Report Overview

Global Soap Market - Highlights

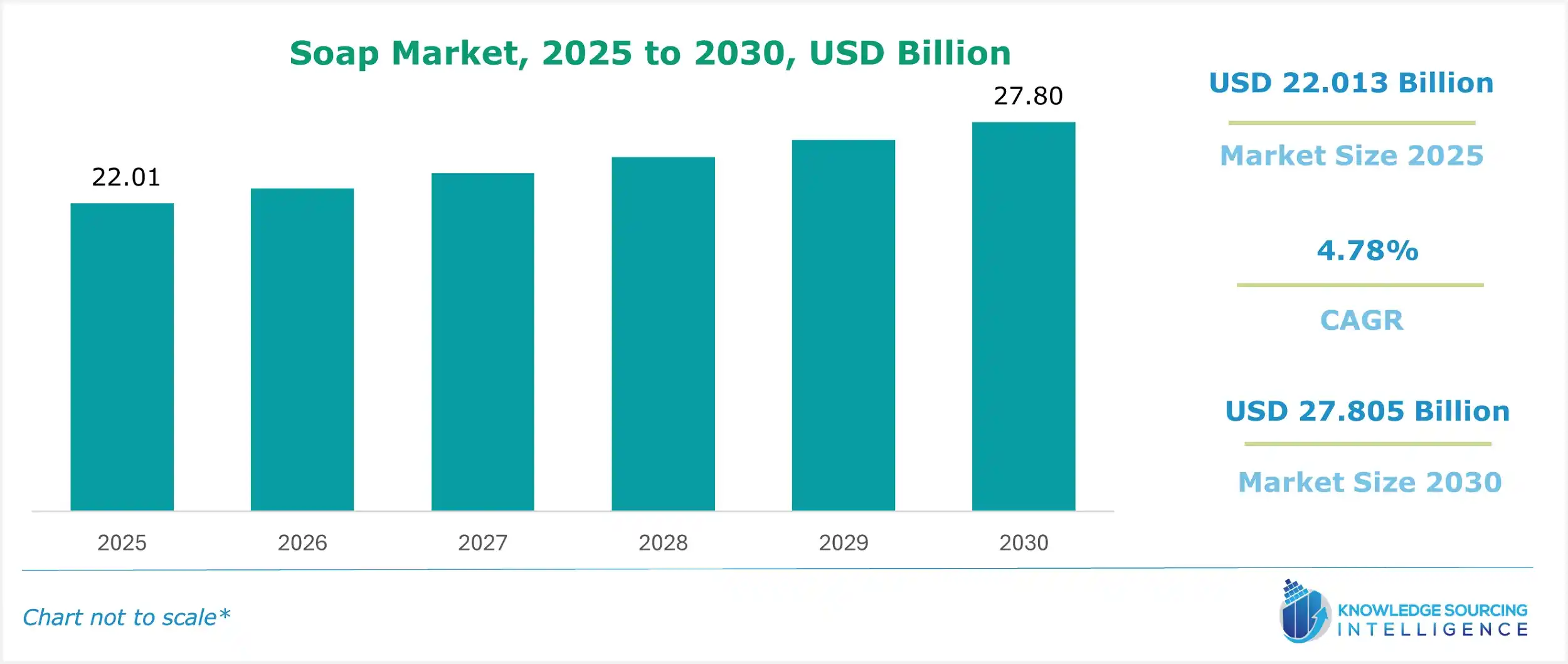

Soap Market Size:

The global soap market, valued at $27.805 billion in 2030 from $22.013 billion in 2025, is projected to grow at a CAGR of 4.78% through 2030.

The Global Soap Market is a mature, essential consumer goods sector currently experiencing dynamic shifts driven by heightened public health consciousness and a pronounced consumer migration toward sustainability and premiumization. The market's stability, underpinned by its necessity in personal and public hygiene, is being strategically reshaped by product innovation across the 'Liquid' and 'Organic' segments. Major multinational corporations are leveraging global distribution networks to capitalize on hygiene awareness in emerging economies while facing intensifying competition from specialized, digitally-native brands that prioritize natural ingredients and eco-conscious packaging. Regulatory frameworks are increasingly influencing product composition, particularly concerning antimicrobial claims and ingredient transparency, necessitating strategic portfolio adjustments by market players.

Global Soap Market Analysis

Growth Drivers:

Widespread public health campaigns, intensified by recent global health events, have permanently increased the consumer and institutional imperative for frequent, effective hand hygiene, directly translating into sustained demand for soap products. Rising disposable incomes across developing nations and accelerating urbanization drive demand by transitioning vast populations from traditional, often less-effective, cleansing methods to modern, packaged soap formats. The proliferation of commercial applications, including an expanding global hospitality sector and rigorous hygiene protocols in healthcare facilities, compels bulk purchasing and consistent replenishment cycles for high-performance liquid soaps and hand sanitizers, thereby fueling consistent market expansion.

Challenges and Opportunities:

A significant challenge arises from raw material price volatility, particularly for palm oil and other key oleochemicals, which introduces margin compression for mass-market conventional soap manufacturers and creates procurement complexity. An opportunity exists in the accelerating demand for sustainable packaging, specifically solid bar formats or refillable liquid systems, which reduces plastic dependency and directly appeals to the growing segment of environmentally conscious consumers. Further opportunity lies in premiumization: formulating soaps with advanced skincare benefits (e.g., pH balancing, moisturizing compounds) allows for higher price points, increasing the total value of consumer spending within the category.

Raw Material and Pricing Analysis:

Soap, as a physical product, is fundamentally a derivative of fats/oils (triglycerides) and an alkali (lye, caustic soda). The pricing of oleochemicals, primarily palm oil, tallow, and coconut oil, directly dictates the cost of goods sold. Global commodity market volatility, influenced by geopolitical factors and climate change impacts on crop yields, introduces significant cost headwinds for producers. A reliance on major producing regions, particularly in Southeast Asia for palm oil, creates a concentrated supply chain risk that impacts ingredient access and pricing stability for major soap manufacturers globally. This dynamic compresses profit margins for mass-market soap, compelling a strategic shift toward cost-optimization or value-added premiumization to maintain profitability.

Supply Chain Analysis:

The global soap supply chain is characterized by two distinct tiers: the upstream processing of raw materials and the downstream distribution of finished goods. Production hubs are typically clustered near oleochemical feedstock sources, such as Indonesia and Malaysia, or adjacent to major consumer markets, like China, India, and North America. Logistical complexities stem from the global transport of bulk chemicals and packaging components, which is susceptible to maritime freight costs and port capacity constraints. A key dependency exists on the stable supply of specialized packaging materials, particularly high-density polyethylene (HDPE) for liquid soap bottles, which can experience price inflation and supply bottlenecks tied to the petrochemical industry.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | FDA Final Rule on Safety and Effectiveness of Consumer Antiseptic Rubs/Washes | The FDA's 2016 ruling requires manufacturers to demonstrate that certain over-the-counter (OTC) antiseptic active ingredients are safe and more effective than non-antimicrobial soap and water, directly reducing the available palette of active ingredients and compelling the reformulation and re-labeling of numerous antibacterial liquid soap products. This regulatory pressure shifts demand toward non-medicated, basic cleansing soap formulations. |

| European Union | EU Regulation (EC) No 1223/2009 (Cosmetics Regulation) | The regulation imposes strict safety assessments, mandatory product notifications via the CPNP portal, and comprehensive labeling requirements for all cosmetic products, including non-medicated soaps. This increases the compliance burden and necessitates transparent ingredient sourcing and documentation, favoring major players with established regulatory departments and raising the barrier to entry for smaller manufacturers. |

| India | Bureau of Indian Standards (BIS) Certification | BIS sets quality specifications for soaps (e.g., total fatty matter, moisture content) under mandatory certification schemes. Adherence ensures product quality and safety, but the mandatory nature formalizes the market, supporting demand for standardized, branded products and potentially limiting non-compliant artisanal or small-scale producers. |

In-Depth Segment Analysis

By Application: Hospitals

The Hospitals segment represents a critical, inelastic demand pocket for the Global Soap Market, driven primarily by stringent, non-negotiable infection control protocols established by national and international health organizations like the World Health Organization (WHO). This setting mandates the use of specialized hand hygiene products, overwhelmingly preferring liquid or foam-based formulations that facilitate rapid, repeatable, and measured dispensing. The requirement is not merely for cleansing, but for certified antimicrobial efficacy. Purchasing decisions are based on clinical evidence, skin compatibility for frequent use by healthcare personnel, and compliance with the 'Five Moments for Hand Hygiene.' This specialized demand structure ensures consistent volume and necessitates that manufacturers secure specific regulatory approvals and clinical-grade formulations, separating it significantly from mass-market consumer demand. The high volume, high-frequency use in hospitals underpins a massive, non-cyclical replenishment model.

By Form: Liquid

The liquid soap segment is driven by both perceived and tangible advantages in hygiene, convenience, and aesthetic customization, resulting in accelerating demand that often outpaces the traditional bar segment. Operationally, liquid soap is favored in commercial and institutional settings (e.g., Airports, Hotels, and Commercial) because dispensing systems minimize cross-contamination risk, improve portion control, and integrate easily into modern restroom designs. For residential consumers, the shift is catalyzed by the enhanced sensory experience offered by liquid formats, allowing for richer fragrances, specialized textures, and the integration of advanced skincare additives like moisturizers and exfoliants. Furthermore, liquid soap facilitates the use of refill pouches and bulk containers, a key market vector that appeals to cost-conscious consumers and companies committed to reducing primary packaging waste, thus sustaining its demand trajectory.

Geographical Analysis

US Market Analysis (North America)

The US market’s expansion is characterized by a strong consumer preference for premium, specialty, and certified "natural" soap formulations, evidenced by a willingness to pay a premium for products with verifiable ethical sourcing or specific functional claims (e.g., sulfate-free, biodegradable). State-level regulations, such as California's chemical transparency mandates, compel manufacturers to disclose ingredients, subsequently driving demand toward products with shorter, easily recognizable ingredient lists. The retail landscape's consolidation, dominated by large-format pharmacies and mass-market retailers, requires manufacturers to prioritize efficient supply chains and sophisticated in-store marketing.

Brazil Market Analysis (South America)

The Brazilian market’s growth is fundamentally driven by price sensitivity and a high-frequency usage culture spurred by the tropical climate. While conventional bar soap remains the core volume driver, rising middle-class disposable incomes are increasing demand for liquid soap, particularly in major metropolitan areas, reflecting a shift toward aspirational products with enhanced fragrance and packaging. Local regulations on product registration and composition, enforced by agencies like ANVISA, require tailored local manufacturing or complex import compliance, which favors established multinational corporations with local manufacturing footprints.

Germany Market Analysis (Europe)

German consumer demand is highly focused on environmental responsibility and product efficacy, prioritizing mild, skin-friendly, and highly certified formulations. The strong public and regulatory emphasis on sustainability, exemplified by rigorous packaging waste laws (e.g., VerpackG) and the EU’s Biocidal Products Regulation, compels manufacturers to develop highly concentrated liquid soaps and plastic-free packaging alternatives. The need for certified organic and dermatologically tested products, often validated by local bodies, commands a premium price point, driving portfolio composition toward high-value offerings.

UAE Market Analysis (Middle East & Africa)

The UAE’s demand is characterized by a high per capita consumption of premium and luxury soap products, particularly within the hospitality (Hotels) and commercial sectors, reflecting the region's focus on high-end tourism and infrastructure. Consumer preference is strongly influenced by fragrance and prestige branding, driving a market where product aesthetics and exclusive scents are significant growth catalysts. The hot, arid climate also fuels demand for moisturizing and specialty body care soaps. Import dependency is high, making the market susceptible to international logistics costs and trade policies.

India Market Analysis (Asia-Pacific)

The Indian soap market is a high-volume, price-elastic landscape dominated by conventional bar soap, which serves as a foundational necessity across rural and urban environments. Market expansion is driven by government-led hygiene campaigns and increasing media penetration, which raises public health awareness and transitions consumers from unpackaged local products to branded, packaged soap. Major domestic and international players leverage deep distribution networks, particularly to capture the massive demand from the Residential segment, where even minor price fluctuations significantly impact purchasing decisions.

Competitive Environment and Analysis

The Global Soap Market is characterized by intense competition between a few dominant multinational conglomerates that command significant scale and brand equity, and a rapidly expanding cohort of niche, direct-to-consumer players. The market leaders rely on vast R&D capabilities, complex global supply chains, and extensive, multi-channel distribution to maintain market share, while emerging competitors leverage ingredient differentiation, sustainability messaging, and agile digital engagement to capture premium segments. Pricing power is generally held by the largest players in the mass-market bar segment, while the specialty liquid and organic segments are more fragmented, allowing for higher margins driven by brand positioning.

Unilever

Unilever’s strategic positioning is built on a massive portfolio of leading global soap brands, including Dove and Lifebuoy. Dove is positioned as a premium skincare brand, emphasizing moisturizing benefits and challenging traditional beauty standards, which sustains demand among high-value residential consumers. Lifebuoy, conversely, is positioned as a mass-market, health-oriented brand, focusing heavily on germ-protection and hygiene education in high-population, developing markets in Asia and Africa, thus capturing significant volume growth through public health messaging. Unilever leverages its vast supply chain and unparalleled retail presence to ensure maximum product accessibility across all major distribution channels globally.

Procter & Gamble Co.

Procter & Gamble Co. (P&G) maintains its competitive edge through a focus on brand heritage and performance-based superiority, particularly with brands like Olay (skincare, premium) and Old Spice (male personal care, including body wash). P&G’s strategy centers on sustained innovation in liquid body wash technology, maximizing consumer switching from bar soap to higher-margin liquid formats through superior formulation and packaging. The company’s emphasis on digital marketing and data-driven customer engagement allows it to quickly adapt to shifting consumer trends and sustain brand relevance among younger demographics.

Reckitt Benckiser Group plc

Reckitt Benckiser Group plc is strategically positioned at the nexus of hygiene and health, with its key brand Dettol serving as a globally recognized antiseptic and germ-protection platform. Dettol's core positioning is centered on protection against germs, which creates immediate, non-discretionary demand in the wake of health crises and within institutional environments. The company's competitive strategy emphasizes the clinical and proven efficacy of its products, commanding a premium over generic soaps, and driving substantial revenue through both residential and commercial/healthcare channels globally.

Recent Market Developments

- September 2025: Unilever announced the completion of the acquisition of the men's personal care brand, Dr. Squatch. This strategic move marks a clear commitment by Unilever to expand its portfolio into premium and high-growth segments, specifically targeting the North American male consumer seeking natural and differentiated bar soap and personal care products. The acquisition directly addresses the rising consumer demand for artisanal, natural-ingredient-focused formulations.

- April 2025: Unilever completed the acquisition of Wild, a digital-native personal care brand. Wild offers refillable, natural, and plastic-free deodorants, bodywashes, and handwashes, aligning with the growing consumer demand for sustainable and eco-friendly soap and personal care options.

Soap Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Soap Market Size in 2025 | US$22.013 billion |

| Soap Market Size in 2030 | US$27.805 billion |

| Growth Rate | CAGR of 4.78% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Soap Market | |

| Customization Scope | Free report customization with purchase |

Global Soap Market Segmentation

- By Type

- Organic

- Conventional

- By Form

- Bars

- Liquid

- By Application

- Residential

- Commercial

- Hospitals

- Airports

- Hotels

- Others

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East And Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America