Report Overview

Underfloor Heating Market - Highlights

Underfloor Heating Market Size:

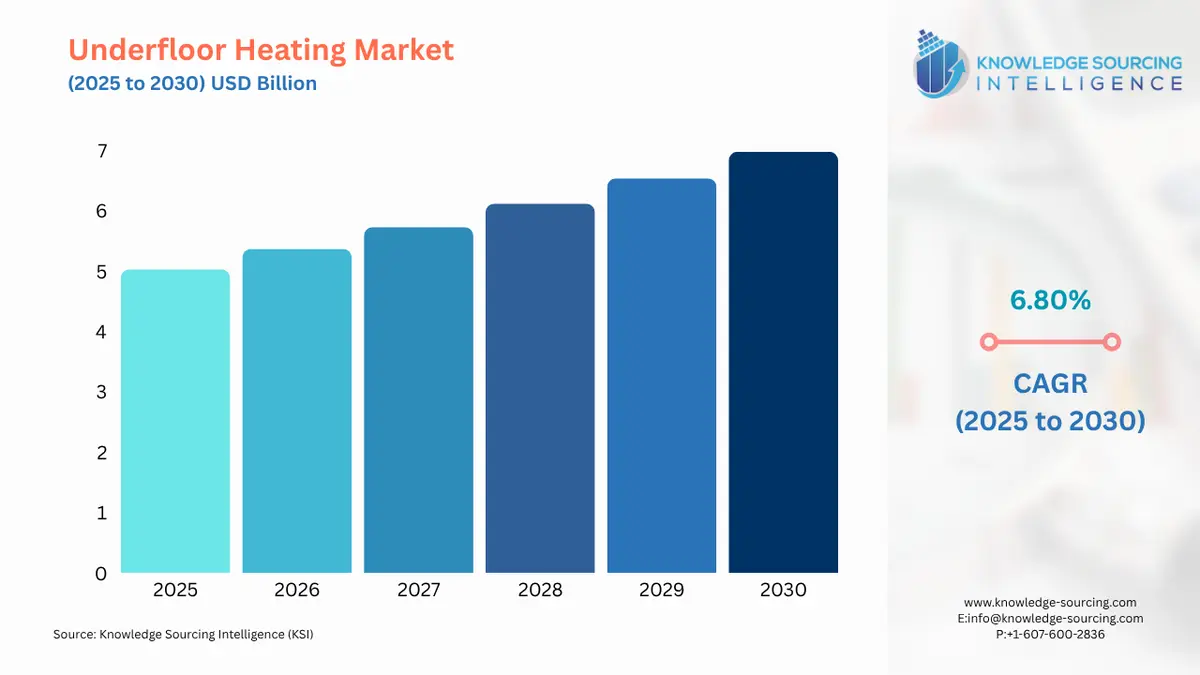

The underfloor heating market will grow at a CAGR of 6.80% to reach US$6.981 billion in 2030 from US$5.025 billion in 2025.

The underfloor heating market is a dynamic segment of the global HVAC industry, delivering energy-efficient and comfortable heating solutions through hydronic underfloor heating systems and electric underfloor heating systems. These systems provide radiant heat from the floor, ensuring uniform warmth, enhanced indoor comfort, and aesthetic flexibility by eliminating the need for radiators. Serving residential, commercial, industrial, and other end-users, underfloor heating is gaining traction globally, particularly in regions like Europe, North America, and Asia Pacific, driven by sustainable building solutions and smart heating technology. The market is propelled by stringent environmental regulations, rising energy costs, and consumer demand for low-carbon heating and net-zero heating solutions. Underfloor heating systems are integral to modern construction and retrofitting, aligning with global decarbonization goals. In Europe, the Energy Performance of Buildings Directive (EPBD) mandates energy-efficient systems, boosting the adoption of hydronic underfloor heating integrated with renewable sources like heat pumps. In North America, incentives like Canada’s Greener Homes Grant support energy-efficient heating solutions. Asia Pacific, particularly China and Japan, sees growth due to urbanization and smart home heating adoption. For instance, Japan’s net-zero targets by 2050 drive demand for radiant floor heating integrated with solar thermal systems. The market benefits from technological advancements, such as smart thermostats, underfloor, and IoT-enabled controls, which optimize energy use and enable remote management. In June 2024, Danfoss introduced the Ally smart heating system, enhancing climate control technology with voice-activated controls. Residential underfloor heating dominates due to consumer preference for comfort and sustainability, while commercial heating systems gain traction in offices and hospitality. Underfloor heating retrofits are also rising, supported by modular systems that simplify installation in older buildings. Key drivers include stringent regulations promoting green building certifications, rising energy costs pushing demand for energy-efficient heating solutions, and advancements in smart heating technology. The integration of renewable energy heating with hydronic underfloor heating systems enhances sustainability, while consumer awareness of low-carbon heating fuels adoption across residential and commercial sectors. High initial installation costs for underfloor heating systems, particularly hydronic underfloor heating, deter adoption in cost-sensitive regions like South America, and Middle East and Africa. Limited availability of skilled installers and integration challenges with existing structures further restrict underfloor heating retrofits, slowing market growth in some areas.

Underfloor Heating Market Overview:

The underfloor heating market is expanding consistently due to growing demand for renewable energy and awareness of its benefits. However, the need for highly skilled workers may hinder growth. The primary catalyst for growth is the booming construction sector, which reached a valuation of $12.74 trillion in 2023, driven by rising needs for housing and renovations spurred by population increases. Urbanization and the integration of technology in construction, such as India’s smart cities program, are boosting demand. Large-scale redevelopment efforts, like China’s $55 billion Shantytown initiative to build 6 million homes, along with a projected global population of 9.9 billion by 2050, are significant contributors. The hospitality and leisure sector also plays a role in market expansion, with global tourist arrivals hitting 1.4 billion in 2023 and an anticipated annual growth of 3-4%, heightening the need for smart hotel solutions. Geographically, the market is categorized into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific regions. Europe maintains a leading position, driven by cold climates necessitating constant heating and a strong emphasis on energy efficiency. North America secures a substantial share thanks to its advanced infrastructure, while the Asia Pacific region is growing rapidly due to an expanding tourism industry. Major players, including Danfoss, Uponor Corporation, and Honeywell International Inc., lead through innovations in hydronic underfloor heating and electric underfloor heating systems. These companies focus on smart thermostats, underfloor and climate control technology, catering to residential, commercial, and industrial applications, fostering a competitive market.

Underfloor Heating Market Drivers:

Stringent Environmental Regulations and Green Building Certifications: The underfloor heating market is propelled by global regulations mandating energy efficiency, such as the EU’s EPBD, which encourages low-carbon heating in new constructions and retrofits. In 2024, the UK’s Future Homes Standard mandated 75-80% lower carbon emissions for new homes, boosting hydronic underfloor heating adoption. Green building certifications like LEED and BREEAM drive demand for sustainable building solutions, particularly in Europe and North America. These policies incentivize renewable energy heating integration, reducing reliance on fossil fuels. Smart thermostats further enhance compliance by optimizing energy use, making underfloor heating systems a preferred choice for eco-conscious developers and homeowners aiming for net-zero heating solutions.

Rising Energy Costs and Demand for Efficiency: Escalating energy prices globally drive demand for energy-efficient heating solutions like underfloor heating systems. In 2024, UK energy bills rose by 10%, prompting homeowners to adopt radiant floor heating for long-term savings. Hydronic underfloor heating systems, paired with heat pumps, reduce energy consumption by operating at lower temperatures than traditional radiators. In Asia Pacific, Japan’s focus on energy efficiency in urban developments further fuels the adoption of smart home heating solutions. Climate control technology enables precise temperature zoning, minimizing waste. This trend supports commercial heating systems in offices and hospitality, where cost savings and comfort are paramount, driving market growth.

Advancements in Smart Heating Technology: Innovations in smart heating technology, such as IoT-enabled smart thermostats underfloor, enhance the underfloor heating market by offering remote control and energy optimization. In June 2024, Danfoss launched the Ally smart heating system, integrating voice-activated controls for hydronic underfloor heating. These systems reduce energy consumption considerably, per Airobot’s findings, appealing to residential and commercial users. In Europe, smart home heating aligns with digitalization trends, while Asia Pacific sees rapid adoption in China and South Korea due to smart city initiatives. Heating system innovations drive market growth by improving user experience and sustainability.

Underfloor Heating Market Restraints:

High Initial Installation Costs: The underfloor heating market faces barriers due to high upfront costs for hydronic underfloor heating systems, which require extensive piping and boiler integration. In 2024, installation costs in South America, like Brazil, ranged from USD 10–20 per square foot, limiting adoption in cost-sensitive markets. Electric underfloor heating is more affordable but faces high running costs in regions with expensive electricity, such as the Middle East and Africa. These costs deter underfloor heating retrofits, particularly in older buildings, slowing market growth. Manufacturers are exploring cost-effective materials to address this challenge, but affordability remains a key restraint.

Limited Skilled Installers and Integration Challenges: The scarcity of skilled installers for underfloor heating systems hinders market growth, especially in the Middle East and Africa and South America. In 2024, a UK study highlighted a shortage of trained technicians, complicating underfloor heating retrofits in older structures. Hydronic underfloor heating requires precise manifold balancing, while electric underfloor heating demands electrical expertise. Integration with existing HVAC systems further complicates adoption, particularly in industrial settings, slowing market expansion in emerging regions.

Underfloor Heating Market Segmentation Analysis:

The Hydronic Underfloor Heating Systems are experiencing significant growth: Hydronic underfloor heating systems dominate the underfloor heating market due to their energy efficiency and compatibility with renewable energy heating sources like heat pumps and solar thermal systems. These systems circulate warm water through pipes, providing consistent heat for large residential and commercial spaces. In June 2024, Danfoss introduced the Icon2 hydronic floor heating control, enhancing efficiency with voice-activated smart thermostats underfloor. Europe, particularly Germany and the UK, leads adoption due to stringent underfloor heating regulations like the EPBD, which favor low-temperature systems. The segment’s dominance is driven by its ability to reduce energy costs and carbon emissions, aligning with net-zero heating solutions in green building certifications. Asia Pacific sees growth in China and Japan due to urbanization and sustainable construction trends.

The Residential segment is expected to dominate the market: The residential segment leads the underfloor heating market, driven by consumer demand for energy-efficient heating solutions and smart home heating. Hydronic underfloor heating and electric underfloor heating systems offer comfort and aesthetic flexibility, appealing to homeowners in Europe and North America. In 2024, the UK’s Future Homes Standard boosted adoption in new homes, emphasizing low-carbon heating. Underfloor heating retrofits are also rising, supported by modular systems like Warmzone’s FilmHeat, which simplifies installation under laminate floors. The segment’s growth is fueled by smart thermostats, underfloor and climate control technology, enhancing user control and energy savings in residential underfloor heating.

Europe is anticipated to lead the market growth: Europe dominates the underfloor heating market, driven by stringent underfloor heating regulations and a focus on sustainable building solutions. Countries like Germany, the UK, and the Nordics lead adoption, supported by the EU’s EPBD, which mandates energy-efficient systems. In 2024, Germany’s Federal Funding for Efficient Buildings provided subsidies for hydronic underfloor heating integrated with heat pumps, boosting demand. Smart home heating and renewable energy heating trends, coupled with green building certifications, drive market growth. Europe’s focus on net-zero heating solutions ensures continued dominance, with underfloor heating systems being a cornerstone of sustainable construction.

Underfloor Heating Market Key Developments:

June 2024: Danfoss introduced the Ally smart heating system for hydronic underfloor heating, featuring voice-activated controls and IoT integration. Launched at InstallerSHOW 2024, it enhances climate control technology by optimizing energy use in residential and commercial settings. The system supports renewable energy heating with heat pumps, aligning with underfloor heating regulations in Europe. It reduces energy consumption by up to 20%, appealing to eco-conscious consumers seeking net-zero heating solutions. This innovation drives smart home heating adoption in Asia Pacific and North America.

June 2024: Danfoss unveiled the Icon2 hydronic floor heating control, a smart heating technology solution for hydronic underfloor heating systems. Launched at InstallerSHOW 2024, it offers precise temperature zoning and compatibility with renewable energy heating sources, enhancing energy-efficient heating solutions. Ideal for residential and commercial applications, it supports Europe’s decarbonization goals and green building certifications. The system’s modular design simplifies underfloor heating retrofits, driving adoption in Germany and the UK. This launch reinforces Danfoss’s leadership in climate control technology.

January 2024: ThermoSphere launched an advanced electric underfloor heating system with four additional cable lengths (42–175 meters), enhancing installation flexibility for residential and commercial projects. Designed for easy integration with smart thermostats underfloor, the system reduces multi-cable installations, minimizing damage risks. It supports energy-efficient heating solutions in Europe and North America, aligning with green building certifications. The innovation caters to underfloor heating retrofits, offering cost-effective solutions for smart home heating. This launch strengthens ThermoSphere’s position in the underfloor heating market.

List of Top Underfloor Heating Market Companies:

Danfoss

Uponor Corporation

Honeywell International Inc.

Mitsubishi Electric Corporation

nVent Electric plc

Underfloor Heating Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 5.025 billion |

| Total Market Size in 2030 | USD 6.981 billion |

| Forecast Unit | Billion |

| Growth Rate | 6.80% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Component, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Underfloor Heating Market Segmentation:

Underfloor Heating Market Segmentation by type:

The market is analyzed by type into the following:

Hydronic Underfloor Heating Systems

Electric Underfloor Heating Systems

Underfloor Heating Market Segmentation by component:

The report analyzes the market by component as below:

Hardware

Software

Services

Underfloor Heating Market Segmentation by end-user:

The report analyzes the market by end-user segment as below:

Residential

Commercial

Industrial

Others

Underfloor heating Market Segmentation by regions:

The study also analysed the underfloor heating market into the following regions, with country-level forecasts and analysis as below:

North America (US, Canada, and Mexico)

South America (Brazil, Argentina, and Others)

Europe (Germany, UK, France, Spain, Italy, and Others)

Middle East and Africa (Saudi Arabia, UAE, and Others)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)