Report Overview

Indoor Distributed Antenna System Highlights

Indoor Distributed Antenna System (DAS) Market Size:

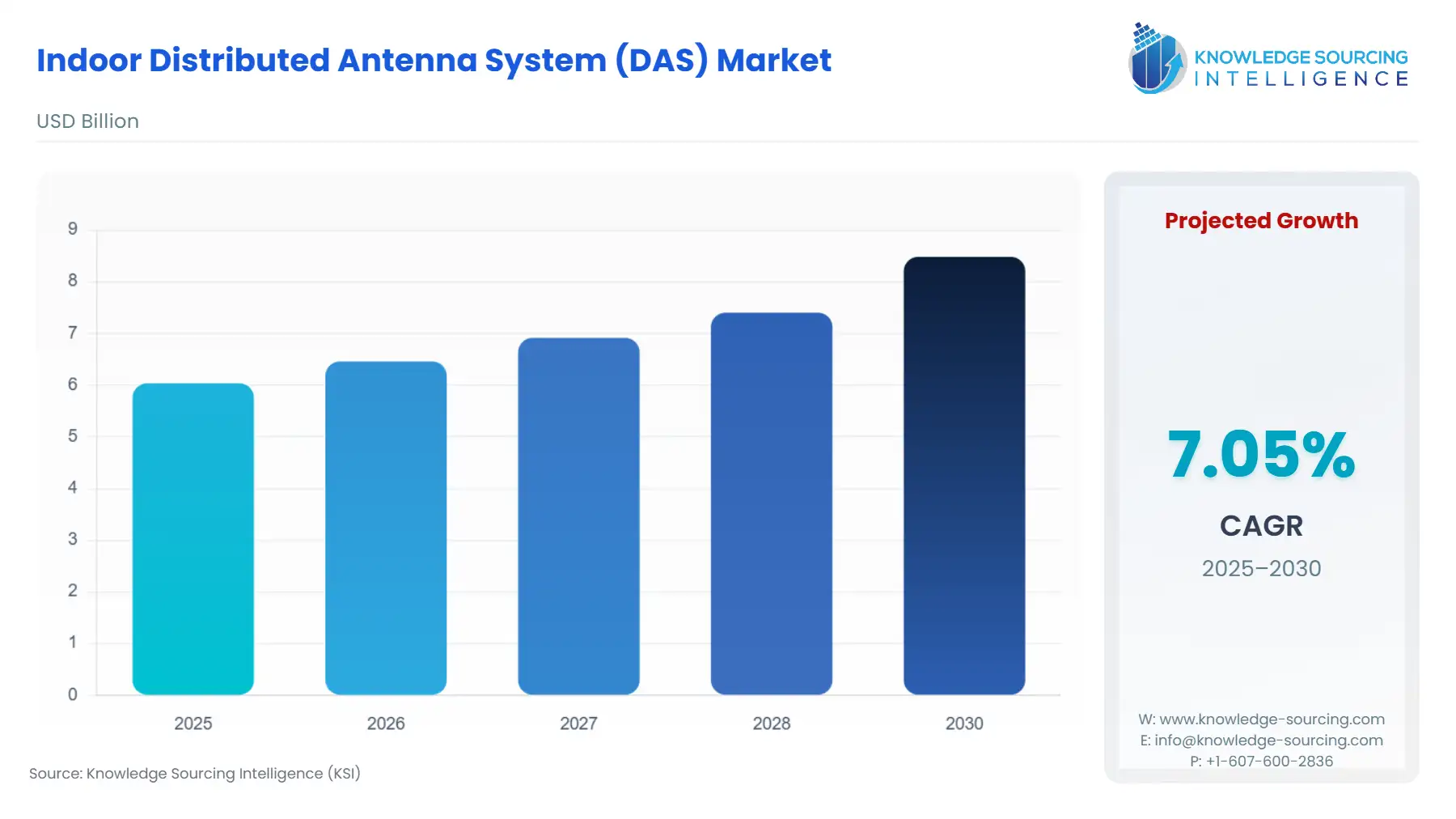

The Indoor Distributed Antenna System (DAS) Market is projected to grow at a CAGR of 7.05% from 2025 to 2030, reaching US$8.484 billion by 2030 from US$6.035 billion in 2025.

The global Indoor Distributed Antenna System (DAS) market is growing at a significant rate during the forecast period. The market is driven by the growing proliferation of smartphones and increasing adoption of data-intensive applications such as video streaming, gaming or cloud services, rising adoption of IoT devices and rollout of 5G networks requiring indoor DAS for extending the 5G coverage and ensuring low-latency and high-speed connectivity. The growing rollout of IoT devices is driving the market for robust wireless connectivity to enable real-time data exchange. The growing emphasis by the government on ensuring the indoor wireless coverage for emergency communications is working, helping the market to grow.

Indoor Distributed Antenna System (DAS) Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Indoor Distributed Antenna System (DAS) Market is segmented by:

- Type of DAS: The Indoor DAS market is segmented into Passive DAS, Active DAS, and Hybrid DAS.

- Financing Model: By financing model, the market is categorized into Carrier-Operated DAS, Neutral-Host DAS and Venue-Funded DAS.

- Facility Type: Based on facility type, the market is classified based on size into Small Facilities (<50,000 sq. ft.), Medium Facilities (50,000–250,000 sq. ft.), and Large Facilities (>250,000 sq. ft.).

- Offering: The Indoor Distributed Antenna System (DAS) Market is categorized by components and services. The component segment includes Antennas, Cables, Repeaters, Routers, and Other related hardware. The services segment encompasses system design, installation, maintenance, and network optimization.

- End-User: By end-user, the market is segmented into the Offices and Retail sector, Transportation hubs, Educational Institutes, the Industrial Sector, and Government and Military facilities.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. Asia-Pacific is expected to dominate the market, and will be growing at the fastest CAGR too.

Top Trends Shaping the Indoor Distributed Antenna System (DAS) Market:

1. Increasing integration of AI and Automation

- The market is witnessing a key change in how networks are managed and optimized as the market is driving towards growing integration of artificial intelligence (AI) and automation into the indoor DAS market. AI integration in the DAS is helping with real-time traffic analysis as well as predictive maintenance, leading to enhanced efficiency by automating the tasks. This makes the DAS systems more appealing to the cost-sensitive consumers.

- Besides the integration of AI technologies, the indoor DAS market is also automating itself with Self-Organizing Networks (SONs). SONs automatically plans and configures the network, helping the indoor DAS in minizing the interferences and enhancing the performance.

2. Massive Demand for Indoor 5G Coverage

- Globally, 5G revolution is gaining momentum and it is estimated that by the end of 2030, 5G is expected to carry 80 percent of the world’s total mobile data traffic (Ericsson Mobility Report 2024). 5G operates on high-frequency mmWave bands, which offer ultra-low latency and high-speed data but struggle to penetrate indoor environments due to building materials like concrete and glass. The growing 5G rollout and the fact that approximately 80% of data traffic is consumed indoors (Ericsson 2024 Report), the demand for DAS will be growing significantly and driving significant investments from telecom operators, building owners, and neutral-host providers in offering 5G with reliable indoor connectivity.

- Thus, in the coming years, 5G-compatibel solutions will gain momentum, and it will be one of the key areas with which companies can align themselves to leverage competitiveness in the market.

Indoor Distributed Antenna System (DAS) Market Growth Drivers vs. Challenges:

Opportunities:

- Growing mobile traffic: There is a global surge in the usage of smartphones. The number of smartphone users has increased tremendously from 1 billion in 2014 to nearly 4.69 billion in 2025 and is estimated to reach 5.83 billion by 2028. The growing use of smartphone is driving the data traffic and increasingly demanding more reliable and consistent coverage, leading the indoor DAS market to grow.

As there is increasing mobile data usage, total global mobile data traffic reaching 303 EB per month in 2030 from 165.67 EB per months in 2024, and increasing wireless communication systems, such as a surge in Wi-Fi networks and demand for high-data consuming tasks like video streaming and gaming, there is increasing demand for high-speed and reliable connectivity. This is one of the key factors driving the demand for Indoor DAS systems as it offers consistent coverage and capacity in environments like offices, malls, and stadiums.

- The expansion of 5G and IoT connectivity: As there is rapid deployment of 5G networks, 5G is anticipated to carry 80% of mobile data traffic globally in 2030, the demand for indoor DAS is growing at a significant rate because 5G offers low-latency and high-speed data, which struggle to penetrate indoor environments due to building materials like concrete and glass. This is driving the demand for Indoor DAS that can support high-speed and coverage of 5 G.

Challenges:

- High installation and maintenance cost: The installation of Indoor DAS requires high cost due to substantial upfront costs like the cost of hardware, software and also needs service for the installation and integration indoors. The cost of DAS system installation varies significantly based on factors such as building size, type of DAS system, installation complexity, equipment, regulatory requirements, and ongoing maintenance. For instance, a small building installation cost is $2 – $4 per sq. ft., while large facilities of more than 250,000 sq. ft. cost around $4 – $10 per sq. ft.

The cost of hardware depends on various factors. A passive DAS can cost from $50,000 – $500,000, while a hybrid DAS can cost around $100,000 – $2,000,000. Also, for instance, a Bi-directional Amplifier costs around $10,000 to $50,000 each. If we take the example of an airport and Transportation hubs, the overall cost including all with be around $2,000,000 – $10,000,000, which is a huge amount and thus one of the key challenge that is restricting its penetration.

Indoor Distributed Antenna System (DAS) Market Regional Analysis:

- North America: The North American region will dominate due to huge smartphone users, very high mobile data traffic, advanced 5G infrastructure, higher IoT connectivity. Around 91% of adults in the US currently in 2025 own a smartphone, up from the 70% ownership rate in May 2016, driving huge data traffic. As per the data by the GSMA, 5G connectivity accounts for more than 15% of the region’s overall mobile economic impact. By the middle of 2024, 5G accounted for over 55% of connections in the region, highlighting the wide 5G rollout.

- Asia-Pacific: The Asia-Pacific will be growing at the fastest rate during the forecast period.

The increasing mobile data traffic, growing smartphone user, growing 5G rollout in India and China, the proliferation of IoT in smart cities projects, connected devices and all are the key factors that are driving the Indoor DAS market.

Indoor Distributed Antenna System (DAS) Market Competitive Landscape:

The market is moderately fragmented, with some important key players such as CommScope Holding Company, Inc., Boingo Wireless, Inc., Corning Incorporated, Comba Telecom Systems Holdings Limited, SOLiD Technologies, Inc. and JMA Wireless, LLC, among others.

- Product Innovation and Strategic Collaboration: In March 2025, Comba Telecom launched ComFlex MAX, a next-generation indoor DAS platform designed for multi-band, multi-standard support (3G/4G/5G) with Open RAN (O-RAN) compliance in partnership with Keysight Technologies. It introduces DAS Slicing and Open interfaces for BBU connectivity, setting new standards for flexibility and scalability in indoor coverage systems.

- Technology Enhancement: In February 2024, CommScope announced a major update to its indoor network solutions by integrating Open RAN support into its ERA® distributed antenna system (DAS) and ONECELL® small cell platform. It enables third-party Open RAN Distributed Units (O-DUs) and introduces all-digital, software-defined in-building radios, highlighting the Open RAN adoption for indoor enterprise networks.

Indoor Distributed Antenna System (DAS) Market Segmentation:

By Type of DAS

- Passive DAS

- Active DAS

- Hybrid DAS

By Financing Model

By Facility Type

- Small Facilities (<50,000 sq. ft.)

- Medium Facilities (50,000–250,000 sq. ft.)

- Large Facilities (>250,000 sq. ft.)

By Offering

- Components

- Antennas

- Cables

- Repeaters

- Routers

- Others

- Services

By End-User

- Offices and Retail sector

- Transportation hubs

- Healthcare Facilities

- Educational Institutes

- Industrial Sector

- Government and Military facilities

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others