Growing Usage of Electronic Vehicles Fuels the Battery Management IC Market

A battery management integrated circuit (IC) is an electrical device that regulates and monitors various batteries' discharge and charging capacities. It is commonly used in applications like electric vehicles, renewable energy storage systems, and portable gadgets.

A battery management IC's primary function is to ensure the battery's safe and efficient operation by controlling the charging and discharging processes using sensors, microcontrollers, and other electronic components to monitor the battery's voltage, temperature, and current.

The ability of battery management IC to assure the safe and efficient operation of batteries in a variety of applications is driving up demand in various sectors like healthcare, automotive, and electronic devices.

Furthermore, the addition of enhanced monitoring and protection capabilities to battery management ICs to help optimize battery performance and extend their lifespan is driving market demand by resulting in cost savings and increased customer satisfaction.

Automotive lithium-ion (Li-ion) battery consumption climbed by around 65% to 550 GWh in 2022, up from roughly 330 GWh in 2021. This was owing mostly to an increase in electric passenger vehicle sales, with new registrations up 55% in 2022 compared to 2021.

In China, battery demand for cars surged by more than 70%, while electric car sales jumped by 80% in 2022 compared to 2021, with battery demand rise partially offset by an increase in the percentage of PHEVs.

The growth in battery demand pushes up demand for essential elements. Despite a 180% increase in output since 2017, lithium demand in 2022 outpaced supply (as it did in 2021). In 2022, EV batteries consumed around 60% of lithium, 30% of cobalt, and 10% of nickel.

Accelerating innovation can assist, such as better battery technologies that require fewer key minerals, as well as initiatives to encourage the adoption of car models with optimized battery size and the development of battery recycling.

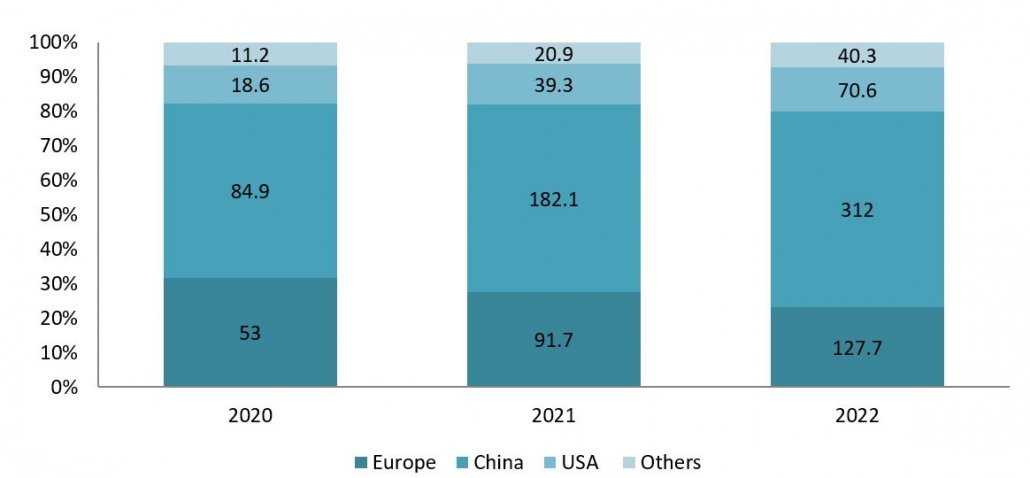

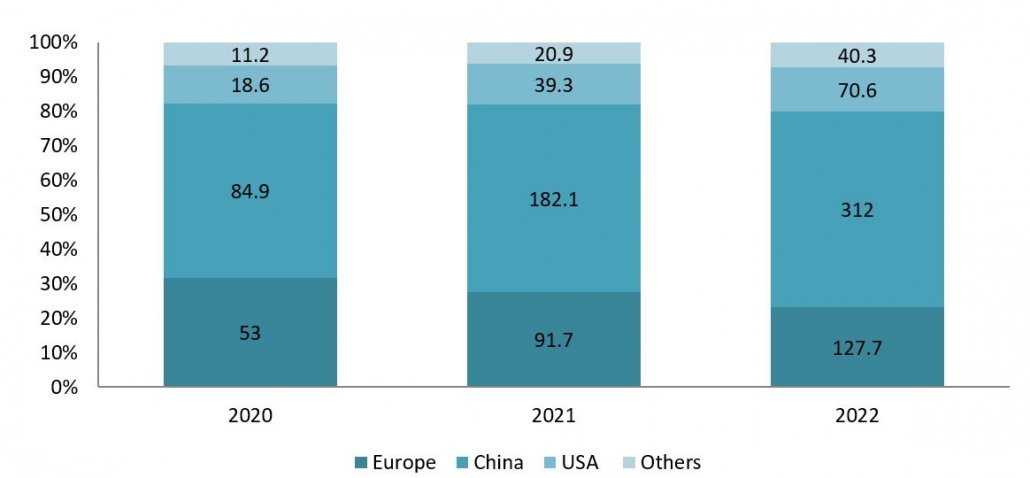

Increased battery demand for vehicles in various regions across the globe from 2020 to 2022 is as follows: 53 GWh/year in 2020 to 127.7 GWh/year in 2022 in Europe, 84.9 GWh/year in 2020 to 312 GWh/year in 2022 in China, 18.6 GWh/year in 2020 to 70.6 GWh/year in 2022 in the United States, and 11.2 GWh/year in 2020 to 40.3 GWh/year in other regions.

Figure 1: Battery Demand by Region Gwh/Year, 2020-2022

Source: International Energy Agency

The increased need for battery storage systems is increasing the demand for battery management integrated circuits (BMICs), which play an important role in these systems. Battery management ICs are used in BSS to monitor and control the safe and efficient charging and discharging of batteries, hence extending battery life by preventing overcharging or over-discharging.

Battery management ICs provide real-time data on battery performance, allowing operators to optimize the BSS's functioning and identify possible difficulties before they become significant problems.

The growing need for BSS, driven by the increased adoption of renewable energy and the need for grid stabilization, is encouraging the development of innovative battery management integrated circuits to meet its demands.

The increased usage of EVs and their manufacture by major firms such as Tesla are boosting demand for battery management ICs. These ICs are a vital component of the battery management systems (BMS) used in EVs. The BMS is in charge of monitoring and maintaining the health, performance, and safety of EV batteries, which rely on massive battery packs to power their operations.

Despite sustained EV sales growth in China, Europe, and the United States, electric vehicles are not yet a global phenomenon due to higher purchase costs and a lack of charging infrastructure in developing and emerging countries, and CO2 emissions from automobiles can be reduced to net zero by 2050.

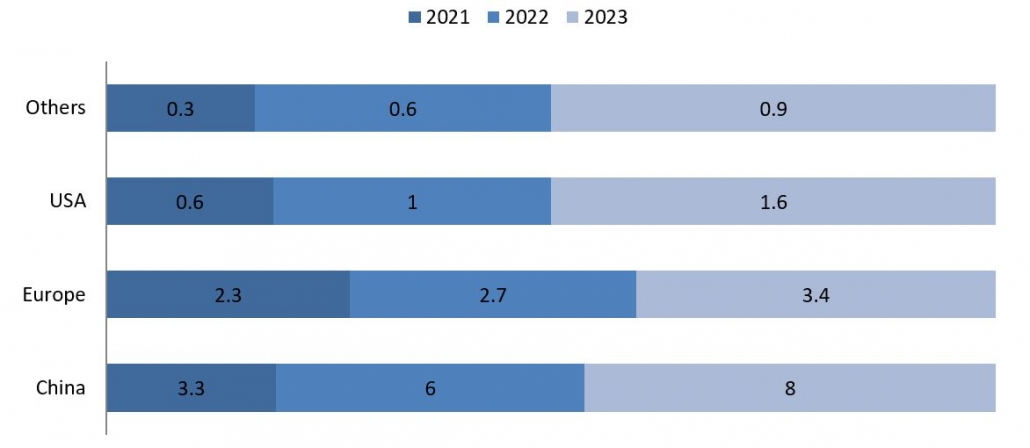

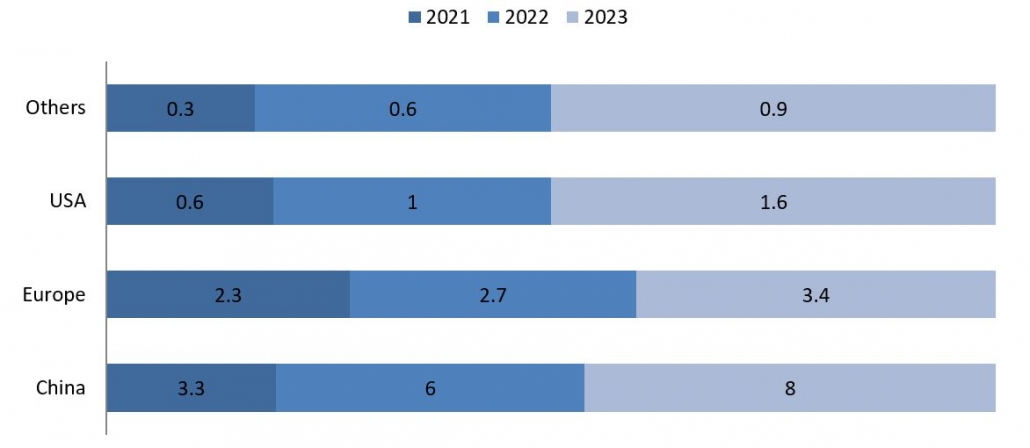

According to data from the International Energy Agency, sales of electronic vehicles have increased in recent years, with China selling 3.3 million cars in 2021 and increasing to 8 million in 2023, Europe selling 2.3 million in 2021 and 3.4 million in 2023, the United States selling 0.6 million in 2021 and 1.6 million in 2023, and other regions selling 0.3 million in 2021 and increasing to 0.9 million in 2023.

Figure 2: Electric Car Sales in Million Based on Regions, 2021-2023

Source: International Energy Agency

The increased need for battery storage systems is increasing the demand for battery management integrated circuits (BMICs), which play an important role in these systems. Battery management ICs are used in BSS to monitor and control the safe and efficient charging and discharging of batteries, hence extending battery life by preventing overcharging or over-discharging.

Battery management ICs provide real-time data on battery performance, allowing operators to optimize the BSS's functioning and identify possible difficulties before they become significant problems.

The growing need for BSS, driven by the increased adoption of renewable energy and the need for grid stabilization, is encouraging the development of innovative battery management integrated circuits to meet its demands.

The increased usage of EVs and their manufacture by major firms such as Tesla are boosting demand for battery management ICs. These ICs are a vital component of the battery management systems (BMS) used in EVs. The BMS is in charge of monitoring and maintaining the health, performance, and safety of EV batteries, which rely on massive battery packs to power their operations.

Despite sustained EV sales growth in China, Europe, and the United States, electric vehicles are not yet a global phenomenon due to higher purchase costs and a lack of charging infrastructure in developing and emerging countries, and CO2 emissions from automobiles can be reduced to net zero by 2050.

According to data from the International Energy Agency, sales of electronic vehicles have increased in recent years, with China selling 3.3 million cars in 2021 and increasing to 8 million in 2023, Europe selling 2.3 million in 2021 and 3.4 million in 2023, the United States selling 0.6 million in 2021 and 1.6 million in 2023, and other regions selling 0.3 million in 2021 and increasing to 0.9 million in 2023.

Figure 2: Electric Car Sales in Million Based on Regions, 2021-2023

Source: International Energy Agency

Leading automotive companies are extending their EV product offering, which is expected to fuel growth in the battery management IC market throughout the forecast period. For example, in March 2023, BMW said that it would launch six new battery EV vehicles by the end of 2025.

Battery management integrated circuits are utilized in a variety of applications in the communication sector, including wearable and wireless communication devices, which rely on batteries for power. Furthermore, smart energy management is critical to ensuring extended battery life and improved device performance for communication devices.

Rapid developments in wireless communication, as well as the growing deployment of 5G networks, are predicted to increase the communication industry's consumption of battery management integrated circuits.

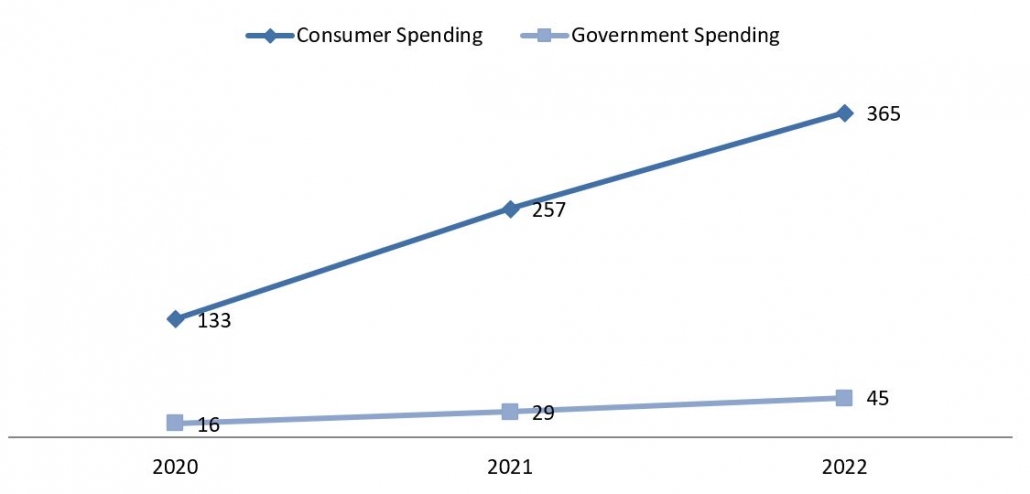

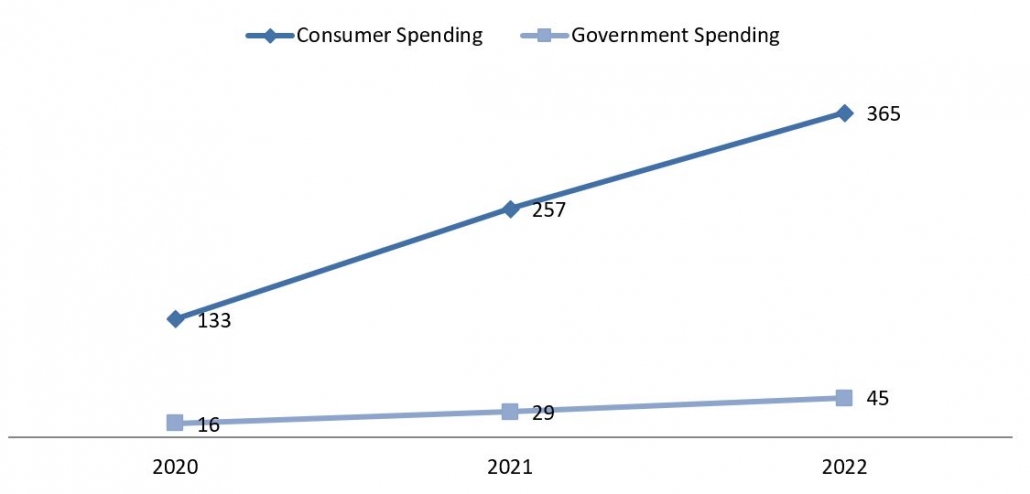

The worldwide expenditure on electric automobiles increased by 50% in 2022 compared to 2021, reaching around USD 425 billion. The majority of money was spent directly by customers when they purchased a car, while governments spent around USD 40 billion on direct purchase incentives. These include subsidies and tax breaks such as VAT exemptions, as well as weight, CO2 emissions, and range incentives.

The increase in worldwide electric vehicle investment is lowering auto manufacturers' reliance on ICE vehicle sales to fund EV manufacturing, R&D, and new model development. Regardless of the lengthy road ahead, this is a critical step towards EV growth and the transition to completely powered road transport.

Figure 3: Global Spending on Electric Cars in Billion USD, 2020-2022

Source: International Energy Agency

Leading automotive companies are extending their EV product offering, which is expected to fuel growth in the battery management IC market throughout the forecast period. For example, in March 2023, BMW said that it would launch six new battery EV vehicles by the end of 2025.

Battery management integrated circuits are utilized in a variety of applications in the communication sector, including wearable and wireless communication devices, which rely on batteries for power. Furthermore, smart energy management is critical to ensuring extended battery life and improved device performance for communication devices.

Rapid developments in wireless communication, as well as the growing deployment of 5G networks, are predicted to increase the communication industry's consumption of battery management integrated circuits.

The worldwide expenditure on electric automobiles increased by 50% in 2022 compared to 2021, reaching around USD 425 billion. The majority of money was spent directly by customers when they purchased a car, while governments spent around USD 40 billion on direct purchase incentives. These include subsidies and tax breaks such as VAT exemptions, as well as weight, CO2 emissions, and range incentives.

The increase in worldwide electric vehicle investment is lowering auto manufacturers' reliance on ICE vehicle sales to fund EV manufacturing, R&D, and new model development. Regardless of the lengthy road ahead, this is a critical step towards EV growth and the transition to completely powered road transport.

Figure 3: Global Spending on Electric Cars in Billion USD, 2020-2022

Source: International Energy Agency

The expanding manufacturing of consumer electronics and the increasing use of EVs in key Asian nations such as South Korea, China, and India are likely to boost the region's battery management IC market.

The increase in consumer electronics production activities in the area is driving market growth, as fuel gauge ICs, battery charger ICs, and authentication ICs are widely used in this sector. A gasoline gauge IC indicates the battery's remaining capacity, whereas a battery charger IC controls the charging process. Furthermore, authentication ICs are used to ensure the legitimacy of a battery or other component.

In conclusion, the Battery Management IC market is poised for significant growth driven by the increasing demand for portable electronics, electric vehicles, energy storage systems, and stringent safety requirements across various industries.

Table 1: Key Developments

Source: International Energy Agency

The expanding manufacturing of consumer electronics and the increasing use of EVs in key Asian nations such as South Korea, China, and India are likely to boost the region's battery management IC market.

The increase in consumer electronics production activities in the area is driving market growth, as fuel gauge ICs, battery charger ICs, and authentication ICs are widely used in this sector. A gasoline gauge IC indicates the battery's remaining capacity, whereas a battery charger IC controls the charging process. Furthermore, authentication ICs are used to ensure the legitimacy of a battery or other component.

In conclusion, the Battery Management IC market is poised for significant growth driven by the increasing demand for portable electronics, electric vehicles, energy storage systems, and stringent safety requirements across various industries.

Table 1: Key Developments

Source: Knowledge Sourcing Intelligence Analysis

Source: International Energy Agency

The increased need for battery storage systems is increasing the demand for battery management integrated circuits (BMICs), which play an important role in these systems. Battery management ICs are used in BSS to monitor and control the safe and efficient charging and discharging of batteries, hence extending battery life by preventing overcharging or over-discharging.

Battery management ICs provide real-time data on battery performance, allowing operators to optimize the BSS's functioning and identify possible difficulties before they become significant problems.

The growing need for BSS, driven by the increased adoption of renewable energy and the need for grid stabilization, is encouraging the development of innovative battery management integrated circuits to meet its demands.

The increased usage of EVs and their manufacture by major firms such as Tesla are boosting demand for battery management ICs. These ICs are a vital component of the battery management systems (BMS) used in EVs. The BMS is in charge of monitoring and maintaining the health, performance, and safety of EV batteries, which rely on massive battery packs to power their operations.

Despite sustained EV sales growth in China, Europe, and the United States, electric vehicles are not yet a global phenomenon due to higher purchase costs and a lack of charging infrastructure in developing and emerging countries, and CO2 emissions from automobiles can be reduced to net zero by 2050.

According to data from the International Energy Agency, sales of electronic vehicles have increased in recent years, with China selling 3.3 million cars in 2021 and increasing to 8 million in 2023, Europe selling 2.3 million in 2021 and 3.4 million in 2023, the United States selling 0.6 million in 2021 and 1.6 million in 2023, and other regions selling 0.3 million in 2021 and increasing to 0.9 million in 2023.

Figure 2: Electric Car Sales in Million Based on Regions, 2021-2023

Source: International Energy Agency

The increased need for battery storage systems is increasing the demand for battery management integrated circuits (BMICs), which play an important role in these systems. Battery management ICs are used in BSS to monitor and control the safe and efficient charging and discharging of batteries, hence extending battery life by preventing overcharging or over-discharging.

Battery management ICs provide real-time data on battery performance, allowing operators to optimize the BSS's functioning and identify possible difficulties before they become significant problems.

The growing need for BSS, driven by the increased adoption of renewable energy and the need for grid stabilization, is encouraging the development of innovative battery management integrated circuits to meet its demands.

The increased usage of EVs and their manufacture by major firms such as Tesla are boosting demand for battery management ICs. These ICs are a vital component of the battery management systems (BMS) used in EVs. The BMS is in charge of monitoring and maintaining the health, performance, and safety of EV batteries, which rely on massive battery packs to power their operations.

Despite sustained EV sales growth in China, Europe, and the United States, electric vehicles are not yet a global phenomenon due to higher purchase costs and a lack of charging infrastructure in developing and emerging countries, and CO2 emissions from automobiles can be reduced to net zero by 2050.

According to data from the International Energy Agency, sales of electronic vehicles have increased in recent years, with China selling 3.3 million cars in 2021 and increasing to 8 million in 2023, Europe selling 2.3 million in 2021 and 3.4 million in 2023, the United States selling 0.6 million in 2021 and 1.6 million in 2023, and other regions selling 0.3 million in 2021 and increasing to 0.9 million in 2023.

Figure 2: Electric Car Sales in Million Based on Regions, 2021-2023

Source: International Energy Agency

Leading automotive companies are extending their EV product offering, which is expected to fuel growth in the battery management IC market throughout the forecast period. For example, in March 2023, BMW said that it would launch six new battery EV vehicles by the end of 2025.

Battery management integrated circuits are utilized in a variety of applications in the communication sector, including wearable and wireless communication devices, which rely on batteries for power. Furthermore, smart energy management is critical to ensuring extended battery life and improved device performance for communication devices.

Rapid developments in wireless communication, as well as the growing deployment of 5G networks, are predicted to increase the communication industry's consumption of battery management integrated circuits.

The worldwide expenditure on electric automobiles increased by 50% in 2022 compared to 2021, reaching around USD 425 billion. The majority of money was spent directly by customers when they purchased a car, while governments spent around USD 40 billion on direct purchase incentives. These include subsidies and tax breaks such as VAT exemptions, as well as weight, CO2 emissions, and range incentives.

The increase in worldwide electric vehicle investment is lowering auto manufacturers' reliance on ICE vehicle sales to fund EV manufacturing, R&D, and new model development. Regardless of the lengthy road ahead, this is a critical step towards EV growth and the transition to completely powered road transport.

Figure 3: Global Spending on Electric Cars in Billion USD, 2020-2022

Source: International Energy Agency

Leading automotive companies are extending their EV product offering, which is expected to fuel growth in the battery management IC market throughout the forecast period. For example, in March 2023, BMW said that it would launch six new battery EV vehicles by the end of 2025.

Battery management integrated circuits are utilized in a variety of applications in the communication sector, including wearable and wireless communication devices, which rely on batteries for power. Furthermore, smart energy management is critical to ensuring extended battery life and improved device performance for communication devices.

Rapid developments in wireless communication, as well as the growing deployment of 5G networks, are predicted to increase the communication industry's consumption of battery management integrated circuits.

The worldwide expenditure on electric automobiles increased by 50% in 2022 compared to 2021, reaching around USD 425 billion. The majority of money was spent directly by customers when they purchased a car, while governments spent around USD 40 billion on direct purchase incentives. These include subsidies and tax breaks such as VAT exemptions, as well as weight, CO2 emissions, and range incentives.

The increase in worldwide electric vehicle investment is lowering auto manufacturers' reliance on ICE vehicle sales to fund EV manufacturing, R&D, and new model development. Regardless of the lengthy road ahead, this is a critical step towards EV growth and the transition to completely powered road transport.

Figure 3: Global Spending on Electric Cars in Billion USD, 2020-2022

Source: International Energy Agency

The expanding manufacturing of consumer electronics and the increasing use of EVs in key Asian nations such as South Korea, China, and India are likely to boost the region's battery management IC market.

The increase in consumer electronics production activities in the area is driving market growth, as fuel gauge ICs, battery charger ICs, and authentication ICs are widely used in this sector. A gasoline gauge IC indicates the battery's remaining capacity, whereas a battery charger IC controls the charging process. Furthermore, authentication ICs are used to ensure the legitimacy of a battery or other component.

In conclusion, the Battery Management IC market is poised for significant growth driven by the increasing demand for portable electronics, electric vehicles, energy storage systems, and stringent safety requirements across various industries.

Table 1: Key Developments

Source: International Energy Agency

The expanding manufacturing of consumer electronics and the increasing use of EVs in key Asian nations such as South Korea, China, and India are likely to boost the region's battery management IC market.

The increase in consumer electronics production activities in the area is driving market growth, as fuel gauge ICs, battery charger ICs, and authentication ICs are widely used in this sector. A gasoline gauge IC indicates the battery's remaining capacity, whereas a battery charger IC controls the charging process. Furthermore, authentication ICs are used to ensure the legitimacy of a battery or other component.

In conclusion, the Battery Management IC market is poised for significant growth driven by the increasing demand for portable electronics, electric vehicles, energy storage systems, and stringent safety requirements across various industries.

Table 1: Key Developments

|

Year |

Development |

| February 2024 | Renesas Electronics Corporation agreed to acquire Altium through a Scheme Implementation Agreement. Renesas will pay A$68.50 per share for all existing Altium shares, totaling A$9.1 billion in equity and A$8.8 billion in enterprise value. This purchase will enable the development of an integrated electronics system design and lifecycle management platform, which will coincide with Renesas' digitalization agenda while also improving user experience and innovation for electronics system designers. |

| September 2023 | Richtek launched the RTQ7882-QT, a Next Generation automotive USB Type-C PD Charger IC. This integrated MCU was compatible with USB PD 2.0/3.1 and China's rapidly charged standards. It provided a communication protocol, sophisticated PWM converter management, firmware programmable hardware safety, and user-programmable features for charged systems with output power ranging from 27 to 100W. |

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently