Report Overview

Thermal Printing Market Size, Highlights

Thermal Printing Market Size:

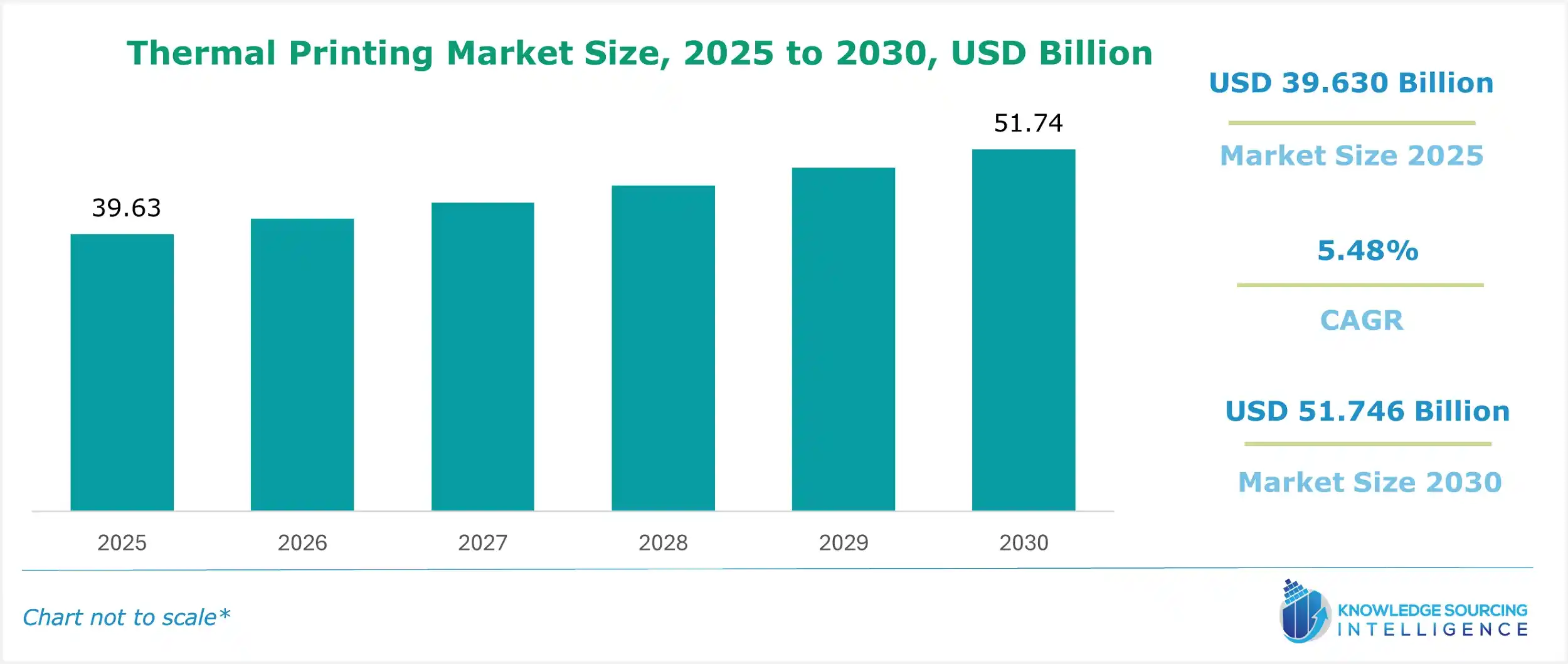

The Thermal Printing Market is expected to grow from USD 39.630 billion in 2025 to USD 51.746 billion in 2030, at a CAGR of 5.48%.

Thermal Printing Market Trends:

The thermal printing market is experiencing robust growth, driven by the increasing demand for thermal printing technology, which uses heat to produce images or text on paper or labels. This market encompasses thermal printers, print heads, thermal transfer ribbons, and labels, serving industries like retail, logistics, healthcare, and e-commerce.

A key driver is the booming e-commerce industry, which relies heavily on thermal printing for product labeling and packaging. Thermal printers offer cost-effective, high-speed, and reliable solutions for producing barcodes, shipping labels, and tags, meeting the needs of online retailers. The rise of convenience-driven consumer behavior further fuels demand for efficient labeling solutions.

The adoption of Radio Frequency Identification (RFID) technology significantly boosts the market. RFID tags, used for inventory tracking and supply chain management, require precise label printing, where thermal printing excels due to its durability and efficiency. Industries like logistics and retail leverage RFID-enabled thermal printing to enhance operational accuracy.

Technological advancements in thermal printing equipment, such as improved print quality, compact designs, and energy-efficient systems, drive market growth. Innovations in thermal transfer ribbons and eco-friendly labels address environmental concerns, aligning with sustainability goals. Water-based inks and recyclable materials in thermal printing supplies cater to green initiatives, appealing to environmentally conscious consumers.

The Asia-Pacific region, led by China and India, dominates due to rapid industrialization, e-commerce growth, and infrastructure investments. North America and Europe follow, driven by technological innovation and retail expansion. The healthcare sector also contributes, using thermal printers for patient identification and medical labeling.

Despite challenges like high initial costs, product innovation, and economies of scale are making thermal printing more accessible. The thermal printing market is poised for sustained growth, fueled by e-commerce, RFID adoption, sustainability trends, and technological advancements, ensuring its critical role in modern labeling and printing solutions.

Thermal Printing Market Drivers:

E-commerce Surge: The rapid expansion of e-commerce globally has heightened demand for efficient labeling solutions. Thermal printing offers cost-effective, high-speed production of barcode labels and shipping tags, critical for inventory and logistics management. The scalability of thermal printers supports the high-volume needs of online retail.

Healthcare Applications: The healthcare sector significantly drives market growth, utilizing thermal printing for patient identification, prescription labeling, and specimen tagging. The technology’s ability to produce durable, smudge-resistant labels enhances patient safety and operational efficiency, aligning with stringent regulatory requirements.

RFID Technology Adoption: The integration of Radio Frequency Identification (RFID) in supply chains boosts demand for thermal printing, as it efficiently produces labels for RFID tags. This is particularly relevant in retail and logistics, where real-time tracking enhances operational transparency.

Thermal Printing Market Restraints:

Environmental Concerns: The reliance on thermal paper, often containing chemicals like BPA or BPS, raises sustainability issues. Regulatory pressures and consumer demand for eco-friendly alternatives may limit market growth unless greener solutions are adopted.

High Initial Costs: While thermal printing is cost-effective for high-volume applications, the upfront investment in advanced printers and consumables can deter small to medium-sized enterprises, particularly in cost-sensitive regions.

Thermal Printing Market Segment Analysis:

By Type: Thermal Transfer Printing

Thermal transfer printing dominates due to its versatility and durability, producing labels resistant to heat, moisture, and chemicals. It is widely adopted in industries like healthcare and manufacturing, where long-lasting labels are critical. Advancements in ribbon technology further enhance print quality, driving segment growth.

By Application: Barcode Labels

Barcode labels represent a leading application segment, fueled by their critical role in e-commerce, retail, and logistics. Thermal printing’s ability to produce high-resolution, scannable barcodes supports efficient inventory tracking and supply chain management, making it indispensable in these sectors.

Thermal Printing Market Geographical Outlook:

- North America: The United States leads due to its robust e-commerce ecosystem and advanced healthcare infrastructure. High adoption of RFID and automation in logistics further drives demand. Canada and Mexico follow, with growth tied to cross-border trade and retail expansion.

- Europe: The United Kingdom, Germany, and France are key markets, propelled by stringent healthcare regulations and a strong manufacturing base. The region’s focus on sustainability may push innovation in eco-friendly thermal printing solutions.

- Asia Pacific: China, Japan, and India are growth engines, driven by booming e-commerce, industrialization, and healthcare investments. China’s massive manufacturing sector and India’s retail modernization fuel demand for barcode and RFID labels.

- Middle East and Africa: The UAE and Saudi Arabia show promise due to logistics and retail growth, though adoption is slower in other areas due to cost barriers and limited infrastructure.

- South America: Brazil and Argentina lead, supported by e-commerce and retail expansion, but economic volatility may temper growth in smaller markets.

Thermal Printing Market Key Developments:

- In August 2025, Kyocera officially launches the TPA Series thermal printhead for high-speed, eco-friendly portable POS systems. Kyocera previewed the product development of its TPA Series printhead designed for receipt printing to thermal point-of-sale systems. The TPA printhead has an impressive 350 mm/sec print speed, great durability, and printing support for Blue4est® paper (phenol-free, recyclable papers).

List of Top Thermal Printing Companies:

- Axiohm (Part of the TXCOM Group)

- Bixolon Co., Ltd.

- TSC Auto ID Technology Co., Ltd.

- Zebra Technologies Corporation

- Honeywell International Inc

Thermal Printing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Thermal Printing Market Size in 2025 | USD 39.630 billion |

| Thermal Printing Market Size in 2030 | USD 51.746 billion |

| Growth Rate | CAGR of 5.48% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Thermal Printing Market |

|

| Customization Scope | Free report customization with purchase |

Thermal Printing Market Segmentation:

- BY TYPE

- Direct Thermal Printing

- Thermal Transfer Printing

- BY APPLICATION

- Barcode Labels

- Labeling

- Kiosks

- Others

- BY END-USER INDUSTRY

- Retail

- Transportation

- Manufacturing

- Healthcare

- Government

- Security

- Others

- BY GEOGRAPHY

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America