Report Overview

Satellite Payloads Market Size, Highlights

Satellite Payloads Market Size:

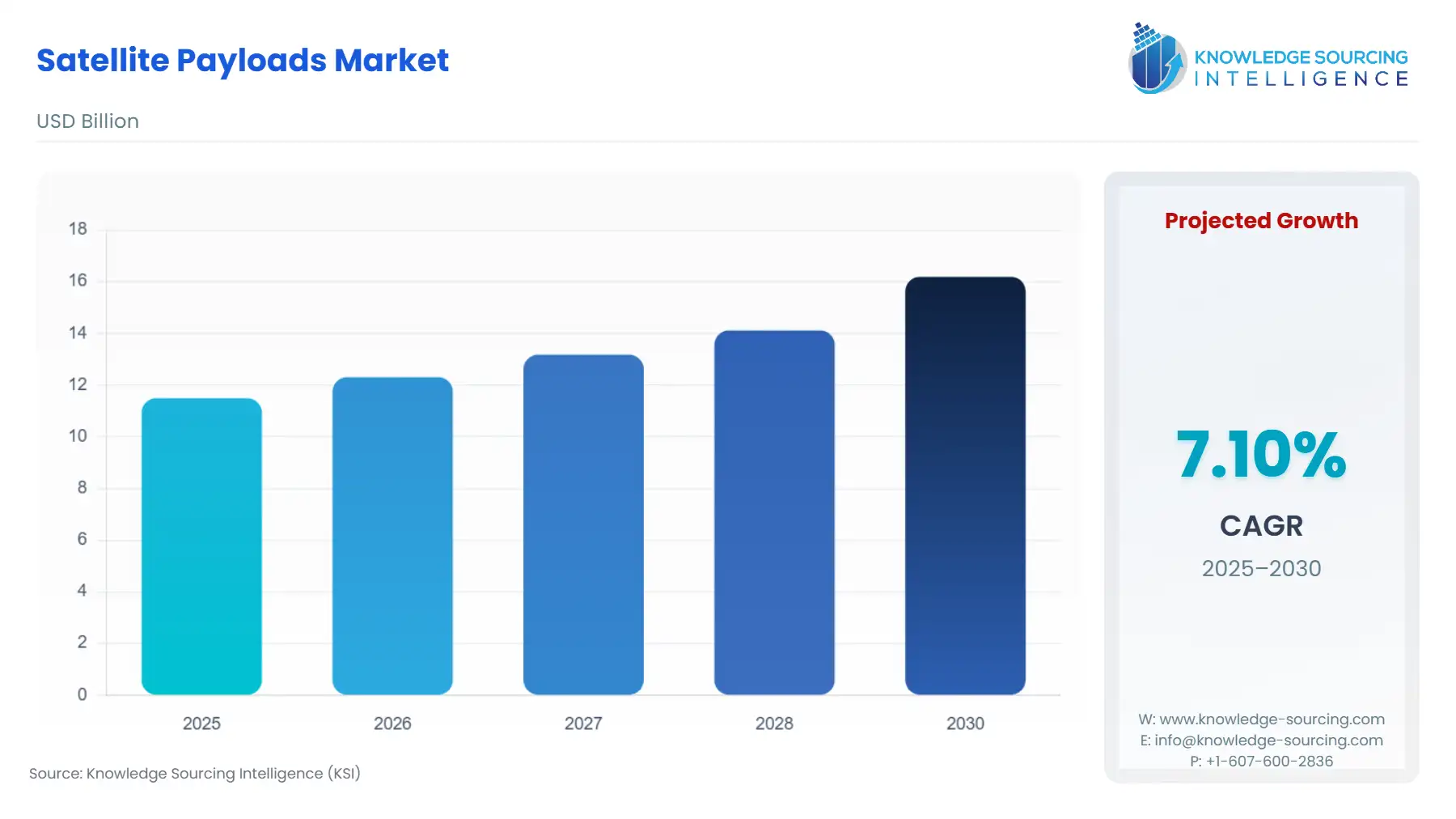

The Satellite Payloads Market is projected to grow at a CAGR of 7.10% from 2025 to 2030, reaching a market size of US$16.195 billion by 2030 from US$11.493 billion in 2025.

The rise in demand for global connectivity, driving heavy deployment of massive LEO satellites; increasing demand for satellites for earth observation and remote sensing for agricultural monitoring, disaster management, climate change tracking and urban planning; increasing investment in reconnaissance and navigation payloads for secure communications, surveillance, and strategic advantages in military and defense amidst rising geopolitical tensions and increasing space missions and satellites launches are directly contributing in increasing the demand of satellite payloads. Additionally, besides a rise in demand, the advancement in high-performance payloads and cost-effective deployment in small and CubeSats are driving the market growth. Also, there has been a rise in funding by the government and private players, increasing the number of satellite programs, propelling the market to grow.

________________________________________

Satellite Payloads Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Satellite Payloads Market is segmented by:

- Payload Type: The market is segmented into communication payloads, remote sensing payloads, navigation payloads, earth observation payloads, scientific payloads, and others. Communication payload dominates the market due to its huge demand for broadband access and will continue to dominate as the demand for broadband access increases.

- Orbit Type: Satellite payloads are deployed in different orbits based on mission requirements: Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geosynchronous Earth Orbit (GEO). LEO will be growing at a rapid rate due to the increasing demand from low-latency communication satellites and small satellite constellations.

- Application: Key applications include communication & broadcasting, navigation & positioning, earth observation & remote sensing, scientific research, military reconnaissance, weather monitoring, and others. Communication and broadcasting dominate the market, while the market of Earth observation is growing.

- End-user industry: The end-user industries for satellite payloads include commercial, military and defense, government and civil agencies, and scientific and research institutions. The commercial segment is expanding rapidly while military and defense will remain have a considerable share.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. The market is dominated by North America and Europe, due to robust space programs and advanced technological capabilities. However, Asia-Pacific is the emerging market with the fastest CAGR growth, driven by China, Japan and India. The growing investment by governments and increasing demand for connectivity and broadband access is leading the market to grow.

________________________________________

Top Trends Shaping the Satellite Payloads Market:

1. Miniaturization and Modularization of Payloads for Small Satellites and CubeSats

- As there is a key technological advancement in electronics, sensors and materials as well as increasing demand for CubeSats and small satellites, there is an increasing shift towards miniaturization of satellite payloads. Also, there is a growing trend towards modularization as it helps allows satellites to adapt to multiple mission requirements.

- For example, EOS SAT-1, launched on January 3, 2023, by EOS Data Analytics (EOSDA), is a 178 kg small satellite built by Dragonfly Aerospace on a 100 kg-class µDragonfly bus, carrying two high-resolution DragonEye electro-optical cameras as its primary payload. The DragonEye cameras are lightweight and energy-efficient, consuming less than 45 W during imaging, and cameras can fit seamlessly into the µDragonfly bus.

2. Integration of Advanced Technologies for Enhanced Security and Precision

- The market is also witnessing increasing integration of advanced technologies such as quantum technologies like quantum sensors and AI for I-optimized payloads or integration of anti-jamming systems. The trend is driven by increasing demand from various sectors for secure communication, precise navigation and surveillance. To align with the growing demand for enhanced security and precision, the market is shifting towards the integration of these advanced technologies in satellite payloads.

- There is a shift from traditional, hardware-locked payloads to reconfigurable, software-controlled payloads. For instance, Eutelsat Quantum, having a digital payload architecture and AI-driven control mechanisms, allows end users to directly control payload functionalities. Projects like ATRIA, led by Eutelsat and GMV, are developing AI/ML-powered systems to automate payload control and enhance operational efficiency in real time.

Satellite Payloads Market Growth Drivers vs. Challenges:

Opportunities:

- Rising demand for global connectivity: As the demand for global connectivity is increasing, it is significantly driving the demand for satellite payloads, especially communication satellite payloads. As per ITU, a total of 5.64 billion people around the world were using the internet at the start of April 2025, equivalent to 68.7 per cent of the world’s total population. It increased from 2.96 billion in April 2015 to 5.64 billion in April 2025, highlighting the growing use of the internet. This is significantly driving the demand for satellite payloads to handle vast amounts of data and provide robust connectivity for different applications, from video streaming to Internet of Things (IoT) networks.

- Increasing use of Earth observation and Remote Sensing: Due to increasing demand for Earth observation and remote sensing for meeting various demands such as a collection of data on climate change, natural disasters, environmental monitoring, and national security, the market of satellite payloads is witnessing growth. This increase in demand for Earth observation and remote sensing is leading to a surge in demand for satellite payloads that have multi-spectral and multi-sensor capabilities and are integrated with AI and machine learning for real-time data processing, propelling the market to grow. For instance, as per a new study by the World Economic Forum with Deloitte, the potential value-added from Earth data is estimated to reach $700 billion in 2030 with a cumulative $3.8 trillion contribution to global gross domestic product (GDP) between 2023-2030, signifying the huge market of Earth observation.

Challenges:

- High cost: One of the major factors that restrains the market is the high cost associated with satellite payloads and satellite launches. Satellite launches are of significant capital expenditure, and satellite payloads form a major chunk of it. Satellite payloads, especially advanced satellite payloads, involve huge capital expenditure and thus acts as a key barrier for many organizations.

________________________________________

Satellite Payloads Market Regional Analysis:

________________________________________

Satellite Payloads Market Competitive Landscape:

The market is moderately consolidated, with some major key players having a considerable share in the market including Thales Group, Airbus SE, Northrop Grumman Corporation, Lockheed Martin Corporation, RTX Corporation, The Boeing Company, L3Harris Technologies Inc., SpaceX Exploration Technologies Corp., OneWeb Communications Ltd., Viasat Inc. and China Aerospace Science and Technology Corporation, among others.

- Satellite Launch: In January 2025, Space42 successfully launched the Thuraya 4 satellite aboard a SpaceX Falcon 9 rocket. Thuraya 4 features advanced communication payloads designed to provide secure, high-speed voice and data connectivity, offering coverage Africa, Europe, Central Asia, and the Middle East. This development reflects ongoing investment in next-generation communication payloads.

- Launch: In December 2024, Lockheed Martin launched GPS III Space Vehicle 07 (SV07) from Cape Canaveral Space Force Station, Florida, at 7:52 p.m. ET. It enhances the U.S. Space Force’s GPS constellation modernization with improved accuracy, anti-jamming, and M-Code (Military Code) capabilities, underscoring the growing investment in high-precision navigation payloads for both civil and defense applications.

________________________________________

Satellite Payloads Market Segmentation:

By Payload Type

- Communication Payloads

- Remote Sensing Payloads

- Navigation Payloads

- Earth Observation Payloads

- Scientific Payloads

- Others

By Orbit Type

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geosynchronous Earth Orbit (GEO)

By Application

- Communication & Broadcasting

- Navigation & Positioning

- Earth Observation & Remote Sensing

- Scientific Research

- Military Reconnaissance

- Weather Monitoring

- Others

By End-User Industry

- Commercial

- Military and Defense

- Government and Civil Agencies

- Scientific and Research Institutions

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others