Report Overview

Saudi Arabia AI in Highlights

Saudi Arabia AI in Finance Market Size:

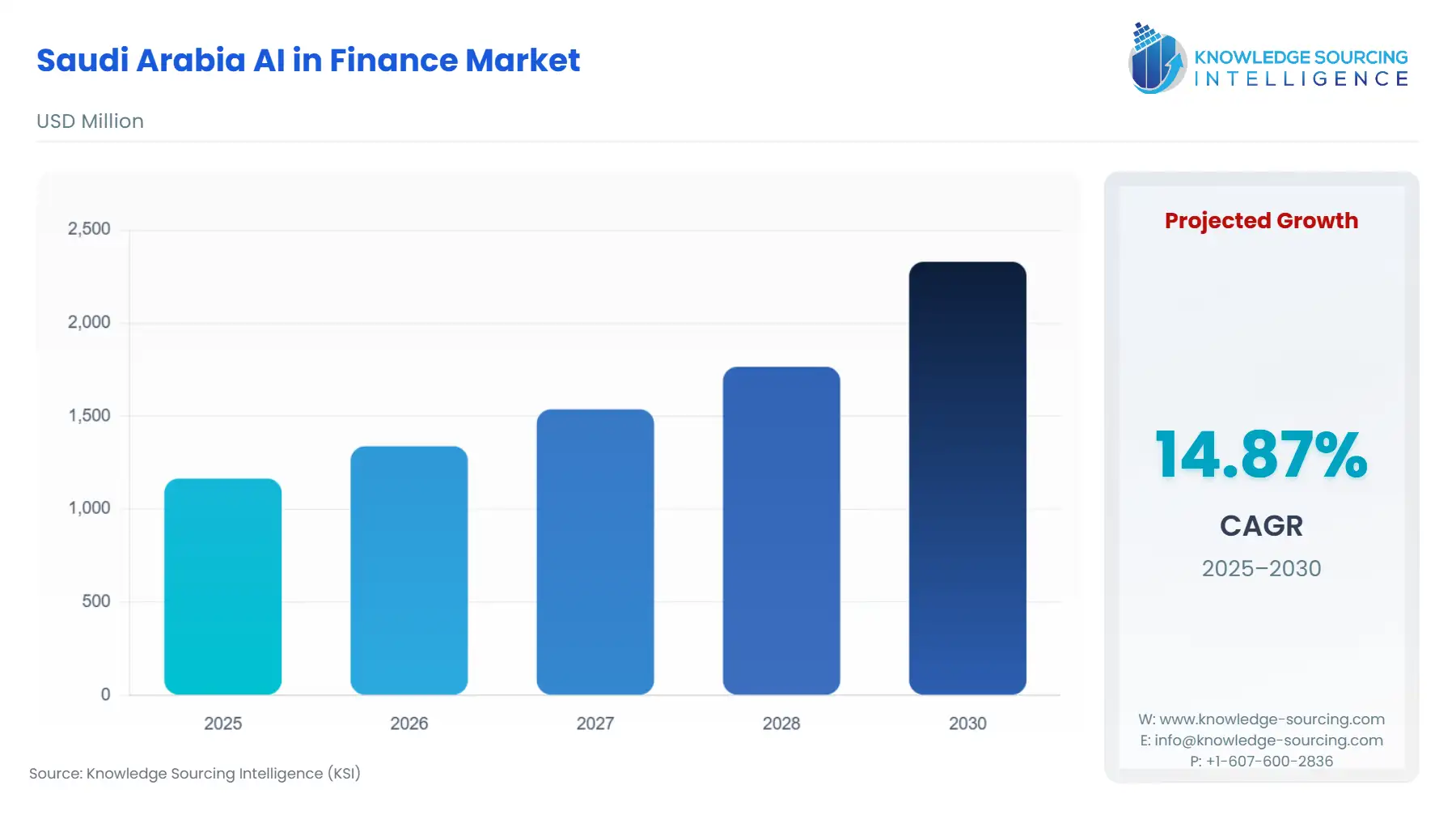

The Saudi Arabia AI in Finance Market is expected to grow at a CAGR of 14.87%, rising from USD 1.165 billion in 2025 to USD 2.330 billion by 2030.

The Saudi Arabian AI in Finance market is experiencing a state-driven acceleration, transforming from an emergent technological curiosity into a critical pillar of national economic strategy, centrally managed by the Saudi Data and Artificial Intelligence Authority (SDAIA). This unprecedented convergence of high-level government mandate (Vision 2030), robust capital allocation through sovereign funds, and a forward-leaning regulatory environment from SAMA positions the Kingdom as a unique demand center for financial AI solutions.

The core dynamic is defined by a systemic imperative: leveraging data and artificial intelligence to drive efficiency, enhance financial inclusion, and mitigate risk across the vast, predominantly young and digitally-native population.

________________________________________

Saudi Arabia AI in Finance Market Analysis:

Growth Drivers

The foundational mandate of Vision 2030 directly propels demand. The National Strategy for Data and AI (NSDAI) aims for over $20 billion in AI-related investments by 2030, fundamentally creating the need by providing public capital and infrastructure for deployment. This capital allocation, particularly through vehicles like the PIF-backed AI initiatives, bypasses typical financing constraints, forcing financial institutions to adopt AI to align with the national agenda and secure government partnerships. Additionally, SAMA’s drive for a cashless society, targeting 70% of electronic payments by 2025, necessitates the procurement of AI-driven systems for real-time fraud detection and secure digital transaction processing, directly increasing demand for Machine Learning (ML) solutions in the back office.

Challenges and Opportunities

A primary challenge remains the scarcity of specialized domestic AI and data science talent, leading to higher costs for external consulting and delayed deployment schedules. This constraint creates an opportunity for global AI firms to establish local partnerships or training academies, fulfilling the demand for high-end implementation and maintenance services. The requirement for AI model explainability and compliance with the Personal Data Protection Law (PDPL), while challenging due to the 'black-box' nature of some models, represents a significant opportunity. It drives specific, non-generic demand for Explainable AI (XAI) solutions that provide algorithmic transparency for regulatory audit and risk management in credit scoring and loan approval processes.

Supply Chain Analysis

The supply chain for the Saudi AI in Finance market is primarily focused on intangible assets: cloud infrastructure, advanced algorithms, and specialized human capital. The primary complexity lies in the global nature of foundational AI technology, including proprietary Large Language Models (LLMs) and high-performance computing (HPC) hardware. Saudi Arabia’s strategic response—creating local data sovereignty and compute capacity through the PIF and SDAIA—aims to mitigate this dependency risk. Production hubs for AI models remain global (US, China), creating logistical and legal complexities around cross-border data transfer. However, the localized development of the ALLAM 34B LLM and HUMAIN platform shifts the primary demand focus toward domestic intellectual property creation and service integration capabilities.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Saudi Arabia | Saudi Central Bank (SAMA) Regulatory Sandbox | Directly accelerates demand for innovative AI/FinTech solutions by providing a controlled environment for testing, reducing the time-to-market and regulatory overhead for new products (e.g., AI-driven wealth management). |

| Saudi Arabia | Saudi Data and AI Authority (SDAIA) / NSDAI | Creates top-down, non-negotiable demand for AI adoption across key sectors, including finance, by setting national targets for investment and establishing the necessary data governance frameworks, thus lowering market entry friction for compliant AI vendors. |

| Saudi Arabia | Personal Data Protection Law (PDPL) | Increases demand for AI solutions with embedded security and compliance features, specifically driving the market for data anonymization tools, robust access controls, and transparent, auditable AI models (Explainable AI) to avoid regulatory penalties. |

________________________________________

Saudi Arabia AI in Finance Market Segment Analysis:

By Application: Back Office

The Back Office segment is characterized by a critical, inelastic growth driven by the imperative for operational efficiency and stringent compliance. The necessity for AI is focused squarely on automating high-volume, repetitive, and rule-based tasks such as compliance checks, anti-money laundering (AML) monitoring, and transaction reconciliation. The high cost of financial fraud in the GCC, coupled with SAMA's focus on cyber-resilience, creates a specific demand for advanced ML models for anomaly detection that move beyond simple rule-based systems. For instance, the sheer volume of digital transactions, exceeding one billion monthly on a single bank's platform like Al Rajhi Bank's, necessitates AI for real-time, scaleable monitoring, which an entirely human workforce cannot achieve, thus cementing AI as an indispensable operational requirement, not an optional enhancement.

By User: Corporate Finance

The Corporate Finance segment’s requirement is catalyzed by Saudi Arabia's overarching economic diversification strategy, which emphasizes the growth of the private sector and Small and Medium-sized Enterprises (SMEs). Large financial institutions must leverage AI to enhance credit risk assessment for non-traditional, often uncollateralized corporate and SME lending. This creates high demand for AI models that can ingest and analyze unstructured data—such as utility bills, social media sentiment, and supply chain data—to generate a comprehensive, forward-looking credit score. Furthermore, the push for large-scale infrastructure projects requires sophisticated AI-driven tools for dynamic liquidity management, trade finance optimization, and predictive cash flow modeling for major Saudi corporates, a use case that traditional statistical models are inadequate to support.

________________________________________

Saudi Arabia AI in Finance Market Competitive Environment and Analysis:

The competitive landscape is dominated by a few large, digitally-advanced local banks that act as both end-users and primary drivers of the market's growth. Their long-standing relationships with the regulator (SAMA) and their control over vast proprietary customer data sets create high barriers to entry for pure-play AI vendors. The competition is centered less on pricing and more on the demonstrated capability to deliver highly compliant, Arabic-language-capable, and scalable AI solutions that integrate seamlessly with legacy core banking systems.

Al Rajhi Bank

Al Rajhi Bank positions itself as a digital leader, with 95% of its transactions processed through digital channels and 86% of personal financing completed digitally in 2024. Its strategy, 'harmonize the group,' focuses on a 'Digital and Data' pillar that explicitly leverages "GenAI and Machine Learning" to achieve "hyper-personalisation" and "Group-wide Insights and Real-time Marketing." This positioning creates direct and continuous demand for advanced data aggregation platforms (like its subsidiary neotek) and AI models capable of high-fidelity customer segmentation and personalized product delivery, fundamentally shifting the bank's operational model from transactional to data-centric.

Banque Saudi Fransi (BSF)

BSF's strategic positioning, evidenced by its May 2025 launch of a next-generation digital banking platform in partnership with Backbase, focuses on an aggressive, full-scale digital transformation powered by an AI-driven core. This approach is an architectural commitment, requiring deep integration of AI-powered features like advanced payment solutions, enhanced security controls (e.g., panic mode enablement), and digital sales capabilities (streamlined credit card applications). BSF's mandate is to set a "new standard for digital banking excellence," which translates to a persistent demand for AI modules that can unify the customer experience across all retail and web channels and support large-scale, secure data processing.

________________________________________

Saudi Arabia AI in Finance Market Recent Developments:

- August 2025: SDAIA President Commends Launch of HUMAIN Chat AI Application. The launch of HUMAIN Chat, a conversational AI application powered by the homegrown ALLAM 34B Arabic Large Language Model, and its commendation by the Saudi Data & AI Authority (SDAIA), represents a major capacity addition. Developed by HUMAIN, a PIF subsidiary, this development establishes sovereign, culturally and linguistically aligned AI infrastructure, creating an in-Kingdom supply chain for LLM-based applications in customer service, internal knowledge management, and eventually, robo-advisory services within the financial sector.

- May 2025: Banque Saudi Fransi (BSF) Launches Next-Generation Banking Platform with Backbase. BSF successfully launched its next-generation, AI-powered digital banking platform, announced via its partner's press release. This large-scale deployment of an integrated platform, which includes AI-powered security features and streamlined digital sales journeys, signifies a strategic shift from incremental technology adoption to a full core platform overhaul by a major financial player. The launch immediately increases demand for AI-driven risk management and omni-channel customer engagement solutions that can be integrated into the new architecture.

________________________________________

Saudi Arabia AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.165 billion |

| Total Market Size in 2031 | USD 2.330 billion |

| Growth Rate | 14.87% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

Saudi Arabia AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office