Report Overview

Barcode Equipment Market - Highlights

Barcode Equipment Market Size:

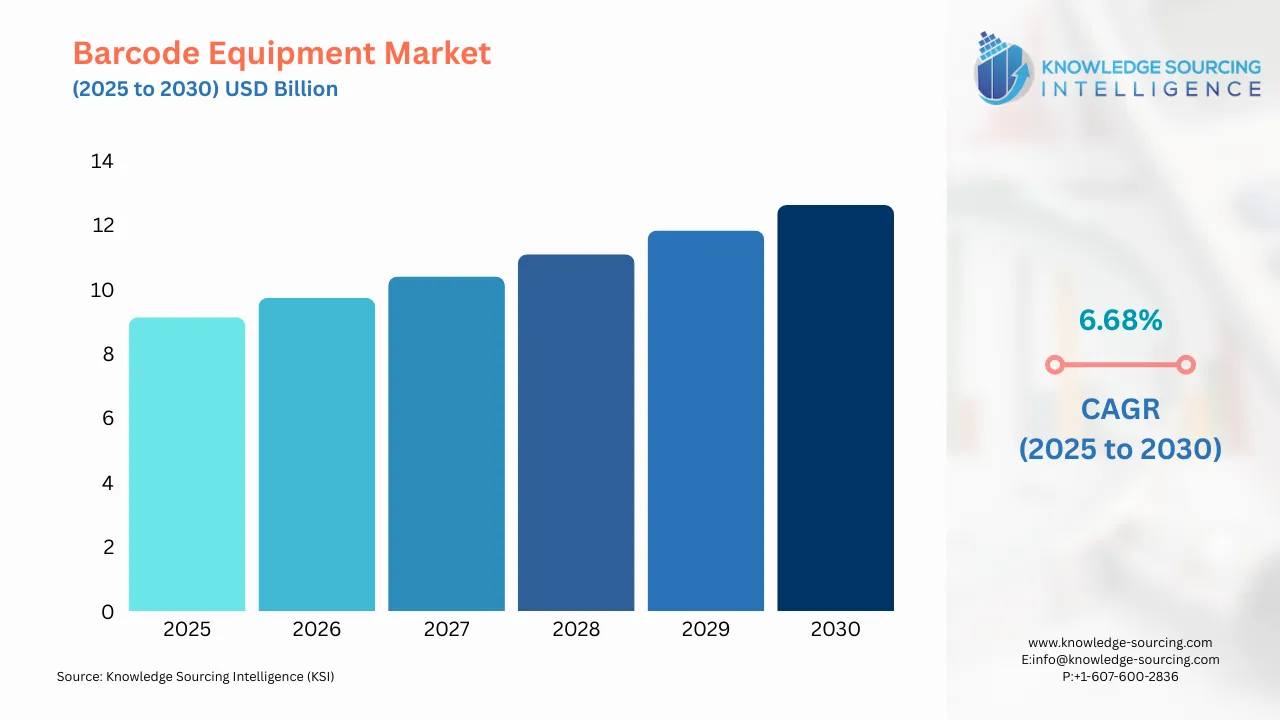

The barcode equipment market is evaluated at US$9.134 billion in 2025 is projected to grow at a CAGR of 6.68% to reach US$12.619 billion in 2030.

Barcode Equipment Market Overview:

Barcode is essentially a method used to portray data in a visual, machine-readable form. The data is represented by using the widths and spacing of parallel lines. These barcodes are available in one-dimensional and two-dimensional forms. The two-dimensional barcodes can be read using a mobile phone with an inbuilt camera. Once scanned, the device stores or immediately processes the data. Barcode equipment is of various types, including barcode scanners, barcode printers, and barcode verifiers.

The global barcode scanner market has undergone a significant transformation in recent decades. Industries such as retail, healthcare, logistics, and transportation are increasingly adopting barcode technology for various applications. In retail, barcodes enable fast and accurate product identification. Healthcare providers use them to track patient medications and manage records throughout a patient’s stay. The transportation sector benefits from barcodes by facilitating efficient paperless ticketing, while logistics companies rely on them to streamline purchasing and return processes

Some of the major players covered in this report include Zebra Technologies Corporation, Honeywell International Inc., Datalogic S.p.A., SATO Holdings Corporation, Toshiba, Cognex Corporation, Brother Industries, Ltd., Epson US, Opticon Sensors Europe B.V., Denso Wave Incorporated, Bluebird Inc., and Wasp Barcode Technologies, among others.

Barcode Equipment Market Trends:

The barcode equipment market is evolving rapidly, driven by technological advancements and the growing demand for efficiency in industries such as retail, logistics, healthcare, and manufacturing. Sustainable barcode labels are gaining traction as businesses prioritize eco-friendly practices, utilizing biodegradable materials and energy-efficient printing technologies to reduce environmental impact while maintaining high print quality and durability. These labels align with regulatory pressures and corporate sustainability goals, ensuring compliance without sacrificing performance. Rugged barcode scanners, designed to withstand harsh conditions like extreme temperatures, dust, and impacts, are critical in industrial environments such as warehouses and manufacturing plants. Companies like Zebra Technologies and Honeywell offer robust solutions, such as the Zebra DS3600 and Honeywell Granit XP, which deliver reliable performance for direct part mark (DPM) and damaged label scanning. Hands-free scanning solutions, including omni-directional barcode readers, are transforming high-volume retail and logistics operations by enabling faster, more efficient workflows. These devices, such as Zebra’s multi-plane scanners, allow operators to process barcodes from any angle, reducing manual effort and accelerating checkout or inventory tasks.

Meanwhile, mobile scanning solutions are redefining operational flexibility, with devices like the ProGlove MARK 3 and Datalogic’s Gryphon 4200 integrating wireless connectivity and AI-driven decoding for seamless data capture in dynamic settings. These scanners, often paired with mobile computers or wearables, enhance real-time inventory tracking and supply chain visibility. The integration of cloud-based analytics and AI further optimizes these technologies, enabling predictive maintenance and data-driven decision-making. As industries embrace automation and digital transformation, the demand for durable, versatile, and sustainable barcode equipment continues to grow, positioning the market for sustained innovation and adoption across diverse sectors.

Barcode Equipment Market Drivers:

E-Commerce and Omnichannel Retailing Growth

The rapid expansion of e-commerce has significantly increased the demand for barcode equipment, as businesses strive to meet the needs of a digital-first marketplace. Barcode scanners and printers are essential for managing inventory across warehouses, distribution centers, and last-mile delivery systems. For instance, in retail, barcode systems enable real-time tracking of stock levels, reducing out-of-stock scenarios and improving customer satisfaction. The rise of omnichannel retailing, where consumers expect seamless integration between online and in-store experiences, further amplifies the need for barcode technology. A 2023 report highlighted that the majority of retailers are investing in technologies like barcode scanners to support buy-online-pickup-in-store (BOPIS) models, which rely heavily on accurate inventory data. In logistics, companies like Amazon utilize barcode systems to streamline operations in their fulfillment centers, ensuring packages are sorted and shipped efficiently. This driver is particularly pronounced in emerging markets like India and China, where e-commerce penetration is growing rapidly due to increasing internet access and smartphone usage.

Technological Advancements

Innovations in barcode equipment are transforming operational capabilities across industries. Modern barcode scanners, such as those equipped with high-resolution CMOS sensors and AI-driven image processing, can read both 1D and 2D codes with greater speed and accuracy. For example, Cognex Corporation’s DataMan 380 series, launched in October 2023, offers advanced decoding algorithms that process multiple barcode types simultaneously, reducing errors in high-speed manufacturing and logistics environments. Similarly, advancements in barcode printers, such as thermal transfer and inkjet technologies, enable high-quality, durable labels that withstand harsh conditions, critical for industries like healthcare and food processing. The integration of barcode systems with IoT and cloud platforms is another significant development. Zebra Technologies’ 2024 introduction of IoT-enabled barcode scanners allows real-time data analytics, enabling predictive inventory management and reducing downtime. These advancements not only enhance operational efficiency but also support scalability, making barcode equipment indispensable for businesses adopting Industry 4.0 principles.

Regulatory and Industry Requirements

Stringent regulations in sectors like healthcare, pharmaceuticals, and food and beverage are driving the adoption of barcode equipment to ensure compliance and traceability. In healthcare, the U.S. Food and Drug Administration (FDA) mandates the use of Unique Device Identification (UDI) barcodes on medical devices to track products through the supply chain, enhancing patient safety and recall efficiency. This regulation has spurred demand for high-precision barcode printers and scanners capable of handling 2D codes, which store detailed product information. Similarly, in the food industry, regulations such as the European Union’s General Food Law require traceability of products from farm to table, necessitating robust barcode systems to monitor batch numbers and expiration dates. These mandates ensure that barcode technology remains a cornerstone of compliance-driven industries, fostering market growth.

Barcode Equipment Market Restraints:

High Initial Costs

The deployment of advanced barcode equipment, such as AI-integrated scanners or IoT-enabled printers, involves significant upfront costs, which can deter adoption, particularly among small and medium-sized enterprises (SMEs). For example, a single high-end industrial barcode printer can cost upwards of $5,000, excluding maintenance and software integration expenses. SMEs, which account for 90% of global businesses, often face budget constraints that limit their ability to invest in such systems, opting instead for manual processes or lower-cost alternatives. A 2024 study by the International Trade Centre noted that 45% of SMEs in developing economies cited high technology costs as a barrier to adopting automated inventory systems, including barcode equipment. This restraint slows market penetration in price-sensitive regions and sectors, limiting the overall growth potential of the barcode equipment market.

Competition from Alternative Technologies

The rise of Radio Frequency Identification (RFID) poses a competitive challenge to traditional barcode systems. RFID offers advantages such as non-line-of-sight reading and the ability to scan multiple items simultaneously, making it appealing for applications like warehouse management and asset tracking. For instance, Walmart has increasingly integrated RFID tags in its supply chain to improve inventory accuracy, reducing reliance on barcode scanners. While RFID’s higher implementation costs, often 10-20 times that of barcode systems, limit its widespread adoption, its growing popularity in high-volume operations threatens the dominance of barcode equipment. This competition pushes barcode manufacturers to innovate continuously to maintain market relevance.

Barcode Equipment Market Segmentation Analysis:

The Cloud-Connected Deployment will experience notable growth

Cloud-connected deployment refers to barcode equipment integrated with cloud-based platforms, enabling real-time data storage, analytics, and remote access. Unlike standalone or integrated deployments, cloud-connected systems offer scalability, flexibility, and seamless integration with enterprise software like warehouse management systems (WMS) and enterprise resource planning (ERP) tools. This deployment model is increasingly preferred due to its ability to support digital transformation, particularly in industries requiring real-time inventory tracking and supply chain visibility.

Cloud-connected barcode systems allow businesses to centralize data from multiple locations, facilitating real-time updates and analytics. For example, a retailer can track inventory across stores and warehouses simultaneously, reducing stock discrepancies. These systems also support mobile and IoT-enabled scanners, enhancing operational mobility. In 2023, Zebra Technologies introduced cloud-connected barcode scanners with IoT capabilities, enabling predictive maintenance and real-time inventory insights. Additionally, cloud deployment reduces the need for on-premise infrastructure, lowering maintenance costs and improving scalability for small and medium-sized enterprises (SMEs).

Cloud-connected barcode equipment is widely adopted in retail, logistics, and healthcare. In retail, cloud systems streamline omnichannel operations, such as buy-online-pickup-in-store (BOPIS), by syncing inventory data across platforms. In logistics, companies like DHL use cloud-based barcode systems to optimize shipment tracking, improving delivery accuracy. In healthcare, cloud-connected scanners ensure compliance with regulations like the FDA’s Unique Device Identification (UDI) by providing traceable data accessible from multiple facilities. The growth of cloud-connected deployment is driven by the rise of e-commerce, which demands real-time inventory management, and the adoption of Industry 4.0 principles, emphasizing interconnected systems. Additionally, advancements in 5G connectivity improve data transfer speeds, making cloud systems more reliable for high-volume operations.

By Industry Vertical, the Retail & E-Commerce sector is growing considerably

The retail & e-commerce sector is the largest industry vertical for barcode equipment, driven by the global surge in online shopping and the need for efficient inventory and order fulfillment systems. Barcode scanners and printers are critical for point-of-sale (POS) transactions, inventory management, and logistics in both physical stores and online platforms.

In retail, barcode equipment supports fast checkouts, inventory tracking, and loss prevention. For instance, Walmart uses advanced barcode scanners to manage inventory across its 10,500 stores, ensuring stock accuracy. In e-commerce, barcode systems enable rapid order processing in fulfillment centers. Amazon’s warehouses rely on barcode scanners to process over 1,200 tons of items daily, guiding workers through efficient picking routes. Additionally, 2D barcodes like QR codes enhance customer engagement by linking to product details or promotions.

This growth necessitates barcode equipment to handle increased order volumes and ensure accurate delivery. The rise of omnichannel retailing, where 73% of retailers invest in barcode systems for BOPIS, further boosts demand. Technological advancements, such as Datalogic’s Gryphon 4200 series launched in 2020, enhance scanning speed and accuracy in retail environments.

The Asia Pacific region is expected to rise significantly

The Asia Pacific region, comprising countries like China, Japan, India, South Korea, Thailand, and Indonesia, is the largest market for barcode equipment. Rapid industrialization, urbanization, and e-commerce growth drive demand, particularly in retail, logistics, and manufacturing sectors.

China leads the region due to its massive e-commerce market, with platforms like Alibaba and JD.com relying on barcode systems for logistics. In 2024, China accounted for approximately 50% of global e-commerce sales, necessitating a robust barcode infrastructure. India’s retail and logistics sectors are expanding rapidly, supported by government initiatives like Digital India, which promote automation. Japan and South Korea, with advanced manufacturing industries, use barcode equipment for quality control and supply chain optimization. Thailand and Indonesia are emerging markets, driven by growing retail chains and logistics hubs. Rapid urbanization and rising consumer demand for fast delivery increase the need for barcode systems in warehousing. Additionally, government policies, such as China’s “Made in China 2025” initiative, promote automation, boosting barcode adoption in manufacturing. Innovations like Honeywell’s 2023 Ring Scanner, designed for high-paced Asian warehouses, further drive market growth.

Barcode Equipment Market Key Developments:

May 2025: Square introduced the Square Handheld, a wireless payment device with integrated barcode scanning and order management capabilities, targeting small and large retailers. The device combines POS functionality with advanced barcode reading, enhancing checkout efficiency and inventory tracking 1.

January 2025: Cognex launched the AI-powered DataMan 290 and 390 barcode readers, designed for manufacturing applications. These fixed-mount scanners excel at decoding damaged or low-quality codes, improving throughput with a user-friendly setup 2.

July 2024: Dynamsoft released the Barcode Reader SDK .NET MAUI Edition, enhancing multi-platform barcode scanning for healthcare applications. The SDK supports cross-device integration, boosting efficiency in patient data management 3.

May 2024: SATO Corporation, in collaboration with EM Microelectronic, upgraded its CL4NX, CL6NX Plus, and CT4-LX printers to support em|echo-V RAINFC label printing and encoding, catering to retail, healthcare, and industrial sectors 4.

List of Top Barcode Equipment Companies:

Zebra Technologies Corporation

Honeywell International Inc.

Cognex Corporation

Datalogic S.p.A.

SATO Holdings Corporation

Barcode Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 9.134 billion |

| Total Market Size in 2030 | USD 12.619 billion |

| Growth Rate | 6.68% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Solution Type, Deployment Model, Industry Vertical, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Barcode Equipment Market Segmentation:

Barcode Equipment Market Segmentation by Solution Type

Hardware

Barcode Scanners

Barcode Printers

Barcode Verifiers

Software

Barcode Equipment Market Segmentation by Deployment Model

The report analyzes the market by deployment model into:

Standalone Deployment

Integrated Deployment

Cloud-Connected Deployment

Barcode Equipment Market Segmentation by Industry Vertical

The report analyzes the market by industry vertical:

Retail & E-Commerce

Logistics & Warehousing

Manufacturing

Healthcare

Transportation

Government & Defense

Others

Barcode Equipment Market Segmentation by Barcode Type

The report analyzes the market by barcode type:

1D

2D

Barcode Equipment Market Segmentation by Regions:

The study also analysed the barcode equipment market into the following regions, with country-level forecasts and analysis as below:

North America (US, Canada, and Mexico)

South America (Brazil, Argentina, and Others)

Europe (Germany, UK, France, Spain, and Others

Middle East and Africa (Saudi Arabia, UAE, and Others)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)