Report Overview

Tuna Fish Market - Highlights

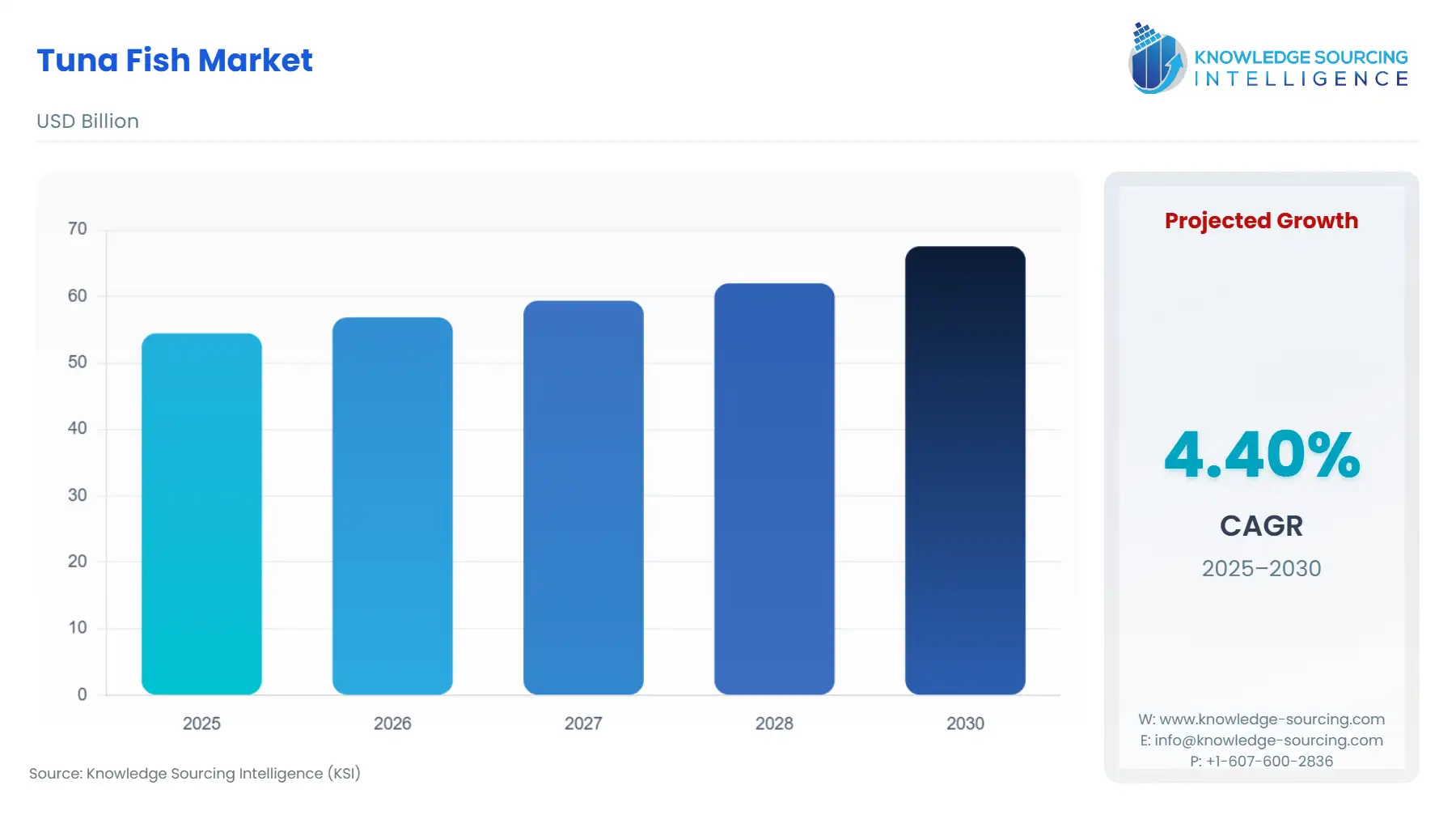

Tuna Fish Market Size:

The Tuna Fish Market is expected to grow from USD 54.474 billion in 2025 to USD 67.576 billion in 2030, at a CAGR of 4.40%.

Tuna is a type of saltwater fish that is not only one of the most consumed fish in the world but is also highly valuable in terms of trade. Tuna is sold in frozen, tinned and fresh forms and is fished in more than 70 nations from Atlantic countries all the way to Indonesia. The tuna is a fish that lives in warm waters and is often caught for food on a commercial scale. Tuna has a meaty flavour and is also very nourishing.

Since the popularity of canned tuna rose in the 1970s, tuna harvests have been rising quickly. Previously viewed as a low-value alternative for other fish like salmon, cod and sardines. The amount of tuna caught worldwide has been rising quickly and steadily. According to data from the National Fisheries Institute, about 1 billion pounds of canned and packed tuna are consumed annually in the United States. Consumption of fresh and frozen tuna has grown over time, particularly in rising markets like the United States, Canada, the Asia Pacific, and Western European countries. Fresh tuna is now widely available in restaurants and supermarkets throughout the world as a result of the globalisation of culinary culture and healthy food choices.

Fishing pressure, which has been exacerbated by rising demand for tuna, has a detrimental effect on tuna supplies. For instance, two important tuna species, yellowfin and bigeye, are on the edge of overfishing in the Coral Triangle region. The ecological equilibrium of this area, which is the world's hub of marine biodiversity, can be disrupted by the overfishing of these important marine predators. As a result, exploitive practices such as overfishing, pirate fishing and ineffective management are impeding the growth of the market. Another factor, such as the shift towards vegan and vegetarian diets, along with the high prevalence of seafood allergies among people, is also obstructing the growth of the tuna fish market during the projection period.

Tuna Fish Market Overview:

The global tuna industry is experiencing robust growth, with sustainable increases apparent. The Food and Agriculture Organisation of the United Nations (FAO), in its reports, notes that the upturn in volume in tuna is largely due to the increase in demand for canned and processed ready-to-eat tuna, in particular from major markets, such as that of the United States, where imports of canned/prepared tuna reached a record of 230,557 tonnes.

The FAO also states that approximately 87% of the major tuna and tuna-like species are currently assessed as healthy. In terms of production volume, about 95% of the global tuna landings come from non-overfished stocks. This is a tribute to the regional fisheries management organisations (RFMOs) and national governments for effectively implementing harvesting strategies and administrative structures. The medium-term prospects are also good: According to the OECD-FAO Agricultural Outlook 2025-2034, global per capita consumption of aquatic animal products will reach 21.8 kg in 2034, rising from 21.1kg in the base period, with Asia accounting for about three-quarters of this increase. This shows that the tuna market is not only coming back in the volume and value of the trade but doing so in the context of increased fishery stewardship of resources and greater long-term consumer demand.

The projected rise in global per capita consumption of aquatic animal foods from 21.1 kg in the base period to 21.8 kg by 2034 indicates steady growth in seafood demand worldwide. This upward trend directly supports the tuna market’s expansion, as tuna remains one of the most consumed and traded fish species globally. Higher consumption levels reflect increasing awareness of seafood’s nutritional benefits and a shift toward protein-rich, low-fat diets. As demand strengthens, it encourages greater investment in sustainable tuna fishing, processing, and trade infrastructure, boosting both market value and long-term industry stability.

Tuna Fish Market Growth Drivers:

High demand for canned tuna and health benefits will support the growth of the global market during the forecast period

The high content of omega-3 fatty acids in tuna fish may contribute to a decrease in the amount of bad cholesterol and omega-6 fatty acids that can build up in the heart's arteries and is linked to lower incidences of cardiovascular illness. Tuna also has a high content of vitamin B12 and vitamin D. It is a rich source of protein with a very minimal amount of carbohydrates and fat. Therefore, the demand for tuna has been increasing due to its health benefits, which are driving the market growth. Even doctors, dieticians and other medical professionals are suggesting that people should consume tuna as it lowers the risk for cardiovascular disease, prevents cancer, promotes weight loss and reduces vision problems.

One of the main factors presently driving the tuna industry is the increase in demand for canned tuna due to its low cost, versatility and ease of preparation. Many people often use canned tuna fish in salads, sandwiches or traditional dishes like tuna noodle casserole. According to data from the National Fisheries Institute, the three regions with the highest consumption rates of canned tuna are the European Union with 51 per cent, the United States and Japan with 31 per cent and 6 per cent respectively. The same source also says that canned tuna is the second most popular seafood item in the United States.

Expanding Global Trade and Export Opportunities

The global trade and export scenario is a major factor driving the expansion of the tuna fish market. As a result, the market is comprised of a sophisticated and highly interdependent supply chain of fishing nations, processing centres, and consumption markets spread over different continents. These countries benefit from the advanced processing methods, their strategic location along the coast, and the well-established cold chain facilities. Thailand, Ecuador, the Philippines, Spain, and Indonesia are the leading exporters of processed and canned tuna products.

The removal of trade barriers and the establishment of regional free trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) have been instrumental in enabling cross-border tuna exports. These agreements have lowered tariffs, eased regulatory barriers, and promoted foreign investment in the tuna processing and packaging industries. Moreover, innovations in the cold chain, containerized shipping, and port infrastructure have significantly enhanced supply stability and reduced the period in which the product is exposed to the risk of spoilage.

Additionally, the increasing demand from consumers for tuna caught in an environmentally friendly manner has opened high-end market opportunities for producers who are certified according to the standards of the Marine Stewardship Council (MSC) and Friend of the Sea (FOS).

In 2023, the EU imported tuna at 9% of the total fish import volume and value. A major part of the imported tuna was skipjack tuna, which gave a volume of 56% and a value of 52%, followed by yellowfin tuna with 29% for both.

Tuna Fish Market Segment Analysis:

By Species: Bluefin

By species, the tuna fish market is segmented into skipjack, albacore, yellowfin, bigeye, bluefin, and others. The Bluefin tuna is one of the most luxurious and expensive species in the global tuna fish market, largely due to its extraordinary flavour, excellent consistency, and high demand in gourmet cooking and fine dining. Bluefin tuna, which includes species like Atlantic Bluefin (Thunnus thynnus), Pacific Bluefin, and Southern Bluefin, is the one that gets accolades most often due to its appetizing taste, vibrant red color, and high fat content; thus, it becomes the most favourite seafood for sushi and sashimi in Japan and other Asian markets. The total volume of tuna by nation in 2022–2023 was the United States, 34,008; Germany, 39,769; Australia, 11,974; France, 12,327; Italy, 13,590; and the United Kingdom, 15,316.

Nevertheless, the Bluefin segment also faces challenges resulting from overfishing and worries about sustainability. In fact, due to the harvesting that has been done very intensively for almost 100 years, the Bluefin stocks in the wild have been reduced to a very low level, which is the reason why regulations and quota-based management systems are becoming increasingly common and are implemented by the organizations like the International Commission for the Conservation of Atlantic Tunas (ICCAT) and the Western and Central Pacific Fisheries Commission (WCPFC) that are responsible for the supervision at the international level.

Tuna Fish Market Geographical Outlook:

By Geography: North America (the US)

The seafood culture is growing in the United States due to its culinary versatility, affordability, and shift toward ready-to-eat formats. Tuna is among the most consumed fish in the United States owing to its high-protein content and low-calorie profile; growing health awareness and lifestyle changes are driving protein-rich diet adoption.

The United States emphasizes ethical sourcing, with MSC (Marine Stewardship Council) certified tuna fish widely sold, showcasing its commitment towards preventing overfishing. According to the Marine Stewardship Council, in 2024, the total MSC-certified tuna volume in the USA stood at 54,636 tons, a significant 60% growth over the volume recorded in 2022.

Additionally, the same source stated that nearly 160 thousand tons of MSC-certified seafood were consumed in the United States in 2024, of which tuna constituted 33%. Besides nutritional content, the consumption of specific species, such as skipjack, which are available in abundance and have high accessibility, has shown considerable improvement over the years, and in markets like the US, such tuna species accounts for nearly 92% market share of MSC tuna products.

Furthermore, beyond residential consumption, the growing demand for seafood cuisine in restaurants is expected to positively drive the demand for tuna products, such as frozen and canned tuna, in the United States. The well-established presence of major brands such as Bumble Bee is also an additional driving factor for the overall market expansion.

Tuna Fish Market Key Developments:

October 2025: Century Pacific’s vegan "unMeat Tuna in Water" was named Best Vegan Fish 2025 by PETA UK, reinforcing the market shift toward plant-based seafood alternatives.

August 2025: Bumble Bee Seafoods launched its 'Bumble Bee Snackers' line, offering convenient single-serve cans of flavored and unflavored tuna for the on-the-go market.

June 2025: Dongwon F&B expanded canned tuna distribution to the U.S. via Amazon with new product varieties.

March 2025: Thai Union Group partnered with Ocean Innovations on a blockchain traceability platform across its tuna supply chain.

December 2024: Bolton Group achieved 99.7% responsibly sourced tuna across all brands, significantly surpassing its sustainability targets for the year with its WWF partnership.

Tuna Fish Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 54.474 billion |

| Total Market Size in 2030 | USD 67.576 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.40% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Species, Type, Distribution Channel, End Use |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Tuna Fish Market Segmentation:

By Species

Skipjack

Albacore

Yellowfin

Bigeye

Bluefin

Others

By Type

Canned

Fresh

Frozen

By Distribution Channel

Offline

Hypermarkets/Supermarkets

Specialty Stores

Others

Online

By End Use

Residential

Commercial and Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East & Africa

Saudi Arabia

UAE

Others

Asia Pacific

Japan

China

India

South Korea

Taiwan

Thailand

Indonesia

Others