Report Overview

USA Shampoo Market - Highlights

USA Shampoo Market Size:

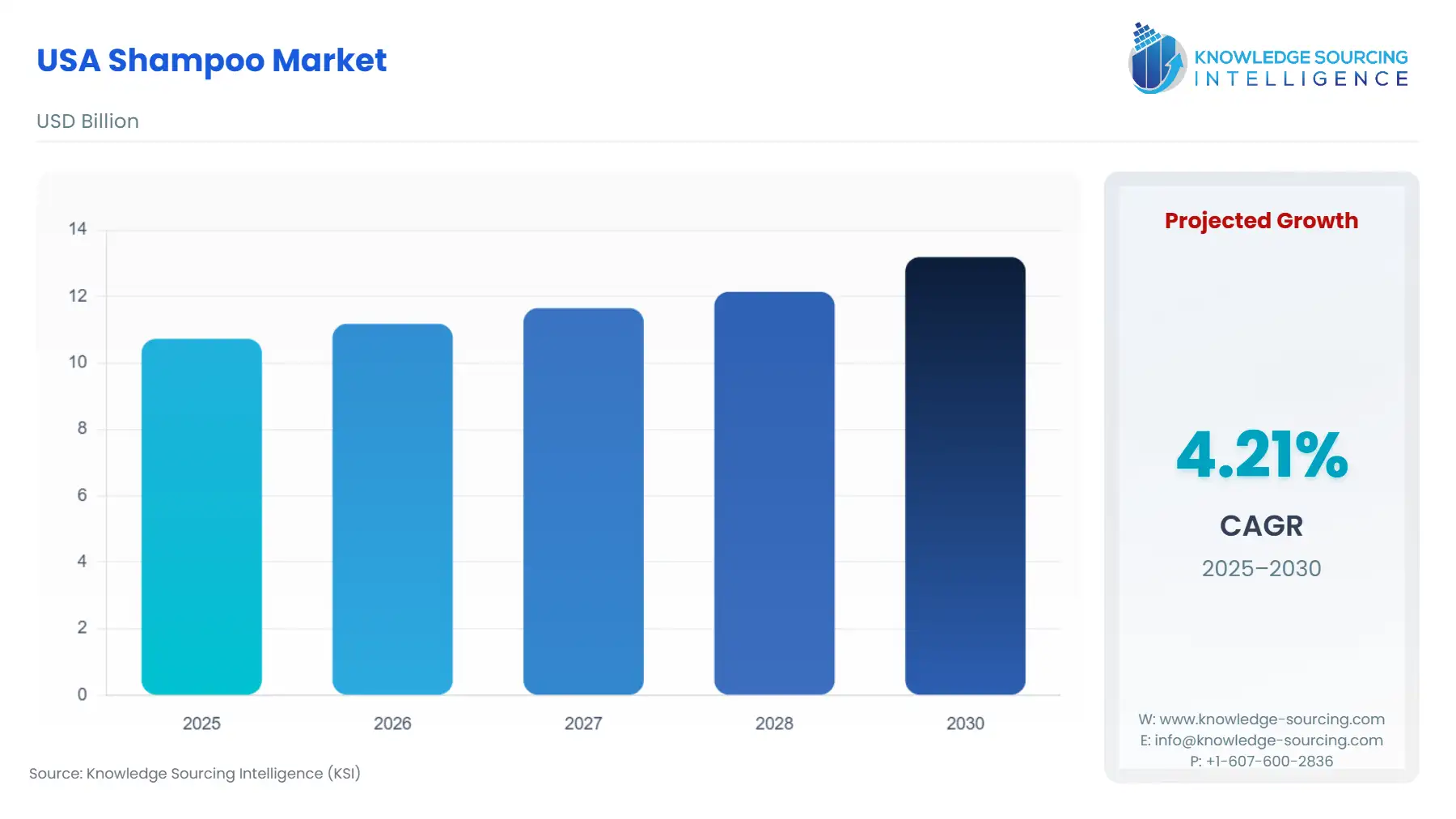

The USA shampoo market is projected to grow at a CAGR of 4.21% during the projected period (2025-2030), reaching a market size of USD 13.189 billion by 2030 from USD 10.730 billion by 2025.

The shampoo market in the United States is a rapidly expanding sector of the personal care industry. The market is being significantly impacted by the clean beauty movement and growing health consciousness, which is being driven by rising consumer demand for natural, sulfate-free, and environmentally friendly products. The landscape is changing due to trends including multipurpose formulas, customized hair care solutions, and the growth of men's grooming goods. Large companies like Procter & Gamble, L'Oréal, and Unilever encourage innovation while e-commerce broadens market access. Purchasing decisions made by consumers are increasingly being influenced by sustainability and ethical sourcing.

USA Shampoo Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The USA shampoo market is segmented by:

- Product: The USA shampoo market is divided into two segments based on product, non-medicated/regular and medicated/special purpose. The non-medicated/regular segment is anticipated to lead the USA shampoo market share due to widespread availability and rising mass-production product acceptance worldwide. Since non-medicated shampoos are easier to find and less expensive than their counterparts, non-medicated products are widely used. Additionally, the non-medicated shampoo segment's revenue is driven by the growing availability of over-the-counter versions at pharmacies and drug shops.

- Application: The market is separated into two segments based on application, domestic and commercial. The household segment is anticipated to lead the market because of the wide range of products available. Significant product use for personal hygiene purposes in the home and the growing number of toddlers and babies using baby shampoos are further factors propelling the household segment's growth. The growing number of businesses promoting their hair grooming products through celebrity endorsements and social media is expected to raise demand among home customers in the USA.

- Distribution Channel: The market is divided into convenience stores, online stores, hypermarkets and supermarkets, and others based on the distribution. The availability of a wide range of products on supermarket shelves allowed hypermarkets and supermarkets to dominate the market. This enables customers to know their alternatives and purchase a specific product or combination of products based on their hair care requirements. The segment's rise was aided by the new trend of buying personal care goods in bulk at department stores and supermarkets.

- Manufacturers: The market is divided into private label, toll manufacturing, and multinational segments based on manufacturers. The multinational segment's growth in the market is propelled by the consistent supply of branded goods, the distribution networks of major multinational corporations, and a strong clientele. Across the USA, these elements made a substantial contribution to the revenue generated by multinational corporations. The segment's growth is driven by expanding projects and capacity-building initiatives carried out by international corporations.

Top Trends Shaping the USA Shampoo Market:

- Growing popularity of convenient and mobile lifestyles

The reason that drives the shampoo business in the US market is the inclination towards time-efficient grooming products. Customers are using dry shampoos as a quick and easy solution to revitalize their hair in between standard washes due to busy schedules and a growing emphasis on efficiency. The fast-paced American lifestyle, where people frequently look for time-saving solutions without sacrificing personal care regimens, is perfectly suited to this trend.

- Growing Consumer Interest in Natural, Organic, and Clean-Labelled Products

Growing consumer knowledge of the possible negative effects of specific chemical compounds, such as parabens and aluminum compounds, is driving a significant change in the US hair care market toward natural and organic hair care products. Manufacturers have created novel formulations of ingredients inspired by nature in response to consumer demand for eco-friendly, chemical-free, and sustainable products. In response to customer desires for clean-labeled products, businesses are increasingly using premium botanical and plant-based components in their products.

USA Shampoo Market Growth Drivers vs. Challenges:

Drivers:

- Broad product availability to boost market expansion: Personal grooming with an emphasis on hair care is growing which is making a substantial contribution to product sales. Companies that make hair care products are successfully addressing several hair-related problems, including dandruff, hair thinning, sebum secretions, and severe hair loss, by introducing anti-hair fall and anti-dandruff shampoo. Product sales will rise even more because of this trend's impressive growth. To broaden their portfolios, several well-known companies are releasing new items.

- A greater emphasis on product customization by manufacturers to promote market expansion: A growing number of industry players are moving toward personalization to accommodate a wide range of customer preferences and hair care requirements. Important market players are experimenting with new substances that could improve the quality of their goods. The market for protein- and vitamin-based products with many health advantages grows, and ingredients including biotin, probiotics, and fruit vitamins are being investigated. Personalization and the launch of new products by major companies will therefore boost the growth of the regional shampoo industry.

Challenges:

- The frequency of counterfeit goods could impede the expansion of the market: A major obstacle to the global market's expansion is fake hair care products, including shampoos, conditioners, and hair oils. Consumer confidence in the market is damaged by counterfeit goods since they cast doubt on the genuineness and caliber of hair care products. Customers who come across counterfeit or inferior goods may lose trust, which could lower their confidence in making such purchases. Legitimate brands are frequently imitated by illicit or counterfeit haircare products, harming the reputation of the original brand.

USA Shampoo Market Competitive Landscape:

The market is moderately fragmented, with many key players including L'Oréal SA, Unilever PLC, Procter & Gamble Co., and The Estée Lauder Companies.

- Product Expansion: In June 2024, The Estée Lauder Companies declared that its hair care line, Bumble & Bumble, would be available on Amazon Premium Beauty in the US. By taking this action, the firm hopes to improve its online visibility and increase the number of people who can purchase its salon-quality goods.

USA Shampoo Market Scope:

| Report Metric | Details |

| USA Shampoo Market Size in 2025 | USD 10.730 billion |

| USA Shampoo Market Size in 2030 | USD 13.189 billion |

| Growth Rate | CAGR of 4.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | Texas, California, New York, New Mexico, Alaska, Others |

| List of Major Companies in the USA Shampoo Market |

|

| Customization Scope | Free report customization with purchase |

USA Shampoo Market Segmentation:

By Product

By Application

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Stores

- Others

By Manufacturers

By Region