Report Overview

Pressure Control Valves Market Highlights

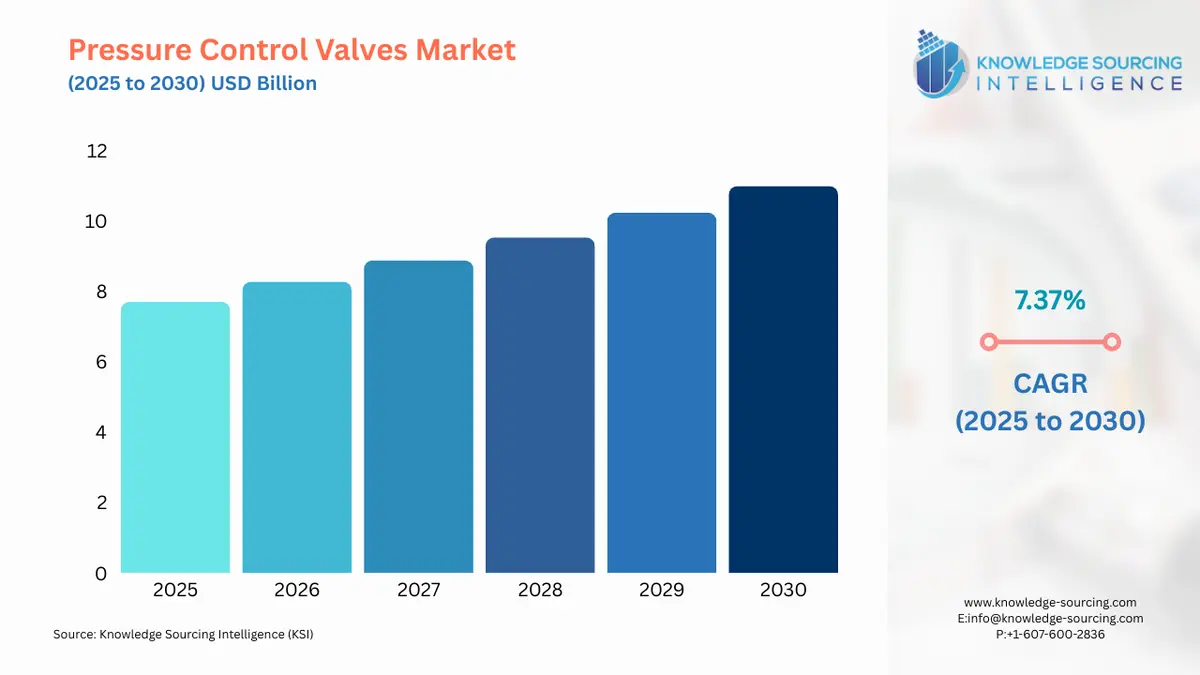

Pressure Control Valves Market Size:

Pressure Control Valves Market is expected to grow at a 7.15% CAGR, achieving USD 11.657 billion in 2031 from USD 7.703 billion in 2025.

Pressure control valves are mechanical devices designed to regulate and control the fluid pressure within a system. The different types of pressure control valves include pressure relief valves, pressure reducing valves, sequencing valves, and counterbalance valves, which are used in the aerospace & defense, industrial, mining, and oil & gas sectors to regulate fluid pressure in equipment and enhance their performance. The increase in oil & gas production and the rise in mining operations are boosting the demand for pressure control valves, thereby expanding the pressure control valves market size and propelling the overall pressure control valves industry growth.

Pressure Control Valves Market Growth Drivers:

Rising oil & gas production

In the oil & gas sector, pressure control valves are essential for ensuring the safe and effective operation of blowout preventers, wellheads, and separators by regulating fluid pressure and preventing leaks. The increasing global oil & gas demand, along with investments to improve oil & gas plants, is bolstering the pressure control valve market growth. According to the International Energy Agency in 2023, the global oil demand is expected to increase by 2 mb/d in 2023 to a record 101.9 mb/d. Furthermore, in March 2022, the Oil Board of India approved an investment of Rs. 6,555 crores (US$839.49 million) for the Numaligarh petrochemical project to improve production.

Increased mining activities

Pressure control valves regulate the pressure of hydraulic fluids in mining equipment such as excavators, loaders, and drilling rigs, which in turn enhances equipment performance and worker safety. Growing mining production and favorable investments for boosting mining activities will propel the pressure control valve industry growth. According to the United States Geological Survey (USGS), 2022, the commodities produced from the USA mines were approximately $98.2 billion in 2022, which was a 3.8% increase over 2021. In addition, the World Bank in 2022 estimated an investment of $1.7 trillion for global mining from low and middle-income countries that could contribute to economic growth.

Pressure Control Valves Market Geographical Outlook:

Asia Pacific is expected to hold a significant market share.

Asia-Pacific is predicted to constitute a significant share of the pressure control valve market due to the presence of key mining nations, coupled with the favorable investment inflows to improve oil & gas operations. In 2020, the Indian state committee recommended the expansion of Vedanta Ltd’s Lanjigarh Alumina mines from 1 million tonnes to 6 million tonnes with an investment of US$993 million. In 2022, Sinopec announced to invest 81.5 billion yuan in the crude oil bases in Shunbei & Tahe fields, and natural gas fields in Sichuan province. These developments will accelerate the pressure control valve usage for smooth operations of machinery, thereby boosting the regional pressure control valves market size.

Pressure Control Valves Market Restraints:

Pressure control valves are manufactured using various materials, including metals and polymers. Fluctuations in the prices of these raw materials can impact the manufacturing costs of valves. If the prices of raw materials increase significantly, it may result in higher production costs, which can potentially reduce demand or lead to increased valve prices, constraining the pressure control valve market growth. Changes in regulatory standards related to safety, emissions, and environmental compliance can also negatively impact the pressure control valves industry, as it may require companies to upgrade their equipment or adopt new technologies, which can result in changes in valve specifications or requirements.

Global Pressure Control Valves Market is analyzed into the following segments:

By Type

Pressure Relief Valves

Pressure Reducing Valves

Sequencing Valves

Counterbalance Valves

Others

By Material

Brass

Stainless Steel

Titanium

Others

By Medium

Liquid

Gas

By End-User

Aerospace & Defense

Oil & Gas

Waste Water Treatment

Energy & Power

Mining

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others