Report Overview

Synthetic Blend Oil Market Highlights

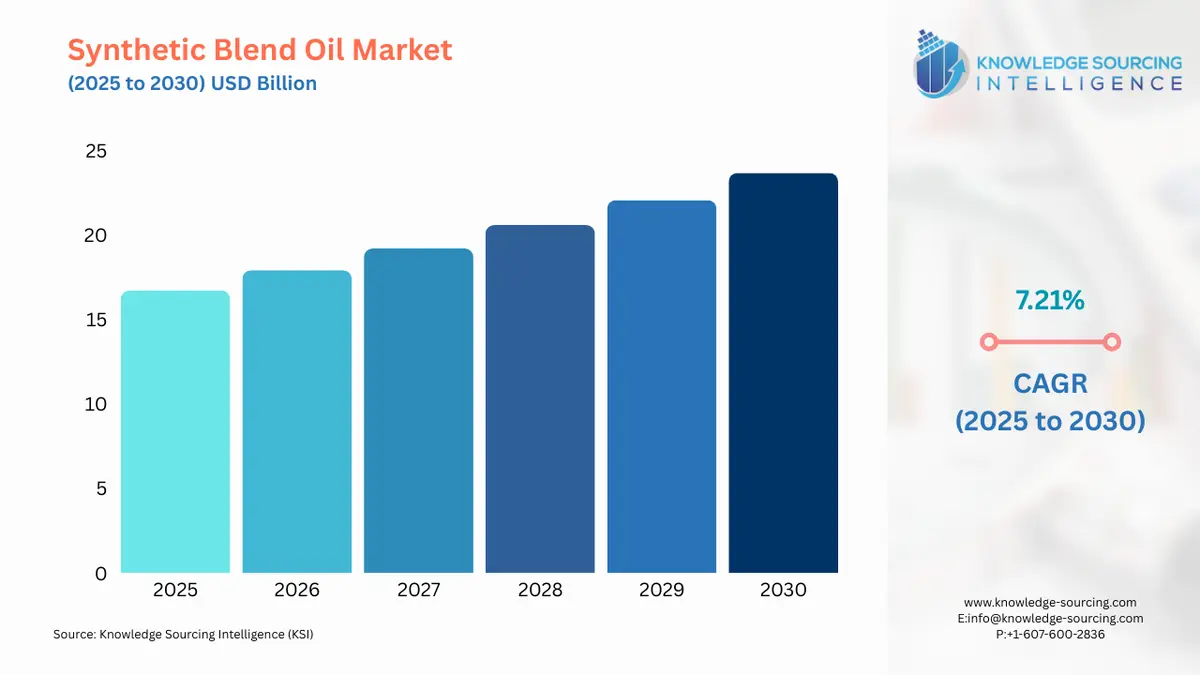

Synthetic Blend Oil Market Size:

Synthetic Blend Oil Market, growing at a 6.99% CAGR, is projected to achieve USD 25.065 billion in 2031 from USD 16.708 billion in 2025.

Synthetic blend oil is a type of motor oil created by mixing a percentage of synthetic oil, typically 20-30%, with conventional mineral oil. Synthetic blend oils are designed to offer the benefits of synthetic oils at a lower cost while still providing some of the advantages of mineral oils. Synthetic blend oil is used in automotive, marine, and industrial activities as it provides superior lubrication and protection against wear and tear and can handle extreme temperatures while also reducing overall costs. Automotive and marine producers demand synthetic blend oils as they provide high-performance lubrication in engines under extreme conditions, extend the life of equipment, and reduce maintenance costs. Such factors are driving their market growth.

Synthetic Blend Oil Market Growth Drivers:

Increased automotive production is accelerating the demand for synthetic blend oils.

The main advantage of synthetic blend oils in the automotive industry is their ability to provide superior protection against wear and tear, which can extend the life of engines and reduce maintenance costs. This is particularly important for high-performance engines with heavy use and extreme operating conditions. Synthetic blend oils can improve fuel efficiency by reducing friction which helps automakers meet stricter environmental regulations. Reducing maintenance costs and improving fuel efficiency in the growing automotive industry will boost the demand for synthetic blend oil. According to the International Organization of Motor Vehicle Manufacturers (OICA), the production of cars in China increased to 23.84 million in 2022 from 21.41 million in 2021. According to the Society of Indian Automobile Manufacturers (SIAM), the production of passenger cars increased from 3.06 million in 2020-2021 to 3.65 million in 2021-2022. This shows that synthetic blend oil will have a great demand in the future.

The expanding marine sector is positively impacting market growth.

The need for high-performance lubricants becomes increasingly important in the marine industry as ships and vessels become more sophisticated. Synthetic blend oils are available in a wide range of viscosities, grades, and formulations that meet various industry specifications, and this flexibility allows marine operators to select the right lubricant for each application, ensuring that engines are properly lubricated and protected. Synthetic blend oils reduce friction and improve engine efficiency, which helps marine operators reduce fuel consumption and minimize environmental impact. The increasing ship and vessel production will boost the demand for synthetic blend oil. According to the International Maritime Organization (IMO), the number of ships in the world merchant fleet increased by 3.04% from January 2020 to January 2021, with 99,800 ships registered.

Synthetic Blend Oil Market Geographical Outlook:

The Asia Pacific is expected to hold a significant market share throughout the forecast period.

Asia Pacific region is expected to constitute a significant market share due to the growth of the automotive and marine sectors in countries such as South Korea and India—also, the regulations relating to strict fuel efficiency and emissions act as additional driving factors. In 2020, to promote the demand for ships built in India, ROFR (Right of First Refusal) guidelines were amended to give preference to ships built in India, flagged in India, and owned by Indians. In 2020, the South Korean government stated it would speed up customs clearance, arrange freight transportation and provide liquidity support for the automotive industry, which employs about 12% of South Korea’s workforce. Such developments will boost the demand for synthetic blend oil in Asia, thereby driving regional market growth.

Synthetic Blend Oil Market Products:

Synthetic Blend Oil Market Segmentation:

By Base Stock Type

Diesters

Phosphate Esters

Polyol Esters

Polyalkylene Glycol

Others

By End-User

Automotive

Marine

Industrial

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others