Report Overview

Vegan Cheese Market - Highlights

Vegan Cheese Market Size:

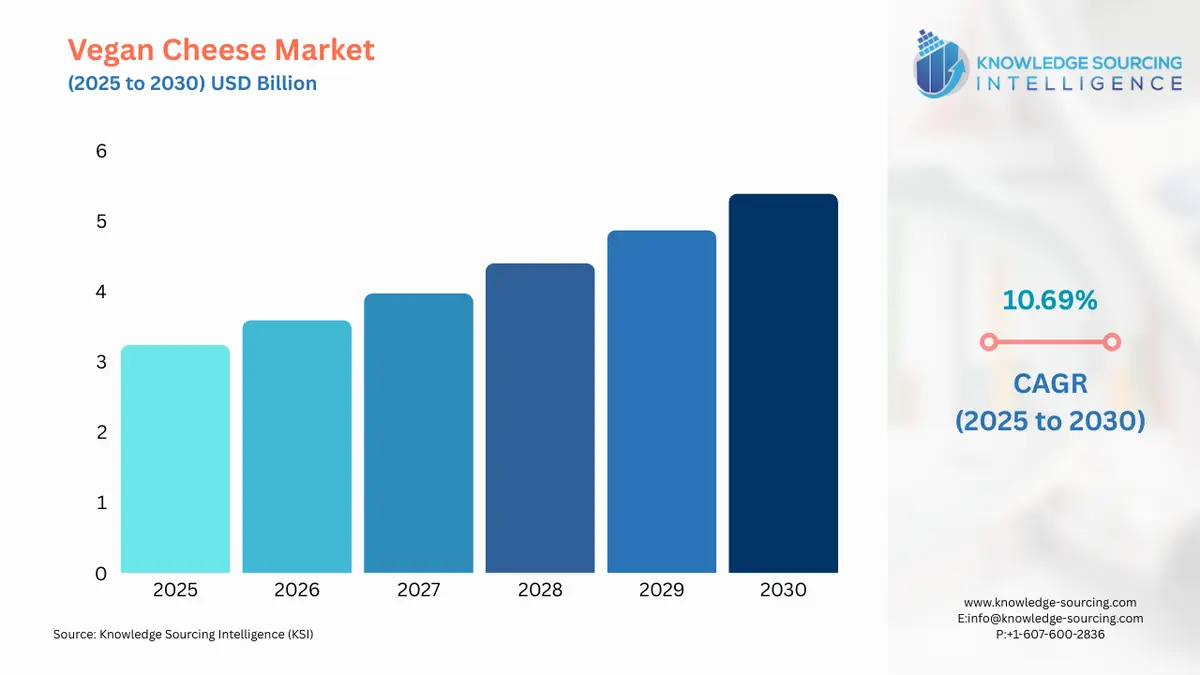

The vegan cheese market is expected to grow from USD 3.243 billion in 2025 to USD 5.389 billion in 2030, at a CAGR of 10.69%.

Vegan cheese products are gaining popularity as consumers are shifting from conventional cheese. Vegan cheese is regarded to be a non-dairy product that is mainly consumed by vegans as it is high in protein and is cholesterol-free. Moreover, vegan cheese is obtained from different sources and is available in different types.

Plant-based cheese is another name that is given to vegan cheese, and this type of cheese is most preferred among individuals suffering from the issue of lactose intolerance. Since there have been growing concerns relating to the unhealthy aspects of animal-based products, individuals are shifting towards more plant-based products, which act as a substitute and are healthy.

The popularity of veganism, along with the dietary restrictions amongst health-conscious consumers, is regarded a an imperative factor driving the growth of the market. Besides, there has been a growing inclination towards veganism in various parts of the world, which is anticipated to further boost the adoption of vegan cheese. Furthermore, an increase in the negative impact of meat consumption, specifically on the environment, can also be regarded as an efficient factor in raising the popularity of plant-based products, which effectively involves the growing demand for vegan cheese.

Vegan Cheese Market Drivers:

The global vegan cheese market is driven by increasing lactose intolerance cases.

- Over the past few years, there has been an increase in lactose-intolerant cases, which has raised a few social and ethical concerns relating to animal-based products. In this regard, individuals are seen to shift to non-dairy products such as vegan cheese, which is expected to drive the growth of the vegan cheese market. According to the European Plant-based Foods Association, amongst the world population, there are about 70% of individuals who suffer from the issue of lactose intolerance. In this regard, it is noted that the ability to tolerate a certain amount of lactose differs from individual to individual. With such a high percentage of lactose-intolerant cases, the market for vegan cheese is expected to witness growth during the forecast period.

- Plant-based diets, on the other hand, are environmentally friendly, a result of which consumers are demanding more plant-based products at a rapid pace. This, in turn, is resulting in vegan cheese turning out to be on a similar trajectory in various parts of the world.

Vegan Cheese Market Key Developments:

- In 2022, a Mumbai-based tech company, Plan B Foods, moved forward with the launch of a range of vegan cheese products, such as cheese slices for the pan-India customers. These vegan cheese slices are further said to be available in two variants, cheddar and classic.

- In January 2023, Pret A Manger introduced its first vegan cheese sandwiches. The new options went on sale in Pret locations all throughout the UK in the same week of their launch. According to the restaurant, these sandwiches are primarily targeted towards vegans and flexitarians. The restaurant stated that it was employing a vegan cheese for the first time in its sandwiches, with the inclusion of dairy-free Violife slices in both of the sandwiches. The vegan cheese slices, according to the manufacturer, are free of dairy, lactose, soy, gluten, and preservatives and have a hickory-smoky rind.

- In January 2023, Aldi, a leading low-cost hypermarket chain, introduced the broadest selection of vegan cheeses it has ever offered. Just in time for Veganuary, the retailer's newest plant-based products have arrived and are available for purchase online or in-store. Vegan soft cheese from Aldi's Plant Menu is offered in both the traditional plain and garlic & herb flavours.

Vegan Cheese Market Geographical Outlook:

- North America accounts for a major share of the global vegan cheese market.

By geography, the global vegan cheese market has been segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific.

The growing shift towards veganism in the region and the increase in health awareness are driving the demand for plant-based food products in the major North American countries. Moreover, the favorable initiatives taken by the government to promote plant-based food products are further expected to boost the market demand for vegan cheese in the region, thereby adding to the overall market growth. The North American vegan cheese market is divided into the United States, Canada, and Mexico. The United States is expected to hold a substantial share of the market owing to the health consciousness among consumers, coupled with the growing cases of lactose intolerance.

Vegan Cheese Market Segmentation Analysis:

- Based on product type, the global vegan cheese market is expected to witness positive demand for cheddar.

Soy, almonds, vegetable oils, and numerous additional all-natural ingredients, such as peas or arrowroot, are frequently used to make vegan cheddar. Many consumers consider vegan cheddar to be a healthier alternative to normal cheese, and as it contains less fat than conventional cheese, it may help lessen their chance of developing heart disease. The demand for vegan cheese, particularly cheddar, has prompted major market players to provide a wider variety of vegan cheddar products. For instance, a major player in this industry, Daiya Foods Inc., provides a variety of dairy-free cheddar products, such as cheddar shreds, blocks, slices, cheese sticks, and mac & cheese in four different cheddar tastes. The products offered by the company are completely vegan and gluten-free. Product offering like the medium cheddar style block is made of an oat base made of filtered water and oat flour, coconut oil, modified potato starch, chickpea protein, chickpea flour, and vitamin B12.

List of Top Vegan Cheese Companies:

- GOOD PLANeT Foods.

- Kite Hill.

- Angel Food

- Miyoko's Creamery

- Green Vie Foods

Vegan Cheese Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Vegan Cheese Market Size in 2025 | USD 3.243 billion |

| Vegan Cheese Market Size in 2030 | USD 5.389 billion |

| Growth Rate | CAGR of 10.69% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Vegan Cheese Market |

|

| Customization Scope | Free report customization with purchase |

Vegan Cheese Market Segmentation:

- By Source

- Soy Milk

- Almond Milk

- Coconut Milk

- Others

- By Product Type

- Mozzarella

- Parmesan

- Cheddar

- Others

- By Distribution Channel

- Online

- Offline

- Hypermarkets

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Vegan Cheese Market Size:

- Vegan Cheese Market Key Highlights:

- Vegan Cheese Market Drivers:

- Vegan Cheese Market Key Developments:

- Vegan Cheese Market Geographical Outlook:

- Vegan Cheese Market Segmentation Analysis:

- List of Top Vegan Cheese Companies:

- Vegan Cheese Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025