Report Overview

UV Curable Resin Market Highlights

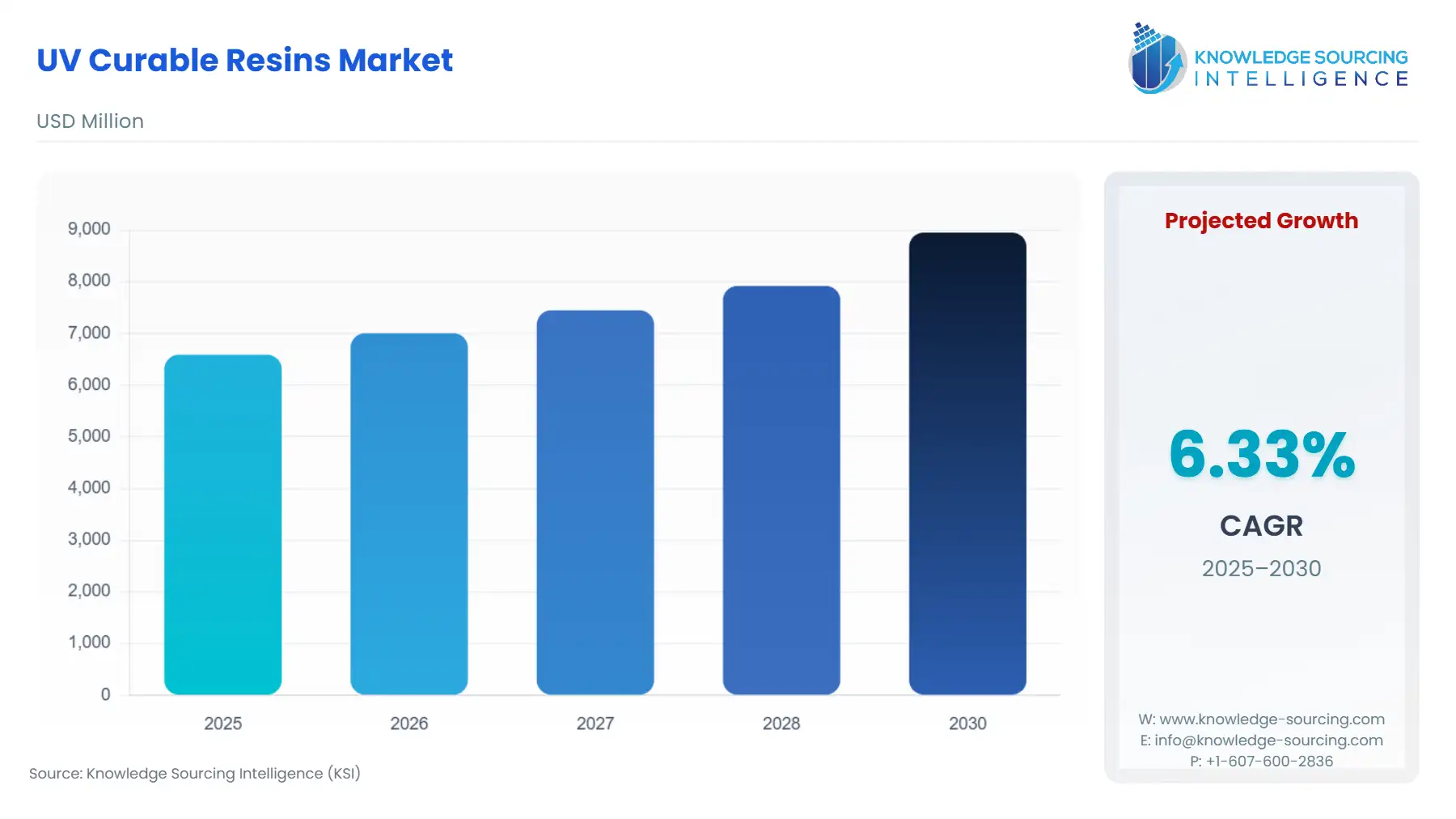

UV Curable Resin Market Size:

The UV Curable Resin Market will reach US$8,954.385 million in 2030 from US$6,588.977 million in 2025 at a CAGR of 6.33% during the forecast period.

The UV Curable Resin Market currently operates as a key enabling technology across high-growth, high-value industrial sectors, fundamentally displacing traditional, thermally-cured and solvent-borne systems. This dynamic is rooted in the inherent performance advantages of UV technology—namely, instantaneous curing, reduced energy consumption, and the elimination of VOC emissions. The market's complexity stems from its diverse chemical landscape, encompassing resin types like epoxies, acrylates, and polyurethanes, each formulated to meet specific performance criteria, ranging from mechanical durability in industrial coatings to optical clarity in display applications.

UV Curable Resin Market Analysis:

- Growth Drivers

The paramount driver is the global regulatory imperative to reduce industrial emissions. Regulations such as the European Union’s push to limit VOCs and Hazardous Air Pollutants (HAPs) immediately restrict the usability of conventional solvent-borne coatings and inks, creating an unconditional demand for compliant, solvent-free alternatives like UV-curable resins. This forces industrial manufacturers, particularly in automotive and packaging, to transition production lines, directly escalating procurement volumes for UV resins. Concurrently, the proliferation of 3D printing (Additive Manufacturing), particularly the SLA and DLP platforms, acts as a structural catalyst. These technologies exclusively use photopolymer resins, meaning the expansion of 3D printing for rapid prototyping, personalized medicine, and on-demand manufacturing directly correlates to an unavoidable, non-substitutable need for UV-curable resin feedstocks.

- Challenges and Opportunities

The primary constraint facing the market is the price and availability volatility of core raw materials, specifically petroleum-derived acrylic monomers and isocyanates, which are subjected to global petrochemical pricing cycles. This supply chain instability introduces a risk of unpredictable pricing, which can marginally decelerate the adoption of UV-curing over cost-sensitive, conventional technologies. Conversely, the market’s core opportunity is the massive demand for high-performance, bio-based alternatives. The scientific focus on utilizing renewable precursors like lignin and itaconic acid to synthesize UV-curable Polyurethane Acrylates (PUAs) and polyesters offers a path to mitigate petrochemical dependence and create a new value proposition. This bio-sourced innovation directly stimulates demand from sustainability-conscious end-users, transforming a regulatory challenge into a competitive advantage.

- Raw Material and Pricing Analysis

The UV Curable Resin market, being a physical product, is fundamentally exposed to the cost dynamics of its oligomer, monomer, and photoinitiator components. Pricing is closely coupled with the volatility of the upstream petrochemical industry, particularly for monomers such as acrylic acid and its derivatives, which are primarily derived from crude oil. This linkage means that geopolitical events or operational disruptions in major petrochemical hubs immediately translate to price pressure on UV resin manufacturers. Furthermore, key oligomer precursors like isocyanates (for urethane acrylates) exhibit a concentrated supply chain, introducing procurement complexity and pricing rigidity. The development of bio-based feedstocks, such as those derived from agricultural or industrial by-products, is an effort to de-link the resin cost structure from petroleum, providing a potential stabilizing mechanism but currently remains a high-cost, low-volume alternative.

- Supply Chain Analysis

The global UV curable resin supply chain is characterized by a multi-tiered structure, with key production and formulation hubs concentrated in Asia-Pacific, North America, and Europe. Asia-Pacific, particularly China and South Korea, serves as the dominant manufacturing base for both raw materials (e.g., acrylic monomers) and finished formulated resins, creating a logistical dependency for the Western hemisphere. Logistical complexities primarily revolve around the specialized handling and storage required for certain reactive intermediates and photoinitiators, which necessitate controlled temperature and light exposure to prevent premature polymerization. The dependence on a centralized Asian manufacturing base for key components, such as low-molecular-weight reactive diluents and high-performance photoinitiators, exposes the global supply chain to significant geopolitical and transport-related risk, often leading to extended lead times and stock-out vulnerabilities for smaller regional formulators.

- Government Regulations

Government regulations are a critical market-shaping force, often serving as a powerful, non-negotiable growth driver for UV-curable technologies due to their low-VOC and HAP-free nature.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Europe | REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) | REACH mandates comprehensive substance registration and can restrict the use of certain conventional solvent-borne chemicals, thus pushing manufacturers to adopt compliant UV-curable alternatives. It specifically affects raw material sourcing and formulation complexity. |

| North America | EPA (Environmental Protection Agency) VOC Limits, CARB (California Air Resources Board) | Strict state-level VOC limits (e.g., in California) make the use of high-solids or 100% solid UV formulations an economic and legal necessity, directly compelling the phase-out of traditional coatings in industries like automotive and printing. |

| Global | Basel Convention (Control of Transboundary Movements of Hazardous Wastes and their Disposal) | While not directly regulating product content, the convention's influence on waste disposal and hazardous chemical transit raises the logistical and financial overhead for managing solvent-borne waste, indirectly making the lower-waste, solvent-free UV-curing process more financially attractive. |

UV Curable Resin Market Segment Analysis:

- By Application: 3D Printing/Additive Manufacturing

The integration of UV-curable resins into 3D Printing (Additive Manufacturing) acts as a high-growth, non-substitutable demand center. Technologies such as Stereolithography (SLA) and Digital Light Processing (DLP) are entirely dependent on liquid photopolymer resins, which are cured by UV light. The growth driver here is the industry’s shift toward mass customization and decentralized manufacturing. In the medical sector, 3D printing enables the on-demand creation of personalized medical devices and complex drug delivery systems, requiring highly specialized, biocompatible UV-curable resins. The ability to rapidly fabricate highly complex geometries with minimal material waste and without part-specific tooling directly compels manufacturing enterprises to adopt these UV-resin based platforms. This segment's expansion is further compounded by the rise of industrial applications for tooling, functional prototypes, and end-use parts, each requiring bespoke resin formulations with specific mechanical, thermal, or chemical properties, moving the UV resin from a general chemical commodity to an advanced material for structural applications.

- By End-Use Industry: Electronics

The Electronics industry presents a critical, high-value demand segment for UV curable resins, driven by the persistent trend toward miniaturization and enhanced device performance. UV-curable materials are essential for encapsulation, bonding, and protective coatings for sensitive electronic components. For instance, UV-cured resins are preferred for the encapsulation of nascent technologies like Perovskite Solar Cells (PSCs) due to their rapid curing time, low shrinkage, and excellent adhesion, all of which are critical for device stability and durability. A specialized demand area involves high-refractive index UV resins, which are being synthesized and deployed in luminance-enhancing prism films for display technologies, such as TFT-LCD and LED backlight units. The fast-paced product cycles in consumer electronics necessitate materials that enable high throughput and precision application, which the rapid, on-demand curing of UV resins uniquely facilitates. Consequently, as electronic devices become more complex and require greater thermal and environmental protection, the need for specialized, high-purity UV-curable epoxies and acrylates will escalate proportionally.

UV Curable Resin Market Geographical Analysis:

- US Market Analysis

The US market is primarily driven by the confluence of strong industrial manufacturing output and strict state-level environmental mandates. California's pioneering and stringent VOC regulations, enforced by agencies like CARB, act as a powerful regional catalyst, compelling formulators and end-users to adopt 100% solids UV-curable coatings, inks, and adhesives across the automotive, wood finishing, and packaging sectors. The significant presence of leading technology companies and a robust defense/aerospace sector also fuels specialized demand for high-performance UV resins in complex composite structures and additive manufacturing applications, positioning the US as a demand center for high-margin, specialty UV resin products.

- Brazil Market Analysis

Brazil’s market dynamics are fundamentally shaped by its large, domestic packaging and automotive manufacturing industries. As the largest economy in South America, the increasing demand for sophisticated consumer packaging, driven by a growing middle class, directly translates to higher consumption of UV-curable printing inks and overprint varnishes (OPVs) due to their superior gloss, abrasion resistance, and fast-curing properties, which enhance production line efficiency. Regulatory enforcement of VOC limits is generally less stringent than in the EU or US, meaning adoption is more often driven by performance and cost-efficiency rather than compliance.

- Germany Market Analysis

Germany serves as the epicentrum of regulatory compliance-driven demand in Europe. Its world-class automotive and heavy industrial manufacturing sectors are profoundly impacted by the EU's REACH regulation and national environmental protection laws. This strict regulatory climate creates an overwhelming commercial imperative for chemical substitution, making UV-curable systems the preferred solution for industrial coatings, especially for eliminating VOCs. The country’s leadership in high-precision engineering and printing technology also sustains a constant demand for high-quality, high-reliability UV resins for sophisticated applications.

- Saudi Arabia Market Analysis

The Saudi Arabian market for UV curable resins is largely tethered to the nation’s large-scale infrastructure projects and emerging domestic manufacturing base. Significant investment in construction and petrochemical diversification generates demand for UV-cured protective and specialty coatings to protect materials like wood and plastics from the harsh desert environment, including high UV radiation. While local manufacturing is growing, much of the supply is currently fulfilled via imports, positioning the market as a high-potential future growth center contingent on local formulation and production capacity expansion.

- China Market Analysis

China is the dominant manufacturing and consumption hub for the UV Curable Resin Market. The sheer scale of its electronics assembly, packaging production, and rapidly growing 3D printing industry creates the largest volumetric demand globally. Driven by massive manufacturing capacity, local suppliers often provide cost-competitive resins, which, coupled with increasingly stringent domestic environmental controls, particularly in coastal manufacturing zones, propel the adoption of low-VOC UV technology. Its strategic importance lies not only in its immense internal demand but also as the primary, high-volume manufacturing source that dictates global raw material and component pricing.

UV Curable Resin Market Competitive Environment and Analysis:

The competitive landscape for UV curable resins is moderately consolidated, dominated by large, diversified chemical conglomerates and specialized resin formulators that leverage deep R&D capabilities and backward integration into raw material production. Competition is defined by product specialization, regional distribution network strength, and the ability to formulate custom solutions for high-growth segments like electronics and 3D printing. Key players compete primarily on the performance characteristics of their resins, such as cure speed, mechanical properties, and compliance with specialized regulatory standards like food-contact approvals.

- BASF SE

BASF SE is a global chemical major with a commanding presence across the UV curable market. The company’s strategic positioning is rooted in its highly integrated production network, which spans from fundamental petrochemical feedstocks to advanced polymer formulation. This vertical integration provides a crucial cost and supply chain advantage over smaller competitors. BASF's core offerings in this space include a wide portfolio of acrylate monomers, oligomers (such as proprietary urethane acrylates), and photoinitiators, with a strong focus on high-performance coating applications for the automotive and industrial sectors. The company leverages its extensive research arm to continually launch new products that address specific industry needs, particularly in developing energy-efficient and low-migration formulations for sensitive applications like food packaging.

- Arkema S.A.

Arkema S.A. focuses its efforts through its Sartomer line of specialty resins, positioning the company as a leader in high-performance and specialty UV-curable materials. Its strategy is concentrated on innovative materials for high-growth, technology-driven applications. Arkema’s portfolio features a specialized range of high-performance acrylate and methacrylate oligomers, catering particularly to the rapidly expanding 3D printing/Additive Manufacturing sector, a segment where material characteristics are paramount for the final part's integrity. The company's competitive advantage is derived from its application-specific expertise and a global network of technical centers, which allows for close collaboration with customers to develop custom resin formulations that meet exacting standards for mechanical strength, biocompatibility, and cure kinetics.

UV Curable Resin Market Recent Developments:

- September 2025: Hydrite, a specialty chemical distributor, announced the acquisition of Enterprise Specialty Products, Inc. (ESP). This move significantly expands Hydrite's regional footprint by marking its entrance into the Southeast US. The acquisition strengthens Hydrite's ability to offer a broader portfolio of specialty chemicals, including key ingredients used in UV curable resin formulations.

- July 2025: Permabond introduced UV6357, a new UV-curable adhesive designed for extreme conditions. It cures transparently within seconds and maintains high performance against chemicals, humidity, and extreme temperatures, making it ideal for arduous refrigeration and freezer applications. This product addresses the need for durable bonding in cold environments.

UV Curable Resin Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 6,588.977 million |

| Total Market Size in 2031 | USD 8,954.385 million |

| Growth Rate | 6.33% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Resin Type, Application, End-Use Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

UV Curable Resin Market Segmentation:

- BY RESIN TYPE

- Acrylates

- Epoxies

- Polyesters

- Urethane Acrylates

- Others

- BY APPLICATION

- Coatings

- Adhesives & Sealants

- Printing Inks

- 3D Printing/Additive Manufacturing

- Composites

- Others

- BY END-USE INDUSTRY

- Automotive

- Electronics

- Packaging

- Healthcare & Medical Devices

- Construction

- Industrial Manufacturing

- Others

- BY CURING TECHNOLOGY

- LED UV Curing

- Mercury UV Curing

- Hybrid UV Systems

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America