Report Overview

Veterinary Anesthesia Equipment Market Highlights

Veterinary Anesthesia Equipment Market Size:

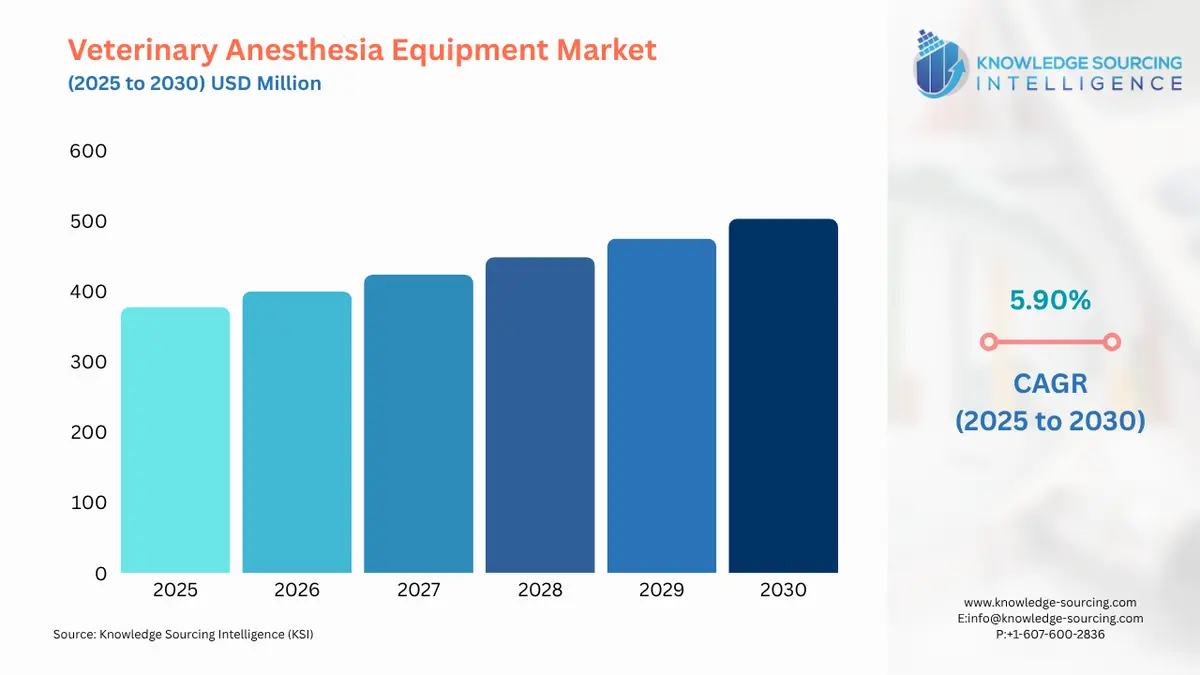

The veterinary anesthesia equipment market is expected to grow at a 5.72% CAGR, increasing to USD 527.404 million in 2031 from USD 377.682 million in 2025.

Veterinary Anesthesia Equipment Market Trends:

Animals cannot cooperate with some diagnostic or treatments hence anesthesia is given to them in a wider range of situations. The growing animal population coupled with rising health problems such as orthopaedic issues and oral problems are major growth factors driving the veterinary anaesthesia equipment market growth. Moreover, the increased awareness among animal owners and rising adoption of companion animals, new product launches by market players, and improvements in the animal healthcare system have provided a positive market scope.

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Veterinary Anesthesia Equipment Market Growth Drivers:

Growing prevalence of animal orthopaedic issues.

The growing prevalence of animal orthopaedic issues indicates the need for anesthesia in convenient treatment thereby propelling the veterinary anesthesia equipment market growth. Thoracic injuries, such as haemorrhage, pneumothorax, diaphragmatic hernia, and rib fractures may require treatment before orthopaedic procedures. According to the AAHA Organization, around 20% of dogs suffer from joint pain and mobility issues and more than 40-92%% of cats are prone to osteoarthritis with hip dysplasia being more common in bulldogs, pugs, and rottweiler. The adverse effects of osteoarthritis can be chondrocyte death, disability, bony remodelling, and loss of articular cartilage. The higher prevalence rate along with the adverse effects is contemplated to bolster the veterinary anesthesia market.

Rising oral problems in animals

A pet's total health, including oral health, is essential because dental issues can either cause or be caused by other health issues. Dental procedures can be carried out on pets while they're under anaesthesia, causing them less anxiety and discomfort. Furthermore, since the pet is not moving around and runs the risk of being hurt by dental tools, cleaning is improved with anaesthesia. According to a survey of Finnish owners of purebred cats by the National Library of Medicine in 2021, dental and oral disorders are the most common type of illness for cats (prevalence: 28%), and dental calculus and gingivitis are the most common clinical symptoms across all cat breeds. The higher prevalence rate of oral problems is expected to boost the veterinary anesthesia equipment market.

Increased adoption of companion animals

The increasing adoption of companion animals with a better sense of ownership and awareness about animal health is contemplated to aid the veterinary anesthesia equipment industry's growth. For instance, around 86.9 million households in the US own companion animals, and there are currently fewer dogs and cats entering shelters due to the increased adoption as per the World Animal Foundation. Moreover, In the US, between 3.5 and 4.1 million dogs and cats are adopted every year, according to the ASPCA and Humane Society. Such increased interest in the adoption of companion animals is positively impacting the veterinary anesthesia industry's growth.

Veterinary Anesthesia Equipment Market Geographical Outlook:

North America is expected to show significant growth.

North American region is expected to hold a significant share of the veterinary anaesthesia equipment market during the forecast period. Various factors attributed to such a share are increasing adoption of companion health with an improved sense of responsibility and rising expenditure on animal health. According to the Animal Health Institute, pharmaceuticals make up more than half of revenues in the US animal healthcare market, flea and tick treatments make up approximately 29% of the sector, and biologics make up just over 19%. Moreover, the presence of major market players such as Kent Scientific Corporation and Midmark Corporation further boosts the veterinary anesthesia equipment market expansion in the region.

List of Top Veterinary Anesthesia Equipment Companies:

Kent Scientific Corporation is a US-based medical equipment supplier company for animal research and anaesthesia systems. The company offers High-Flow Vaporizer anesthesia for large animals, and Somno Low-Flow Vaporizers for small animals such as mice, and rats.

Midmark Corporation is one of the leading companies in healthcare products, and diagnostic software for medical, veterinary, and dental products. Midmark VMS® Plus, Midmark VMS®, Midmark VME2®, and Midmark VMS® Wall Mount are some of the anaesthesia machines offered by the company for animal health.

Veterinary Anesthesia Equipment Market Scope:

Report Metric | Details |

Veterinary Anesthesia Equipment Market Size in 2025 | USD 377.682 million |

Veterinary Anesthesia Equipment Market Size in 2030 | USD 503.092 million |

Growth Rate | CAGR of 5.90% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Veterinary Anesthesia Equipment Market |

|

Customization Scope | Free report customization with purchase |

Veterinary Anesthesia Equipment Market Segmentation

By Product

On-Troller

Wall Mounted

Table Top

By Animals

Companion

Livestock

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation

Page last updated on: September 29, 2025