Report Overview

Thin Film Solar Cells Market Size:

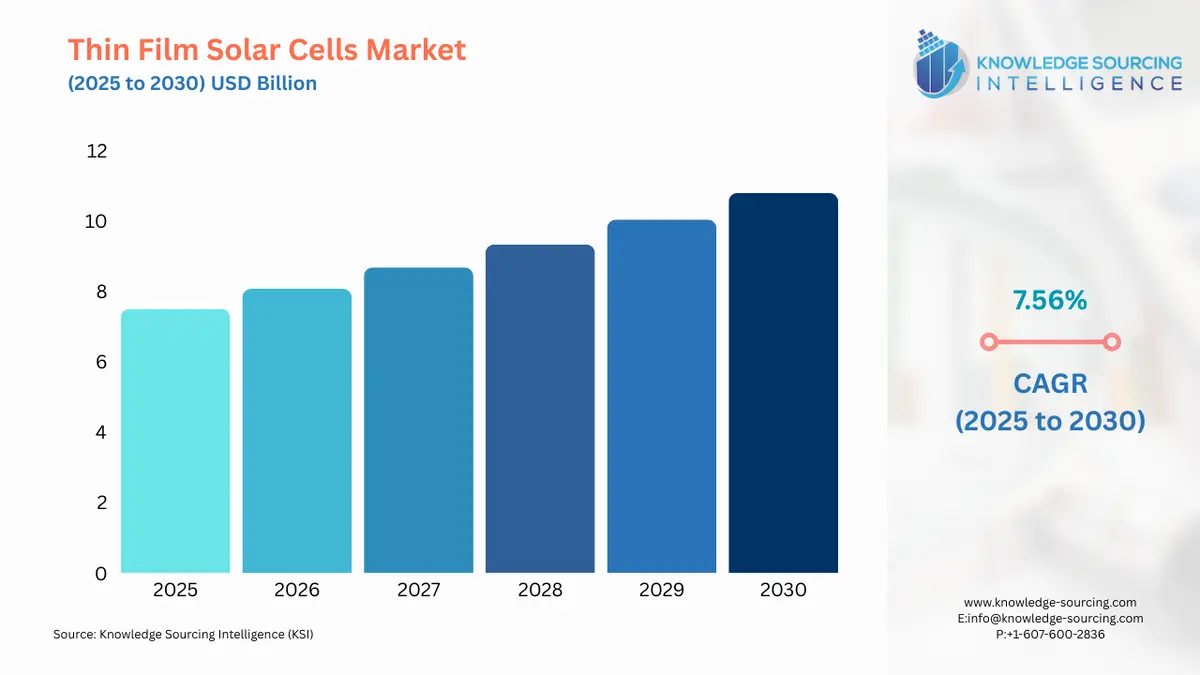

Thin Film Solar Cells Market is expected to grow at a 7.56% CAGR, achieving USD 10.798 billion by 2030 from USD 7.500 billion in 2025.

A thin-film solar cell is a second-generation solar cell created by depositing one or more thin layers of photovoltaic material over a substrate consisting of glass, plastic, or metal. Cadmium telluride (CdTe), gallium arsenide, and amorphous thin-film silicon are among the commercially available thin-film solar cell materials. The growing consumer energy demand and people moving towards renewable energy are expected to drive higher demand for thin film solar cells for residential and industrial applications throughout the projected period. Renewable energy sources will grow the quickest in the electrical sector, expanding from 24% in 2017 to about 30% in 2023, according to the International Energy Association. The Lower PV module prices and increased energy consumption in the world due to declining non-renewable energy are driving the market of thin-film solar cells, over the forecasted period.

Thin Film Solar Cells Market Growth Drivers:

- The rise in demand for electricity will boost the market for thin-film solar cells

An increasing population is one of the key factors driving rapid industrialization and urbanization, which will increase the need for electricity and drive the thin film solar cell market. Additionally, according to the United Nations in mid-November 2022, there were 8.0 billion people on the planet, up from 2.5 billion in 1950. The population of the world is projected to rise by about 2 billion people over the course of the next 30 years, from the present 8 billion to 9.7 billion in 2050, with a potential peak of roughly 10.4 billion in the middle of the 1980s. According to IEA, modern economies are powered by electricity, which will account for over 50% of global final energy consumption by 2050 due to a sharp rise in electricity demand. This shows that electricity consumption is going to rise and demand for solar energy will also increase at a rapid pace as the population increase which will boost the market growth for thin film solar cells

- The cadmium-telluride thin film solar cells will dominate the market growth

Cadmium telluride is a by-product of zinc, lead, and copper mining, smelting, and refining. The ability to produce cadmium-telluride (CdTe) thin film solar cells at a low cost will drive the growth of the thin film solar cell market. These are used in photovoltaic techniques to produce solar cells at a low cost, and this is the only solar energy technology that uses the least amount of water in its production. According to the National Renewable Energy Laboratory (NREL), The cell efficiencies of CdTe thin-film PV solar cells are up to 16.7% greater than those of other thin-film technologies and they have led the way in this field's research and development (R&D). In terms of producing CdTe PV, the United States is the industry leader. The has led the way in this field's research and development (R&D). In August 2022, the US Department of Energy announced a USD 20 million cadmium telluride (CdTe) accelerator consortium to cut the prices of CDTE solar cell technology, the second most popular solar technology after silicon. These increasing investments and usage of cadmium telluride type of thin film solar cell will boost the market growth during the forecasted period.

Thin Film Solar Cells Market Geographical Outlook:

- During the forecast period, the Asia-Pacific region is anticipated to boost the market growth

Asia-Pacific is expected to drive the growth of the thin film solar PV market due to the increasing usage of solar PV modules in utility-scale, commercial, and residential applications. Thin film solar PVs are largely used in utility-scale projects in China, which comes in the world's largest solar PV market. In Jan 2019, a draft policy was published by China's National Development and Reform Commission (NDRC) that would raise the renewable energy target from 20% to 35% by 2030. As per the same source, in 2019, an estimated 40 GW of new renewable energy capacity is anticipated to be linked to the grid, with large-scale solar facilities accounting for around 50% of this capacity. The demand for thin film solar cells will increase as a result of the increased emphasis on developing the transmission and distribution networks for renewable energy in numerous nations in the Asia Pacific region. For instance, in December 2022 the Union Ministry of Power in India announced intentions to integrate a 500 GW renewable energy transmission capacity by 2030, resulting in an increase in the connectivity of solar parks via the grid. Also, the implementation of various net metering and feed-in tariff schemes would increase the need for on-grid thin film solar cells. These government activities in the Asia-Pacific region to develop the thin film solar cell market will be accelerated over the anticipated time.

Segmentation

- THIN FILM SOLAR CELLS MARKET BY TYPE

- Amorphous Silicon

- Cadmium Telluride

- Others

- THIN FILM SOLAR CELLS MARKET BY SUBSTRATE

- Plastic

- Glass

- Metal

- THIN FILM SOLAR CELLS MARKET BY END-USER

- Residential

- Commercial

- Industrial

- THIN FILM SOLAR CELLS MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America