Report Overview

Pressure Regulator Market - Highlights

Pressure Regulator Market Size:

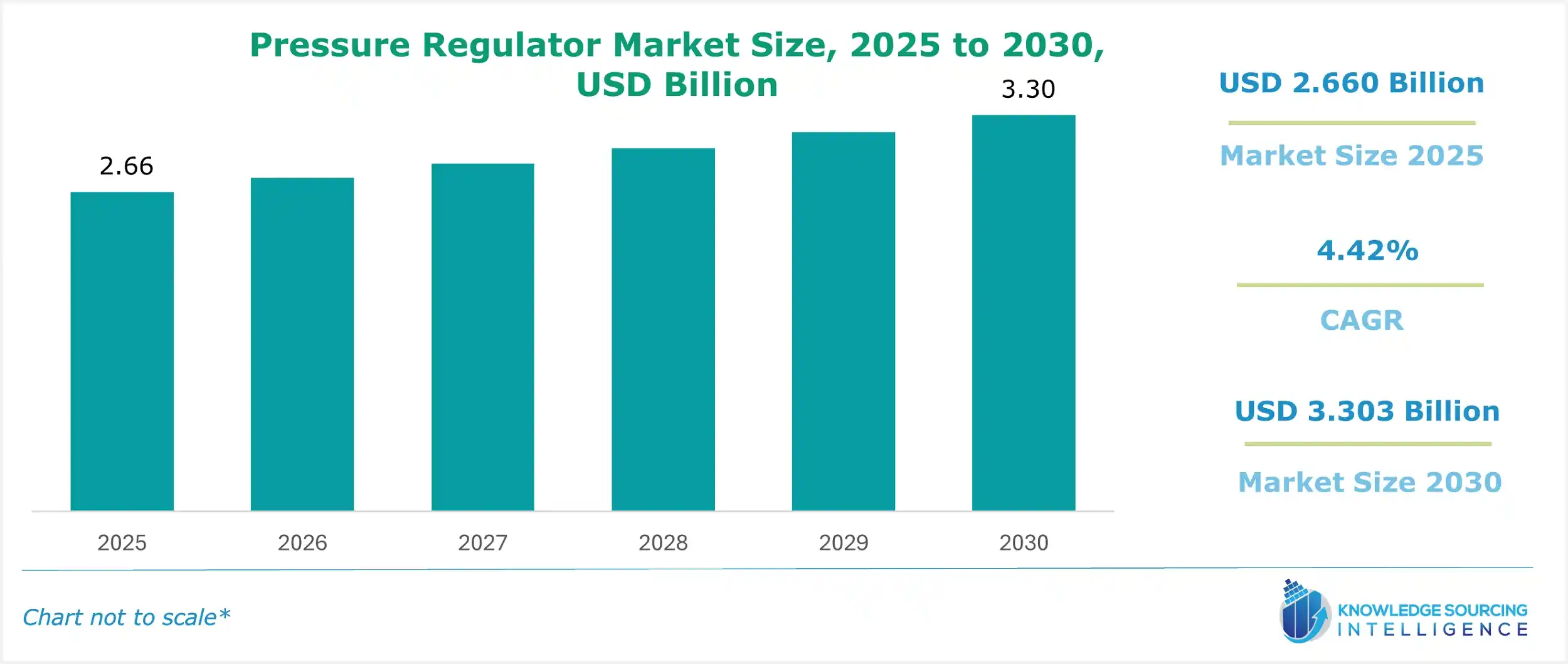

Pressure Regulator Market, with a 4.29% CAGR, is projected to grow from USD 2.660 billion in 2025 to USD 3.422 billion in 2031.

Pressure Regulator Market Trends:

The pressure regulator market is poised for steady growth, driven by increasing demand across multiple industries. Pressure regulators are essential for pressure management, efficiently reducing high input pressures to safe, usable output levels for liquids and gases. These devices are critical in sectors such as oil & gas, water treatment, chemicals, pharmaceuticals, and manufacturing, ensuring operational safety and efficiency.

The market is segmented into back-pressure regulators, which maintain upstream pressure, and pressure reduction regulators, which lower downstream pressure. Growth in pharmaceuticals, driven by rising global healthcare needs, and chemicals, fueled by industrial applications, significantly boosts demand. The oil & gas sector also plays a key role, as pressure regulators are vital for safe handling of high-pressure fluids in exploration and refining processes. Additionally, water treatment facilities rely on these devices to manage pressure in purification systems, supporting global sustainability efforts.

Key drivers include industrial expansion and stringent safety regulations, which mandate precise pressure control to prevent equipment damage and ensure worker safety. Technological advancements, such as smart pressure regulators with real-time monitoring, enhance efficiency and reliability, further propelling market growth. The Asia-Pacific region, particularly China and India, leads due to rapid industrialization and infrastructure development. Despite challenges like high initial costs, the pressure regulator market is set to expand as industries prioritize operational efficiency and regulatory compliance.

Pressure Regulator Market Segment Analysis:

Expanding the oil & gas sector enhances the pressure regulator market size.

Pressure regulators are vital for maintaining optimal operating conditions, safeguarding pipelines, refineries, and processing facilities, and ensuring personnel safety and environmental protection. The oil and gas industry is expanding owing to the surge in global oil demand and the implementation of exploration projects. According to the U.S. Energy Information Administration, in December 2021, oil production in the United States stood at 11.6 million b/d, which signified an increase of 3.6% from 11.2 million barrels per day (b/d) in December 2020. During the same period, natural gas production also increased from 112.6 billion cubic feet per day (Bcf/d) to 118.7 Bcf/d.

The rising pharmaceutical sector is driving the pressure gauge market growth.

The pharmaceutical industry's requirements for precise and consistent pressure control in manufacturing processes drive the demand for pressure regulators. These regulators play a vital role in ensuring drug safety, quality, and efficacy by maintaining stable pressure conditions throughout various production stages. As the pharmaceutical industry grows, the need for reliable pressure regulators becomes crucial, making it a key driver for the pressure regulator market growth. According to the report of the Centers for Medicare & Medicaid Services In 2021, Medicare spending in the United States witnessed a notable increase of 8.4%, reaching a total of $900.8 billion. This amount accounted for approximately 21% of the total National Health Expenditure (NHE).

The booming chemical industry bolsters the pressure regulator market growth.

The chemical industry involves the handling and processing of various gases and liquids under specific pressure conditions, and the demand for reliable and efficient pressure regulators becomes crucial as they help in maintaining consistent and controlled pressure in chemical processes, ensuring safety. With the growth of the chemical sector and its expanding applications, demand for pressure regulators has increased. According to the Department of Chemicals and Petrochemicals, the annual growth of production for major chemicals between 2019 and 2020 was 3.06% compared to the previous year, whereas, on the other hand, basic major Petrochemicals demonstrated an annual growth of 17.04% over the preceding year.

Pressure Regulator Market Geographical Outlook:

The Asia-Pacific region is expected to account for a significant market share

The Asia Pacific region's expansion of oil and gas exploration, production, and refining activities, led to a higher demand for pressure regulators for safe operations, and the region's rapidly growing healthcare sector is further propelling the market growth. For instance, as per the India Brand Equity Foundation. Diesel demand in India is projected to double to 163 million metric tons (MT) by 2029-30, and diesel and gasoline are expected to account for 58% of the country's total oil demand by 2045. Meanwhile, China's medical device market is expected to drive the market value to reach $48.8 billion by 2026, according to the International Trade Administration.

Pressure Regulator Market Growth Drivers:

Alternative availability is constraining the pressure regulator market growth.

One of the key factors restraining the growth of the pressure regulator industry is the availability of alternative technologies or solutions. Alternative methods for pressure control, such as electronic or digital pressure control systems, may emerge as substitutes for traditional pressure regulators. These alternative technologies may offer advantages such as higher precision, automation capabilities, and integrated control features. For instance, in January 2021, Honeywell introduced a next-generation digital cabin pressure control and monitoring system for aircraft. This advanced system weighs less than six pounds, making it 30% lighter than its previous version. It also features a new, smaller digital controller that enables easy integration of future upgrades.

Pressure Regulator Market Company Products:

Fisher CSB700 Pressure Reducing Regulator: Emerson Electric offers the CSB700 Series, a range of direct-operated, spring-loaded regulators designed to cater to a wide range of pressure-reducing applications. These regulators are engineered with versatility in mind, offering various body sizes, end connections, and external pressure registration for flexible installation. The CSB700 Series also provides multiple overpressure protection options, ensuring compatibility with diverse application requirements.

J78R, 60DJ: Honeywell International Inc.’s “J78R, 60DJ” gas product offers advanced features for optimal performance. The J78R model is equipped with an inlet pressure compensation diaphragm, ensuring precise pressure regulation even in fluctuating inlet pressure conditions. Additionally, the product includes a zero shut-off feature, providing a reliable and secure shut-off mechanism for enhanced safety and control.

SBPR: Go Regulator presents the SBPR Series, a purpose-built sub-atmospheric back pressure regulator engineered to deliver accurate and precise control of upstream vacuum conditions. With its specialized design, the SBPR Series ensures reliable and precise regulation for maintaining optimal vacuum levels.

Pressure Regulator Companies:

Emerson Electric Co

Honeywell International Inc.

Eaton Corporation

Swagelok Company

SMC Corporation

Pressure Regulator Market Scope:

Report Metric | Details |

Pressure Regulator Market Size in 2025 | USD 2.660 billion |

Pressure Regulator Market Size in 2030 | USD 3.303 billion |

Growth Rate | CAGR of 4.42% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Pressure Regulator Market |

|

Customization Scope | Free report customization with purchase |

Pressure Regulator Market Segmentation:

By Type

Back Pressure Regulator

Pressure Reduction Regulator

Others

By Material

Brass

Aluminum

Plastic

Stainless Steel

By Media Type

Liquid

Gas

By End-User

Oil & Gas

Chemical

Water Treatment

Pharmaceuticals

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others