelectric material used for piezo accelerometers, gyroscopes, level sensors, pressure sensors, and flow meters. This helps the aerospace industry to monitor real-time air pressure and gyroscope levels in their planes.

The booming demand in the automotive industry drives the piezoelectric sensors market expansion.

The automotive industry uses piezoelectric sensors to detect airbag deployment and collision of vehicles after an accident. Rise in awareness of vehicle safety, coupled with booming automotive demand on a global scale, has increased the demand for such types of sensors in the automotive industry to monitor tyre pressure, airbag deployment, engine management, and anti-lock braking systems (ABS). According to the International Organization of Motor Vehicle Manufacturers, in 2022, global automotive production stood at 85.01 million units, which signified an increase of 6% over 2021’s production volume of 80.5 million units.

Piezoelectric Sensor Market Geographical Outlook:

North America is expected to dominate the market

North America is projected to account for a major share of the piezoelectric sensors market owing to the region’s increasing aerospace and automotive industries. North America has advanced manufacturing capabilities in the automotive sector, which supports the growth of the piezoelectric sensor market. According to the International Organization of Motor Vehicle Manufacturers, in 2022, the USA’s automotive production reached 10.06 million units, thereby representing a 10% increase in production scale over 2021. Furthermore, major players, namely CTS Corporation, are expanding their sensor portfolio through strategic acquisitions, which is acting as an additional driving factor for regional market growth. In March 2022, CTS Corporation acquired the industry leader, TEWA temperature piezoelectric sensor. TEWA temperature sensor is an advanced manufacturer of high-quality temperature sensors. It contributes to innovation and growth in the region.

Piezoelectric Sensor Market Challenges:

High cost and maintenance will restrain the piezoelectric sensor market growth.

The growth of the piezoelectric sensor industry may be restrained by its pricing, maintenance, and calibration. High-quality piezoelectric sensors can be costly, especially for specialized applications. Cost considerations may limit their use in some industries or applications. To ensure accuracy and reliability, piezoelectric sensors require frequent calibration and maintenance, which can raise the overall cost of ownership.

Piezoelectric Sensor Market Company Products:

PCB ICP Shock Accelerometer Sensor- Piezoelectric ICP accelerometers have a high signal and the convenience of two-wire electrical connectivity. Internal mechanical isolation reduces the high-frequency stress that would otherwise be experienced by their ceramic sensing elements. Their inherent toughness allows them to be severely out of range without suffering damage.

TE Connectivity Piezo Film Sensor - TE Connectivity piezoelectric sensors provide sustainable vibration, accelerometer, or dynamic switch elements. Piezo sensors and transducers are available in a variety of packages, including cable, film, and miniature elements. Sensor features include frequency response, operating temperatures, dynamic ranges, and high mechanical strength.

Kistler Pressure Sensor- Kistler offers both piezoelectric sensors to measure pressure. Kistler piezoresistive pressure sensors can measure both static and quasi-static pressure. These pressure sensors can detect dynamic, highly dynamic, and quasi-static pressure curves or pulsations.

List of Top Piezoelectric Sensor Companies:

PCB Piezotronics Inc (Amphenol)

CTS Corporation

TE Connectivity

Kistler Group (Kistler Holding AG)

Sensor-Works Ltd

Piezoelectric Sensor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

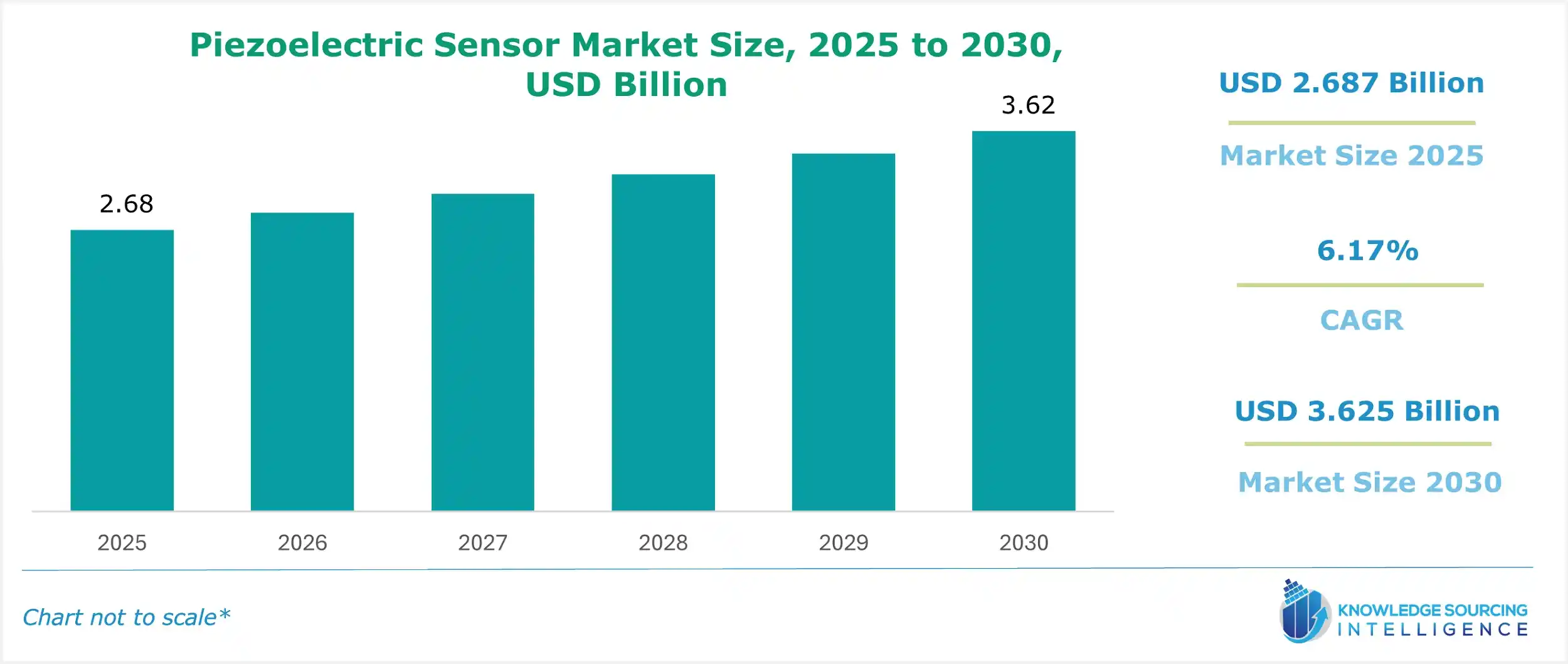

Piezoelectric Sensor Market Size in 2025 | USD 2.687 billion |

Piezoelectric Sensor Market Size in 2030 | USD 3.625 billion |

Growth Rate | CAGR of 6.17% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Piezoelectric Sensor Market |

|

Customization Scope | Free report customization with purchase |

Segmentation:

By Type

Pressure Sensor

Accelerometer Sensor

Pin-type Sensor

Force Sensor

By Product Type

Piezo Cables

Piezo Films Sheets

Piezo Switches

By End-User

Automobile

Aerospace & Defence

Medical & Healthcare

Electrical & Electronics

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others