Report Overview

Video Walls Market Report, Highlights

Video Walls Market Size:

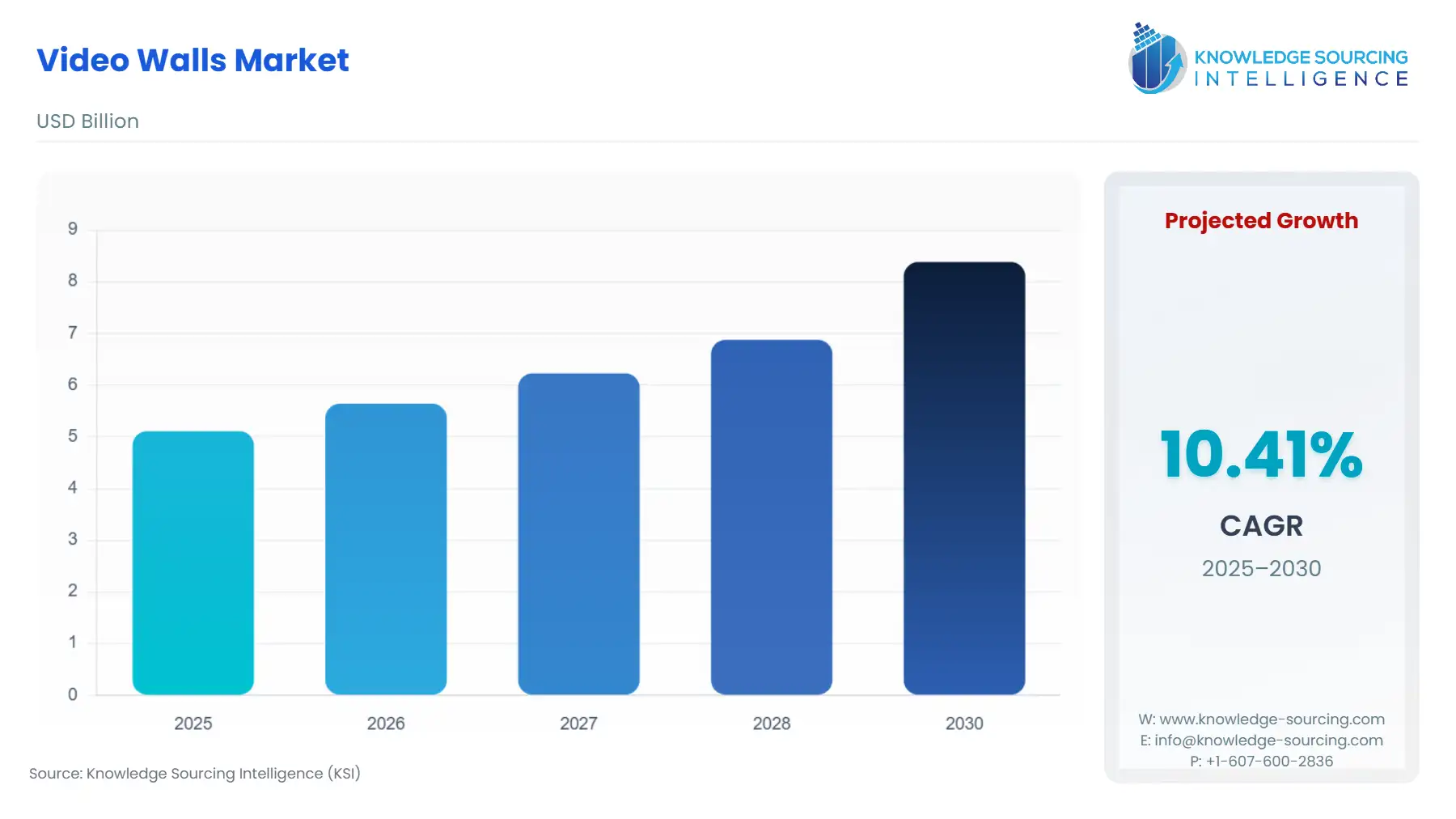

The Video Walls Market is expected to grow from USD 5.110 billion in 2025 to USD 8.384 billion in 2030, at a CAGR of 10.41%.

Video Walls Market Trends:

The rise of new technologies like AI, ML, and big data has led to the development of new content distribution techniques, which have contributed to the expansion of the market for video walls. For instance, a video wall with AI capabilities that displays quick, personalized messages is anticipated to have a greater effect on the audience.

Further, a lot of data and information is sent to staff members, audiences, or customers in all corporate workplaces, control rooms, and public areas to get their attention or elicit a response. Video walls can be used to transmit information visually in real-time effectively. Another important element driving up demand for video walls globally is increasing tourism. Video walls for transportation serve a valuable purpose in such settings to keep the crowd informed. However, the high initial setup cost remains a key challenge.

Video Walls Market Growth Drivers:

- The emergence of new technologies

The development of new content distribution strategies, because of the emergence of new technologies like artificial intelligence (AI), machine learning (ML), and big data, has aided in the expansion of the video wall industry. For instance, a video wall equipped with artificial intelligence (AI) technology is expected to have a stronger effect on the audience since it can display rapid, customized communication.

- Increase in digital signage systems.

The market is growing as more digital signage systems with augmented reality integration are being adopted in retail spaces to boost customer engagement. Many retail firms use interactive screens to improve in-store communication and increase consumer happiness. Shopping centers use outdoor displays to draw in passersby, advertise companies and in-store deals, or offer directional assistance. Digital displays that draw attention with moving pictures that are quick and easy to alter are replacing the classic shop window displays with mannequin models and static decorations.

According to a Pickcel report released in May 2022, retail businesses saw a 24% boost in foot traffic after integrating digital signage, and these developments are encouraging the adoption of video walls which has also increased the revenue of video wall suppliers, for instance, as per the 2021 report by Unilumin Group, ltd. Unilumin's international revenue for the first half of 2022 totalled RMB 1.759 billion (+51.87% YoY).

- Video walls for transportation

By end-user, the video walls market is segmented into education, communication and technology, media and entertainment, transportation, healthcare, retail, and others. The transportation segment of the video walls market is anticipated to acquire a significant market share. The most popular digital technology used in the transportation sector is the video wall, found in key transportation hubs, including airports, train stations, bus terminals, etc. In response to the increased need for digital material and information relevant to travellers, interactive commercials presented on a video wall can be credited with a large portion of the increase in transport media revenue.

The education and retail sectors also demand video walls for several uses, such as campus message boards, directories, and information displays in schools and colleges,s as well as for attractive and high-quality displays to attract customers and brand communications in the retail sector. The sports sector is also increasingly adopting LED video walls for digital scoreboards, ad boards, etc.

- Growing demand for LED video walls.

By type, the sports sector is also increasingly adopting LED video walls for digital scoreboards, ad boards, etc. Thus, the demand for different types of video walls from all the growing industries in the U.S. is expected to boost the LED video wall market. For example, in September 2022, Viewsonic unveiled the first 135-inch, all-in-one, direct-view LED Display Solution Kit featuring a foldable screen, resulting in a roughly 50% smaller packing footprint than earlier models.

Video Walls Market Geographical Outlook:

Regional Insights. The video wall market has been classified by geography into North America, South America, Europe, the Middle East and Africa (MEA), and the Asia Pacific. The North American region holds a sizeable market share in 2021 due to increasing demand from growing industries such as education and advertising. The MEA region will expand owing to increasing demand from tourism and other booming industries. The European region is also expected to grow at a significant CAGR due to large automotive manufacturing operations where these video walls are used for vehicle consoles and immersive design representations.

- North American Market Insights:

The regional market has been further segmented into the United States, Canada, and Mexico. The USA has a mature market for several industries such as automotive, advertising, retail, etc. These industries are adopting advanced technologies such as video walls for multiple applications, driving the demand for video walls. Travel and tourism accounted for 2.15% of the total US GDP in 2021, amounting to US$502 billion, per the Bureau of Economic Analysis of the United States government report.

Further, the rise in advertising activities and spending by large companies has led to an increase in digital out-of-home advertising involving digital billboards, advancing the demand for video walls. The US is one of the leading nations in advertising spending, beating out other large and populous countries such as China and India.

Video Walls Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.110 billion |

| Total Market Size in 2031 | USD 8.384 billion |

| Growth Rate | 10.41% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Video Walls Market Segmentation:

- By Type

- LCD Video Walls

- Plasma Display Panel Video Walls

- Projection Cube Video Walls

- Blended Projection Video Walls

- By Application

- Advertising

- Information Display

- Control Rooms

- Digital Signage

- Others

- By End-User

- Education

- Communication and Technology

- Media and Entertainment

- Transportation

- Healthcare

- Retail

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America