Report Overview

UK AI in Workforce Highlights

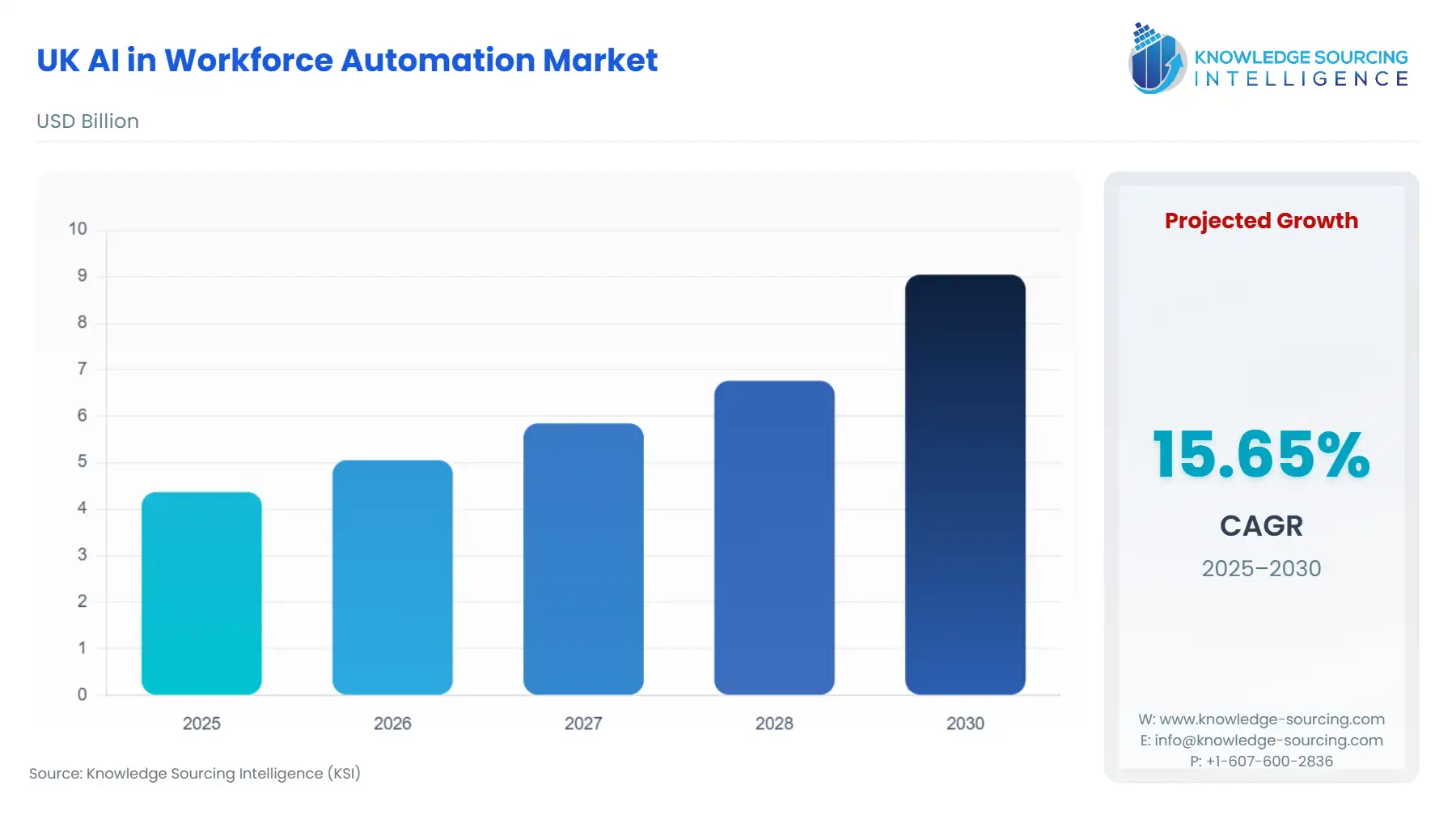

UK AI in Workforce Automation Market Size:

The UK AI in Workforce Automation Market is expected to grow at a CAGR of 15.65%, reaching USD 9.042 billion in 2030 from USD 4.370 billion in 2025.

________________________________________

The UK AI in Workforce Automation market is characterized by a rapid transition from nascent technology exploration to concrete enterprise implementation, driven by a national imperative for productivity enhancement. The foundational component of this market is the integration of Artificial Intelligence, specifically Robotic Process Automation (RPA), Generative AI (GenAI), and Machine Learning (ML) capabilities, into core business processes to create 'digital workers' or autonomous workflows.

This dynamic ecosystem is fuelled by a robust domestic technology base, evidenced by a significant increase in the number of dedicated and diversified AI firms, which are now competing to provide sophisticated, end-to-end automation software and services to the public and private sectors. The market's structural shift is centered on moving from task-level automation to complex process orchestration, necessitating higher-value, consultative services and platform-based solutions that can operate securely at an enterprise scale.

UK AI in Workforce Automation Market Analysis:

Growth Drivers

The imperative for increased labor productivity is the primary catalyst driving the demand for AI in workforce automation. UK productivity lags behind key European counterparts, creating an urgent commercial and governmental mandate to adopt technologies that streamline operational efficiency and reduce costs. This directly increases demand for automation platforms that promise quantifiable returns on investment by offloading manual, repetitive tasks from human employees. Concurrently, the proliferation of cloud-based AI solutions offers enhanced scalability and accessibility, lowering the deployment barrier for enterprises, which directly propels the uptake of consumption-based, cloud-deployed automation services like intelligent document processing and virtual assistant integration.

Challenges and Opportunities

A significant growth constraint is the persistent skills gap, with 16% of firms in 2023 citing the level of AI expertise and skills as a major barrier to adoption. This deficiency in internal capabilities creates friction in deployment and long-term management, thereby increasing demand for managed automation services and dedicated training solutions. Conversely, this challenge presents an immediate opportunity for market growth in the form of specialised consulting and support services. Furthermore, the rising awareness of complex ethical considerations, such as algorithmic bias and lack of transparency, drives an emerging demand for robust AI assurance tools and governance platforms that enable auditable and responsible use of automation technologies.

Supply Chain Analysis

The global supply chain for this market is primarily intellectual and computational, not logistical. The key production hubs for the core enabling technology, such as large language models (LLMs) and advanced machine learning frameworks, are concentrated in North America (US) and Asia-Pacific, creating a significant dependency on US-based hyperscale cloud providers for computational power (compute). The local UK supply chain focuses on the 'last mile' of value creation: bespoke integration, solution architecture, and professional services, often involving UK-headquartered firms like Quantexa and Blue Prism. Logistical complexity stems from data sovereignty requirements and the continuous, high-speed iteration of foundational AI models, demanding continuous upskilling of the domestic workforce and robust data transfer infrastructure.

Government Regulations

The UK government's regulatory approach is characterized by a "pro-innovation" framework, seeking to maximize the economic and social value of AI while mitigating risks. This has a direct, two-sided impact on the demand for workforce automation.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| UK-Wide | A pro-innovation approach to AI regulation White Paper (Published 2023) | Explicitly targets reducing regulatory uncertainty to encourage investment and adoption. This framework, based on principles like safety and fairness, increases enterprise confidence to invest in AI automation, boosting demand for solutions that are demonstrably robust and accountable. |

| UK Public Sector | Artificial Intelligence Playbook for the UK Government (Updated 2025) | Sets out 10 common principles for safe, responsible, and effective AI use in government. This mandates an increase in demand for certified, assured automation solutions capable of meeting the principles of Fairness, Transparency, and Accountability, particularly in civil service workforce automation. |

| UK-Wide | General Data Protection Regulation (GDPR) and Data Protection Act 2018 | The stringency of data protection requirements increases the cost and complexity of deploying AI automation that handles personal or sensitive data. This restricts the demand for un-governed, off-the-shelf AI and instead channels it towards high-assurance, secure, and On-Premises or Private Cloud-based solutions. |

UK AI in Workforce Automation Market Segment Analysis:

By Technology: Software & Services

The Software & Services segment commands the largest market share, driven by the shift from one-time software licenses to scalable, subscription-based Software-as-a-Service (SaaS) and professional services models. The core growth driver is the need for speed-to-value in deploying automation. Services, including consulting, implementation, and training, are non-negotiable for most enterprises, as the Office for National Statistics (ONS) data indicates a significant portion of UK firms lack the necessary in-house AI expertise. This directly increases the demand for comprehensive solution providers like Digital Workforce, which offer end-to-end automation-as-a-service. Moreover, the inherent complexity of integrating different automation components (RPA, ML, GenAI) within legacy IT infrastructure sustains high demand for systems integration and managed services, effectively transforming a purely software market into an integrated solution ecosystem where the service component is the critical differentiator.

By Industry Vertical: Banking & Finance

The Banking & Finance sector remains the most mature and capital-intensive vertical for AI workforce automation in the UK. The primary growth driver is the regulatory burden and the non-negotiable need for compliance and auditability. Automation systems are demanded not merely for cost reduction but as an essential tool for managing Anti-Money Laundering (AML) checks, Know Your Customer (KYC) procedures, and high-volume trade reconciliations. The sheer volume of structured and unstructured data processed by major UK financial institutions necessitates AI-driven automation for fraud detection and risk scoring, creating high demand for sophisticated predictive analytics and cognitive automation platforms such as those offered by Quantexa. Furthermore, the competitive pressure to enhance customer experience drives the adoption of AI-powered chatbots and virtual assistants to handle routine customer inquiries, thereby driving demand for Natural Language Processing (NLP) solutions within the sector.

UK AI in Workforce Automation Market Competitive Environment and Analysis:

The UK AI in Workforce Automation market is characterized by a mix of established global Robotic Process Automation (RPA) vendors, specialist domestic AI-native companies, and professional service firms expanding their automation portfolios. Competition revolves around solution specificity for high-value verticals (e.g., Financial Crime), deployment flexibility (Cloud vs. On-Premises), and the ability to integrate advanced AI/ML capabilities seamlessly into existing RPA platforms.

Digital Workforce

Digital Workforce, a Finland-headquartered but globally operating specialist in Intelligent Automation, focuses its strategic positioning on providing an Automation-as-a-Service model. This positioning directly addresses the UK market's twin challenges: the skills gap and the high upfront cost of building an in-house Center of Excellence. Its key products and services include Roboshore, a managed service for continuous RPA development and maintenance, and a platform that provides access to pre-built, cloud-based automation solutions. The company's strategy of delivering end-to-end services, from process identification to maintenance, is a direct competitive response to the market's preference for outsourced complexity.

Blue Prism

Historically a pioneer in the enterprise RPA space, Blue Prism (now part of SS&C Blue Prism) retains significant market presence in the UK, particularly within large enterprises and regulated sectors where its security and governance capabilities are critical. The company's core offering, the Blue Prism Enterprise platform, focuses on a secure, centrally managed 'digital workforce' that is non-intrusive and auditable. Its strategic positioning centres on evolving from pure RPA to Agentic Automation, as evidenced by the integration of Generative AI capabilities. This evolution is vital for retaining market share against agile competitors by enabling its platform to manage complex, non-deterministic tasks that go beyond traditional, rule-based automation.

UK AI in Workforce Automation Market Recent Developments:

- July 2025: SS&C Blue Prism Launches Next Generation Development Updates

SS&C Blue Prism, the parent company of Blue Prism, released significant development updates for its Next Generation platform, including the introduction of Automation Studio—a new web-based interface for streamlined process design and review. Additionally, the update included the integration of the SS&C Blue Prism Assistant, an AI copilot embedded directly into the platform to provide product help and suggest Digital Exchange assets. This launch, announced in the company's official blog, directly enhances the user experience and accessibility of the platform, a strategy designed to lower the technical barrier to entry for business users and increase the velocity of automation development and adoption across its customer base.

UK AI in Workforce Automation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.370 billion |

| Total Market Size in 2031 | USD 9.042 billion |

| Growth Rate | 15.65% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Deployment, Size of Organisation, Industry Vertical |

| Companies |

|

UK AI in Workforce Automation Market Segmentation:

- BY COMPONENT

- Software & Services

- Hardware

- BY DEPLOYMENT

- On-Premises

- Cloud-based

- BY SIZE OF ORGANISATION

- Small & Medium Enterprises

- Large Enterprises

- BY INDUSTRY VERTICAL

- Healthcare

- Retail

- Manufacturing

- Banking & Finance

- Supply Chain

- Others