Report Overview

Smart Thermostat Market Report, Highlights

Smart Thermostat Market Size:

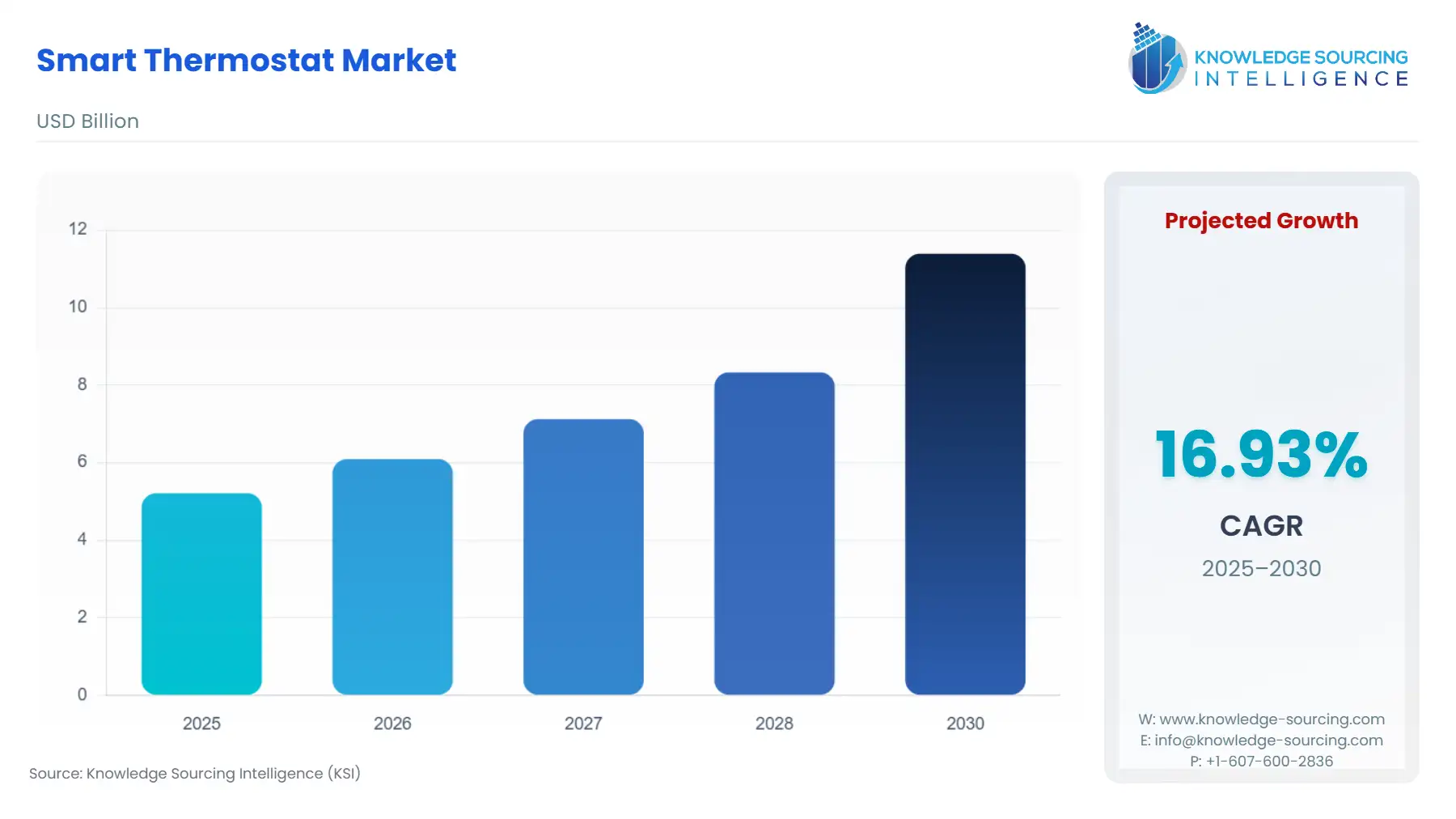

The smart thermostat market is expected to grow at a CAGR of 16.95%, reaching a market size of US$11.391 billion in 2030 from US$5.211 billion in 2025.

Smart thermostats are electronic devices that control the operation of air conditioners in residential & commercial buildings. They are part of home automation gadgets that are becoming increasingly popular in smart homes. Favorable government initiatives aimed at promoting building energy efficiency followed by investments in smart city establishment are projected to drive smart thermostat market demand in the coming years, bolstering market expansion.

The boom in wireless communication, followed by people's growing emphasis on optimizing overall energy usage, has paved the way for future market expansion. Moreover, the need for automation devices is increasing as the rate of urbanization rises. All capabilities are available in IoT devices, such as the smart thermostat.

Smart Thermostat Market Growth Drivers:

- The growing demand for smart buildings and cities has propelled the overall market growth.

Rapid urbanization and improvement in living standards have bolstered the demand for smart interlinked technologies and IoT (Internet of Things) solutions to be implemented in public infrastructure. These include city lighting, energy efficiency, traffic flow, and traffic congestion. Such focus has emphasized smart city development for long-term growth. Major economies are investing in smart cities where residential and commercial establishments feature wireless technology to maximize resource efficiency and encourage governments and citizens to make sound decisions.

- Adaptation Of the Internet of Things (IoT) is expected to drive the market expansion.

Smart thermostats assist in air quality preservation by regulating temperature and humidity, owing to which they find high applicability in apartments, condos, and commercial spaces. The use of such technology can save money on energy and increase productivity, thereby providing optimal performance. Thus, the government and businesses could improve the devices and applications to maintain adequate efficiency optimization in smart buildings and city projects. Intense emphasis and utilization of these devices may drive demand.

- Favorable efforts to bolster smart thermostat adoption have positively impacted their market demand.

The usage of energy-efficient systems especially enhances the overall functioning. With the growing carbon content, the emphasis on the usage of smart technology in industrial and commercial settings is expected to witness significant growth in the future. Likewise, it will raise awareness of smart thermostat technology in the coming years. As a result, many customers know that the thermostat device assists them in saving money on electricity. Operating the AC, tablets, cellphones, and other devices with single access control is possible. The necessity to integrate automation into the emission concept has provided new growth prospects for the market.

Smart Thermostat Market Segmentation Analysis:

- WiFi technology is projected to account for a considerable share.

Based on technologies available through connected thermostat devices, the segment is divided into WiFi, ZigBee, NFC, Ethernet, Bluetooth, and others. Companies are investing in new product development and launches to cater to the booming demand for wireless connected devices. For instance, in January 2024, Universal Electronics Inc. announced the showcase of its four new smart thermostat products at the 2024 International Consumer Electronics Show. The new offerings would expand the company’s UEI TIDE wireless thermostats line. Learning thermostat devices are expected to increase substantially during the forecast period owing to their instinctive and sophisticated features, which enhance customer experience.

- Residential application is expected to grow at a steady rate.

The smart thermostat market, by application, is analyzed into residential, commercial, and industrial. The residential application is estimated to show significant growth fuelled by increased awareness of energy conservation and efficiency and environmental protection, which has increased the implementation of fuel HVAC control mechanisms, including smart thermostats. They contribute to the most efficient use of energy and the most pleasant indoor environment. Additionally, favorable government policies, tax access to credit for HVAC system installation, and end-users increasing focus on lowering electricity bills have all contributed significantly to the residential smart thermostat market’s growth.

Smart Thermostat Market Geographical Outlook:

- Asia Pacific is predicted to hold a considerable share of the market.

Asia Pacific has been a critical enabler of the smart thermostat market and is projected to grow at a significant rate. HVAC controls, such as smart thermostats, are aided by the population explosion in this continent's emerging countries and a growing awareness of environmental issues. The rise in green building adoption and government initiatives to regulate energy-efficient practices across the commercial sector are assisting the deployment of smart thermostats in the region.

Smart Thermostat Market Restraints:

- The high cost associated with smart thermostats will hamper the market expansion.

Upgraded control mechanisms and cutting-edge, connected thermostats necessitate large investments. As a result, small and medium-sized businesses (SMEs) may find it difficult to implement them in the market. Furthermore, consumers with limited purchasing power may struggle to afford the cost. Operating on a touch-sensitive display panel may be difficult due to a lack of technical expertise.

Smart Thermostat Market Key Developments:

- August 2023: Network Thermostat partnered with Controls Depot to distribute the former’s NetX thermostat to residential, commercial, and industrial users across Canada. The alliance aims to revolutionize the way Canadians manage indoor temperature and climate.

- April 2023: Resideo Technologies Inc. launched the “Honeywell Home T10+ Smart Thermostat”, which features the company’s proprietary Redlink 3.0 technology and Equipment interface module. It enables HVAC professionals to customize ventilation, dehumidification, and humidification.

- January 2023: Lennox Industries announced the launch of the “Lennox S40 Smart Thermostat”, which aims to provide good indoor quality to customers by customizing comfort by room, and pollutant detection. The product launch expanded the company’s portfolio of smart products and included accessories such as “Lennox Smart Room Sensor” and “Lennox Air Quality Monitor”.

- July 2022: Universal Electronics Inc. launched the “UEI TBH300” smart thermostat, which features RUCKUS Wireless gateway and Zibee technology. The new product further expands Universal’s smart home devices offerings and, besides residential, is also ideal hospitality sector.

Smart Thermostat Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Smart Thermostat Market Size in 2025 | US$5.211 billion |

| Smart Thermostat Market Size in 2030 | US$11.391 billion |

| Growth Rate | CAGR of 16.95% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Smart Thermostat Market |

|

| Customization Scope | Free report customization with purchase |

Smart Thermostat Market Segmentation:

- By Technology

- WiFi

- ZigBee

- NFC

- Ethernet

- Bluetooth

- Others

- By Application

- Residential

- Commercial

- Industrial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others