Report Overview

UK ALD Precursors Market Highlights

UK ALD Precursors Market Size:

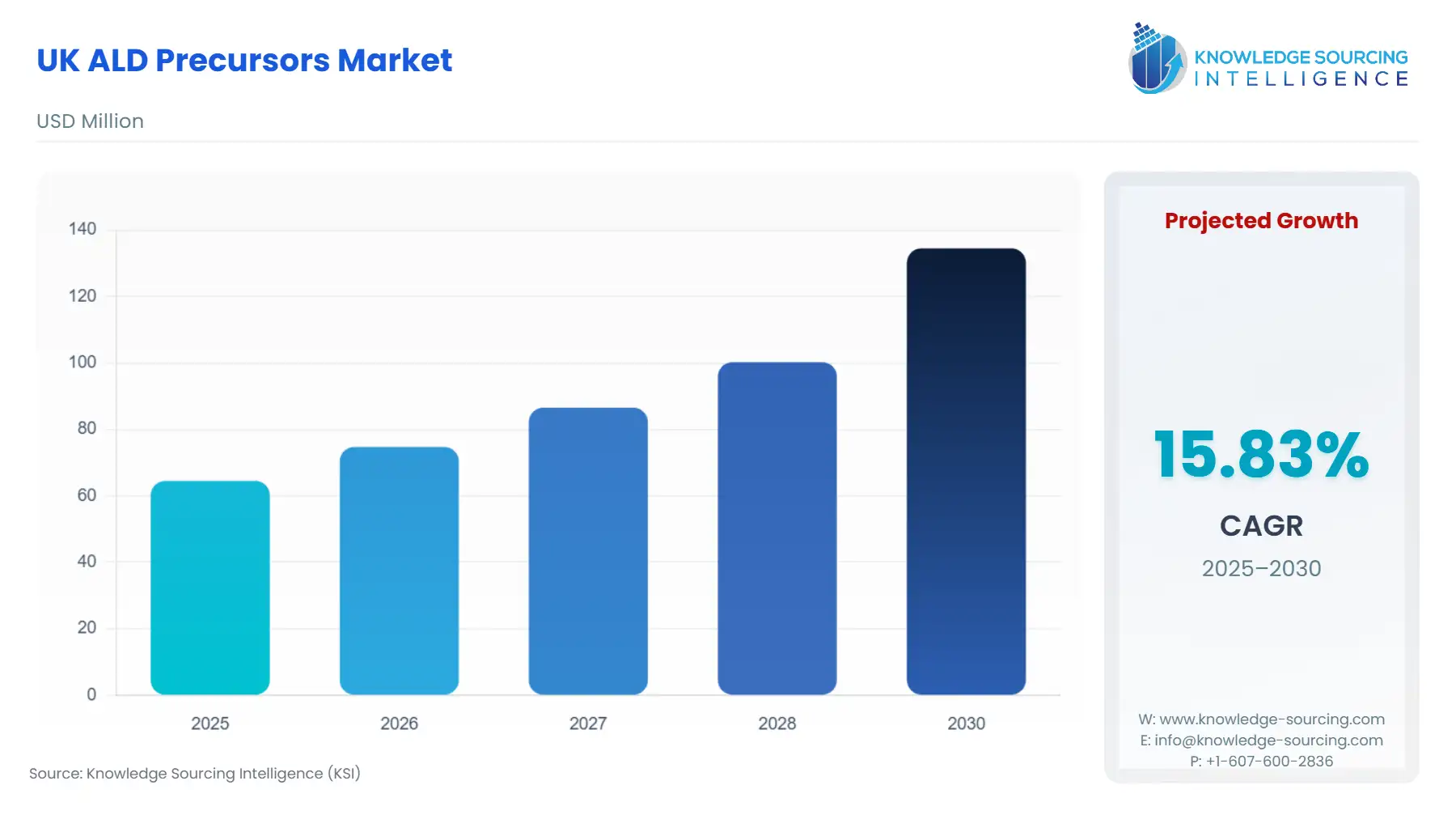

The UK ALD Precursors Market is expected to expand at a CAGR of 15.83%, growing to USD 134.524 million in 2030 from USD 64.509 million in 2025.

The UK ALD precursors market is experiencing steady growth, driven by the demand for advanced materials used in the production of semiconductors, solar energy devices, and energy storage solutions. As industries move towards miniaturization and enhanced performance, ALD technologies are increasingly critical. This trend is further accelerated by the UK’s growing commitment to sustainability, which supports the increased use of ALD in renewable energy and electric vehicle manufacturing. At the same time, challenges related to raw material availability and supply chain volatility require strategic attention to ensure continued market stability.

UK ALD Precursors Market Growth Drivers:

Several key factors are driving the rapid growth of the ALD precursors market in the UK.

- Semiconductor Industry Demand: The UK’s semiconductor sector plays a key role in the need for ALD precursors. With continuous advancements in chip technologies, the need for thin, precise layers of materials is critical. ALD processes, particularly for the deposition of high-k dielectrics and metal films, are becoming essential for semiconductor fabrication. As both the consumer electronics and communications sectors expand, the demand for sophisticated ALD technologies—and therefore ALD precursors—is expected to rise significantly.

- Adoption of Renewable Energy Technologies: The UK government’s strong push for clean energy solutions, including solar energy, is driving the demand for ALD precursors used in the production of high-efficiency solar cells. ALD enables the deposition of thin films essential for photovoltaic (PV) cells, and as the UK sets ambitious renewable energy targets, the need for ALD-based solutions in the solar sector is set to expand. The rapid growth in green technologies is thus fostering increased demand for ALD materials.

- Technological Innovations in ALD: Emerging ALD technologies, including Plasma-Enhanced ALD (PE-ALD) and Roll-to-Roll ALD, have opened up new avenues for precursor requirements. These innovations are particularly significant for industries requiring high precision and scalability, such as energy storage, healthcare, and the aerospace sector. With advancements in ALD, there is a growing interest in developing precursors that can support more efficient, cost-effective deposition processes, driving market expansion.

- Regulatory Push for Sustainable Practices: The UK’s evolving regulatory landscape, focused on carbon reduction and sustainable manufacturing, is accelerating the adoption of ALD technologies. For example, the automotive industry is increasingly adopting ALD processes to improve performance while reducing environmental impact. ALD is also crucial in the development of energy storage solutions like batteries and supercapacitors, which are vital for the green transition.

Challenges and Opportunities:

Despite the significant growth prospects, the UK ALD precursors market faces several challenges.

- Supply Chain Constraints: The global nature of ALD precursor supply chains presents a challenge. The UK market is dependent on the availability of high-purity chemicals, which are often sourced from specific regions, such as Asia and North America. Geopolitical tensions, economic instability, and logistics issues can disrupt the steady flow of these materials, potentially affecting costs and availability.

- Pricing Volatility: The pricing of ALD precursors is closely tied to raw material costs, which can fluctuate due to supply and demand dynamics, environmental regulations, and geopolitical developments. With the increasing need for these specialized materials, there may be upward pressure on prices, which could impact cost-sensitive industries.

However, the market also presents significant opportunities.

- Opportunities in Energy Storage: With the UK’s emphasis on electric vehicles (EVs) and renewable energy, there is a substantial opportunity for ALD technologies to drive advancements in energy storage solutions. ALD is already used in enhancing the performance of lithium-ion batteries, which are central to EVs. As demand for EVs grows, especially under the UK’s net-zero emission goals, the need for ALD-based battery technologies will rise, providing significant opportunities for growth in this segment.

- Healthcare Sector Demand: ALD processes are critical in producing high-precision coatings for medical devices and diagnostics. The growing need for advanced medical technologies, especially those that require nanoscale coatings for enhanced performance, will likely stimulate the demand for ALD precursors. Innovations in healthcare technologies could therefore present new applications for ALD in the UK.

Raw Material and Pricing Analysis:

The primary raw materials for ALD precursors include metal-organic compounds and halide-based chemicals, which are typically sourced globally from specialized suppliers. The availability of these materials can be affected by raw material mining activities, global supply chain constraints, and environmental policies aimed at reducing emissions. Volatile pricing in these raw materials can lead to fluctuations in the overall cost structure of ALD precursors, which may, in turn, affect the price point for end-users, especially in cost-sensitive industries like consumer electronics and automotive.

Supply Chain Analysis:

The global supply chain for ALD precursors is complex, with key production hubs located in North America, Europe (including the UK), and Asia. Companies like Merck KGaA, Air Liquide, and Linde plc dominate the supply of ALD precursors globally. Logistical challenges in the transportation of high-purity chemicals, compounded by geopolitical instability and natural disasters, can disrupt the supply chain. Additionally, the need for compliance with strict environmental and safety standards in the transportation and storage of these chemicals adds another layer of complexity to the supply chain.

UK ALD Precursors Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| UK | Environment Agency (EA) | Stringent environmental regulations encourage the adoption of sustainable technologies. ALD processes, particularly in automotive and energy storage, are becoming more crucial as companies adhere to carbon reduction goals. |

| UK | Department for Business, Energy & Industrial Strategy (BEIS) | BEIS’s initiatives to promote green technologies, including energy storage and electric vehicles, increase demand for ALD precursors used in batteries and EV components. |

| EU | REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) | REACH regulations mandate that ALD precursors comply with stringent environmental and safety standards, driving demand for safer, more eco-friendly materials. |

UK ALD Precursors Market Segment Analysis:

- By Application – High-k Dielectric: High-k dielectrics are essential in the semiconductor industry, particularly for enhancing transistor performance and miniaturization. In the UK, this application is a significant driver of ALD precursor demand, as the country is home to key semiconductor manufacturers. High-k materials like hafnium oxide (HfO?) require ALD for deposition due to the precision and uniformity it offers. As semiconductor technology moves toward smaller geometries and faster performance, the need for advanced ALD precursors to fabricate these high-k layers will continue to expand, positioning the segment as a critical growth driver in the UK market.

- By End-User – Electronics & Semiconductors: The electronics and semiconductor industries remain the largest consumers of ALD precursors in the UK. The growing need for more powerful and compact electronic devices, as well as advances in telecommunications infrastructure like 5G, directly influence the need for ALD processes. The deposition of thin films in semiconductor fabrication processes, such as for high-performance memory chips and logic devices, is a key area of growth. With the increasing miniaturization of electronic components and the ongoing demand for cutting-edge technologies, this segment will continue to propel the need for ALD precursors in the UK market.

UK ALD Precursors Market Competitive Environment and Analysis:

The competitive landscape in the UK’s ALD precursors market is defined by a combination of local and international players.

- Merck KGaA: Merck KGaA is a leading supplier of ALD precursors globally, including in the UK. The company’s wide-ranging portfolio of ALD materials supports various sectors, including semiconductors, energy storage, and healthcare. Merck’s innovation in sustainable ALD processes positions it well in the UK market, especially as the country’s green technology initiatives expand.

- Air Liquide: Air Liquide, a key player in the UK ALD precursors market, provides high-purity chemicals essential for semiconductor and renewable energy applications. The company’s robust supply chain and focus on sustainable manufacturing practices make it a critical supplier of ALD precursors in the region.

UK ALD Precursors Market Developments:

- February 2025: Lam Research unveiled the ALTUS® Halo, the industry's pioneering ALD tool for molybdenum precursor deposition, enhancing chip performance in UK semiconductor fabs amid rising AI-driven demand for sub-3nm nodes. This innovation boosts throughput by 20%, supporting the UK's National Semiconductor Strategy for advanced manufacturing.

- May 2024: Hanwha Precision Machinery introduced the I2FIT-Mo thermal ALD system, optimized for molybdenum precursors in DRAM fabrication, reducing resistivity and fluoride residues. Deployed in UK facilities, it advances memory tech for data centers, contributing to Europe's chip sovereignty goals under Horizon Europe funding.

UK ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 64.509 million |

| Total Market Size in 2031 | USD 134.524 million |

| Growth Rate | 15.83% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

UK ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others