Report Overview

UK Table Grape Market Highlights

UK Table Grape Market Size

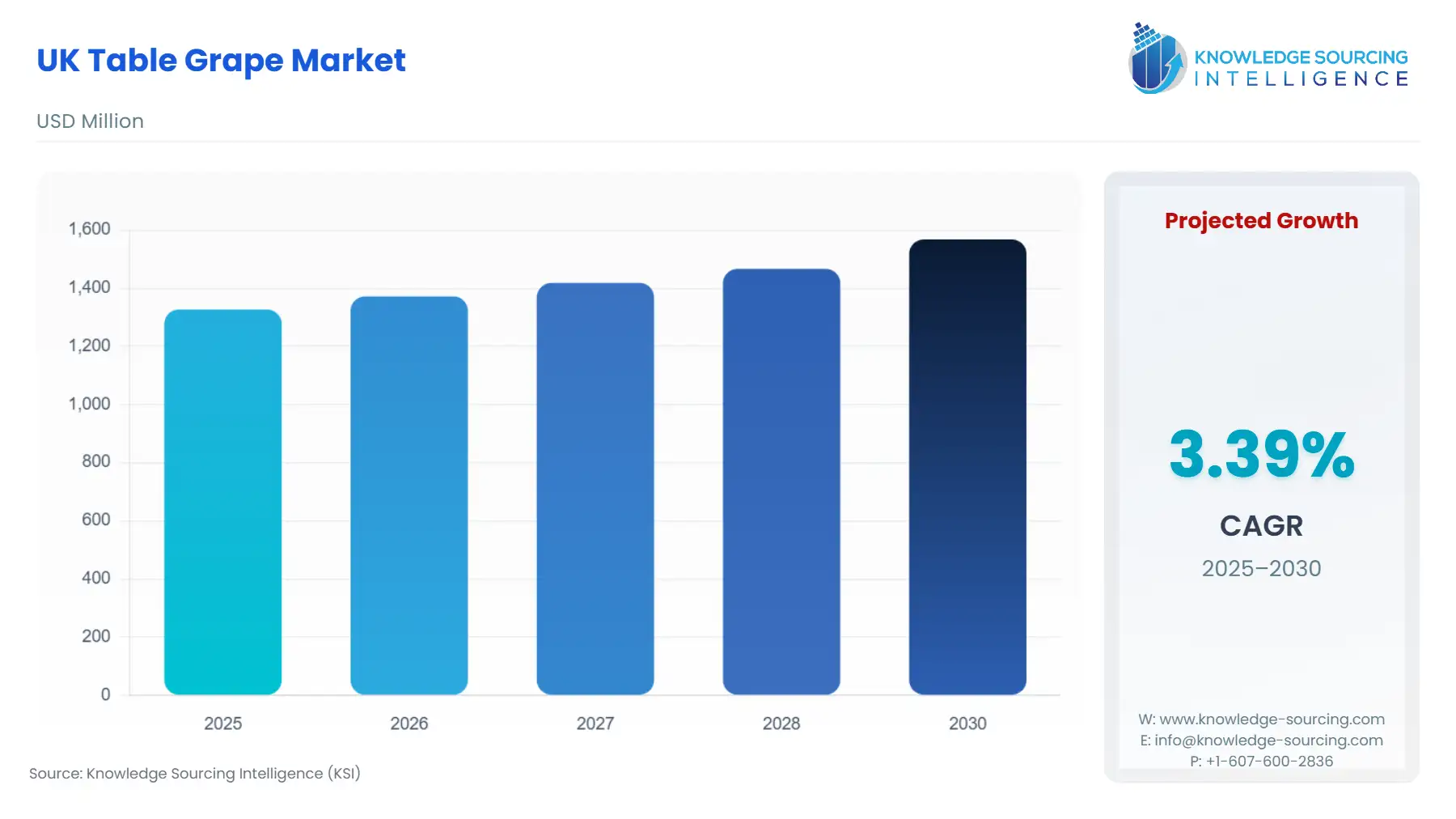

The UK Table Grape Market is projected to grow at a CAGR of 3.40% over the forecast period, increasing from US$1.327 billion in 2025 to US$1.568 billion by 2030.

UK Table Grape Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

:

One of the world's largest consumers of table grapes, the United Kingdom has a vibrant, competitive market that can accommodate a variety of types and levels of quality. Although consumption patterns differ significantly from those of its European neighbors in many ways, growers of grapes in the United Kingdom experience good weather conditions for more production.

Table grape consumption is increasing in the United Kingdom due to changing dietary preferences and increased personal disposable income. Growing consumer knowledge of the advantages of eating various fruits is encouraging more people to eat table grapes, which is helping the market for table grapes develop. Additionally, the market for table grapes is expanding due to technical developments in storage, controlling grape deterioration, and preventing water loss.

UK Table Grape Market Drivers:

- Increasing trend towards Convenience

Convenience is increasingly valued by consumers in the United Kingdom. Table grapes benefit from this trend since they are convenient to eat and make a great fresh snack. For the same reason, buyers prefer seedless cultivars, such as the Thompson, Superior, and Crimson grown in Greece, which are predicted to drive market demand even higher in the United Kingdom. For instance, Agrimessina is a third-generation fruit grower and supplier to the UK market. It is based in Puglia and can provide fruit from the middle of July to the beginning of December. Its vineyards currently produce 700 hectares of grapes, 75% of which are their output and 25% of which originate from affiliated farmers.

- Increasing Production and Consumption

According to a study published by the U.S. Department of Agriculture (USDA) in 2022, the nation's consumption of grapes increased from 275,000 MT in 2019 to 280,000 MT in 2022. The same data shows that between 2020 and 2022, the country's imports of fresh grapes (especially table grapes) climbed from 269,000 MT to 280,000 MT. Furthermore, according to information from the United States Department of Agriculture's (USDA) Economic Research Service, the UK's agricultural production in 2019 was predicted to be about US$29.83 billion. Thus, a combination of all these elements is what propels the rise of table grapes in the United Kingdom. As per the report of the CBI Ministry of Foreign Affairs, the import value of fresh grapes, essentially table grapes, rose from € 310 million in 2017 to € 365 million in 2021, showing the huge demand for table grapes in the United Kingdom. Furthermore, the USDA Foreign Agricultural Services reported in June 2023, the increase in import volume of table grapes from 269,000 MT in 2020/21 rose to 280,000 MT in 2022/23, owing to the growing health awareness and increasing knowledge of the health benefits of the consumption of table grapes.

- Increasing Awareness of English Wine

Greater awareness of English wine and a trend toward supporting domestic agriculture have contributed to market growth. As of 2020, 3,800 hectares of area were dedicated to the total UK Vineyard Area, which is regarded to be double in size compared to the last ten years alone. Out of these 3,800 hectares, 98% of it is within England. According to The Wine Society, the UK constitutes the majority of vineyards and wineries.

UK Table Grape Market Geographical Outlook:

- England is Expected to Grow Significantly

The main grape-growing regions in England are in the southern parts of the country, particularly in counties like Kent, Sussex, and Hampshire. These areas have a milder climate that is more conducive to grape cultivation. England's table grape market emphasizes locally produced grapes, which appeals to consumers who prefer to support domestic agriculture and reduce the carbon footprint associated with importing fruits from distant regions. The table grape season in England is relatively short, typically running from late summer to early autumn. Due to the climate, the growing season is limited, and most grapes are harvested during this period. The English climate is not traditionally known for grape cultivation due to its cooler temperatures, but advancements in technology and changing climate patterns have allowed for the expansion of grape-growing regions in the country.

List of Top UK Table Grape Companies:

Fresca Group is known to invest in the future of fruit production, mainly in terms of its strategy for the long term. It focuses on its core product areas, such as grapes, which benefit enormously from innovation and new variety developments. Grape Evolution Ltd. was further developed through a long-term international collaboration led by the world-renowned Dr. Avi Perl of the Israeli Agricultural Research Organization Institute (Volcani). Their strategy revolves around delivering better-performing varieties for growers, which are sure to bring demand in the market.

UK Table Grape Market Key Development:

- April 2025: UK retailers introduce sustainable, recyclable packaging for table grapes to meet consumer eco-demands.

- January 2024: Grape Evolution Ltd launches new seedless grape varieties with enhanced flavor profiles.

UK Table Grape Market Scope:

| Report Metric | Details |

| UK Table Grape Market Size in 2025 | US$1.327 billion |

| UK Table Grape Market Size in 2030 | US$1.568 billion |

| Growth Rate | CAGR of 3.40% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | England, Scotland, Wales, Northern Ireland |

| List of Major Companies in the UK Table Grape Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation

- By Variety

- Seeded

- Seedless

- By Distribution Channel

- Offline

- Online

- By Region

- England

- Scotland

- Wales

- Northern Ireland