Exploring the Top 10 Fintech Technologies

Fintech technologies are innovative tools, applications, and systems designed to improve and simplify financial services. These technologies use the power of digital innovations to transform the way financial transactions are conducted, intending to make financial services more convenient, efficient, and accessible for individuals and businesses. Fintech technologies also enhanced financial inclusion by making financial services more accessible to underserved populations. Join us as we explore the "Top 10 Fintech Technologies" in this article that have changed businesses and enhanced financial services.

Top 10 Fintech Technologies

Source: OMDIA

5. Artificial intelligence

Artificial intelligence (AI) is a rapidly growing area of computer science that focuses on creating intelligent machines capable of performing tasks that would normally require human intelligence. AI aims to imitate human mental skills such as learning, reasoning, problem-solving, and decision-making. This technology has surged in popularity, revolutionizing a variety of industries and sectors around the world. For instance, in September 2023, EY organization (EY) announced the launch of EY.ai, a unified platform that combines human capabilities and artificial intelligence (AI) to help clients change their businesses through confidence with an investment of US$1.4 Billion

North America is growing significantly in Artificial Technology due to the presence of tech giants in major countries such as the United States and Canada. North America possesses a strong ecosystem of venture capitalists and investment firms that provide significant funding and resources to AI startups, allowing them to thrive and push the limits of technological advancement.

6. Banking Fintech

Banking fintech technology is the innovative digital solutions that have transformed the traditional banking sector. These technologies have a wide range of applications, such as mobile banking, online payment platforms, and robo-advisors. Fintech revolutionized banking services, allowing customers to access their accounts, conduct transactions, and manage investments from anywhere and at any time. In addition, it possesses streamlined processes, reduced operational costs, and improved security measures, resulting in faster and more secure transactions. It also aided financial inclusion by providing services to the unbanked and improving access to credit and insurance.

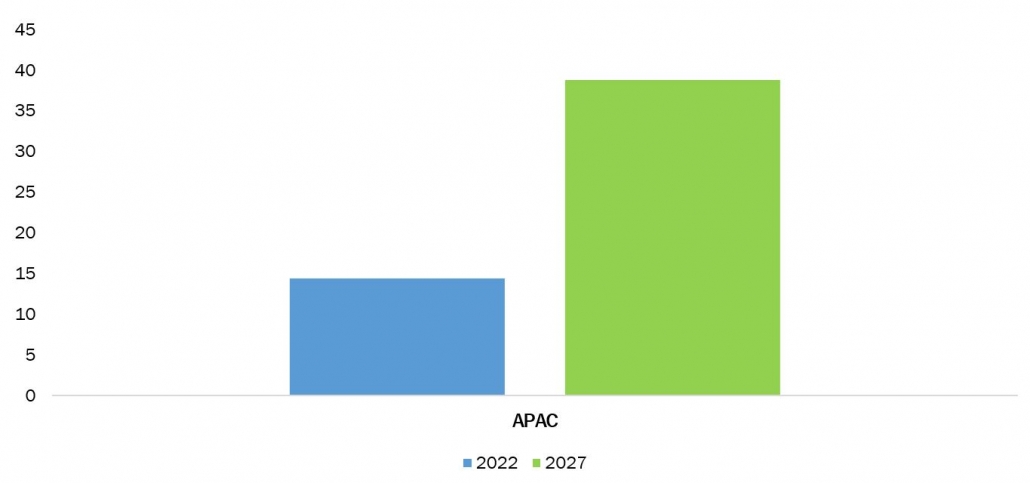

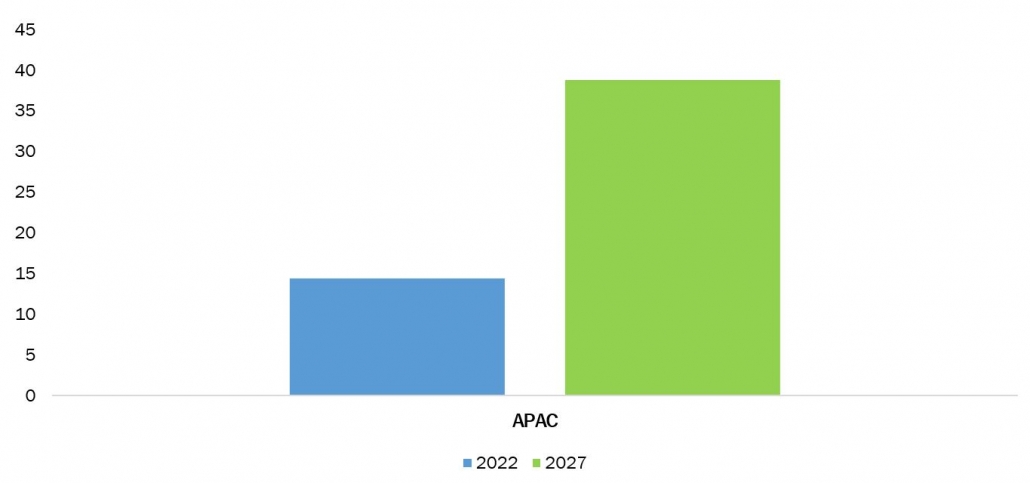

Asia Pacific is growing significantly in banking fintech technology due to the rapidly growing middle class and increasing smartphone users, providing a large customer base for fintech services. For instance, in November 2022, according to the Ministry of Information Broadcasting, India had over 1.2 billion mobile phone users and 600 million smartphone users.

7. Robotics

Robotics, a fintech technology, has transformed the financial industry by improving operational efficiency, risk management, and customer experience. With the advancement of artificial intelligence and automation, robotics have made ways to integrate into a wide range of financial processes, including customer service and fraud detection. These robots can process massive amounts of data, analyze financial patterns, and carry out transactions with extreme accuracy and speed. In addition, robotics technology enables the automation of risk assessment, fraud detection, and compliance monitoring, resulting in improved security and reduced human error. Fintech Robotics led to applications in banks, insurance companies, trading firms, and investment organizations, providing cost-effective solutions while improving overall operational efficiency in the fast-paced fintech business.

8. Cryptocurrency

Cryptocurrency is a cutting-edge fintech technology that transformed the financial landscape as it emerged as a decentralized digital currency that uses cryptography to ensure secure financial transactions. The most notable example is Bitcoin, which pioneered the concept of blockchain technology, a transparent and immutable ledger. Cryptocurrencies can be used for a variety of purposes, including online purchases, investment opportunities, and money transfers. Their decentralized nature eliminates the need for intermediaries such as banks, resulting in lower transaction fees and processing delays.

9. Machine Learning

Machine learning emerged as a key technology in the field of financial technology (fintech). It includes algorithms and statistical models that allow computer systems to make predictions or decisions about datasets. Machine learning in fintech has changed many aspects of the financial industry, including task automation, identifying problems, risk management, and fraud detection. It can also identify patterns and trends in large amounts of financial data that humans may not be able to detect. This technology has enabled organizations to create more accurate and efficient credit scoring models, personalized investment recommendations, and self-driving trading systems. The use of it in fintech accelerated the rate of innovation, making financial services easier to access, reliable, and efficient.

North America is growing significantly due to the presence of major technology leaders in the major economies of the region such as IBM, Amazon Web Services (AWS), Oracle, and Google. These companies are heavily investing in machine learning research and development, which contributed to the rapid growth of machine learning in the region.

10. Cybersecurity

Cybersecurity technology is critical in the field of finance as it protects sensitive financial data from unauthorized access and ensures the integrity of online transactions. With the rapid growth of digital payment systems, mobile banking, and online trading platforms, strong cybersecurity measures have become critical. These technologies not only improve security, but also protect customer information, prevent identity theft, and maintain financial institutions' trust and reputation. Finance services can efficiently reduce risks, detect and mitigate cyber threats, and provide a safe and secure environment for conducting financial operations in the digital world by leveraging cutting-edge cybersecurity technology.

North America is experiencing significant growth due to the well-developed eco-system and several government investments in cybersecurity that support the growth of cybersecurity technologies in the major countries in the region such as the United States and Canada. For instance, in March 2023, the Biden-Harris administration issued the National Cybersecurity Strategy to ensure that all Americans benefit from a safe and secure digital ecosystem.

Source: OMDIA

5. Artificial intelligence

Artificial intelligence (AI) is a rapidly growing area of computer science that focuses on creating intelligent machines capable of performing tasks that would normally require human intelligence. AI aims to imitate human mental skills such as learning, reasoning, problem-solving, and decision-making. This technology has surged in popularity, revolutionizing a variety of industries and sectors around the world. For instance, in September 2023, EY organization (EY) announced the launch of EY.ai, a unified platform that combines human capabilities and artificial intelligence (AI) to help clients change their businesses through confidence with an investment of US$1.4 Billion

North America is growing significantly in Artificial Technology due to the presence of tech giants in major countries such as the United States and Canada. North America possesses a strong ecosystem of venture capitalists and investment firms that provide significant funding and resources to AI startups, allowing them to thrive and push the limits of technological advancement.

6. Banking Fintech

Banking fintech technology is the innovative digital solutions that have transformed the traditional banking sector. These technologies have a wide range of applications, such as mobile banking, online payment platforms, and robo-advisors. Fintech revolutionized banking services, allowing customers to access their accounts, conduct transactions, and manage investments from anywhere and at any time. In addition, it possesses streamlined processes, reduced operational costs, and improved security measures, resulting in faster and more secure transactions. It also aided financial inclusion by providing services to the unbanked and improving access to credit and insurance.

Asia Pacific is growing significantly in banking fintech technology due to the rapidly growing middle class and increasing smartphone users, providing a large customer base for fintech services. For instance, in November 2022, according to the Ministry of Information Broadcasting, India had over 1.2 billion mobile phone users and 600 million smartphone users.

7. Robotics

Robotics, a fintech technology, has transformed the financial industry by improving operational efficiency, risk management, and customer experience. With the advancement of artificial intelligence and automation, robotics have made ways to integrate into a wide range of financial processes, including customer service and fraud detection. These robots can process massive amounts of data, analyze financial patterns, and carry out transactions with extreme accuracy and speed. In addition, robotics technology enables the automation of risk assessment, fraud detection, and compliance monitoring, resulting in improved security and reduced human error. Fintech Robotics led to applications in banks, insurance companies, trading firms, and investment organizations, providing cost-effective solutions while improving overall operational efficiency in the fast-paced fintech business.

8. Cryptocurrency

Cryptocurrency is a cutting-edge fintech technology that transformed the financial landscape as it emerged as a decentralized digital currency that uses cryptography to ensure secure financial transactions. The most notable example is Bitcoin, which pioneered the concept of blockchain technology, a transparent and immutable ledger. Cryptocurrencies can be used for a variety of purposes, including online purchases, investment opportunities, and money transfers. Their decentralized nature eliminates the need for intermediaries such as banks, resulting in lower transaction fees and processing delays.

9. Machine Learning

Machine learning emerged as a key technology in the field of financial technology (fintech). It includes algorithms and statistical models that allow computer systems to make predictions or decisions about datasets. Machine learning in fintech has changed many aspects of the financial industry, including task automation, identifying problems, risk management, and fraud detection. It can also identify patterns and trends in large amounts of financial data that humans may not be able to detect. This technology has enabled organizations to create more accurate and efficient credit scoring models, personalized investment recommendations, and self-driving trading systems. The use of it in fintech accelerated the rate of innovation, making financial services easier to access, reliable, and efficient.

North America is growing significantly due to the presence of major technology leaders in the major economies of the region such as IBM, Amazon Web Services (AWS), Oracle, and Google. These companies are heavily investing in machine learning research and development, which contributed to the rapid growth of machine learning in the region.

10. Cybersecurity

Cybersecurity technology is critical in the field of finance as it protects sensitive financial data from unauthorized access and ensures the integrity of online transactions. With the rapid growth of digital payment systems, mobile banking, and online trading platforms, strong cybersecurity measures have become critical. These technologies not only improve security, but also protect customer information, prevent identity theft, and maintain financial institutions' trust and reputation. Finance services can efficiently reduce risks, detect and mitigate cyber threats, and provide a safe and secure environment for conducting financial operations in the digital world by leveraging cutting-edge cybersecurity technology.

North America is experiencing significant growth due to the well-developed eco-system and several government investments in cybersecurity that support the growth of cybersecurity technologies in the major countries in the region such as the United States and Canada. For instance, in March 2023, the Biden-Harris administration issued the National Cybersecurity Strategy to ensure that all Americans benefit from a safe and secure digital ecosystem.

- Blockchain

- Fintech SaaS

- Cloud computing

- IoT

- Artificial intelligence

- Banking Fintech

- Robotics

- Cryptocurrency

- Machine learning

- Cybersecurity

Source: OMDIA

5. Artificial intelligence

Artificial intelligence (AI) is a rapidly growing area of computer science that focuses on creating intelligent machines capable of performing tasks that would normally require human intelligence. AI aims to imitate human mental skills such as learning, reasoning, problem-solving, and decision-making. This technology has surged in popularity, revolutionizing a variety of industries and sectors around the world. For instance, in September 2023, EY organization (EY) announced the launch of EY.ai, a unified platform that combines human capabilities and artificial intelligence (AI) to help clients change their businesses through confidence with an investment of US$1.4 Billion

North America is growing significantly in Artificial Technology due to the presence of tech giants in major countries such as the United States and Canada. North America possesses a strong ecosystem of venture capitalists and investment firms that provide significant funding and resources to AI startups, allowing them to thrive and push the limits of technological advancement.

6. Banking Fintech

Banking fintech technology is the innovative digital solutions that have transformed the traditional banking sector. These technologies have a wide range of applications, such as mobile banking, online payment platforms, and robo-advisors. Fintech revolutionized banking services, allowing customers to access their accounts, conduct transactions, and manage investments from anywhere and at any time. In addition, it possesses streamlined processes, reduced operational costs, and improved security measures, resulting in faster and more secure transactions. It also aided financial inclusion by providing services to the unbanked and improving access to credit and insurance.

Asia Pacific is growing significantly in banking fintech technology due to the rapidly growing middle class and increasing smartphone users, providing a large customer base for fintech services. For instance, in November 2022, according to the Ministry of Information Broadcasting, India had over 1.2 billion mobile phone users and 600 million smartphone users.

7. Robotics

Robotics, a fintech technology, has transformed the financial industry by improving operational efficiency, risk management, and customer experience. With the advancement of artificial intelligence and automation, robotics have made ways to integrate into a wide range of financial processes, including customer service and fraud detection. These robots can process massive amounts of data, analyze financial patterns, and carry out transactions with extreme accuracy and speed. In addition, robotics technology enables the automation of risk assessment, fraud detection, and compliance monitoring, resulting in improved security and reduced human error. Fintech Robotics led to applications in banks, insurance companies, trading firms, and investment organizations, providing cost-effective solutions while improving overall operational efficiency in the fast-paced fintech business.

8. Cryptocurrency

Cryptocurrency is a cutting-edge fintech technology that transformed the financial landscape as it emerged as a decentralized digital currency that uses cryptography to ensure secure financial transactions. The most notable example is Bitcoin, which pioneered the concept of blockchain technology, a transparent and immutable ledger. Cryptocurrencies can be used for a variety of purposes, including online purchases, investment opportunities, and money transfers. Their decentralized nature eliminates the need for intermediaries such as banks, resulting in lower transaction fees and processing delays.

9. Machine Learning

Machine learning emerged as a key technology in the field of financial technology (fintech). It includes algorithms and statistical models that allow computer systems to make predictions or decisions about datasets. Machine learning in fintech has changed many aspects of the financial industry, including task automation, identifying problems, risk management, and fraud detection. It can also identify patterns and trends in large amounts of financial data that humans may not be able to detect. This technology has enabled organizations to create more accurate and efficient credit scoring models, personalized investment recommendations, and self-driving trading systems. The use of it in fintech accelerated the rate of innovation, making financial services easier to access, reliable, and efficient.

North America is growing significantly due to the presence of major technology leaders in the major economies of the region such as IBM, Amazon Web Services (AWS), Oracle, and Google. These companies are heavily investing in machine learning research and development, which contributed to the rapid growth of machine learning in the region.

10. Cybersecurity

Cybersecurity technology is critical in the field of finance as it protects sensitive financial data from unauthorized access and ensures the integrity of online transactions. With the rapid growth of digital payment systems, mobile banking, and online trading platforms, strong cybersecurity measures have become critical. These technologies not only improve security, but also protect customer information, prevent identity theft, and maintain financial institutions' trust and reputation. Finance services can efficiently reduce risks, detect and mitigate cyber threats, and provide a safe and secure environment for conducting financial operations in the digital world by leveraging cutting-edge cybersecurity technology.

North America is experiencing significant growth due to the well-developed eco-system and several government investments in cybersecurity that support the growth of cybersecurity technologies in the major countries in the region such as the United States and Canada. For instance, in March 2023, the Biden-Harris administration issued the National Cybersecurity Strategy to ensure that all Americans benefit from a safe and secure digital ecosystem.

Source: OMDIA

5. Artificial intelligence

Artificial intelligence (AI) is a rapidly growing area of computer science that focuses on creating intelligent machines capable of performing tasks that would normally require human intelligence. AI aims to imitate human mental skills such as learning, reasoning, problem-solving, and decision-making. This technology has surged in popularity, revolutionizing a variety of industries and sectors around the world. For instance, in September 2023, EY organization (EY) announced the launch of EY.ai, a unified platform that combines human capabilities and artificial intelligence (AI) to help clients change their businesses through confidence with an investment of US$1.4 Billion

North America is growing significantly in Artificial Technology due to the presence of tech giants in major countries such as the United States and Canada. North America possesses a strong ecosystem of venture capitalists and investment firms that provide significant funding and resources to AI startups, allowing them to thrive and push the limits of technological advancement.

6. Banking Fintech

Banking fintech technology is the innovative digital solutions that have transformed the traditional banking sector. These technologies have a wide range of applications, such as mobile banking, online payment platforms, and robo-advisors. Fintech revolutionized banking services, allowing customers to access their accounts, conduct transactions, and manage investments from anywhere and at any time. In addition, it possesses streamlined processes, reduced operational costs, and improved security measures, resulting in faster and more secure transactions. It also aided financial inclusion by providing services to the unbanked and improving access to credit and insurance.

Asia Pacific is growing significantly in banking fintech technology due to the rapidly growing middle class and increasing smartphone users, providing a large customer base for fintech services. For instance, in November 2022, according to the Ministry of Information Broadcasting, India had over 1.2 billion mobile phone users and 600 million smartphone users.

7. Robotics

Robotics, a fintech technology, has transformed the financial industry by improving operational efficiency, risk management, and customer experience. With the advancement of artificial intelligence and automation, robotics have made ways to integrate into a wide range of financial processes, including customer service and fraud detection. These robots can process massive amounts of data, analyze financial patterns, and carry out transactions with extreme accuracy and speed. In addition, robotics technology enables the automation of risk assessment, fraud detection, and compliance monitoring, resulting in improved security and reduced human error. Fintech Robotics led to applications in banks, insurance companies, trading firms, and investment organizations, providing cost-effective solutions while improving overall operational efficiency in the fast-paced fintech business.

8. Cryptocurrency

Cryptocurrency is a cutting-edge fintech technology that transformed the financial landscape as it emerged as a decentralized digital currency that uses cryptography to ensure secure financial transactions. The most notable example is Bitcoin, which pioneered the concept of blockchain technology, a transparent and immutable ledger. Cryptocurrencies can be used for a variety of purposes, including online purchases, investment opportunities, and money transfers. Their decentralized nature eliminates the need for intermediaries such as banks, resulting in lower transaction fees and processing delays.

9. Machine Learning

Machine learning emerged as a key technology in the field of financial technology (fintech). It includes algorithms and statistical models that allow computer systems to make predictions or decisions about datasets. Machine learning in fintech has changed many aspects of the financial industry, including task automation, identifying problems, risk management, and fraud detection. It can also identify patterns and trends in large amounts of financial data that humans may not be able to detect. This technology has enabled organizations to create more accurate and efficient credit scoring models, personalized investment recommendations, and self-driving trading systems. The use of it in fintech accelerated the rate of innovation, making financial services easier to access, reliable, and efficient.

North America is growing significantly due to the presence of major technology leaders in the major economies of the region such as IBM, Amazon Web Services (AWS), Oracle, and Google. These companies are heavily investing in machine learning research and development, which contributed to the rapid growth of machine learning in the region.

10. Cybersecurity

Cybersecurity technology is critical in the field of finance as it protects sensitive financial data from unauthorized access and ensures the integrity of online transactions. With the rapid growth of digital payment systems, mobile banking, and online trading platforms, strong cybersecurity measures have become critical. These technologies not only improve security, but also protect customer information, prevent identity theft, and maintain financial institutions' trust and reputation. Finance services can efficiently reduce risks, detect and mitigate cyber threats, and provide a safe and secure environment for conducting financial operations in the digital world by leveraging cutting-edge cybersecurity technology.

North America is experiencing significant growth due to the well-developed eco-system and several government investments in cybersecurity that support the growth of cybersecurity technologies in the major countries in the region such as the United States and Canada. For instance, in March 2023, the Biden-Harris administration issued the National Cybersecurity Strategy to ensure that all Americans benefit from a safe and secure digital ecosystem.Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently