3D Printing Market - Strategic Insights and Forecasts (2025-2030)

Description

3D Printing Market Size:

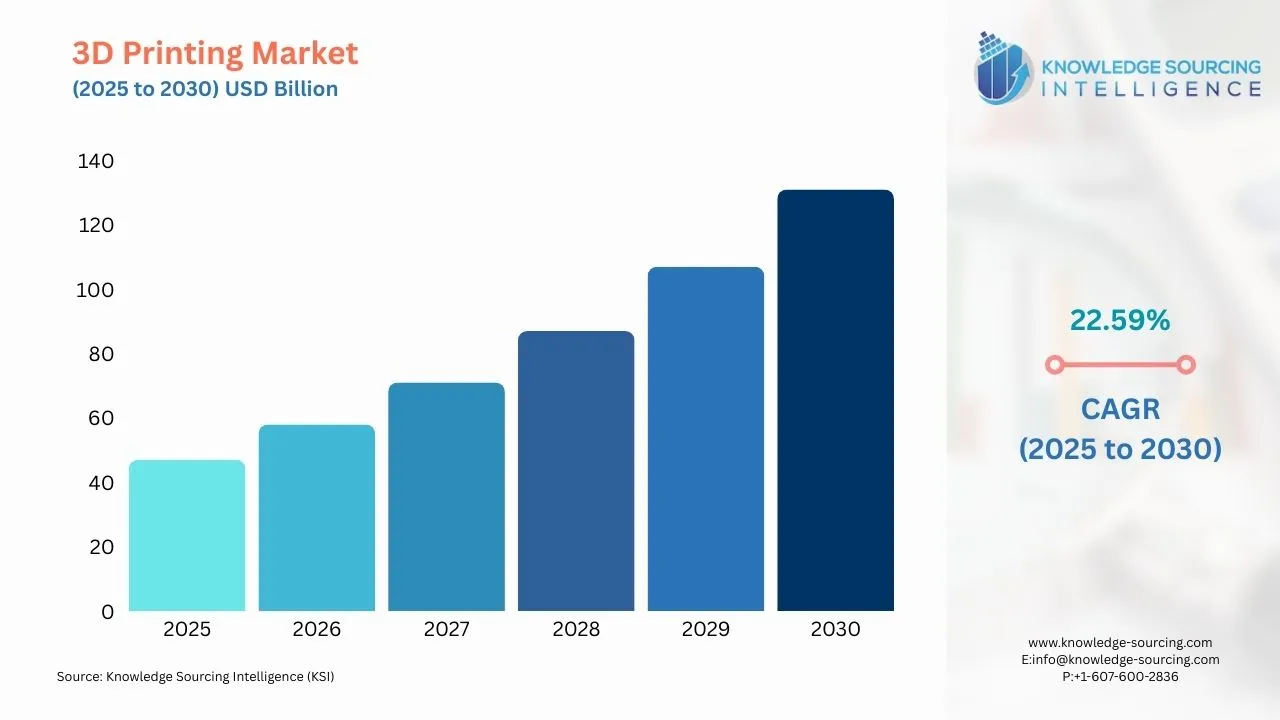

The 3D printing market is expected to grow at a CAGR of 22.59% reaching a market size of USD 131.447 billion in 2030 from USD 47.482 billion in 2025.

3D Printing Market Highlights:

- 3D printing technologies are revolutionizing rapid prototyping in various industries.

- Manufacturers are adopting 3D printing for cost-effective small batch production.

- Customization is increasing as industries demand personalized products.

- Medical applications are expanding with 3D printed prosthetics and implant.

- Additive manufacturing is reducing material waste and improving sustainability.

- Research is advancing new materials for stronger and more versatile prints.

- 3D printing is transforming spare parts and on-demand manufacturing.

To learn more about this report, request a free sample copy

To learn more about this report, request a free sample copy

3D Printing Market Overview:

- The global 3D printing market, also known as additive manufacturing market, is witnessing strong growth, fueled by rising demand for customized production, rapid prototyping, and advancements in materials and technologies. Industries such as aerospace, automotive, healthcare, and consumer goods are adopting 3D printing for its precision, design flexibility, and ability to shorten production timelines. The integration of artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) is enhancing 3D printing by streamlining design processes, improving predictive maintenance, and automating workflows, leading to smarter material selection, real-time monitoring, and superior quality control.

- Industrial 3D printing drives high-precision applications in aerospace, automotive, and healthcare, while desktop 3D printing empowers small-scale innovation and prototyping. Digital manufacturing enables rapid prototyping, accelerating design cycles, and reducing costs. The technology supports functional parts production, delivering durable, complex components, and facilitates mass customization for tailored solutions. With advancements in materials and printing techniques, the market is expanding, offering scalable, efficient manufacturing processes that meet diverse industry demands for precision, flexibility, and sustainability in modern production ecosystems.

- The market is driven by ongoing research and development (R&D) investments, focusing on faster printing speeds, diverse materials (e.g., metals, polymers, composites, graphene, and carbon fiber), and broader applications. Established companies and innovative startups are intensifying competition through new product launches, strategic collaborations, and mergers. The market also benefits from supportive government policies, increased private sector investment, and Industry 4.0 advancements, such as smart factories and digital manufacturing, which boost supply chain efficiency.

- Geographically, North America, Europe, and the Asia-Pacific region are seeing rapid expansion in the 3D printing industry, driven by favorable policies, robust funding, and advanced infrastructure. Countries like the United States, Germany, China, and Japan are leading investments in additive manufacturing, solidifying regional dominance and global market growth.

- As companies prioritize digital manufacturing and supply chain flexibility, the 3D printing market is poised for sustained expansion and increased adoption across industrial and consumer sectors.

3D Printing Market Trends:

- The 3D printing market is advancing with Industry 4.0 and integrating AI in 3D printing to optimize workflows and enhance precision. Generative design leverages AI to create innovative, lightweight structures, while design for additive manufacturing (DfAM) ensures optimized part production. Distributed manufacturing and on-demand manufacturing enhance supply chain resilience by enabling localized production. Post-processing automation streamlines finishing tasks, improving efficiency. 4D printing technology introduces materials that adapt over time, expanding applications in aerospace and healthcare. These trends reflect a shift toward intelligent, flexible, and sustainable manufacturing solutions, redefining production in a connected, digital era.

3D Printing Market Growth Drivers:

- Technological Advancements: Rapid advancements in 3D printing technologies, such as fused deposition modeling (FDM), selective laser sintering (SLS), direct metal laser sintering (DMLS), stereolithography (SLA), and binder jetting, are transforming additive manufacturing into a viable production method beyond prototyping. Innovations in material science, including high-performance polymers, metals, ceramics, and emerging materials like graphene and carbon fiber, enable the production of lightweight, durable, and complex components. For example, graphene-based 3D-printed medical implants and carbon fiber parts for automotive and aerospace applications are gaining traction due to their strength-to-weight ratio.

AI and ML are revolutionizing 3D printing by enabling generative design, where algorithms optimize part geometries for strength, weight, and material efficiency. NLP is being integrated into design software to streamline user interfaces and improve accessibility for non-experts. Recent innovations, such as high-speed extrusion and continuous fiber 3D printing (CF3D), are expanding the technology’s applications in high-stakes industries like aerospace and defense. For instance, in November 2024, ADDMAN Group partnered with Continuous Composites to scale CF3D for hypersonics and UAVs, producing complex composite parts with rapid-curing thermoset resins.

Moreover, major players, along with several technology startups, are enacting innovative advancements. This has led to the creation of faster and more reliable manufacturing-based 3D printing machines thanks to updated hardware features. One of the most popular types of 3D printers is the polymer model. For instance, in December 2022, Redington Limited signed a deal for Wipro, Materialize, and ETEC products to create full-stack services and products that help businesses use 3D manufacturing. In addition, Redington Limited worked with Wipro 3D to bring polymer 3D printers all around India.

- Cost Reduction and Improved Accessibility: The demand for 3D printing comes from the quick progress of production technologies, in addition to materials. This implies that globally, 3D printing materials and techniques are on a fast track, resulting in new growth opportunities for the technology, with which even complex personal items can be made.

- For instance, Sophisticated metal parts are currently possible to produce using new printing technologies like direct metal laser sintering (DMLS) and selective laser sintering (SLS), which denotes fresh horizons for 3D printing within military, space, as well automotive areas. Considering that space is shifting and more countries are getting ready to send their satellites to orbit, the demand for SLS printing is likely to increase.

- Additionally, there’s an ongoing effort to develop other kinds of materials like graphene and carbon fiber meant for 3D printing, with both of them seen as possible options in the future, being both lightweight and strong at the same time. Graphene and carbon fiber are used for different purposes due to their weightless properties. For example, graphene is used in a 3D-printed medical implant, and carbon fibre is used in racing car components. For instance, Titan Tough Epoxy 85 elastomer, an innovative additive manufacturing material introduced during Formnext, which happened in November 2022 by Inkbit - a company based in Massachusetts; it must be noted that industries requiring high precision as well as production-grade mechanical properties benefit more from this particular type of substance.

- Industry-Specific Applications: The versatility of 3D printing is driving adoption across diverse sectors. In aerospace, companies like Boeing and NASA use 3D printing for lightweight components and rocket engines. In healthcare, 3D printing enables patient-specific implants, prosthetics, and bioprinting for tissue engineering. The automotive sector leverages 3D printing for rapid prototyping and lightweight parts, while construction uses it for modular structures and sustainable building solutions. The availability of biocompatible and environmentally friendly materials further supports growth in consumer goods and medical applications.

3D Printing Market Restraint:

-

The high start-up cost is expected to hamper the growth

- The growing initial costs of this technology are a major barrier to its adoption. The investment includes technology, materials, software, certification, staff development, and education on additive manufacturing. Conversely, the advent of the industrial desktop 3D printer is helping end users reduce the expensive initial costs associated with 3D printing equipment. Desktop printers still beat 3-D technology in cost and user-friendliness.

3D Printing Market Geographical Outlook:

- The 3D printing market is experiencing robust global growth, driven by additive manufacturing advancements and increasing adoption across industries like aerospace, healthcare, automotive, and consumer goods. The market is segmented geographically into North America, Europe, and Asia-Pacific, each contributing uniquely to its expansion through technological innovation, government support, and industrial applications.

North America 3D Printing Market

- North America holds a substantial share of the 3D printing market, attributed to its early adoption of advanced manufacturing technologies.

- The United States and Canada lead due to strategic investments and partnerships by major players like Stratasys. In November 2022, Axial3D, a med-tech innovator, secured $15 million in funding, with Stratasys contributing $10 million to advance patient-specific 3D printing for medical devices and hospital systems (Stratasys press release, 2022).

- This partnership underscores the region’s focus on healthcare innovation, particularly in custom implants and surgical planning. Aerospace and defense, industrial manufacturing, and consumer goods also drive growth, supported by technological advancements in Fused Deposition Modeling (FDM) and Selective Laser Sintering (SLS). North America’s robust infrastructure and R&D investments ensure continued market leadership.

Europe 3D Printing Market

- Europe is a key hub for 3D printing innovation, bolstered by over €400 million in funding from the European Commission’s Horizon Europe program (European Commission, 2023). Countries like Germany, the UK, and France excel in automotive, aerospace, and healthcare applications. Companies such as EOS GmbH and Materialise lead in metal 3D printing and software solutions, enhancing precision manufacturing. The region’s emphasis on sustainability, AI-driven printing, and post-processing robotics aligns with green manufacturing goals, driving demand for eco-friendly materials and high-precision applications.

Asia Pacific 3D Printing Market

- Asia-Pacific is the fastest-growing region, fueled by rapid industrialization, government initiatives, and foreign direct investment (FDI). China’s Made in China 2025 strategy promotes 3D printing in medical, education, and aerospace sectors, while Japan and South Korea lead in electronics and robotics applications. India is emerging as a key market, supported by a growing knowledge pool and government policies for advanced manufacturing. The region’s focus on prototyping, customized production, and technologies like binder jetting drives market expansion.

- Challenges such as high equipment costs and material limitations persist, but innovations in cost-effective printers and sustainable materials are addressing these issues. The 3D printing market thrives on global demand, technological advancements, and industry-specific applications, with North America, Europe, and Asia-Pacific driving growth through innovation, sustainability, and strategic investments.

3D Printing Market Key Developments:

- November 2025: ELEGOO Showcases at Formnext 2025. ELEGOO announced its participation at Formnext 2025, showcasing its latest achievements in the 3D printing ecosystem, including the newly launched Nexprint creator platform for global users to connect and share original 3D models.

- October 2025: HeyGears Launches Reflex 2 Series 3D Printers. HeyGears introduced the Reflex 2 Pro and Reflex 2 3D printers, offering enhanced productivity, reliability, and scalability for various 3D printing applications beyond prototyping into production.

- October 2025: Velo3D and iRocket Expand Partnership. Velo3D and iRocket strengthened their partnership through investments in Sapphire printers and Rapid Production Solutions to scale U.S.-based 3D printing for reusable launch vehicles and aerospace components.

- September 2025: Pete Pharma and FABRX Announce Partnership. Pete Pharma partnered with FABRX to introduce pharmaceutical 3D printing innovations, focusing on a pharmacy-first approach to personalized medicine and advanced drug delivery systems.

- September 2025: Creality Unveils K2 Pro and Nexbie at IFA 2025. Creality launched the K2 Pro and Nexbie 3D printers at IFA 2025, delivering immersive experiences with advanced features for high-speed, multi-color printing and ecosystem integration.

List of Top 3D Printing Companies:

-

Stratasys: A global leader offering a wide range of 3D printers, including FDM and PolyJet systems, for industries like aerospace, automotive, and healthcare. Recent innovations include the F3300 printer for advanced industrial applications and strategic partnerships, such as with AM Craft for aviation parts (November 2024).

-

3D Systems: A pioneer in additive manufacturing, known for its SLA, SLS, and DMP technologies. In November 2024, 3D Systems integrated Equispheres’ aluminum powders into its DMP Flex 350 and DMP Factory 350 printers, boosting productivity by up to 50%.

-

HP Development Company, L.P.: A key player in multi-jet fusion (MJF) and metal jet printing, HP focuses on scalable, cost-effective solutions. Its November 2024 innovations include the halogen-free HP 3D HR PA12 FR polymer and the Metal Jet S100 platform for industrial applications.

-

ExOne (Desktop Metal): Specializes in binder jetting for metal and sand printing, serving aerospace, automotive, and energy sectors. Its acquisition by Desktop Metal in 2021 expanded its portfolio, with recent advancements in high-speed printing for industrial applications.

-

Ultimaker (UltiMaker): A leader in desktop 3D printing, offering FDM printers like the Factor 4 (launched April 2024) for industrial-grade prototyping. UltiMaker focuses on user-friendly, cost-effective solutions for education, design, and small-scale manufacturing.

3D Printing Market Scope:

| Report Metric | Details |

| 3D Printing Market Size in 2025 | US$47.482 billion |

| 3D Printing Market Size in 2030 | US$131.447 billion |

| Growth Rate | CAGR of 22.59% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in 3D Printing Market |

|

| Customization Scope | Free report customization with purchase |

3D printing Market Segmentation:

- By Component

- Hardware

- Software

- CAD Tools

- Slicers

- Others

- Services

- Materials

- Metals

- By Type

- Aluminum

- Nickel

- Steel

- Others

- By Form

- Filament

- Powder

- Liquid

- By Type

- Plastic

- By Type

- PLA

- PET

- ABS

- Others

- By Form

- Filament

- Powder

- Liquid

- By Type

- Ceramics

- Others

- Metals

- By Technology

- Vat Photopolymerization

- Stereolithography

- Digital Light Processing

- Continuous Digital Light Processing

- Metal Extrusion

- Material Jetting

- Binder Jetting

- Direct Energy Deposition

- Powder Bed Fusion

- Multi Jet Fusion

- Selective Laser Sintering

- Direct Metal Laser Sintering / Selective Laser Melting

- Electron Beam Melting

- Sheet Lamination

- Vat Photopolymerization

- By End-User

- Healthcare

- Automotive

- Aerospace and Defense

- Construction

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- Spain

- United Kingdom

- France

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America

Our Best-Performing Industry Reports:

Frequently Asked Questions (FAQs)

The 3d printing market is expected to reach a total market size of USD 131.447 billion by 2030.

3D Printing Market is valued at USD 47.482 billion in 2025.

The 3d printing market is expected to grow at a CAGR of 22.59% during the forecast period.

Growth is driven by rapid technological advancements, such as new printing techniques and materials. Additionally, the increasing demand for customized production, rapid prototyping, and reduced manufacturing costs are key drivers.

The North American region is anticipated to hold a significant share of the 3d printing market.

Table Of Contents

1. INTRODUCTION

1.1. Market Overview

1.2. Market Definition

1.3. Scope of the Study

1.4. Market Segmentation

1.5. Currency

1.6. Assumptions

1.7. Base and Forecast Years Timeline

1.8. Key Benefits to the Stakeholder

2. RESEARCH METHODOLOGY

2.1. Research Design

2.2. Research Processes

3. EXECUTIVE SUMMARY

3.1. Key Findings

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

4.5. Analyst View

5. 3D PRINTING MARKET BY COMPONENT

5.1. Introduction

5.2. Hardware

5.3. Software

5.3.1. CAD Tools

5.3.2. Slicers

5.3.3. Others

5.4. Services

5.5. Materials

5.5.1. Metals

5.5.1.1. By Type

5.5.1.1.1. Aluminum

5.5.1.1.2. Nickel

5.5.1.1.3. Steel

5.5.1.1.4. Others

5.5.1.2. By Form

5.5.1.2.1. Filament

5.5.1.2.2. Powder

5.5.1.2.3. Liquid

5.5.2. Plastic

5.5.2.1. By Type

5.5.2.1.1. PLA

5.5.2.1.2. PET

5.5.2.1.3. ABS

5.5.2.1.4. Others

5.5.2.2. By Form

5.5.2.2.1. Filament

5.5.2.2.2. Powder

5.5.2.2.3. Liquid

5.5.3. Ceramics

5.5.4. Others

6. 3D PRINTING MARKET BY TECHNOLOGY

6.1. Introduction

6.2. Vat Photopolymerization

6.2.1. Stereolithography

6.2.2. Digital Light Processing

6.2.3. Continuous Digital Light Processing

6.3. Metal Extrusion

6.4. Material Jetting

6.5. Binder Jetting

6.6. Direct Energy Deposition

6.7. Powder Bed Fusion

6.8. Multi Jet Fusion

6.8.1. Selective Laser Sintering

6.8.2. Direct Metal Laser Sintering / Selective Laser Melting

6.8.3. Electron Beam Melting

6.9. Sheet Lamination

7. 3D PRINTING MARKET BY END-USER

7.1. Introduction

7.2. Healthcare

7.3. Automotive

7.4. Aerospace and Defense

7.5. Construction

7.6. Others

8. 3D PRINTING MARKET BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. By Component

8.2.2. By Technology

8.2.3. By End-User

8.2.4. By Country

8.2.4.1. USA

8.2.4.2. Canada

8.2.4.3. Mexico

8.3. South America

8.3.1. By Component

8.3.2. By Technology

8.3.3. By End-User

8.3.4. By Country

8.3.4.1. Brazil

8.3.4.2. Argentina

8.3.4.3. Others

8.4. Europe

8.4.1. By Component

8.4.2. By Technology

8.4.3. By End-User

8.4.4. By Country

8.4.4.1. Germany

8.4.4.2. Spain

8.4.4.3. United Kingdom

8.4.4.4. France

8.4.4.5. Others

8.5. Middle East and Africa

8.5.1. By Component

8.5.2. By Technology

8.5.3. By End-User

8.5.4. By Country

8.5.4.1. Saudi Arabia

8.5.4.2. Israel

8.5.4.3. Others

8.6. Asia Pacific

8.6.1. By Component

8.6.2. By Technology

8.6.3. By End-User

8.6.4. By Country

8.6.4.1. China

8.6.4.2. Japan

8.6.4.3. South Korea

8.6.4.4. India

8.6.4.5. Others

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

9.1. Major Players and Strategy Analysis

9.2. Market Share Analysis

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Competitive Dashboard

10. COMPANY PROFILES

10.1. Stratasys

10.2. ExOne

10.3. Ultimaker

10.4. Xjet

10.5. HP Development Company, L.P.

10.6. Materialise

10.7. Nikon SLM Solutions AG

10.8. Sciaky Inc.

10.9. Proto Labs

10.10. Opotmec, Inc.

10.11. DWS Systems

10.12. 3DCeram

10.13. voxeljet AG

10.14. ENVISIONTEC US LLC

Companies Profiled

Stratasys

ExOne

Xjet

HP Development Company, L.P.

Nikon SLM Solutions AG

Sciaky Inc.

Optomec, Inc.

DWS Systems

3DCeram

voxeljet AG

ENVISIONTEC US LLC

Related Reports

| Report Name | Published Month | Download Sample |

|---|---|---|

| Additive Manufacturing Market: Size, Trends, Forecast 2025-2030 | May 2025 | |

| 4D Printing Market Report 2030 | Industry Insights and Growth | April 2025 | |

| 3D Printing Material Market Size, Share, Trends, Forecast 2030 | November 2025 | |

| 3D Printing Ceramics Market Report 2030 | Industry Insights | May 2025 | |

| 3D Printing Software Market Size, Share, Trends, Forecast 2030 | November 2025 |