Report Overview

Solid Grade Thermoplastic Acrylic Highlights

Solid Grade Thermoplastic Acrylic (Beads) Resins Market:

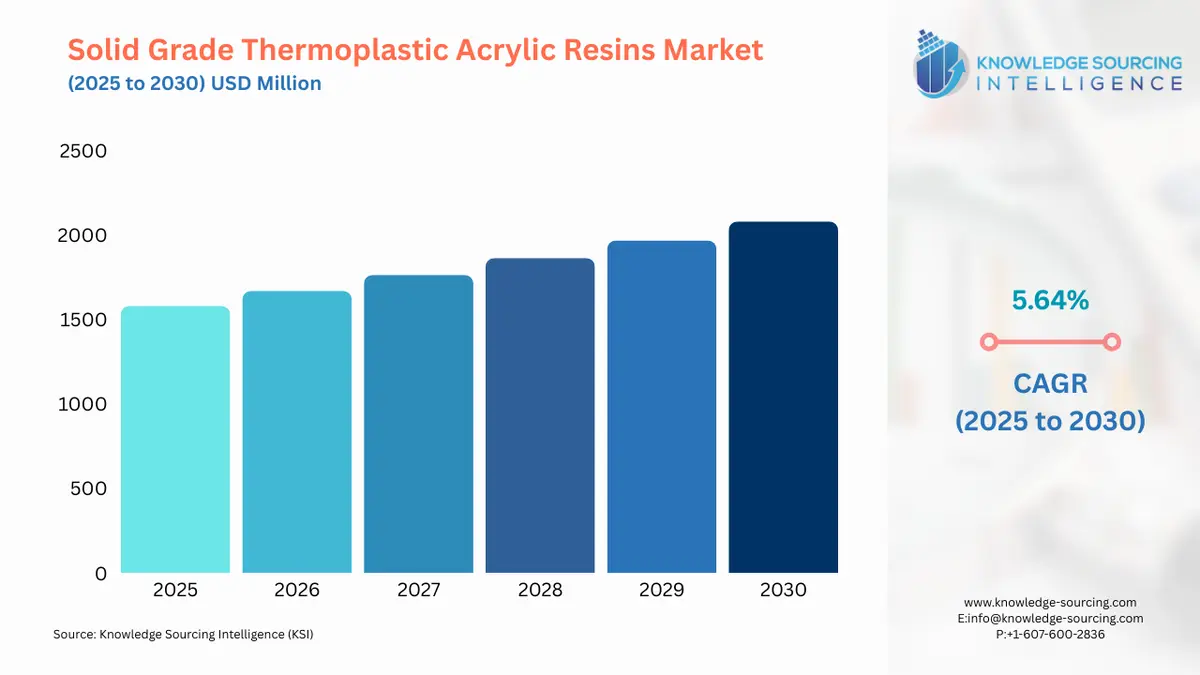

The Solid Grade Thermoplastic Acrylic (Beads) Resins Market will grow to a market size of USD 2,079.745 million in 2030 from USD 1,580.467 million in 2025, growing at a CAGR of 5.64%.

The acrylic resin market is witnessing robust growth, with solid-grade thermoplastic acrylic (beads) resins emerging as a key segment within the broader specialty chemicals market. These resins, primarily composed of PMMA beads (polymethyl methacrylate), are valued for their clarity, durability, and versatility, making them essential in applications ranging from paints and coatings to adhesives and medical composites. As thermoplastic polymers, solid acrylic beads offer unique properties like excellent weatherability, adhesion, and chemical resistance, positioning them as a preferred material in industries such as automotive, construction, and electronics.

The market is driven by global demand for high-performance, sustainable materials and is shaped by innovations in eco-friendly formulations and regulatory compliance. Solid grade thermoplastic acrylic (beads) resins, often referred to as solid acrylics, are spherical, powder-like polymers derived from methyl methacrylate (MMA) and other acrylic monomers. These resins are integral to the specialty chemicals market, offering superior properties such as high gloss, UV stability, and adhesion to diverse substrates like metal, plastic, and concrete. Their primary applications include paints and coatings for architectural, automotive, and industrial uses, as well as adhesives, inks, and medical composites.

The acrylic resin market benefits from the material’s ability to meet stringent environmental regulations, particularly through low-VOC (volatile organic compound) formulations, aligning with global sustainability goals. The market is experiencing a surge due to rapid industrialization, urbanization, and the shift toward electric vehicles (EVs) and renewable energy. For instance, Covestro AG completed the acquisition of DSM’s resins and functional materials business, enhancing its portfolio of sustainable coating resins and strengthening its position in the acrylic resin market. Similarly, Trinseo’s collaboration with Japan Steel Works Europe GmbH focused on chemical recycling of PMMA beads, advancing sustainability in thermoplastic polymers. These developments underscore the market’s alignment with eco-conscious trends and technological innovation, positioning solid acrylics as a critical component in modern industrial applications. Several factors propel the market’s growth:

- Expansion of Paints and Coatings Industry: The global demand for high-performance coatings in construction, automotive, and industrial sectors drives the need for solid acrylics, valued for their durability and low-VOC properties.

- Growth in Electric Vehicle Production: The rise of EVs increases demand for lightweight, durable coatings using PMMA beads, supporting efficiency and aesthetic appeal in automotive applications.

- Sustainability and Regulatory Compliance: Stricter VOC emission standards globally push the adoption of water-based and low-VOC thermoplastic polymers, boosting the acrylic resin market.

- Infrastructure and Urbanization: Rapid urban development, especially in the Asia-Pacific, fuels demand for solid acrylics in architectural coatings and construction materials.

Despite growth, the market faces challenges:

- High Production Costs: The complex manufacturing processes and premium raw materials for PMMA beads increase costs, limiting affordability in price-sensitive markets.

- Raw Material Price Volatility: Fluctuations in the supply and cost of MMA and other monomers pose challenges to consistent production and pricing of solid acrylics.

Comparison with Polycarbonate and Glass

Solid grade thermoplastic acrylic (beads) resins, or PMMA beads, offer distinct properties compared to polycarbonate and glass, making them suitable for specific applications within the acrylic resin market. PMMA beads provide exceptional optical clarity (92% light transmission), rivaling glass, and are significantly lighter, with a density of 1.19 g/cm³ compared to glass’s 2.5 g/cm³. Unlike glass, solid acrylics are shatter-resistant, enhancing safety in applications like signage and automotive lenses. However, glass offers superior scratch resistance and thermal stability, withstanding temperatures up to 1,500°C, while PMMA softens above 100°C, limiting its use in high-heat environments. Compared to polycarbonate, PMMA beads excel in clarity and weatherability, resisting UV degradation better than polycarbonate, which yellow’s over time. Polycarbonate, with a density of 1.2 g/cm³, is tougher and more impact-resistant (250 times stronger than glass), making it preferable for high-impact applications like bulletproof shields. However, solid acrylics are easier to process and dissolve in solvents like xylene, enabling versatile formulations in coatings and adhesives. In terms of cost, PMMA beads are generally more affordable than polycarbonate but pricier than glass for large-scale applications. For instance, thermoplastic polymers like PMMA are favored in automotive coatings for their lightweight properties, as highlighted by Covestro’s sustainable resin advancements. Both materials compete in the specialty chemicals market, but solid acrylics dominate in applications requiring aesthetic clarity and environmental resistance.

The solid grade thermoplastic acrylic (beads) resins market is thriving, driven by the expansion of the paints and coatings industry, EV growth, sustainability trends, and infrastructure development. Despite challenges like high production costs and raw material volatility, PMMA beads offer unmatched clarity, weatherability, and versatility, positioning them as a cornerstone of the specialty chemicals market. Compared to polycarbonate and glass, solid acrylics excel in lightweight, low-VOC applications, though they face limitations in high-heat and high-impact scenarios. Recent advancements, such as Covestro’s acquisition and Trinseo’s recycling initiatives, highlight the market’s commitment to innovation and environmental responsibility. Industry experts can leverage these trends by investing in sustainable formulations, expanding into high-growth regions like Asia-Pacific, and exploring novel applications to meet evolving demands in the acrylic resin market.

Solid Grade Thermoplastic Acrylic (Beads) Resins Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

The thermoplastic acrylic beads market is witnessing steady growth, driven by the expanding paints and coatings industry. Thermoplastic acrylic resins, valued for their durability, weather resistance, clarity, and adhesive properties, are in high demand across construction, automotive, and industrial sectors. These resins enhance the performance of coatings, providing robust protection and aesthetic appeal. The automotive industry, particularly the booming electric vehicle (EV) sector, significantly contributes to market growth. Acrylic bead resins are used in automotive coatings for their ability to withstand harsh environmental conditions and maintain aesthetic quality. The shift toward sustainability is another key driver, with increasing demand for water-based thermoplastic acrylic beads. These eco-friendly coatings reduce volatile organic compound (VOC) emissions, aligning with global environmental regulations and sustainable manufacturing goals. Regions like Asia-Pacific, led by China and India, dominate due to rapid industrialization and infrastructure development. The construction sector relies on these resins for protective coatings in buildings and structures. Advancements in resin technology enhance application efficiency, further boosting adoption. The thermoplastic acrylic beads market is poised for growth as sustainable coatings, automotive innovation, and industrial applications drive demand for high-performance, environmentally conscious solutions.

Solid Grade Thermoplastic Acrylic (Beads) Resins Market Trends

- The solid grade thermoplastic acrylic (beads) resins market is thriving, driven by demand for sustainable and high-performance materials. Low VOC resins and waterborne coatings are leading trends, as environmental regulations push for reduced emissions. Arkema launched a waterborne acrylic resin for low-VOC resins, enhancing sustainability in architectural durable coatings. Bio-based acrylic resins, derived from renewable sources, are gaining traction for their eco-friendly profile, with Mitsubishi Chemical Group developing plant-based MMA monomers for commercial scale by 2026. The lightweighting automotive trend drives demand for PMMA beads in EV coatings, improving efficiency and aesthetics. UV-resistant polymers are critical for outdoor applications, offering superior weatherability. Additionally, 3D printing photopolymers are emerging, with solid acrylics used in high-precision additive manufacturing for medical and industrial parts. For instance, Trinseo’s chemical recycling of PMMA beads advanced sustainability. These trends highlight the market’s focus on innovation, sustainability, and versatility across industries.

Solid Grade Thermoplastic Acrylic (Beads) Resins Market Drivers vs. Challenges

Drivers:

- Booming Paints and Coatings Market: The surging demand for paints and coatings, fueled by growth in construction, automotive, and industrial sectors, is driving the need for solid-grade thermoplastic acrylic resin beads. These resins are favored for their high gloss and clarity in automotive and architectural coatings, UV resistance for outdoor paints, and chemical resistance for industrial applications, offering superior performance compared to other resin types. PMMA beads are valued for their clarity, weatherability, and low-VOC properties, making them ideal for high-performance coatings. The rise of electric vehicles (EVs) boosts demand for automotive refinish paints, where solid acrylics provide lightweight, durable finishes. Additionally, inks and varnishes benefit from acrylic resins’ adhesion and gloss, driving their use in packaging and printing. This trend, fueled by urbanization and infrastructure development, particularly in the Asia-Pacific, positions PMMA beads as a critical component in the specialty chemicals market.

- Shift to Water-Based Acrylic Beads: Increasing restrictions on solvent-based thermoplastic acrylic resins, due to heightened focus on reducing VOC emissions, are pushing the market toward waterborne or water-based acrylic beads. Companies are adapting by focusing on water-based solutions to meet this evolving trend. For example, Trinseo's expansion of acrylic resin production in Europe, including thermoplastic beads, aligns with this shift.

- Expansion of Electric Vehicle and Lightweighting Trends: The rapid growth of electric vehicle (EV) production drives demand for solid grade thermoplastic acrylic (beads) resins in automotive refinish paints and industrial coatings. PMMA beads offer lightweight, durable, and UV-resistant properties, supporting lightweighting automotive initiatives to enhance EV efficiency and aesthetics. These resins are also used in signage materials for automotive displays, benefiting from their optical clarity and durability. The acrylic resin market is further supported by the need for adhesives and sealants in EV assembly, where acrylic resins provide strong bonding. This driver is particularly strong in regions like Asia-Pacific, where Mitsubishi Chemical Group’s new PMMA beads facility targets EV demand.

- Sustainability and Regulatory Compliance: Stringent environmental regulations and consumer demand for eco-friendly materials are key drivers for the solid grade thermoplastic acrylic (beads) resins market. Low VOC resins and waterborne coatings align with global VOC emission standards, boosting adoption in architectural coatings and industrial coatings. In October 2022, Trinseo’s collaboration with Japan Steel Works Europe GmbH advanced chemical recycling of PMMA beads, supporting circularity and sustainability in the specialty chemicals market. Bio-based acrylic resins are also gaining traction, reducing reliance on petrochemicals. These resins are used in adhesives and sealants and medical device components, where low emissions and biocompatibility are critical. The push for sustainable signage materials and inks and varnishes further drives market growth, as manufacturers prioritize green formulations to meet regulatory and consumer expectations.

Challenges:

- Volatility in Raw Material Prices: The solid grade thermoplastic acrylic (beads) resins market faces significant challenges due to volatility in raw material prices, particularly for methyl methacrylate (MMA), a key component of PMMA beads. Fluctuations in MMA supply, driven by petrochemical market dynamics and geopolitical factors, increase production costs and disrupt pricing stability. This affects applications like automotive refinish paints and industrial coatings, where cost competitiveness is critical. Mitsubishi Chemical Group noted supply chain challenges for MMA impacting PMMA beads production, despite their new facility expansion. Smaller manufacturers struggle to absorb these costs, limiting market growth in price-sensitive regions like South America and parts of Asia-Pacific, where cheaper alternatives may be preferred.

- Competition from Alternative Materials: The acrylic resin market is constrained by competition from alternative materials like polycarbonate, epoxy, and polyurethane, which offer comparable or superior properties in certain applications. For instance, polycarbonate provides greater impact resistance for signage materials and medical device components, while epoxy resins may be favored in heavy-duty industrial coatings for their chemical resistance. This competition challenges solid acrylics in high-performance sectors, despite their clarity and weatherability advantages. In February 2025, Trinseo’s recycled PMMA beads for optical lenses faced competition from polycarbonate-based alternatives, highlighting market pressures. Overcoming these challenges requires continuous innovation in low-VOC resins and bio-based acrylic resins to maintain a competitive edge in the specialty chemicals market.

Solid Grade Thermoplastic Acrylic (Beads) Resins Market Segmentation Analysis

The Water-Based formulation segment is expected to grow considerably

- Water-based formulations dominate the solid grade thermoplastic acrylic (beads) resins market due to their alignment with stringent VOC emission standards and growing demand for eco-friendly solutions. PMMA beads in water-based systems offer low VOC emissions, excellent adhesion, and durability, making them ideal for paints and coatings and adhesives and sealants. Their versatility supports applications in architectural coatings and automotive refinish paints, driven by sustainability trends. The shift toward water-based formulations is further supported by consumer and regulatory preferences for low-VOC resins, positioning this segment as the market leader, particularly in North America and Europe, where environmental compliance is prioritized.

By Application, the demand from the Paints and Coatings segment is rising notably

- The paints and coatings segment is the largest application for solid grade thermoplastic acrylic (beads) resins, driven by demand for durable, high-gloss finishes in construction, automotive, and industrial sectors. PMMA beads provide superior clarity, UV resistance, and adhesion, making them critical for architectural coatings, automotive refinish paints, and industrial coatings. The segment benefits from the rise of low VOC resins and waterborne coatings, aligning with global sustainability goals and enhancing market growth in the specialty chemicals market.

By End-User Industry, the Automotive and Transportation sector is growing rapidly

- The automotive and transportation sector leads the solid grade thermoplastic acrylic (beads) resins market, fueled by the rise of electric vehicles (EVs) and lightweighting automotive trends. PMMA beads are used in automotive refinish paints and adhesives and sealants, offering lightweight, durable, and UV-resistant properties for vehicle coatings and components. This segment’s dominance is driven by the need for high-performance solid acrylics in automotive applications, supporting efficiency and aesthetics in the rapidly expanding EV market, particularly in Asia-Pacific and North America.

Solid Grade Thermoplastic Acrylic (Beads) Resins Market Geographical Outlook

- Asia-Pacific: The Asia-Pacific region is expected to dominate the market, driven by rapid construction, infrastructure development, automotive growth, and industrialization. The rising electric vehicle (EV) sector and demand for acrylic beads in paints, coatings, and additives across various industries further propel market growth. Less stringent regulations in the region also support market expansion.

- North America: North America is anticipated to hold a significant market share, driven by demand from the automotive, construction, and other sectors. However, growth is expected to be steady due to increasing awareness of environmental sustainability and stricter regulations.

Solid Grade Thermoplastic Acrylic (Beads) Resins Market Key Developments

- In February 2025, Trinseo collaborated with Lapo srl to develop lenses using ALTUGLAS™ R-LIFE V046 CR88, a recycled PMMA bead resin with high recycled content. This innovation supports the specialty chemicals market by offering sustainable solid acrylics for optical applications, aligning with circular economy trends and reducing environmental impact.

Solid Grade Thermoplastic Acrylic (Beads) Resins Market Segmentation:

By Formulation Technology

- Solvent-Based

- Water-Based

- High-Solids

- UV-Curable

By Application

- Paints and Coatings

- Adhesives and Sealants

- Plastic additives and modifiers

- Inks and Printing

- Medical and Dental Composites

- Others

By End-User Industry

- Construction

- Automotive and Transportation

- Healthcare

- Packaging

By Region

- North America

- USA

- Mexico

- Others

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others