Report Overview

Advanced Thermal Management Systems Highlights

Advanced Thermal Management Systems Market Size:

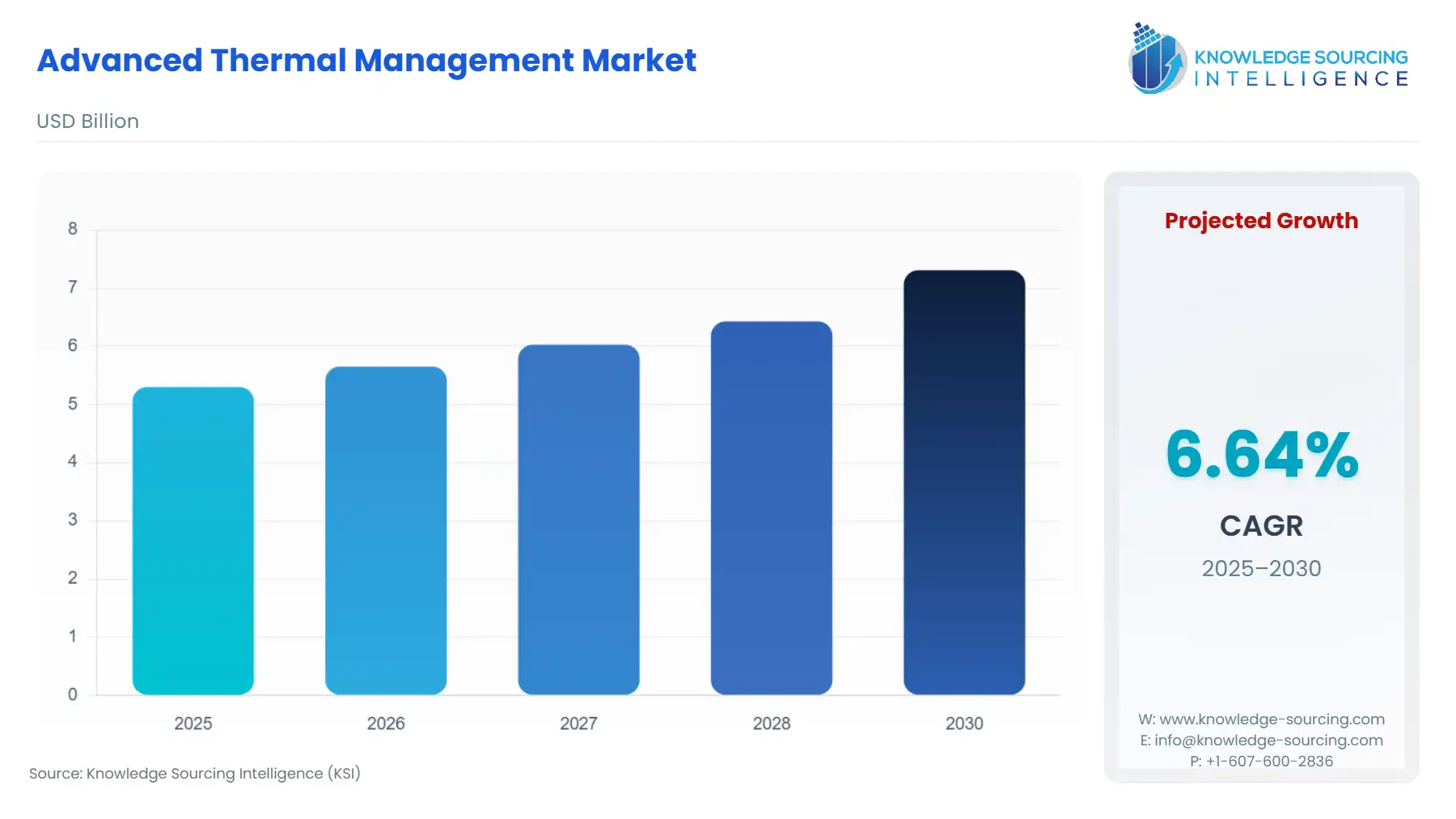

The advanced thermal management market is projected to grow at a CAGR of 6.64% during the projected period, reaching a market size of US$7.311 billion by 2030 from US$5.302 billion in 2025.

Thermal management is the instruments and methods used to maintain a system within its working temperature. Advanced thermal management often removes surplus heat in electrical devices to avoid overheating. The majority of electronic systems produce heat, which can harm delicate internal parts if too much thermal energy accumulates within the gadget. In a similar way, prolonged exposure to extreme temperatures outside can harm devices.

The need for thermal management solutions is primarily driven by the growing requirement for sophisticated heat dissipation and thermal management components in the consumer electronics sector as well as the growing emphasis on creating tiny electronic devices.

Advanced Thermal Management Market Overview & Scope:

The advanced thermal management market is segmented by:

- Material Type: The advanced thermal management market is categorized into adhesive and non-adhesive materials. Adhesive materials are designed to have shear strength, exceptional chemical and temperature resistance, and the ability to endure extreme impact and peel pressures. The need for sticky adhesives is fuelled by the dangerous heat produced by electronic systems and components used in consumer electronics and medical applications.

- Device: By device, the market is categorized into conduction cooling devices, convection cooling devices, advanced cooling devices, and hybrid cooling devices. Conduction cooling devices are the broad term for equipment that uses conduction cooling technology. Conduction cooling solutions have several advantages, including low maintenance, high dependability, and reduced wear and tear because they are passive and don't require moving parts.

- End-User Industry: By end-use industry, the market is segmented into consumer electronics, servers & data centers, automotive, aerospace & defense, enterprises, healthcare, and others. Regardless of complexity or scale, advanced thermal management is essential to ensuring the best possible operation and performance of all electronic applications. Thousands of data processing devices, including servers, switches, and routers, make up data centers. These devices emit a lot of heat and energy. To avoid temperature increases and subsequent deterioration of reliability and performance, which results in higher maintenance expenses, the heat produced in these data centers must be adequately drained.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. Asia-Pacific is anticipated to dominate the market, and it will be growing at the fastest CAGR.

Top Trends Shaping the Advanced Thermal Management Market:

1. Advanced heat dissipation solutions are becoming more and more necessary.

- Thermal interface materials are made especially to transmit heat while displaying a compression force characteristic that can support both the heat-producing component and the heat sink. When electronic components work, heat is produced. The usefulness and dependability of these goods are determined by how they control their heating and cooling systems. There must be a mechanism to transfer heat from the components to a heat-dissipating device, like a liquid cooling plate, chassis, or conventional heat sink, when temperatures rise too high.

2. Strict standards and controls for emissions

- The need for thermal management solutions can be seen as being mostly driven by the increased emphasis on reducing vehicle emissions. The ability to lower vehicle emissions is the reason thermal management systems are becoming more in demand as environmental concerns develop. Ineffective interior climate management can significantly increase fuel consumption and emissions, pose a safety risk from fogging, and damage the windshield. In this regard, by 2024, the California Air Resources Board (CARB) plans to enforce stricter rules to enhance NOx emission solutions that supply heat to an after-treatment system rapidly and maintain that heat without reducing fuel efficiency.

Advanced Thermal Management Market Growth Drivers vs. Challenges:

Drivers:

- The commercial sector's increasing demand for electric vehicles is driving market expansion. The desire to reduce greenhouse gas (GHG) emissions and promote sustainable transportation options has led to an increase in the demand for electric vehicles (EVs). The need for EV Thermal Systems has grown along with EV sales. The battery, motor, and other delicate electronic parts are kept at their proper operating temperatures by the thermal system. Enhancing vehicle performance, prolonging battery life, and guaranteeing the safety and dependability of an electric vehicle all depend on effective thermal management. Batteries now have higher densities and faster charging rates because of considerable advancements in battery technology in recent years.

- Long storage hours and lifecycle cost benefits, along with safety advantages, make it a better choice: Redox flow batteries have a longer energy storage duration, such as VRFBs. These batteries also have a longer shelf life, typically 20-25 years, compared to other battery alternatives. Additionally, it is safer than others, leading to an increase in its demand.

Challenges:

- Design intricacies associated with cooling system components: Practical thermal processes and systems frequently involve complexes, including chemical reactions, conjugate mechanisms, complex domains, substantial property changes, and intricate boundary conditions. Design optimization for cooling systems to lower their weight, cost, and power consumption, as well as component design verification, are challenges related to cooling system production. Other issues encountered during cooling system component production include choosing coolants and creating ideal airflow paths.

- High development costs for systems and solutions for specialized thermal management: All sectors usually incur high energy costs because the majority of their operations rely on technology. These processes use more electricity, which increases the company's overall energy consumption investment and costs. One of the biggest challenges faced by thermal management systems and solutions providers is controlling the heat produced by electronic devices, including computers, laptops, servers, switches, and other networking equipment. For high-power applications, components like microprocessors and microcontrollers need more power to meet their computational and functional needs. Degradation or failure of these components may result from exposure to highly localized temperatures or operations at high temperatures (over 125°C).

Advanced Thermal Management Market Regional Analysis:

- Asia-Pacific: The market share is expected to be the highest in the Asia-Pacific region. The market is anticipated to rise because of the region's quick economic development and the expanding trade in cars and consumer electronics. The existence of significant automotive thermal system OEMs and the demand for automobiles in China, India, Japan, and South Korea are projected to make the Asia Pacific the largest market.

Advanced Thermal Management Market Competitive Landscape:

The market is moderately fragmented, with many key players including Henkel, Honeywell International Inc., Vertiv Co, Delta Electronics, Inc., Parker Chomerics, TAT Technologies Ltd., Autoneum Holding AG, Boyd, European Thermodynamics Ltd., and Laird Thermal Systems.

Advanced Thermal Management Market Key Developments:

- November 2025: Vertiv and Caterpillar announced a collaboration to develop integrated energy optimization solutions, enhancing end-to-end power and cooling offerings for AI data centers.

- October 2025: Vertiv announced a new ecosystem of OCP-compliant rack, power, and cooling solutions designed to support high-density AI infrastructure deployments.

- March 2025: Vertiv launched the CoolLoop Trim Cooler, a modular solution designed to support air and liquid cooling for high-performance computing in diverse climate conditions.

Advanced Thermal Management Systems Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.302 billion |

| Total Market Size in 2031 | USD 7.311 billion |

| Growth Rate | 6.64% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Material Type, Device, End-User Industry, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Advanced Thermal Management Market Segmentation:

By Material Type

By Device

- Conduction Cooling Devices

- Convection Cooling Devices

- Advanced Cooling Devices

- Hybrid Cooling Devices

By End-User Industry

- Consumer Electronics

- Servers & Data Centers

- Automotive

- Aerospace & Defense

- Enterprises

- Healthcare

- Others

By Region

- North America

- USA

- Mexico

- Others

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others