Report Overview

US AI in Workforce Highlights

US AI in Workforce Automation Market Size:

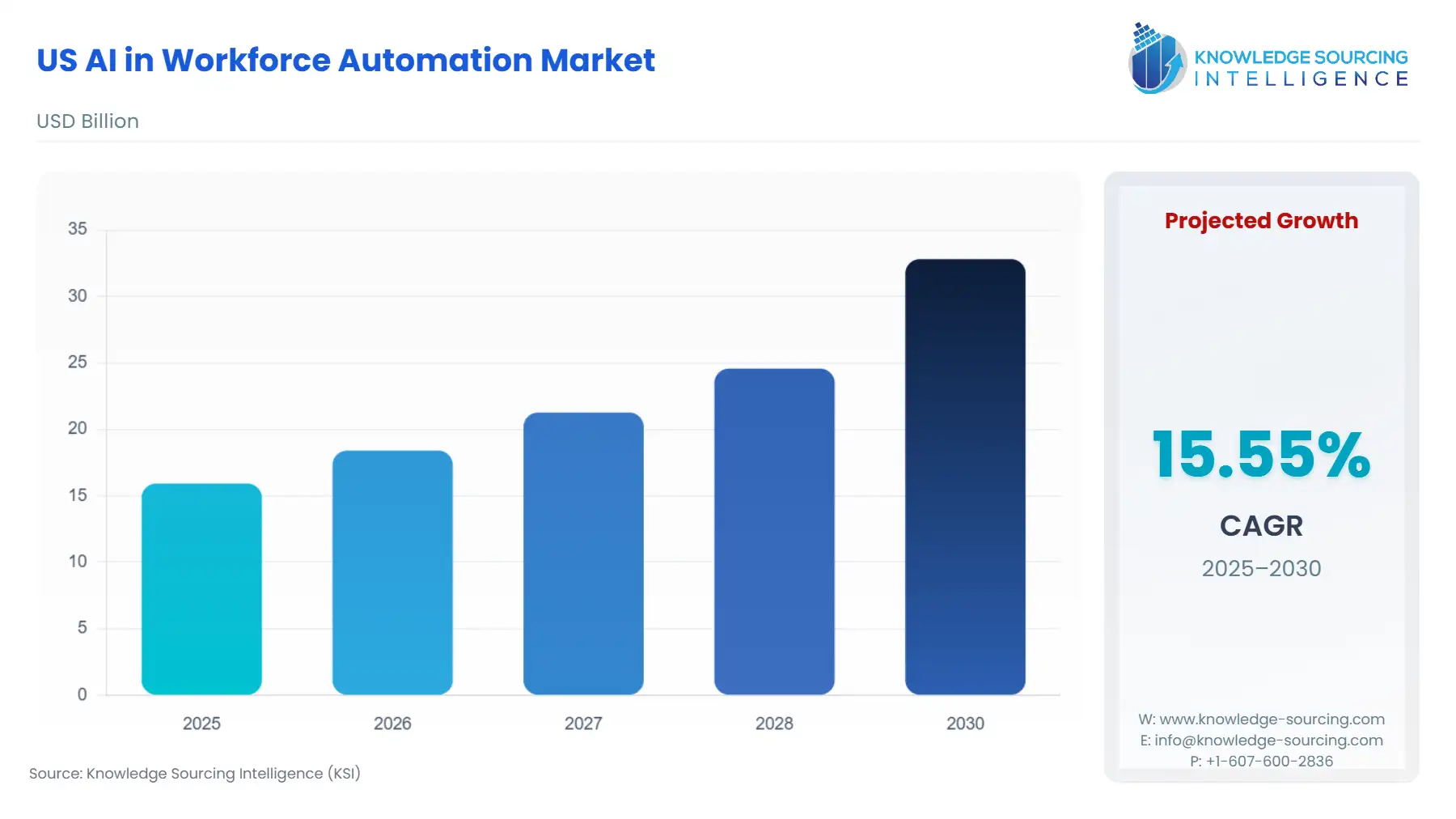

The US AI in Workforce Automation Market is expected to grow at a CAGR of 15.55%, reaching USD 32.819 billion in 2030 from USD 15.932 billion in 2025.

The US market for Artificial Intelligence (AI) in Workforce Automation is defined by an accelerating enterprise focus on leveraging sophisticated algorithmic tools to enhance operational efficiency, rather than solely reducing headcount.

The market's structural evolution reflects an aggressive pivot from generic process automation toward intelligent, context-aware systems that augment human performance in knowledge-intensive roles. Current market dynamics reveal that while the initial focus was on automating routine, high-volume tasks in sectors like manufacturing and clerical administration, the dominant demand shift is now directed at complex decision support, cognitive augmentation, and skill-gap mitigation across large enterprises. This transition is predicated on a critical need for verified data development and governance, transforming the AI software stack into a core component of the modern Human Capital Management (HCM) and Enterprise Resource Planning (ERP) architecture. The ongoing proliferation of generative AI capabilities is further compressing deployment timelines and raising the market-wide expectation for production-ready, highly specialized automation agents.

US AI in Workforce Automation Market Analysis:

Growth Drivers

The critical growth catalyst is the organizational imperative to boost productivity and process quality. Verifiable data indicates 45.8% of US businesses adopt AI primarily to enhance process reliability, directly fueling demand for AI software solutions capable of quality control and workflow optimization. Furthermore, high AI-adopting firms demonstrate quantifiable commercial success, achieving approximately 9.5% greater sales growth over five years compared to less exposed counterparts. This proven relationship between AI investment and accelerated business performance establishes an aggressive feedback loop, where productivity gains directly translate into increased corporate expenditure on advanced AI automation platforms. The subsequent demand is for integrated platforms that move beyond mere task execution to enable strategic decision-making and organizational scalability.

Challenges and Opportunities

The central challenge constraining market expansion is the fragmentation and uncertainty surrounding state and local AI regulation, which complicates the deployment of automated decision-making tools by introducing new legal and compliance risks, thereby slowing procurement cycles. Conversely, this same regulatory environment generates a distinct opportunity by creating non-negotiable demand for specialized AI services that are designed with transparency and auditability at the core. The critical opportunity is also fueled by the projected skills transformation, with up to 39% of core US job skills expected to change by 2030. This necessitates massive organizational reskilling, driving significant demand for AI-powered talent management, personalized learning, and internal mobility platforms designed to proactively close emerging skills gaps.

Supply Chain Analysis

The supply chain for AI in Workforce Automation is an intangible, knowledge-centric pipeline, beginning with the foundational element: proprietary enterprise data. The critical complexity lies in the programmatic development and high-quality labeling of this raw data, which is essential for tuning and aligning sophisticated models like Large Language Models (LLMs) to specific enterprise use cases. Key production hubs are concentrated in US technology clusters, but the logistical complexity is entirely digital, resting on secure, high-speed, and low-latency cloud infrastructure (e.g., AWS, Azure, Google Cloud). The market exhibits a heavy dependency on high-performance computing hardware, specifically Graphics Processing Units (GPUs), which represents the primary cost and a potential choke point in the deployment of increasingly large automation models, particularly for on-premises deployments. The supply chain's efficiency dictates the pace of innovation and the time-to-value for end-users.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| New York City, NY | Local Law 144 (Automated Employment Decision Tools, July 2023) | Directly increases demand for third-party auditing and "explainability" features within AI hiring/promotion software to ensure compliance with bias audit and public notice requirements. |

| Colorado | SB 24-205 (AI Act, May 2024) | Creates a legal requirement for developers and deployers of "high-risk" AI systems to use "reasonable care" to avoid algorithmic discrimination, pushing demand toward pre-certified and responsible AI automation platforms. |

| U.S. Department of Labor (DOL) | Guidance on AI Compliance with FLSA and FMLA (May 2024) | Intensifies the demand for highly accurate, human-auditable time-and-attendance and payroll automation systems to prevent AI from incorrectly classifying compensable work hours, which could lead to Fair Labor Standards Act (FLSA) violations. |

US AI in Workforce Automation Market Segment Analysis:

By Component: Software & Services

The Software & Services segment commands the market, propelled by the urgent need for cognitive augmentation and complex workflow orchestration that only sophisticated software can deliver. This segment's growth is directly amplified by the U.S. Census finding that the primary motivation for AI adoption is improving process quality (45.8%), a capability intrinsically delivered by software-based analytics and machine learning (ML) models. The service component, including implementation, training, and ongoing model alignment, is critical, particularly for large enterprises facing the monumental task of transitioning up to 39% of their existing workforce skills by 2030. Therefore, demand is not just for the software license but for bundled solutions that include change management services and custom data development necessary to tune generic LLMs for proprietary operational data. The shift from task automation to end-to-end cognitive process management ensures software and integrated services remain the core commercial engine.

By Industry Vertical: Healthcare

The need for AI in Workforce Automation within the Healthcare vertical is driven by a non-negotiable mandate for efficiency gains in administrative and clinical support functions without compromising patient safety or care quality. The sector faces unique labor-market dynamics, with projections indicating significant growth in high-contact roles (e.g., nurse practitioners projected to grow by 52%) that are augmented, not replaced, by AI. This creates a specific demand for automation tools that can triage patient data, automate medical transcription, manage scheduling, and synthesize research, thereby freeing highly skilled personnel for direct patient interaction. AI platforms that streamline complex operational tasks like hospital management systems and diagnostic support directly increase the productivity of a severely constrained labor pool. This scarcity of high-skill labor invests AI augmentation as an economic imperative rather than a discretionary operational upgrade.

US AI in Workforce Automation Market Competitive Environment and Analysis:

The US AI in Workforce Automation market is highly competitive, characterized by a mix of established Human Capital Management (HCM) leaders integrating AI capabilities and specialist AI-native startups focusing on data-centric solutions. The competitive leverage point has shifted from feature-parity to the verifiable ethicality and performance of proprietary models. Major companies identified in the market include Workday, Snorkel AI, Lateetud, and Clarifai.

Workday

Workday, Inc. holds a dominant strategic position by integrating AI directly into its core HCM and financial management platform, which is utilized by over 60% of the Fortune 500. Its strategy centers on delivering "enterprise-ready AI agents" embedded within existing workflows. A key product detail is the Workday 2025 Spring Release, which introduced over 350 features, updates, and AI enhancements. These additions focus on streamlining HR and finance processes, including the Data Query feature that leverages AI to simplify data searches using natural language, directly addressing the demand for efficient data access and decision support.

Snorkel AI

Snorkel AI’s strategic positioning focuses on addressing the most significant bottleneck in AI deployment: data quality and programmatic labeling. The company provides the Snorkel Flow platform, which pioneered the shift from manual data labeling to programmatic data development using a technique called "weak supervision." Its verifiable product positioning was solidified by the launch of Snorkel Custom, a platform and service offering designed to help enterprises programmatically develop data and quickly tune Large Language Models (LLMs) for specific production-quality AI use cases. This specialization captures demand from enterprises committed to building and owning highly performant, custom-tuned models.

US AI in Workforce Automation Market Recent Developments:

- October 2025: Workday announced and completed the acquisition of Paradox, an AI company specializing in candidate experience, to integrate its conversational AI and machine learning capabilities into Workday's Talent Acquisition suite. The acquisition aims to redefine the frontline candidate experience, providing Workday with an AI-powered engine for faster candidate conversion and time-to-hire, directly bolstering its automation capacity in the HR lifecycle.

- August 2025: Workday signed and closed an acquisition agreement for Flowise, bringing powerful AI Agent Builder capabilities to the Workday platform. This move directly responds to the demand for low-code/no-code tools, empowering customers and partners to rapidly create, share, and scale AI-powered enterprise solutions on the Workday platform.

- April 2024: Snorkel AI announced the launch of Snorkel Custom, a new service and platform offering that combines the Snorkel Flow platform with expert support to help enterprises programmatically develop data and evaluate, tune, and serve LLMs for custom AI use cases. This launch addresses the critical industry-wide need for production-quality, enterprise-aligned AI, with a focus on data development and model alignment.

US AI in Workforce Automation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 15.932 billion |

| Total Market Size in 2031 | USD 32.819 billion |

| Growth Rate | 15.55% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Deployment, Size of Organisation, Industry Vertical |

| Companies |

|

US AI in Workforce Automation Market Segmentation:

- BY COMPONENT

- Software & Services

- Hardware

- BY DEPLOYMENT

- On-Premises

- Cloud-based

- BY SIZE OF ORGANISATION

- Small & Medium Enterprises

- Large Enterprises

- BY INDUSTRY VERTICAL

- Healthcare

- Retail

- Manufacturing

- Banking & Finance

- Supply Chain

- Others