Report Overview

Small Cell Power Amplifier Highlights

Small Cell Power Amplifier Market Size:

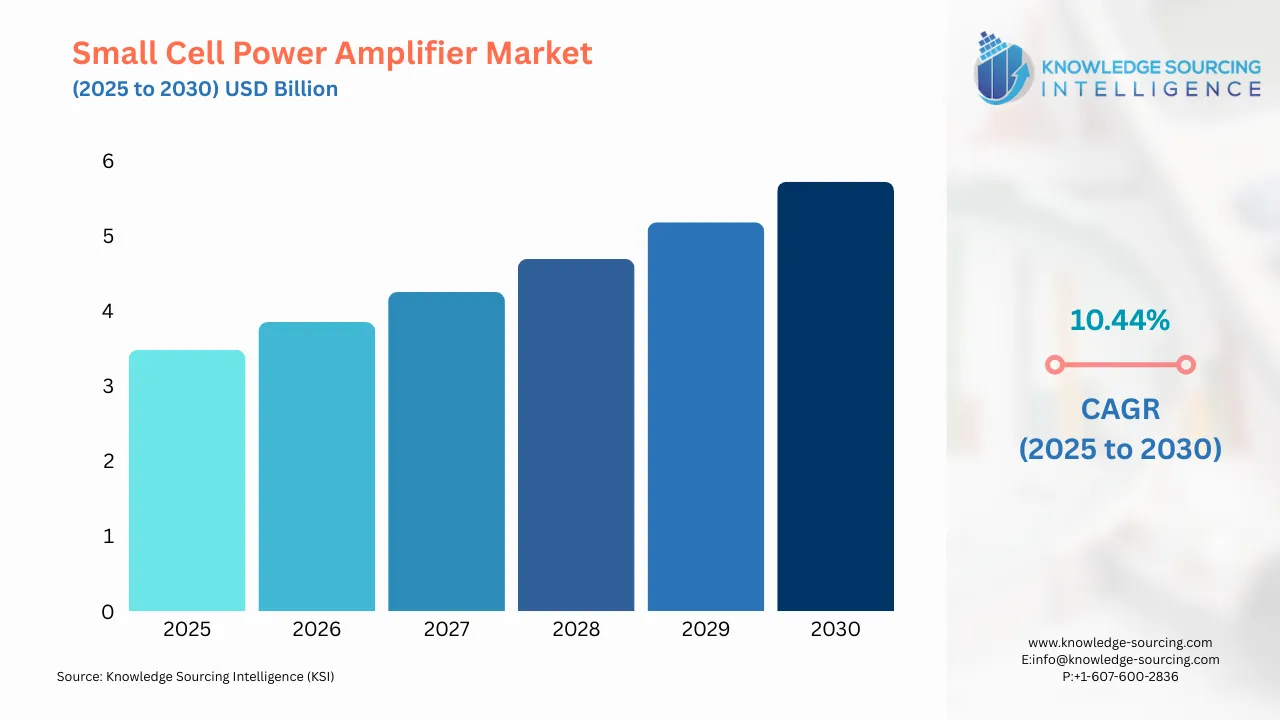

The Small Cell Power Amplifier Market is projected to grow at a CAGR of 10.44% to reach US$5.724 billion in 2030 from US$3.484 billion in 2025.

The Small Cell Power Amplifier Market serves as the foundational hardware layer for modern high-capacity wireless infrastructure. These components are specifically engineered to amplify low-power radio frequency (RF) signals for transmission across short distances, typically within a range of 10 meters to 2 kilometers. Unlike macro-cell amplifiers, small cell variants must balance high linearity and gain with extreme thermal efficiency and a miniaturized form factor. This technical requirement has led to a transition from silicon-based substrates to wide-bandgap materials, which facilitate the high-frequency operations necessary for Sub-6 GHz and mmWave 5G spectrum allocations.

The market has reached a critical inflection point characterized by "hyper-densification" in urban environments and a pivot toward private LTE/5G networks for industrial IoT. The need for these amplifiers is no longer solely a function of mobile carrier coverage expansion but is increasingly tied to the integration of high-speed connectivity in consumer electronics, automotive radar, and smart city infrastructure. While the overall telecommunications capital expenditure has seen a cyclical cooling in some regions, the specific demand for high-efficiency, multi-band power amplifiers continues to be sustained by the need for localized network capacity and the global rollout of Wi-Fi 7 standards.

Small Cell Power Amplifier Market Analysis

Growth Drivers

The primary market growth driver is the global implementation of Ultra-Dense Networks (UDNs). As 5G moves into higher frequency bands (C-band and mmWave), signal propagation distance decreases, necessitating the installation of numerous small cells to maintain throughput. This architectural shift directly multiplies the unit demand for power amplifiers per square kilometer compared to 4G macro-deployments. Additionally, the emergence of Wi-Fi 7 in 2024 and 2025 has catalyzed demand for high-linearity amplifiers capable of supporting 320 MHz bandwidths and 4096-QAM modulation. These technical requirements necessitate a replacement cycle for existing enterprise access points, funneling demand into premium RF front-end modules.

Challenges and Opportunities

The market faces a significant challenge in thermal management constraints within compact form factors. As power density increases, particularly in GaN-based MMICs, the heat flux becomes a bottleneck for device reliability, forcing manufacturers to innovate in advanced packaging and heat dissipation materials. However, this challenge creates a distinct opportunity for GaN-on-SiC technology. GaN's superior thermal conductivity and efficiency allow for more compact radio units, which are essential for stealthy urban installations and residential femtocells. Furthermore, the exit of legacy players like NXP creates a vacuum in the mid-band infrastructure segment, providing an opportunity for specialized firms like Sumitomo and Wolfspeed to consolidate market share in high-performance RF solutions.

Raw Material and Pricing Analysis

The pricing dynamics of the small cell power amplifier market are heavily influenced by the availability of Gallium and Silicon Carbide (SiC) wafers. In late 2024, export controls on Chinese refinery output led to a tightening of Gallium supplies, resulting in an estimated 18% increase in GaAs epi-wafer pricing. This volatility directly impacts the Bill of Materials (BOM) for amplifier manufacturers. Furthermore, the transition to 200mm SiC wafer production by firms like Wolfspeed aims to drive down unit costs through economies of scale, though initial capital expenditure remains high. The supply chain for these high-purity chemicals and substrates is concentrated in a few geographic hubs, making the market sensitive to localized geopolitical shifts and trade policies.

Supply Chain Analysis

The supply chain for small cell power amplifiers is a complex global network with key front-end fabrication hubs in the United States, Taiwan, and Japan. While the design and R&D functions remain concentrated in North America and Europe, the high-volume assembly and test (OSAT) operations are predominantly situated in the Asia-Pacific region. Dependencies on specialized semiconductor equipment and rare-earth materials create vulnerabilities; for instance, the recent closure of NXP’s ECHO fab in Arizona highlights the risks of facility-level disruptions. To mitigate these risks, industry leaders are increasingly adopting multi-source procurement strategies and investing in domestic manufacturing capabilities under initiatives like the U.S. CHIPS Act to ensure a resilient supply of critical RF components.

Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | CHIPS and Science Act / Dept. of Commerce | Incentivizes Domestic Production: Provides $52.7 billion in funding for semiconductor R&D and manufacturing. This directly bolsters the supply chain for GaN and GaAs power amplifiers by subsidizing the expansion of U.S.-based fabrication facilities, reducing reliance on overseas foundries. |

European Union | Eco-Design Directive (2024 Update) | Mandates Energy Efficiency: Sets strict limits on idle-power consumption (<1 W) for network equipment. This regulation forces manufacturers to pivot demand toward high-efficiency Class-D and GaN amplifiers, effectively banning older, less efficient Class-AB architectures from the EEA market. |

Global | ITU-R M.2160 (IMT-2030 Framework) | Standardizes 6G R&D: Formalizes the capability targets for 6G, including sub-THz frequency support. This regulatory milestone stimulates immediate demand for high-frequency power amplifier research and development testbeds, securing long-term design wins for leading RF vendors. |

Small Cell Power Amplifier Market Segment Analysis

By Application: Small Cell Base Stations

The Small Cell Base Stations segment represents the largest application of power amplifiers, as telecommunications operators seek to resolve "dead zones" and capacity bottlenecks in high-traffic urban areas. This segment is specifically driven by the C-band (3.7–3.98 GHz) and 3.45 GHz spectrum auctions in the U.S., which have anchored the near-term roadmaps for Radio Access Network (RAN) upgrades. Small cell base stations require power amplifiers with high Mean Time Between Failure (MTBF) and exceptional linearity to manage dense signal environments without interference. As operators shift from CAPEX-heavy macro-builds to OPEX-focused densification, the demand for integrated Front-End Modules (FEMs), which combine the power amplifier, switch, and low-noise amplifier (LNA) into a single package, has surged. This integration reduces the PCB footprint by up to 50%, enabling the deployment of "shroud-less" small cells on municipal street furniture, which is a key requirement for city-wide smart infrastructure projects.

By Industry Vertical: Telecommunications

The Telecommunications vertical continues to be the primary engine for the small cell power amplifier market, fueled by the global mandate for ubiquitous 5G connectivity. This segment’s growth is characterized by a shift toward Private 5G Networks for industrial and enterprise use. Manufacturing facilities, ports, and hospitals are deploying localized small cells to support low-latency automation and real-time data analytics. These private networks require customized power amplifier configurations that support specific industrial bands, such as the Citizens Broadband Radio Service (CBRS) in the United States. Furthermore, the telecommunications sector is increasingly prioritizing Power Added Efficiency (PAE) to reduce the electricity costs associated with network operations. This focus directly shifts demand away from legacy LDMOS technology toward GaN-on-SiC, which offers higher efficiency at the high frequencies used in 5G and future 6G testbeds. The vertical's demand is also bolstered by the replacement of aging 4G small cells with multi-mode units that can simultaneously support 4G and 5G signals.

Small Cell Power Amplifier Market Geographical Analysis

USA Market Analysis

The United States market is a leader in high-frequency RF innovation, primarily driven by the "rip and replace" initiatives and the rapid rollout of mid-band 5G. The presence of major vendors like Qorvo and Skyworks ensures a robust local ecosystem. Furthermore, the U.S. Department of Defense is a significant consumer of GaN-based power amplifiers for advanced radar and electronic warfare (EW) systems, which shares a technological synergy with high-power small cell infrastructure. The 2025 regulatory focus on supply chain security and domestic manufacturing under the CHIPS Act has further localized the demand for U.S.-fabricated RF components.

Brazil Market Analysis

In South America, Brazil is the primary market, focusing on expanding 5G coverage in major metropolitan areas like São Paulo and Rio de Janeiro. The market trend is currently concentrated in Microcell and Picocell applications to densify urban centers. While the market is smaller compared to North America, the Brazilian National Telecommunications Agency (ANATEL) has been aggressive in spectrum auctions, creating a steady demand for cost-effective, high-reliability power amplifiers. The local market favors vendors that can provide "tropicalized" hardware capable of operating in high-humidity and high-temperature environments.

Germany Market Analysis

Germany represents the anchor of the European market, driven by the Industrie 4.0 initiative. The German government’s allocation of local 5G spectrum for private industrial networks has created a unique market for small cell power amplifiers in automotive manufacturing and logistics. There is a strong regulatory emphasis on energy efficiency and environmental compliance, aligning with the EU’s Eco-Design directives. Consequently, German demand is pivoting rapidly toward next-generation Class-D and GaN-based amplifiers that offer superior efficiency and reduced carbon footprints for corporate sustainability goals.

Saudi Arabia Market Analysis

The Saudi Arabian market is experiencing a surge in demand as part of the Vision 2030 healthcare and smart city transformation projects. The development of NEOM and other "giga-projects" requires a massive, ground-up installation of small cell networks to support ubiquitous AI and IoT services. The requirement is focused on high-performance, ruggedized amplifiers that can withstand extreme desert temperatures. The Saudi government is investing heavily in digital infrastructure, making the kingdom a key growth hub in the Middle East for premium, high-capacity telecommunications hardware.

China Market Analysis

China is the world’s largest and most competitive market for small cell power amplifiers. The Chinese market is characterized by a "5G-first" policy, with the government mandating the construction of millions of small cells to achieve nationwide coverage. Local firms like Huawei and ZTE drive massive domestic demand for amplifiers that support a wide range of spectrum bands. However, the market also faces export control headwinds, which have spurred a national effort to achieve semiconductor self-sufficiency. This has led to a surge in demand for domestically produced GaN and GaAs components from local fabless designers and foundries.

Small Cell Power Amplifier Market Competitive Environment and Analysis

The competitive landscape is undergoing a period of intense consolidation and strategic pivots. High barriers to entry, including the need for proprietary GaN fabrication processes and advanced digital pre-distortion (DPD) algorithms, favor established incumbents with deep IP portfolios.

Qorvo, Inc.

Qorvo is a dominant player in the RF front-end market, positioning itself as a provider of highly integrated solutions. In October 2025, Qorvo introduced the QPA9510, a wideband power amplifier covering 100 to 1000 MHz with 55 percent efficiency, specifically targeting the growing demand in public safety and smart utility metering. Qorvo’s strategic advantage lies in its ability to provide complete "antenna-to-bits" solutions. Its recent merger activities, including the October 2025 announcement to combine with Skyworks Solutions in a $22 billion deal, aim to create a U.S.-based leader capable of rivaling global semiconductor giants by integrating a vast portfolio of RF, analog, and mixed-signal technologies.

Skyworks Solutions, Inc.

Skyworks specializes in high-performance analog semiconductors for wireless infrastructure. Its SKY663xx family of power amplifiers is specifically designed for the stringent requirements of 5G enterprise small cells, offering wide instantaneous bandwidth (up to 200 MHz) in compact 5x5 mm packages. Skyworks leverages a system-level expertise that appeals to Tier-1 infrastructure OEMs like Nokia and Ericsson. Its strategic focus on Wi-Fi 7 connectivity has allowed it to capture significant market share in the consumer electronics and enterprise access point segments, where tight EVM (Error Vector Magnitude) specifications are a primary growth driver.

Wolfspeed, Inc.

Wolfspeed is the global leader in Silicon Carbide (SiC) and GaN-on-SiC technology. Unlike traditional silicon vendors, Wolfspeed’s competitive position is built on its vertical integration, from raw material substrate growth to final device fabrication. In 2025, Wolfspeed achieved significant milestones in 200mm SiC wafer production, which is a critical catalyst for reducing the cost of high-power GaN amplifiers. While much of its recent news focuses on the automotive sector (e.g., the December 2025 deal to power Toyota’s EV platforms), the same SiC technology underpins its RF power amplifiers for 5G base stations, offering the highest thermal conductivity and power density in the market.

Small Cell Power Amplifier Market Developments

December 2025: NXP Semiconductors N.V. officially announced the wind-down of its Radio Power product line and the closure of its ECHO GaN fab in Chandler, Arizona. The company cited worsening market conditions and a lack of recovery outlook in the 5G infrastructure segment as the primary reasons for the strategic exit.

October 2025: Qorvo, Inc. and Skyworks Solutions, Inc. reached a definitive agreement to combine their businesses for $22 billion. The merger is intended to create a global leader in high-performance RF and analog solutions, optimizing their combined supply chains and R&D pipelines to meet the escalating complexity of 5G and 6G technologies.

October 2025: Qorvo, Inc. introduced the QPA9510, a compact 3x3 mm RF power amplifier. The device achieves 55% efficiency across the 100-1000 MHz range, addressing system-level challenges for designers in the public safety, RFID, and smart metering sectors.

Small Cell Power Amplifier Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 3.484 billion |

| Total Market Size in 2030 | USD 5.724 billion |

| Forecast Unit | Billion |

| Growth Rate | 10.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Treatment, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Small Cell Power Amplifier Market Segmentation:

By Type

Femtocell

Picocell

Microcell

By Application

Small Cell Base Stations

Wideband Instrumentation

Others

By Industry Vertical

Telecommunications

Consumer Electronics

Healthcare

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Thailand

Indonesia

Others