Report Overview

Sodium Ion Battery Market Highlights

Sodium Ion Battery Market Size:

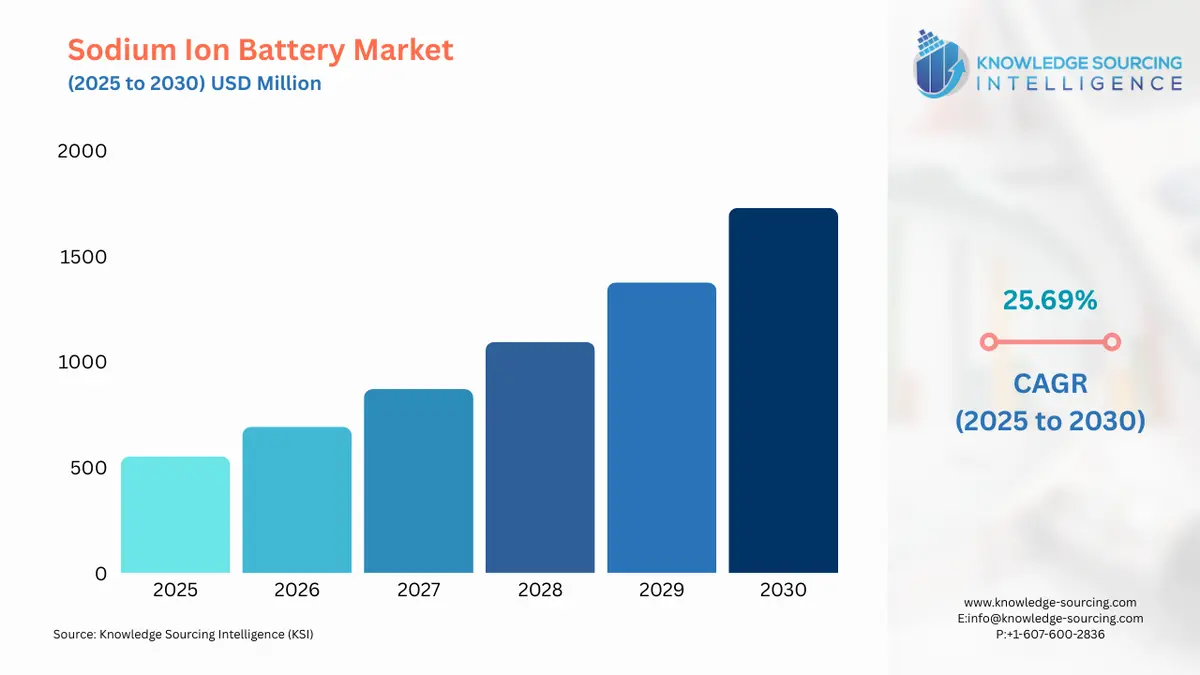

Sodium Ion Battery Market is expected to grow at a 24.92% CAGR, achieving USD 2092.96 million in 2031 from USD 550.787 million in 2025.

Sodium Ion Battery Market Trends:

Sodium-ion batteries are an emerging technology with potential applications in energy storage. These are rechargeable and work based on the movement of ions between two electrodes, an anode, and a cathode, during charging and discharging cycles. Increasing demand for clean energy along with the rising environmental concern and easy accessibility of sodium is expected to propel the sodium ion battery market. Moreover, the increasing demand for electric vehicles around the globe coupled with government efforts and technological advancements are further contemplated to bolster the sodium ion battery market.

Sodium Ion Battery Market Growth:

Increasing Demand for Clean Energy

Sodium-ion batteries can play a significant role in the clean energy transition by addressing the intermittency issue of renewable energy sources. It helps to balance the supply and demand of electricity and ensures a stable and reliable power grid, even when renewable energy sources are not actively generating electricity. Therefore, the rising demand for clean energy is contemplated to bolster the sodium ion battery market. For instance, the installed solar PV capacity worldwide grew by 19% from the previous year to 843 GW in 2021, according to the IRENA. Moreover, the IEA estimates that by 2050, solar PV, wind, and hydropower will generate around 80% of the world's electricity.

Low-Cost Substitute for Lithium-Ion Batteries

The low cost and easy accessibility of sodium could potentially lead to more affordable sodium-ion batteries, making them an attractive option for energy storage applications. Sodium is widely abundant than lithium which makes it relatively cheaper as compared to scarce lithium availability in just a few locations. Moreover, manufacturers and customers can benefit from sodium-ion battery use in a variety of ways, including improved safety, wider temperature range usefulness, more inexpensive pricing, and lightweight.

Increasing Demand for Electric Vehicles

Electric vehicles (EVs) and sodium-ion batteries are connected through the application of advanced energy storage technologies in the automotive industry. The increasing adoption of EVs is therefore expected to propel the sodium ion battery market. For instance, the share of EV sales increased from 2.2% in 2020 to 4.6% in 2021 as per the International Energy Agency (IEA). Moreover, To hasten the adoption of electric cars, the EV30@30 Campaign was introduced during the 8th Clean Energy Ministerial Conference in 2017. It establishes a collective aspirational target of 30% market share for electric cars in the total vehicle sales (excluding two-wheelers) by 2030 for all members of the Electric Vehicle Initiative.

Rising R&D and Investments

Continuous research and technological advancements in sodium-ion battery technology are leading to improved performance, higher energy density, and longer cycle life. This in turn is accelerating the sodium ion battery market. For instance, the Department of Energy's Advanced Research Projects Agency-Energy granted Natron Energy, USD 19.9 million in September 2020 as part of a new initiative to expedite the development of technologies to accelerate their commercialization efforts. ?Moreover, research was conducted by the Chinese Academy of Sciences in collaboration with Zhengzhou University in February 2023 which reported the synergetic effect in the well-constructed interface which boosts the reversible sodium storage capacity.

Government and Institutional Support

Government policies and incentives aimed at promoting sustainable and clean energy technologies are also playing a role in driving the adoption of sodium-ion batteries. For instance, in the statement published in April 2021, the Ministry of Industry and Information Technology (China) stated that it was working to incorporate sodium-ion batteries into the pertinent development planning and major science and technology support program during the "14th Five-Year Plan" timeframes. Additionally, NEXGENNA received UK government funding of £11.5 million for the project to improve energy storage by developing a next generation of sodium-ion batteries which was started in 2019 and is expected to be completed by September 2023.

Sodium Ion Battery Market Restraints:

Despite the high potential of sodium-ion batteries, particularly in grid-scale applications, several challenges need to be addressed before they can be considered commercially viable which are expected to limit the sodium-ion battery market. For instance, sodium-ion batteries are susceptible to air and any contaminants that could develop on the surface of iron- and magnesium-containing cathodes. This raises the possibility of water intrusion, which might impair battery performance. Moreover, the electrolyte for sodium-ion batteries needs to be sufficiently durable for grid-scale usage, which presents another problem.

Sodium Ion Battery Market Geographical Outlook:

North America is Expected to Grow Significantly

North American region is expected to hold a significant share of the sodium ion battery market during the forecast period. The factors attributed to such a share are the government effort, rising demand for electric vehicles, and technological advancements. For example, a stable battery that recharges as quickly as a conventional lithium-ion battery was developed by researchers at the University of Texas in January 2022. This brand-new sodium-based technology recharges as quickly as a lithium-ion battery while resisting dendrite formation. Moreover, the presence of major market players such as Natron Energy, and emerging start-up Aquion further accelerates the sodium ion battery market.

List of Top Sodium Ion Battery Companies:

Mitsubishi Corporation is a well-known and prominent Japanese multinational conglomerate with diverse business interests across various industries including chemical, financing, and others. Mitsubishi Chemical Group develops electrolyte formulation and offers SoI-Rite™ electrolyte formulation.

CATL (Contemporary Amperex Technology Co., Ltd.) is a leading Chinese manufacturer of batteries and energy storage systems. CATL is also involved in providing energy storage solutions for stationary applications.

Sodium Ion Battery Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Sodium Ion Battery Market Size in 2025 | USD 550.787 million |

Sodium Ion Battery Market Size in 2030 | USD 1,727.772 million |

Growth Rate | CAGR of 25.69% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Sodium Ion Battery Market |

|

Customization Scope | Free report customization with purchase |

Sodium Ion Battery Market Segmentation

By Form Factor

Cylindrical

Prismatic

Pouch

By End-User

Residential

Commercial

Industrial

By Application

Stationary Energy Storage

Transportation

Consumer Electronics

Industrial Backup Power

Marine

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others