Report Overview

Waterway Transportation Software Solution Highlights

Waterway Transportation Software Solution Market Size:

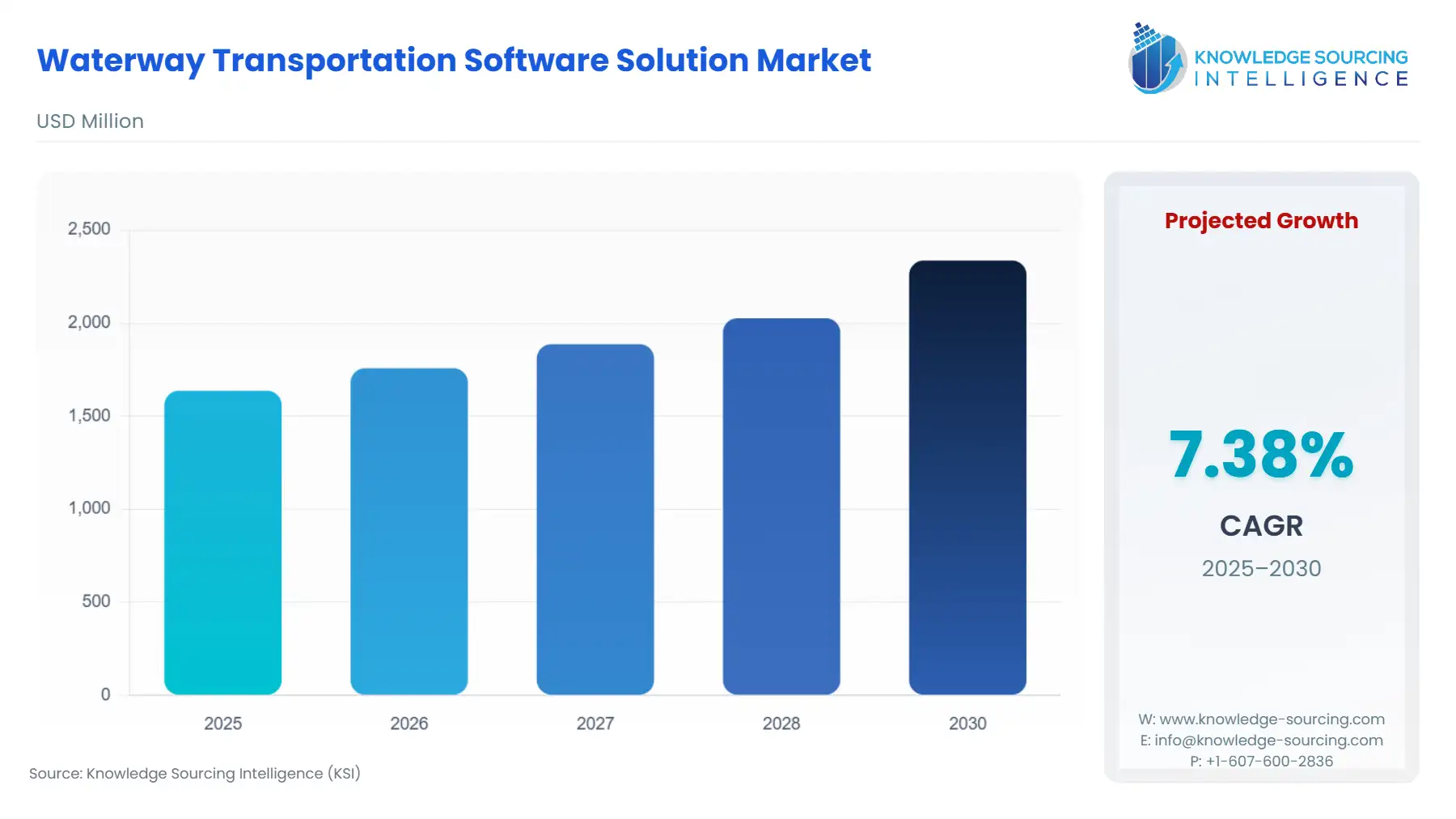

Waterway Transportation Software Solution Market is projected to expand at a 7.17% CAGR, reaching USD 2.48 billion in 2031 from USD 1.637 billion in 2025.

Waterway Transportation Software Solution Market Trends:

Waterway transportation software is a digital tool that helps stakeholders in the waterway transportation industry manage and optimize the movement of goods and people through rivers, canals, and oceans. The software can be used to streamline operations, reduce costs, and improve efficiency by tracking vessels, managing cargo, optimizing routes, and planning logistics. It can also provide real-time information on weather conditions, water levels, and other factors that can impact transportation.

The waterway transportation software solution market deals with the development and provision of software solutions and services that are designed to optimize the movement of goods and people through waterways. The market includes software solutions for vessel tracking, cargo management, route optimization, and logistics planning, as well as services such as consulting, maintenance, and support. The waterway transportation market serves a diverse range of stakeholders, including shipping companies, port authorities, and logistics providers. It is expected to increase manifolds in the upcoming years due to increasing demand for efficient and cost-effective transportation solutions, driven by rising global trade, rising demand for energy resources, and the need to reduce carbon emissions.

Waterway Transportation Software Solution Market Growth Drivers:

Rising global trade: The increasing volume of international trade is driving the demand for efficient and cost-effective transportation solutions. Waterway transportation, with its ability to handle large cargo volumes, is a crucial component of the global trade network.

Rising demand for natural resources: The energy and natural resources sectors, including oil, gas, and mining, are heavily reliant on waterway transportation to move their products. As global demand for energy and natural resources continues to grow, the need for efficient transportation solutions in these sectors is also increasing.

Rising environmental concerns: Waterway transportation is preferred as a more environmentally friendly mode of transportation compared to other modes such as road or air transport, as it produces fewer greenhouse gas emissions and has a lower energy consumption rate.

Government initiatives to improve transportation infrastructure: Many governments, especially in emerging economies, are investing in infrastructure projects to improve their transportation networks. This includes the development of waterways, ports, and other related infrastructure.

Advancements in technology: The waterway transportation industry is experiencing rapid technological advancements, including the adoption of Internet of Things (IoT) devices, artificial intelligence (AI), and big data analytics. These technologies are enabling companies to gather and analyze real-time data, optimize their operations, and make more informed decisions.

List of Top Waterway Transportation Software Solution Companies:

Aljex offers a TMS software solution designed for freight brokers. The software enables users to optimize their freight organization, win more freight, and increase productivity. It includes features such as load tracking, carrier selection, and invoicing.

SAP's logistics execution solution helps companies manage their logistics operations, including transportation, warehouse management, and order fulfilment. The software includes various unique features such as inventory management, order processing, and shipment tracking.

DNV GL offers a range of software solutions for the maritime industry, including vessel performance management, fleet management, and safety and risk management. Their software solutions help shipping companies optimize their operations, reduce costs, and improve safety and environmental performance.

Waterway Transportation Software Solution Market Segmentation Analysis:

Prominent growth in the Shipbroker software segment within the waterway transportation software solution market:

The shipbroker software segment within the waterway transportation software solution market is experiencing prominent growth due to several factors. The shipbroker software segment helps shipping companies optimize their operations, reduce costs, and improve efficiency. As the demand for efficient and cost-effective transportation solutions continues to rise, the shipbroker software segment is expected to grow. The increasing volume of international trade is driving the demand for ship broker software. Shipping companies need to manage their operations efficiently to meet the growing demand for their products. Ship broker software helps companies optimize their operations, enabling them to handle larger cargo volumes and meet the demands of global trade. The shipbroker software segment is experiencing rapid technological advancements, including the adoption of IoT devices, AI, and big data analytics. These technologies are enabling shipping companies to gather and analyze real-time data, optimize their operations, and make more informed decisions.

Waterway Transportation Software Solution Market Geographical Outlook:

The Asia Pacific region is expected to hold a significant share of the waterway transportation software solution market:

The Asia Pacific region is expected to hold a significant share of the waterway transportation software solution market due to several factors. The Asia Pacific region is experiencing rapid economic growth, which is driving the demand for efficient transportation solutions. Waterway transportation is a crucial component of the region's transportation network, and software solutions that help optimize the movement of goods and people through waterways are in high demand. Many countries in the Asia Pacific region are investing heavily in transportation infrastructure, including waterways. These investments are expected to drive the demand for waterway transportation software as companies seek to optimize their operations in these newly developed areas. The Asia Pacific region is home to many countries that are rich in natural resources.

Waterway Transportation Software Solution Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Waterway Transportation Software Solution Market Size in 2025 | USD 1.637 billion |

Waterway Transportation Software Solution Market Size in 2030 | USD 2.337 billion |

Growth Rate | CAGR of 7.39% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Waterway Transportation Software Solution Market |

|

Customization Scope | Free report customization with purchase |

Waterway Transportation Software Solution Market Segmentation

By Solution

Warehousing

Vessel Tracking

Yard Management

Maritime Software

Ship Broker Software

Others

By Deployment Type

Hosted

On-Premises

By End User

Consumer And Retail

Oil and Gas

Energy and Mining

Aerospace And Defence

Chemicals

Pharmaceuticals

Food and Beverages

Other

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation:

Waterway Transportation Software Solution Market Key Highlights:

Waterway Transportation Software Solution Market Growth Drivers:

List of Top Waterway Transportation Software Solution Companies:

Waterway Transportation Software Solution Market Segmentation Analysis:

Waterway Transportation Software Solution Market Geographical Outlook: