Report Overview

Spain Electric Vehicle Components Highlights

Spain Electric Vehicle Components Market Size:

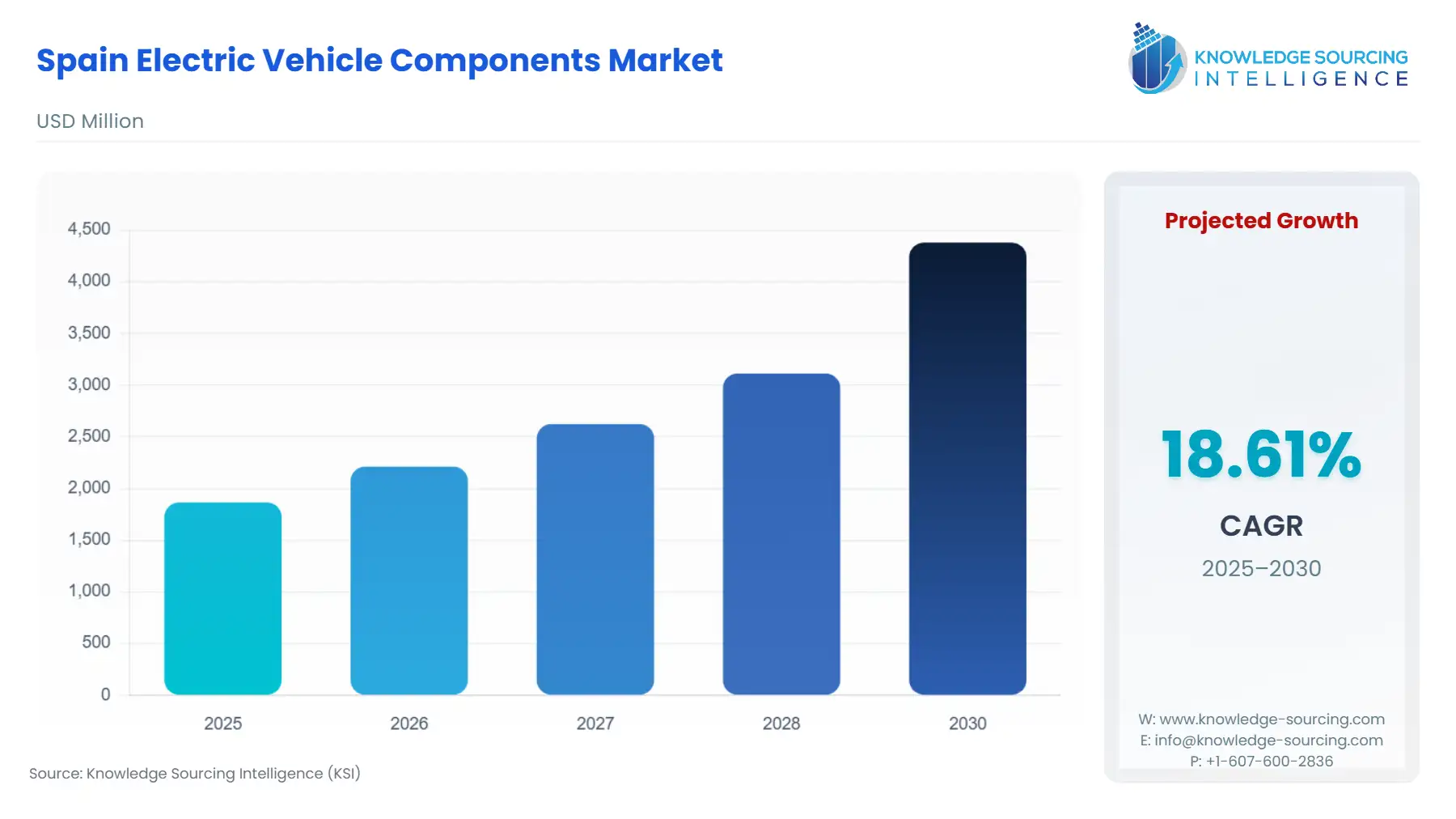

The Spain Electric Vehicle Components Market is anticipated to rise at a CAGR of 18.61%, reaching USD 4.379 billion in 2030 from USD 1.865 billion in 2025.

The Spanish Electric Vehicle (EV) Components Market is in a determined phase of industrial transformation, moving from a traditional internal combustion engine (ICE) focused supply chain to an electrified ecosystem. This transition is not organic; it is a direct result of a comprehensive national policy designed to secure Spain's long-term position as Europe’s second-largest vehicle producer. The confluence of mandated regulatory targets and substantial, government-backed public-private investment schemes fundamentally shifts the market dynamics.

Spain Electric Vehicle Components Market Analysis:

- Growth Drivers

The PERTE VEC initiative acts as the primary growth catalyst, providing significant financial support aimed explicitly at developing the domestic industrial value chain for EVs. This program directly increases the demand for components by funding the creation of new production capacity, plant expansions, and the conversion of existing production lines. For example, the focus on the battery ecosystem through PERTE VEC mandates local sourcing and production, thereby generating intense, immediate demand for battery pack sub-components, including thermal management systems, and specialized materials. Furthermore, the 7.8% growth in BEV passenger car registrations in 2024 demonstrates a consumer-driven expansion that compels OEMs to increase their component procurement to meet production mandates and market pull. This requirement is particularly acute for high-power density components like Electric Motors and Inverters.

- Challenges and Opportunities

A key challenge is the inconsistent growth across vehicle segments, evidenced by the significant declines in electric van (-26.7%) and electric motorcycle (-36.5%) registrations in 2024. This market constraint creates a demand uncertainty for components specialized in smaller or commercial vehicle platforms, potentially delaying critical investment in diversified production tooling. However, an immediate opportunity lies in the rapid expansion of the public charging network, which grew by 32% in 2024. This infrastructure surge creates a direct, high-value demand for robust, high-power Power Electronics (specifically ultra-rapid chargers, 150kW and above), providing a parallel, stable revenue stream for component manufacturers outside of traditional vehicle production.

Raw Material and Pricing Analysis

Manufacturing EV components—a physical product—is heavily dependent on a global supply chain for critical raw materials. The Spanish component manufacturing sector, in line with the broader European trend, faces high dependency on imports from third countries, particularly China, across the value chain for materials like lithium, nickel, and rare-earth permanent magnets. Price volatility for these materials, such as the surge in lithium prices experienced following the pandemic, directly impacts the final cost and, consequently, the demand for locally produced Battery Packs and Electric Motors. The domestic drive to build battery gigafactories aims to mitigate this supply chain fragility, shifting the procurement challenge from finished cell imports to a more manageable raw material and processing dependency.

- Supply Chain Analysis

The Spanish EV component supply chain is highly integrated with the broader European automotive manufacturing structure, with over 60% of auto-parts manufactured in Spain exported in 2024. This establishes Germany, France, and Portugal as critical logistical dependencies and primary export hubs for Spanish-produced components. A logistical complexity arises from the shift to high-voltage, heavy components like battery packs, which requires new, specialized, and expensive logistical networks to transport finished goods from the new manufacturing hubs (e.g., those supported by PERTE VEC) to OEM assembly plants. This dependency on foreign export markets means that component demand is highly susceptible to external regulatory shifts and fluctuations in production volumes in neighbouring European countries.

Spain Electric Vehicle Components Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Spain |

PERTE VEC (Strategic Project for Economic Recovery and Transformation of the Electric and Connected Vehicle) |

Funds industrial transformation, directly stimulating demand for localized production of battery systems and core powertrain components via public-private investment projects. |

|

Spain |

Royal Decree 184/2022 (Regulating EV Charging Services) |

Mandates clear operational principles, interoperability, and data transparency for charging infrastructure, which increases demand for standardized, high-quality On-Board Chargers and Power Electronics (inverters, DC-DC converters) to ensure compliance. |

|

Spain |

Moves Plan III (Incentive Program) |

Provides direct subsidies for the purchase of electric vehicles, which directly stimulates consumer demand, thereby increasing the production volume imperative for OEMs and, consequently, the procurement demand for all EV components. |

Spain Electric Vehicle Components Market Segment Analysis:

- Electric Motor (By Component Type)

The need for Electric Motors is fundamentally driven by the national push to convert major automotive assembly plants, like SEAT’s Martorell facility, for small EV production by 2025. This significant, multi-billion-euro conversion acts as a growth signal, requiring immediate, large-scale procurement and eventual manufacturing of high-efficiency permanent magnet motors. The motor’s demand profile is evolving, moving from an incremental volume need to a core structural requirement for specific platforms, such as the 'Small BEV' family led by the Volkswagen Group in Spain. The imperative for extended driving range mandates the use of highly power-dense and efficient motors, specifically increasing demand for advanced materials and cooling technologies integrated into the motor's design.

- OEMS (By End-User)

Original Equipment Manufacturers (OEMs) represent the dominant demand segment, primarily driven by their commitment to comply with European and national fleet-wide emission reduction targets. This regulatory pressure makes the shift to component procurement a compulsory strategic imperative rather than an optional commercial decision. The market is concentrated on integrated EV powertrain solutions, including battery, motor, and power electronics bundles, to ensure system-level compatibility and efficiency for new EV models. Furthermore, the OEM segment is the core beneficiary of the PERTE VEC funds, which directly subsidizes their investment in new production lines, artificially amplifying their demand for components to ramp up new EV model production. The commitment of SEAT to invest €3 billion in the conversion of its Martorell plant is the single most significant demand signal from this end-user segment.

Spain Electric Vehicle Components Market Competitive Analysis:

The competitive landscape is characterized by a mix of established global Tier-1 automotive suppliers with a long-standing presence in Spain and new entrants focusing on e-mobility. Competition centers on technology differentiation, specifically in power density and thermal management efficiency for the core powertrain components.

- SEAT S.A. (Volkswagen Group): As the lead for the 'Small BEV' development within the Volkswagen Group, SEAT's strategy directly translates into procurement demand for small electric car components. The company's €3 billion investment in its Martorell plant conversion for EV production from 2025 is a concrete growth driver for components such as the Electric Motor and Battery Pack for the CUPRA UrbanRebel and other Group models.

- Volkswagen Group España Distribución: The group's broader Future: Fast Forward project, which includes the electrification of the Martorell and Pamplona plants and the gigafactory in Sagunto, establishes the central procurement and manufacturing architecture for the country. This strategy ensures significant, long-term component demand, leveraging Spain’s position to produce EVs for multiple Group brands.

Spain Electric Vehicle Components Market Developments:

- December 2024: Stellantis and China's Contemporary Amperex Technology Co. Limited (CATL) continued the strategic development and investment plans for a major EV battery production facility in Zaragoza. This multi-billion euro venture is central to Stellantis' plan to electrify its Spanish production lines, ensuring a local supply of high-voltage battery packs. This acquisition of local production capability for such a vital EV component aims to strengthen Spain's position as an EV manufacturing hub, reduce reliance on overseas imports, and stimulate significant growth in the regional automotive component supply sector.

- February 2023: SEAT S.A. announced an investment of €3 billion to convert its Martorell plant for the production of fully electric vehicles, including the CUPRA UrbanRebel, starting in 2025. This commitment directly underpins the future demand for core EV components like motors and power electronics manufactured in the Spanish ecosystem.

Spain Electric Vehicle Components Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.865 billion |

| Total Market Size in 2031 | USD 4.379 billion |

| Growth Rate | 18.61% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Vehicle Type, Technology, End User |

| Companies |

|

Spain Electric Vehicle Components Market Segmentation:

- BY COMPONENT TYPE

- Battery Pack

- Electric Motor

- Power Electronics

- Inverter

- Converter (DC-DC)

- On-Board Charger

- Thermal Management System

- Body & Chassis

- Other Components

- BY VEHICLE TYPE

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers & Three-Wheelers

- BY TECHNOLOGY

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

- BY END-USER

- OEMS

- Aftermarket