Report Overview

Redox Flow Battery Market Highlights

Redox Flow Battery Market Size:

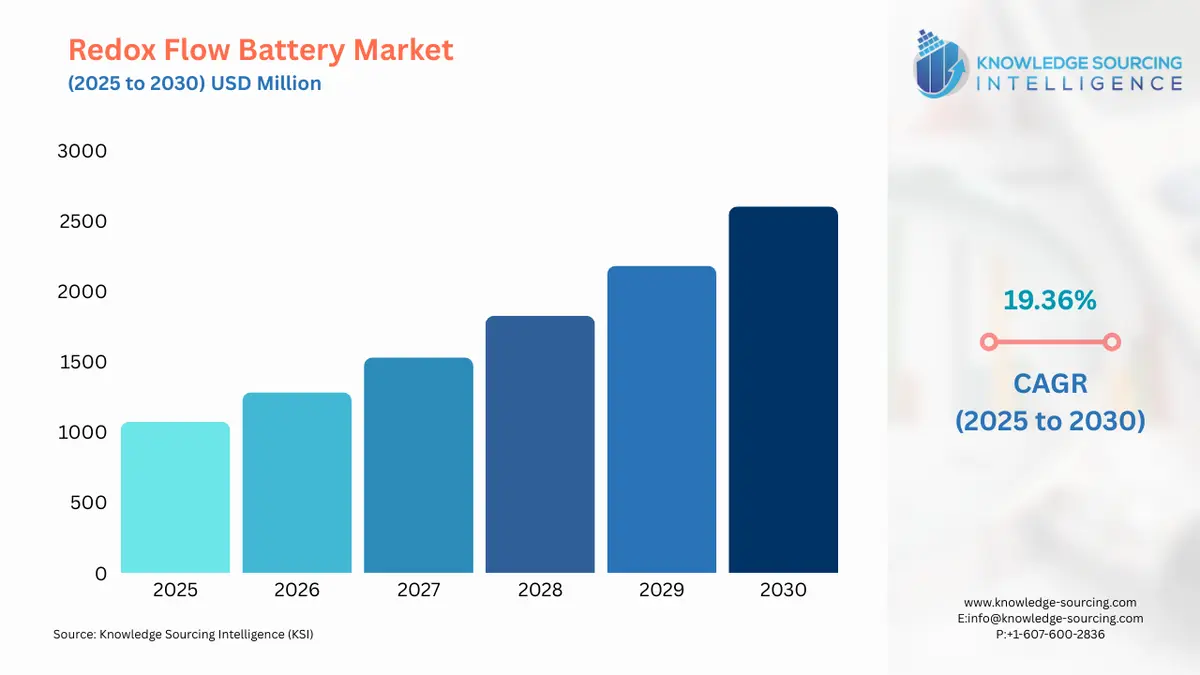

The Redox Flow Battery Market is projected to grow at a CAGR of 19.36% through 2030, reaching a market size of US$2,602.864 million by 2030 from US$1,074.456 million in 2025.

The redox flow battery market is rapidly emerging as a critical segment within the global energy storage industry, driven by the need for scalable, long-duration solutions to support sustainable energy systems. Redox flow batteries (RFBs) are electrochemical energy storage systems that store energy in liquid electrolytes, separated by a membrane, allowing independent scaling of power and energy capacity. Unlike conventional batteries, RFBs decouple power (determined by the stack size) from energy (determined by electrolyte volume), making them ideal for large-scale applications like grid stabilization and renewable energy integration.

The market is gaining traction due to increasing investments in sustainable energy systems, stringent energy storage policies, and advancements in battery cost reduction. Redox flow batteries, particularly vanadium-based systems, are gaining prominence in the transition to clean energy, as they address the intermittency of renewable sources like solar and wind. Their ability to store energy for extended periods (6–12 hours or more) without significant degradation makes them suitable for utility-scale applications, such as load leveling, peak shaving, and grid stabilization. The redox flow battery market is supported by global efforts to reduce carbon emissions, with governments and industries prioritizing sustainable energy systems. For instance, in September 2024, VRB Energy secured USD 55 million to establish a U.S.-based vanadium redox flow battery manufacturing facility in Arizona, reflecting growing investment in domestic production. Additionally, in June 2024, Invinity Energy Systems commissioned a 4 MWh vanadium flow battery for a solar microgrid project in California, showcasing practical applications in renewable integration. The market is also influenced by energy storage policies that incentivize long-duration storage. For example, the U.S. Department of Energy’s Long-Duration Energy Storage program supports RFB deployment to enhance grid reliability. The versatility of RFBs extends beyond utilities to applications in electric vehicle (EV) charging stations and data centers, driven by their battery safety and long cycle life. Unlike traditional batteries, RFBs use non-flammable, water-based electrolytes, reducing fire risks and enabling safe deployment in densely populated areas. Several factors propel the market:

Renewable Energy Integration: The global shift toward renewables necessitates robust energy storage to manage intermittency, with RFBs excelling in long-duration storage for solar and wind energy.

Battery Cost Reduction: Advances in manufacturing and electrolyte optimization, such as Sumitomo Electric’s 30% cost-reduced vanadium RFB unveiled at ESNA 2025, drive affordability.

Energy Storage Policy: Government incentives, like China’s 2021–2025 Five-Year Plan mandating storage for renewable projects, boost RFB adoption.

Battery Safety: RFBs’ non-flammable electrolytes make them safer for urban and industrial applications, increasing their appeal over other technologies.

Despite growth, the market faces challenges

Supply Chain Volatility: Dependence on materials like vanadium, with 62% of global supply from China, poses risks due to price fluctuations and geopolitical factors.

High Initial Costs: Despite battery cost reduction, RFBs require significant upfront investment for large-scale systems, limiting adoption in cost-sensitive markets.

Comparison with Lithium-Ion Batteries

Redox flow batteries offer distinct advantages and challenges compared to lithium-ion batteries, the dominant energy storage technology. Battery safety is a key differentiator: RFBs use water-based electrolytes, minimizing fire risks, while lithium-ion batteries, with flammable organic electrolytes, pose safety concerns in large-scale applications. RFBs also excel in long-duration storage (6–12 hours), as their energy capacity scales cost-effectively by increasing electrolyte volume, whereas lithium-ion costs rise proportionally with storage duration due to additional cell requirements. However, lithium-ion batteries have higher energy density, making them compact and suitable for short-duration applications like EVs and consumer electronics. RFBs’ lower energy density requires larger footprints, limiting their use in space-constrained settings. Battery cost reduction is progressing for RFBs, but lithium-ion benefits from mature supply chains and economies of scale, making it cheaper for smaller-scale applications. Supply chain volatility affects both lithium-ion relies on lithium and cobalt, while RFBs depend on vanadium, both subject to geopolitical and price risks. Raw material sourcing for RFBs is being addressed through innovations like Redox One’s iron-chromium RFB, which avoids vanadium dependency. Overall, RFBs are better suited for stationary, long-duration storage, while lithium-ion dominates compact, short-duration applications.

Redox Flow Battery Market Overview

The Redox Flow Battery (RFB) Market is estimated to grow significantly during the mentioned timeframe due to the rising demand for long-duration batteries for energy storage in renewable energy systems. Its properties, like longer shelf life, high energy storage duration, and others, along with safety, make its demand competitive with alternatives. Additionally, the increasing government support and policies for energy storage are leading to market growth. The global push for renewable energy, driven by commitments like the Paris Agreement, is increasing the adoption of solar and wind power, fueling demand for energy storage systems capable of long-duration storage. Redox flow batteries, such as vanadium-based ones, offer 6 to 10 hours of storage, making them increasingly sought after to meet energy storage needs. The market is moving toward alternative chemistries like hybrid, iron redox, and polysulfide-bromide redox batteries. This transition is driven by the need for cost-effective solutions and reducing dependence on vanadium, fostering innovation in the energy storage sector. The Asia-Pacific region is expected to experience significant growth and maintain market dominance, led by China, Japan, and South Korea. Factors such as expanding renewable energy adoption, industrialization, and strong government support are driving the market. China's dominance in vanadium production further strengthens the region's position. In September 2024, VRB Energy, a vanadium redox flow battery manufacturer, announced plans to construct two factories in China: one in Changzhi City, Shanxi province, with a 300MW annual capacity, and another in Huaihua with a 200MW annual capacity. Some of the major players covered in this report include Invinity Energy Systems plc, VRB Energy Inc., Sumitomo Electric Industries Ltd., ESS Tech Inc., Largo Inc., and Redflow Limited, among others.

Redox Flow Battery Market Trends

The redox flow battery market is experiencing dynamic growth, driven by the need for long-duration energy storage to support renewable energy integration. Vanadium redox flow batteries (VRFBs) dominate due to their long lifespan and scalability, with innovations like Sumitomo Electric’s 30-year lifespan VRFB unveiled in February 2025, offering up to 10 hours of storage. Zinc-bromine batteries are gaining traction for their cost-effectiveness and use of abundant materials, reducing reliance on vanadium. Iron flow batteries, including all-iron RFBs, are emerging as sustainable alternatives, with Redox One developing iron-chromium systems to bypass vanadium supply constraints. Organic redox flow batteries and membrane-free RFBs represent next-gen flow batteries, promising lower costs and higher energy densities. In April 2025, XL Batteries commissioned a grid-scale organic redox flow battery in Houston, showcasing advancements in alternative electrolytes. These trends highlight a shift toward diverse chemistries and cost-effective, scalable solutions to meet global energy storage demands.

Redox Flow Battery Market Growth Drivers vs. Challenges

Drivers:

Rising Demand for Renewable Energy Integration: The redox flow battery market is propelled by the global push for renewable energy integration, where long-duration storage is critical to manage the intermittency of solar and wind power. Vanadium redox flow batteries (VRFBs) excel in utility-scale storage, providing 6–12 hours of energy to stabilize grids. For example, Invinity Energy Systems delivered a 4 MWh VRFB for a California solar microgrid power project, demonstrating its role in renewable integration. Applications like peak demand shaving and ancillary services, such as frequency regulation, further drive adoption, as RFBs maintain consistent performance over thousands of cycles. The ability to support off-grid solutions in remote areas and C&I energy storage for commercial facilities enhances their appeal, aligning with global decarbonization goals and increasing demand for reliable, scalable energy storage solutions.

Supportive Energy Storage Policies: Government-led energy storage policies are a significant driver, incentivizing the deployment of redox flow batteries to support sustainable energy systems. Policies like the U.S. Department of Energy’s Long-Duration Energy Storage program promote RFBs for utility-scale storage and microgrid power, enhancing grid reliability. In China, the 2021–2025 Five-Year Plan mandates energy storage for renewable projects, boosting demand for VRFBs and iron flow batteries. These policies encourage investments in C&I energy storage and EV charging station storage, where RFBs’ long lifespan and safety are advantageous. For instance, VRB Energy secured funding to establish a U.S. manufacturing facility, supported by policy-driven incentives for domestic production. Such initiatives drive market growth by fostering innovation and deployment.

Advancements in Battery Safety and Longevity: The inherent battery safety of redox flow batteries, particularly VRFBs and organic redox flow batteries, drives market growth due to their non-flammable, water-based electrolytes, making them ideal for urban and industrial settings. Unlike lithium-ion batteries, RFBs pose minimal fire risks, supporting applications like EV charging station storage and C&I energy storage. Their long cycle life, often exceeding 20,000 cycles, suits peak demand shaving and ancillary services. In April 2025, XL Batteries commissioned a grid-scale organic redox flow battery in Houston, highlighting safety and longevity for large-scale projects. These attributes make RFBs a preferred choice for microgrid power and off-grid solutions, driving adoption in regions prioritizing safe, durable energy storage solutions for renewable integration and grid resilience.

Challenges:

Supply Chain Volatility: Supply chain volatility remains a significant restraint for the redox flow battery market, particularly for VRFBs, which rely heavily on vanadium, a material with a concentrated global supply primarily from China. Fluctuations in vanadium prices and geopolitical risks disrupt raw material sourcing, impacting production costs and scalability. A 2025 report highlighted that 62% of vanadium supply originates in China, posing risks for manufacturers. While innovations like all-iron RFBs and organic redox flow batteries aim to reduce dependency on vanadium, these technologies are still scaling. This restraint limits market growth, particularly for utility-scale storage projects requiring consistent supply chains, and challenges manufacturers to diversify sourcing or develop alternative chemistries.

High Initial Capital Costs: Despite advancements in battery cost reduction, redox flow batteries face high initial capital costs, hindering widespread adoption. The complex infrastructure required for large-scale systems, including electrolyte tanks and stacks, increases upfront expenses compared to lithium-ion batteries. This is particularly challenging for C&I energy storage and off-grid solutions in cost-sensitive markets. While next-gen flow batteries like membrane-free RFBs aim to lower costs, the market remains capital-intensive. For example, Stryten Energy’s joint venture with Largo Inc. in February 2025 to produce U.S.-sourced vanadium electrolyte addresses cost and supply issues but requires significant investment. High costs limit penetration in emerging markets, restraining growth despite RFBs’ advantages in battery safety and longevity for applications like peak demand shaving.

Redox Flow Battery Market Segmentation Analysis

Vanadium Redox Flow Battery (VRFB) is experiencing increasing demand

Vanadium redox flow batteries (VRFBs) dominate the redox flow battery market due to their proven reliability, long cycle life (often exceeding 20,000 cycles), and scalability for long-duration energy storage. VRFBs use vanadium electrolytes in multiple oxidation states, ensuring stability and minimal degradation, making them ideal for utility-scale energy storage and renewable energy integration. Their ability to decouple power and energy capacity supports applications like microgrids and off-grid solutions. In September 2024, VRB Energy secured USD 55 million to establish a U.S.-based VRFB manufacturing facility, highlighting its market leadership and focus on domestic production. The widespread adoption of VRFBs in projects like Invinity Energy Systems’ 4 MWh solar microgrid battery in California underscores their dominance, driven by battery safety and compatibility with sustainable energy systems.

By Application, the Utility-scale Energy Storage segment is rising rapidly

The utility-scale energy storage segment leads the redox flow battery market, driven by the need for long-duration storage to stabilize grids and integrate renewable energy. VRFBs and iron flow batteries excel in providing 6–12 hours of storage, supporting peak demand shaving and ancillary services like frequency regulation. For instance, Invinity Energy Systems commissioned a 4 MWh VRFB for a California solar project, demonstrating its role in large-scale grid applications. This segment benefits from energy storage policies, such as the U.S. Department of Energy’s Long-Duration Energy Storage program, which promotes RFBs for grid reliability. The scalability and battery safety of RFBs make them a preferred choice for utilities aiming to enhance grid resilience and support renewable energy goals.

The Utilities industry is expected to grow significantly

The utilities sector is the largest end-use industry for redox flow batteries, driven by the global transition to sustainable energy systems and the need for reliable grid storage. VRFBs and next-gen flow batteries are widely deployed for utility-scale energy storage, enabling load leveling, renewable integration, and ancillary services. For instance, Stryten Energy and Largo Inc. formed Storion Energy to produce vanadium electrolyte for VRFBs, strengthening the supply chain for utility applications. Utilities benefit from RFBs’ long lifespan and battery safety, critical for large-scale installations in urban and rural grids. Supportive energy storage policies, such as China’s 2021–2025 Five-Year Plan mandating storage for renewable projects, further drive adoption in this sector, solidifying utilities as the dominant end-use industry.

Redox Flow Battery Market Key Developments

In February 2025, Sumitomo Electric unveiled an advanced vanadium redox flow battery (VRFB) at Energy Storage North America. The new system features significant improvements, including a 15% increase in energy density to reduce its physical footprint and a 30% reduction in overall costs. By utilizing newly developed materials, the company has also extended the battery's operational lifespan to a remarkable 30 years with proper maintenance, further enhancing its long-term cost-effectiveness for grid-scale energy storage applications.

In December 2024, Stryten Energy, a US-based energy storage solutions provider, and Largo Inc. announced a joint venture to form Storion Energy, LLC. This new company is designed to establish a domestic supply chain for vanadium redox flow batteries in the United States. Storion Energy will provide domestically manufactured, price-competitive vanadium electrolyte via a unique leasing model, aiming to lower the barrier to entry and accelerate the adoption of VRFB technology for long-duration energy storage.

In September 2024, VRB Energy, a global leader in vanadium redox battery technology, secured a $55 million investment to establish a new grid-scale vanadium redox flow battery manufacturing facility in Arizona, USA. The investment, with $20 million earmarked for the facility, is a significant step toward expanding the company's manufacturing capacity in North America. This move aims to localize the supply chain and meet the growing demand for long-duration energy storage solutions in the US.

In June 2024, Singapore-based VFlowTech announced the launch of a new manufacturing facility for vanadium redox flow batteries in Palwal, Haryana, India. The 40,000-square-foot facility, with a current annual capacity of 100 MWh, marks a major expansion for the company. The goal of the new facility is to reduce production costs and improve quality control, supporting India's push for a more sustainable and self-reliant energy infrastructure.

Redox Flow Battery Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1,074.456 million |

| Total Market Size in 2030 | USD 2,602.864 million |

| Forecast Unit | Billion |

| Growth Rate | 19.36% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Component, Power, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Redox Flow Battery Market Segmentation:

By Type

Vanadium Redox Flow Battery (VRFB)

Zinc-Bromine Flow Battery

Iron Flow Battery

Hybrid Flow Battery

Other

By Component

Electrolyte

Electrodes

Membranes

Others

By Power

<100 kW

100 kW-1 MW

>1 MW

By Application

Utility-scale Energy Storage

Renewable Energy Integration

Microgrids and Off-grid solutions

Commercial & Industrial (C&I) Facilities

Telecom & Data Centers

Military and Remote Applications

By End-Use Industry

Utilities

Commercial & Industrial

Government & Defense

Mining

Educational & Research Institutes

By Region

North America

USA

Mexico

Others

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East & Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Others