Report Overview

UV Curing System Market Highlights

UV Curing System Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

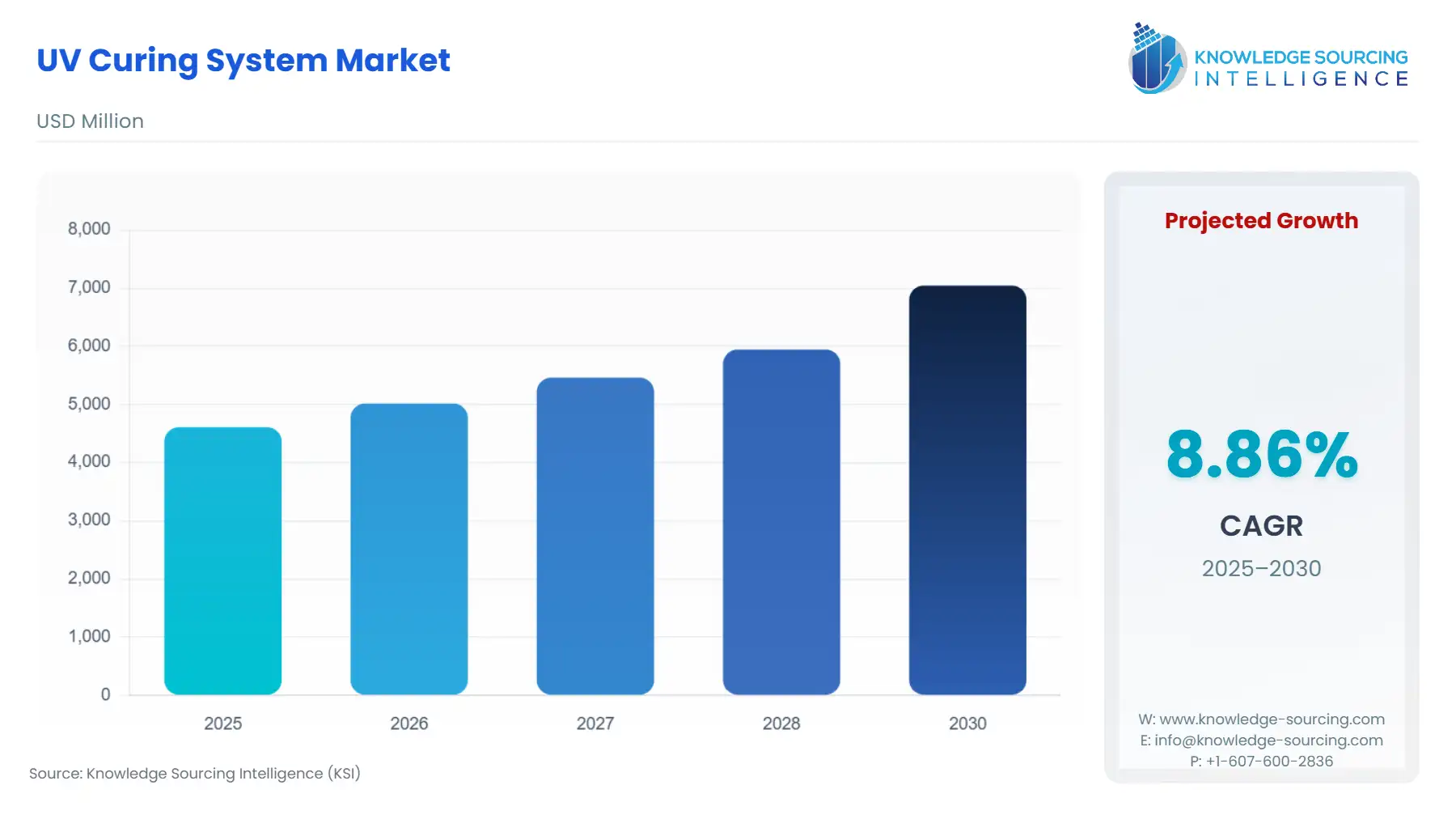

The UV Curing System Market is expected to grow from US$4,610.174 million in 2025 to US$7,047.601 million in 2030, at a CAGR of 8.86%.

The UV Curing System Market represents a sophisticated intersection of photochemistry and precision engineering, providing a method for nearly instantaneous polymerization of inks, coatings, and adhesives. Unlike traditional thermal drying, which relies on evaporation and heat, UV curing utilizes high-intensity ultraviolet light to trigger a chemical reaction that converts liquids into solids in seconds. This technology is fundamental to modern high-speed manufacturing, where throughput speed, energy efficiency, and environmental compliance are non-negotiable. As industries move toward Industry 4.0, the integration of smart sensors and IoT-enabled curing systems allows for real-time monitoring of irradiance and dosage, ensuring repeatable quality in mission-critical applications such as medical device assembly and semiconductor packaging.

The market is currently undergoing a "Green Transformation," driven by both economic and legislative factors. The operational cost of energy has made the 50–60% efficiency gains of UV LED technology highly attractive compared to the high-maintenance requirements of mercury-arc lamps. Furthermore, the ability to eliminate solvent-based processes helps manufacturers meet the stringent air quality standards of the EU and North America. Consequently, the UV Curing System Market is no longer a niche technological choice but a strategic asset for companies seeking to future-proof their production lines against rising energy costs and evolving environmental mandates.

UV Curing System Market Analysis:

Growth Drivers

The global transition toward UV LED technology serves as the primary growth engine, driven by the operational imperative for energy efficiency and the regulatory phase-out of mercury. According to industry data, UV LED systems utilize approximately 50-70% less power than conventional mercury lamps, providing a direct reduction in overhead costs. A secondary driver is the demand for high-speed automation in the electronics and medical sectors. Instant curing enables "one-piece flow" manufacturing, reducing work-in-progress (WIP) and increasing throughput. This efficiency directly propels demand for specialized hardware like Spot Cure systems, which are essential for the rapid assembly of miniaturized components in smartphones and medical wearables.

- The wide presence of market players in the UV curing industry is strengthening the market growth in the forecast period.

Dymax UV light spot cure units, which can cure light-curable materials in 1-10 seconds, are one example of a light-curing equipment product portfolio. The company’s UV light-curing spot lamps hold applications in research and development laboratories, in addition to being utilized in medical, industrial, electronics, automotive, and optical industries. Also, the products are supplied with a variety of standard or customized light delivery choices. Several light guide options are available, including 3mm, 5mm, and 8mm in diameter. The length of the light guide includes 1meter (standard) to 6 meters. Also, other options include liquid or fiber, and single or multifurcated configurations. The technology being used for spot-curing consists of high-intensity LEDs instead of traditional metal-halide or mercury-arc lamps. Hence, the use of LEDs makes them ideal for curing thermally sensitive materials. This further contributes to low-energy consumption, thus providing cost-saving benefits, and is capable of providing better performance for better process control.

The company’s light-curable materials are highly useful for high-end industries such as aerospace and defense where they are used in the extension of an engine’s service life, improvement of imaging sensors, and protection of printed circuit boards (PCBs) from the harsh environment, which holds importance in the designing and manufacturing of components extensively in use in the rotorcraft, MRO, OEM, and avionics sectors of the A&D industry. Additionally, the company’s light-curable formulations are highly capable of addressing the increasing industrial challenges and demands. Hence, with continuous innovations, improvements in electronic components are being made by offering product technology that enhances the throughput and reduces rework and costs. The company’s offerings of light-curable materials include UV curable materials as well as conformal coatings, encapsulants, form-in-place gaskets, ruggedizing materials, potting compounds, SpeedMask® maskants, and aerospace adhesives. The applications include camera module bonding, surface finishing protection, PCB coating, and sensor protection.

- The growing printing industry is driving the market expansion.

With printing playing a significant role in the modern world, the industry is set to grow, with several advancements being made as per the evolving demands of customers worldwide. With digitization, the demand for digital printing technology is also rising, further boosting the burgeoning industry growth. Companies are leveraging various printing technologies in order to make an impact among the various consumers at the global level and add value to their businesses through integrated marketing solutions. The industry is expanding beyond the conventional method of printing, where big industry players have started working on integrating their products with popular cloud-based apps, including Box, Dropbox, and Microsoft OneDrive. Hence, the growing adoption of cloud-based solutions is further bolstering industrial growth. Also, the players in the industry are transforming their business models, where efforts are being made to move their focus to packaging and labelling. Many big vendors have begun to offer smartphone apps for “printing on the go” and are planning to enter the next phase, i.e., “printing from outside the office”.

- The growing trend of eco-friendly manufacturing processes and UV-curing systems is gaining popularity, further propagating the market growth in the forecast period.

The UV curing of inks and coatings, with curing, as part of many manufacturing processes in various end-use industries, means the market for UV curing technology holds high growth potential with the shift to adopting environmentally friendly technologies. The process of curing using ultraviolet radiation offers several benefits in comparison to other traditional methods, which include the reduction or elimination of environmentally deleterious chemicals, thus helping in the reduction of cleanup times with high gloss capabilities. With technological advancements, UV curing also holds high potential for growth in the future where interested end-users are working in close collaboration with the UV lamp or equipment manufacturers, formulators in the coating industry, and their raw material suppliers to develop UV curing systems they are poised to overcome the current technological limitations and assist in the broader adoption of UV LED curing for several end-use applications in the wood industry, coatings industry, automotive or transportation industry, and many other industrial applications. This is because of the fact that in many other sectors, UV LED curing technology has still not reached the levels required for commercialization.

Challenges and Opportunities

The primary obstacle to market adoption is the high initial capital expenditure (CAPEX) associated with retrofitting existing production lines with advanced LED arrays, which can deter small and medium-sized enterprises (SMEs). However, this challenge presents a significant opportunity in the Retrofit and Services market. Manufacturers like Baldwin Technology are capitalizing on this by offering modular systems that allow for a phased transition from mercury to LED. Additionally, the expansion of the Disinfection application—utilizing UVC wavelengths for water and air treatment—provides a massive growth avenue post-pandemic, as public and industrial facilities integrate permanent UV-based hygiene protocols into their infrastructure, creating sustained demand for high-output Flood Cure systems.

Raw Material and Pricing Analysis

The UV Curing System is a complex physical product, making its supply chain highly dependent on specialized raw materials. Key inputs include Gallium Nitride (GaN) and other semiconductor materials for LED chips, as well as high-purity quartz glass for mercury lamp envelopes and optical lenses. Pricing for these systems is sensitive to the volatility of the semiconductor market; supply chain disruptions in East Asia can lead to lead-time extensions and price premiums for control units and power supplies. Additionally, the cost of specialized photoinitiators used in UV-curable materials directly influences the total cost of ownership for the end-user, creating a feedback loop where system demand is partially tied to the affordability of the chemical consumables.

Supply Chain Analysis

The global supply chain for UV curing systems is highly centralized, with primary production hubs located in Germany, the United States, and Japan. These regions host the core R&D and manufacturing facilities for market leaders like Excelitas, Nordson, and Hoenle. Logistical complexity stems from the need for precision-aligned optical components and the transport of fragile high-pressure lamps. Dependencies are high on the electronics sector for microprocessors and thermal management components (heatsinks and fans). To mitigate geopolitical risks and supply bottlenecks, many companies are adopting "Regional for Regional" strategies, shifting assembly closer to major end-user markets in the Asia-Pacific region to support the burgeoning electronics and automotive sectors.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Global |

Minamata Convention on Mercury |

Mandatory Technology Shift: This global treaty, with over 150 parties, mandates the phase-out of various mercury-added products. By 2025–2027, the production and trade of many mercury-vapor lamps will be restricted. This regulation creates a non-negotiable demand for UV LED alternatives as the only viable long-term technological path for industrial curing. |

|

European Union |

REACH / RoHS Directives |

Drives Demand for Eco-Friendly Materials: The restriction of hazardous substances (RoHS) and the registration of chemicals (REACH) pressure manufacturers to eliminate toxic solvents and heavy metals. UV curing systems enable the use of 100% solid, VOC-free formulations, directly increasing demand for systems that can handle high-viscosity, eco-compliant coatings and inks. |

|

United States |

FDA / EPA Standards |

Ensures Compliance in Healthcare/Food: The FDA sets strict migration limits for food packaging and biocompatibility standards for medical devices. UV curing systems provide a "locked-in" cure that prevents chemical leaching, making them the preferred technology for meeting safety mandates in the Healthcare and Food Packaging end-user industries. |

UV Curing System Market Segment Analysis:

- By Source: UV LED

The UV LED segment is currently the fastest-growing technology source in the market, driven by a structural pivot away from legacy mercury-vapor systems. Unlike traditional lamps that require long warm-up periods and generate significant infrared heat, UV LEDs provide instant on/off capability and a cool curing process. This is critical for the demand in the Packaging and Printing sectors, where heat-sensitive substrates like thin films and plastics would otherwise warp or melt. Furthermore, the monochromatic output of LEDs (typically at 365nm, 385nm, or 395nm) allows for targeted polymerization, improving the consistency of the cure. The need for UV LED is also sustained by its longer operational lifespan, typically 20,000 to 30,000 hours compared to the 1,000 to 2,000 hours of mercury lamps, resulting in a lower total cost of ownership (TCO) that appeals to large-scale industrial manufacturers seeking to minimize maintenance downtime and hazardous waste disposal costs associated with mercury.

- By End User Industry: Electronics

The Electronics sector acts as a high-value demand driver for UV curing systems, specifically focusing on the need for precision, miniaturization, and high-density bonding. As consumer electronics move toward flexible displays and 5G-enabled high-frequency components, traditional thermal bonding methods are increasingly unsuitable due to their broad heat impact. UV curing allows for the targeted application of adhesives and conformal coatings that protect delicate circuitry from moisture and mechanical stress without damaging heat-sensitive parts. Specifically, the need for Spot Cure and Focused Beam systems is propelled by the requirements of Automated Optical Inspection (AOI) lines, where components must be "tack-cured" in milliseconds to maintain alignment before final assembly. The rapid growth of the electric vehicle (EV) market further accelerates this demand, as automotive power electronics and battery management systems require robust, high-performance encapsulation and potting that only high-intensity UV curing can provide within the aggressive cycle times of automotive production.

UV Curing System Market Geographical Analysis:

- US Market Analysis (North America)

The US market is characterized by a high concentration of Innovation and Healthcare demand. Home to many of the world's leading medical device and aerospace manufacturers, the US drives demand for highly specialized, FDA-compliant UV curing systems for catheter bonding, needle assembly, and aerospace composite curing. The region's focus on Sustainability and VOC reduction also compels the massive printing and packaging industry in the Midwest and Southeast to adopt UV LED retrofits to comply with state and federal clean air standards.

- Brazil Market Analysis (South America)

Brazil serves as the primary manufacturing hub for South America, increasingly driven by the Automotive and Consumer Goods sectors. As global OEMs modernize their Brazilian facilities, there is a clear trend toward integrating automated UV curing for automotive headlamps and interior coatings. Local factors, such as the volatility of energy prices, make the energy-saving profile of UV LED particularly attractive, though high import duties on high-tech electronics remain a constraint that favors established players with local distribution and service networks.

- Germany Market Analysis (Europe)

Germany is the technological heart of the European UV curing market, with demand anchored in its world-class Printing and Automotive industries. German manufacturers are "early adopters" of UV technology, driven by the country's aggressive Energiewende (Energy Transition) policies and strict EU environmental mandates. There is intense demand for high-performance Multi-Stall and Conveyor systems that can support the high-speed, high-quality requirements of German engineering. Germany also hosts major players like Dr. Hoenle AG and Heraeus Noblelight, making it a hub for both supply and demand.

- Israel Market Analysis (Middle East & Africa)

Israel represents a unique, high-tech niche in the MEA region, with demand centered on Advanced Electronics and Disinfection. The country’s robust startup ecosystem in medical technology and semiconductors drives the need for precision Spot Cure systems. Additionally, Israel’s leadership in water technology creates a specific market for UVC Disinfection systems. The local market is highly sophisticated, demanding the latest in Software integration and sensor-based process control for high-end manufacturing applications.

- Japan Market Analysis (Asia-Pacific)

Japan is a global leader in the Semiconductor and High-Density Electronics segment. The relentless pursuit of Miniaturization and Yield Optimization drives this demand. Japanese firms like OMRON Corporation and Panasonic are both suppliers and major consumers of UV curing technology. The market focuses on ultra-stable, high-intensity LED sources for cleanroom environments. Local factors include a high degree of automation and a cultural emphasis on "Monozukuri" (craftsmanship), which translates to a demand for curing systems with extreme precision and documented reliability.

UV Curing System Market Competitive Environment and Analysis:

The UV Curing System Market is a highly competitive, technology-driven landscape dominated by a few large-scale photonic conglomerates and several specialized materials-and-equipment innovators. Competitors differentiate themselves through optical efficiency, thermal management of LED arrays, and the integration of smart control systems. The market is currently in a phase of Intense Consolidation, as large players acquire specialized technology firms to offer "end-to-end" solutions, combining the light source with the specific chemical adhesives or coatings.

- Excelitas Technologies Corp.

Excelitas Technologies Corp. has solidified its position as a global leader in the photonic solutions space. Its strategic positioning was significantly enhanced in 2024 when it completed the acquisition of the Noblelight business from the Heraeus Group. This move integrated the renowned Noblelight and Phoseon brands under one umbrella, allowing Excelitas to offer one of the broadest portfolios of UV and IR technology in the world. Its OmniCure and Phoseon product lines are industry standards for high-performance UV LED spot and area curing, particularly in the medical and electronics sectors.

- Dymax

Dymax is a unique player that bridges the gap between chemical materials and hardware equipment. Their strategic advantage lies in their "Integrated Solution" approach, where they develop both the Light-Curable Materials (adhesives, coatings, maskants) and the Curing Equipment optimized to trigger them. Dymax remains highly active in product innovation, as evidenced by their showcase at MD&M West 2024, where they introduced the BlueWave® QX4 V2.0 LED spot-curing system and their new HLC™ Hybrid Light Curable technology, which allows for curing in both light and shadow areas.

- Nordson Corporation

Nordson Corporation leverages its massive global footprint and expertise in precision dispensing to dominate the industrial application space. Nordson's UV curing solutions, often integrated into their broader fluid dispensing and selective soldering systems, are critical for high-volume automotive and electronics assembly lines. The company focuses on Process Repeatability and High Throughput, providing robust, industrial-grade systems that can survive 24/7 manufacturing environments. Their recent financial reports indicate continued growth in their advanced technology segments, driven by demand for precision assembly solutions.

UV Curing System Market Developments:

- September 2025: Excelitas launched the Phoseon Nexus II UV LED Curing Platform for flexographic printing, integrating Nexus DataHub for Industry 4.0 monitoring.

- March 2025: Excelitas introduced the Phoseon VeriCure water-cooled UV LED system for high-speed wood coating, reducing energy use by 60% with unmatched uniformity.

- May 2025: Phoseon UV LED curing systems added Modbus TCP communication support for enhanced automation and control.

UV Curing System Market Scope:

| Report Metric | Details |

| UV Curing System Market Size in 2025 | US$4,610.174 million |

| UV Curing System Market Size in 2030 | US$7,047.601 million |

| Growth Rate | CAGR of 8.86% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in UV Curing System Market |

|

| Customization Scope | Free report customization with purchase |

UV Curing System Market Segmentation:

- By Type

- Spot cure

- Flood cure

- Focused beam

- By Source

- Mercury lamp

- UV LED

- By Application

- Bonding & Assembling

- Disinfection

- Coating & Finishing

- Printing

- By UV Curing Materials

- Adhesives

- Coatings

- Potting Compounds

- Maskants

- By End User Industry

- Automotive

- Healthcare

- Electronics

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America