Report Overview

UK Continuous Glucose Monitoring Highlights

UK Continuous Glucose Monitoring Market Size:

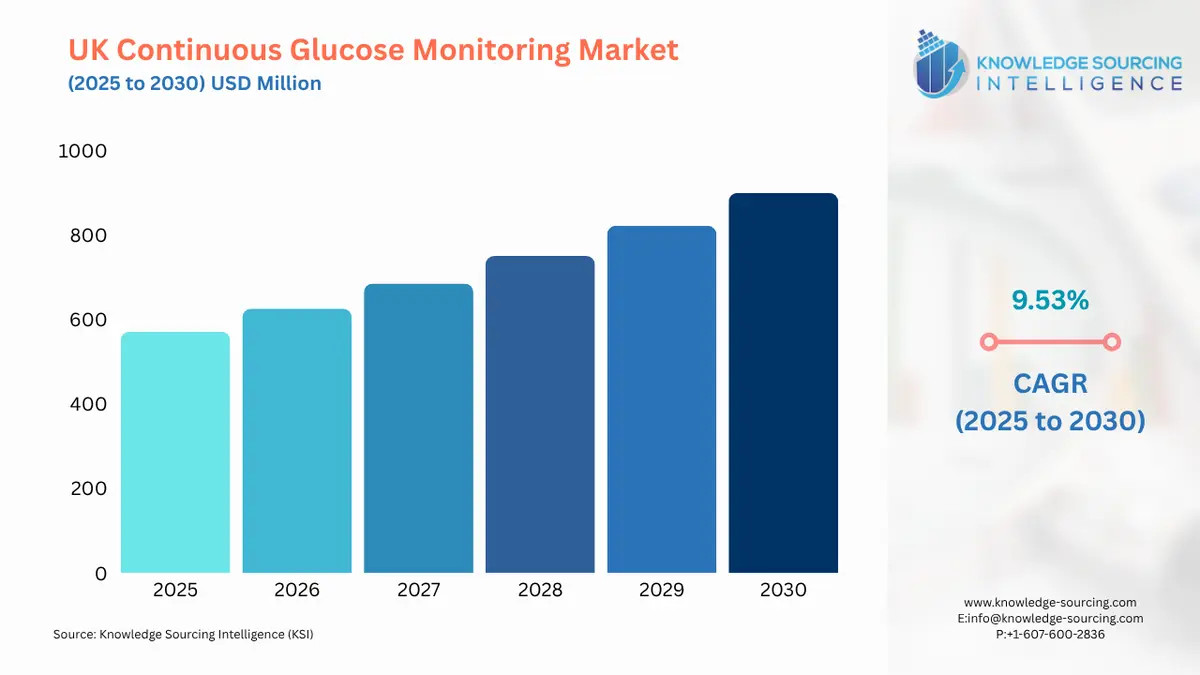

The UK continuous glucose monitoring market, valued at USD 899.846 million in 2030 from USD 570.921 million in 2025, is projected to grow at a CAGR of 9.53%.

The UK continuous glucose monitoring (CGM) market is a rapidly evolving segment of the medical device industry, driven by the increasing need for effective diabetes management and advancements in wearable health technologies. Continuous glucose monitoring devices provide real-time or intermittent tracking of blood glucose levels, offering critical insights for diabetes patients, critical care patients, and other users in hospitals and clinics, homecare, and specialized settings. These devices, including real-time CGM and intermittent CGM systems, have transformed diabetes care by replacing traditional finger-prick tests with automated, user-friendly solutions that enhance glycemic control and patient outcomes. In the UK, the market is fueled by rising diabetes prevalence, supportive healthcare policies, and innovations in wearable glucose sensors and smartphone-integrated CGM. Diabetes affects millions in the UK, with approximately 4.9 million diagnosed cases in 2022, predominantly Type 2, and an estimated 13.6 million at risk of developing the condition. The National Health Service (NHS) has prioritized CGM adoption, particularly for Type 1 diabetes patients, with 97% coverage for these devices in England, positioning the UK as a global leader in CGM access. This is complemented by policies like the NHS Long Term Plan, which emphasizes personalized care and digital health integration, driving demand for CGM homecare solutions. Technological advancements, such as non-invasive CGM and AI-driven analytics, further enhance device accuracy, wearability, and patient engagement, making CGM systems indispensable for diabetes management technology. The market is characterized by a mix of established players and innovative startups. Companies like Abbott, Dexcom, and Medtronic lead with robust real-time CGM systems, while emerging firms like Sava explore non-invasive CGM UK solutions using microneedle technology. The integration of CGM with insulin pumps and mobile apps supports seamless data sharing, enabling remote monitoring and telehealth applications. This is particularly relevant in homecare settings, where patients seek convenience and autonomy. Additionally, the market extends to critical care patients, where CGM ensures precise glucose monitoring in intensive care units, improving clinical outcomes. Key drivers include the rising prevalence of diabetes, technological advancements in glucose monitoring devices UK, and strong NHS support. The growing diabetic population, coupled with increased awareness of CGM benefits, fuels demand for patient-friendly CGM devices. Innovations like longer-lasting sensors and smartphone-integrated CGM enhance usability, while NHS funding and reimbursement policies expand access, particularly for Type 1 diabetes CGM. These factors drive market growth by improving adoption rates and encouraging innovation. Challenges include high device costs and limited reimbursement for Type 2 diabetes monitoring patients, which restrict broader adoption. Additionally, concerns about data accuracy and the need for frequent sensor recalibration pose technical barriers. These issues, combined with resistance to new workflows among healthcare providers, hinder market expansion, particularly in cost-sensitive segments. The UK CGM market is moderately concentrated, with major players investing in R&D to develop advanced glucose sensors and integrate AI for predictive analytics. The shift toward non-invasive CGM and closed-loop systems offers significant growth opportunities, especially in homecare and diabetes clinics. The market’s alignment with digital health trends, such as telemedicine, positions it for sustained growth, supported by government initiatives and patient advocacy. Leading companies include Abbott Laboratories, Dexcom, Inc., Medtronic PLC, Senseonics Holdings, Inc., and Ascensia Diabetes Care Holdings AG. These firms dominate through innovation in real-time CGM and intermittent CGM, catering to diverse end-users. The market’s competitive nature drives continuous improvements in device affordability and functionality.

UK Continuous Glucose Monitoring Market Overview

The medical device known as continuous glucose monitoring (CGM) provides ongoing blood sugar observation services to both type 1 and type 2 diabetes patients through a wearable apparatus. A substantial rise in CGM market demand exists across the UK due to numerous market factors. The increasing number of diabetes patients and enhanced public understanding of CGM devices benefit the market due to government policies and financial support. The market continues to rise because of growing disposable income, combined with healthcare having increased prominence in the industry. Other technological observation tools join the CGM device as essential elements that drive modern healthcare. These healthcare devices enable remote patients to use monitoring devices combined with wearable sensors through continuous glucose monitoring systems (CGMS). Greater use of CGM devices: Adoption of CGM devices among people with diabetes in the UK is on the rise, fueled by heightened awareness of their effectiveness in improving blood glucose control. The National Health Service (NHS) has played a key role in expanding access to these devices, particularly for individuals with type 1 diabetes, often offering them at costs comparable to flash glucose monitors.

UK Continuous Glucose Monitoring Market Drivers

Rising Prevalence of Diabetes in the UK: The increasing number of diabetes cases, particularly Type 2, drives the UK continuous glucose monitoring market. With approximately 4.9 million diagnosed individuals in 2022 and rising obesity rates, the demand for diabetes management technology is surging. CGM devices enable Type 1 diabetes patients and insulin-treated Type 2 patients to monitor glucose levels in real-time, reducing complications like hypoglycemia. Diabetes UK’s advocacy for better management tools has heightened awareness, boosting the adoption of wearable glucose sensors. The growing diabetic population necessitates scalable solutions, with CGM offering actionable insights for lifestyle and treatment adjustments. This trend is expected to persist as diabetes cases are projected to rise significantly by 2030.

NHS Support and Reimbursement Policies: The NHS’s commitment to improving diabetes care significantly drives the CGM market trends UK. In 2024, NHS England achieved significant coverage of real-time CGM for Type 1 diabetes patients, supported by policies like the NHS Long Term Plan. Reimbursement for CGM devices, particularly for insulin-dependent patients, reduces out-of-pocket costs, enhancing accessibility. Initiatives like the Diabetes Prevention Programme further promote CGM homecare solutions, encouraging adoption among diabetes patients. This strong policy support fosters market growth by integrating CGM into standard care, ensuring broader access and encouraging manufacturers to innovate in patient-friendly CGM devices.

Technological Advancements in CGM Devices: Innovations in glucose monitoring devices UK, such as improved sensor accuracy, longer wear times, and smartphone-integrated CGM, propel market growth. In 2024, advancements like Abbott’s FreeStyle Libre 3 offered calibration-free, real-time monitoring, enhancing the user experience. Integration with mobile apps and AI-driven analytics enables personalized insights, appealing to both Type 1 diabetes CGM and Type 2 diabetes monitoring users. Developments in non-invasive CGM UK, such as Sava’s microneedle sensors, promise greater comfort and broader application, including sports nutrition. These advancements drive adoption by improving usability and outcomes.

UK Continuous Glucose Monitoring Market Restraints

High Device Costs and Limited Reimbursement: The high cost of CGM devices UK, including sensors and transmitters, restricts adoption, particularly for Type 2 diabetes monitoring patients not covered by NHS reimbursement. In 2024, out-of-pocket costs for devices like Dexcom G7 remained a barrier for non-insulin-dependent users, limiting market penetration. While NHS funding supports Type 1 diabetes patients, reimbursement for Type 2 patients is inconsistent, hindering broader uptake. The need for frequent sensor replacement further escalates costs, impacting affordability in homecare settings. These financial constraints challenge manufacturers to balance innovation with cost-effectiveness.

Data Accuracy and Calibration Challenges: Concerns about data accuracy and the need for periodic calibration in some continuous glucose monitoring devices pose technical barriers. In 2024, studies highlighted variability in sensor performance, particularly in older CGM models, affecting reliability in critical care patients. Resistance to adopting new workflows among healthcare providers, due to training gaps, further slows integration in hospitals and clinics. These challenges limit trust in CGM systems, hindering market growth in clinical settings.

UK Continuous Glucose Monitoring Market Segmentation Analysis

The demand for Real-time CGM is increasing notably: Real-time CGM dominates the UK continuous glucose monitoring market due to its ability to provide continuous, immediate glucose readings, critical for Type 1 diabetes CGM and insulin-treated patients. These systems, such as Dexcom G7 and Abbott’s FreeStyle Libre 3, transmit data to smartphones or receivers every few minutes, enabling proactive diabetes management. Dexcom G7’s launch in the UK introduced a faster sensor warmup and no-calibration design, enhancing usability in homecare and hospitals and clinics. Real-time CGM’s integration with insulin pumps and AI analytics supports closed-loop systems, improving glycemic control. The NHS’s widespread support for these devices, covering 97% of Type 1 patients, underscores their dominance. Their versatility in diabetes management technology ensures continued growth as manufacturers focus on accuracy and user-friendliness.

By Application, the Diabetes Patients segment is expected to grow considerably: The diabetes patients segment is the largest application in the UK CGM market, driven by the rising prevalence of Type 1 and Type 2 diabetes. CGM devices enable continuous monitoring, reducing hypoglycemic events and improving quality of life. In 2024, Abbott’s FreeStyle Libre 2 demonstrated significant HbA1c reductions in Type 1 patients, reinforcing its role in diabetes management technology. The segment benefits from NHS policies promoting real-time CGM for insulin-dependent patients, with growing adoption among Type 2 users. Smartphone-integrated CGM enhances patient engagement, while advancements like non-invasive sensors expand appeal. This segment’s dominance is fueled by the need for personalized, proactive care in homecare and clinical settings.

By End-Users, the homecare segment is rising rapidly: The homecare segment leads the UK continuous glucose monitoring market, reflecting patients’ preference for self-managed diabetes care. CGM homecare solutions like Dexcom G7 and FreeStyle Libre 3 offer user-friendly, smartphone-integrated CGM systems, enabling real-time monitoring without frequent clinical visits. In 2024, NHS England expanded CGM access, supporting Type 1 diabetes patients in homecare settings, with exponential adoption rates. The rise of non-invasive CGM UK solutions, such as Sava’s microneedle sensors, further drives growth by improving comfort and affordability. Integration with telehealth platforms enhances remote monitoring, aligning with digital health trends. This segment’s dominance is driven by convenience, NHS support, and technological advancements.

UK Continuous Glucose Monitoring Market Key Developments:

2025: Medtronic received CE Mark approval for its MiniMed 780G system with the Simplera Sync sensor, 50% smaller with a simplified insertion process. It enhances real-time CGM for diabetes patients, launching in Europe in spring 2025.

October 2024: Abbott published a study showing FreeStyle Libre 3’s effectiveness in reducing HbA1c in Type 1 diabetes patients, boosting adoption in homecare and hospitals and clinics with its calibration-free design.

June 2024: UK startup Sava received MHRA approval to begin trials for its non-invasive CGM UK device using 1mm microneedles, targeting affordability and broader use in diabetes management technology.

UK Continuous Glucose Monitoring Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 570.921 million |

| Total Market Size in 2030 | USD 899.846 million |

| Forecast Unit | Million |

| Growth Rate | 9.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Gender, Age, Type, End-Users |

| Companies |

|

UK Continuous Glucose Monitoring Market Segmentation:

By Gender:

Male

Female

By Age:

Adults (>14 Years)

Children (<=14 Years)

By Type:

Real-time CGM

Intermittent CGM

By Application:

Diabetes Patients

Critical Care Patients

By End-Users:

Hospitals and Clinics

Homecare

Others