Report Overview

Agricultural Tractor Market - Highlights

Agricultural Tractor Market Size:

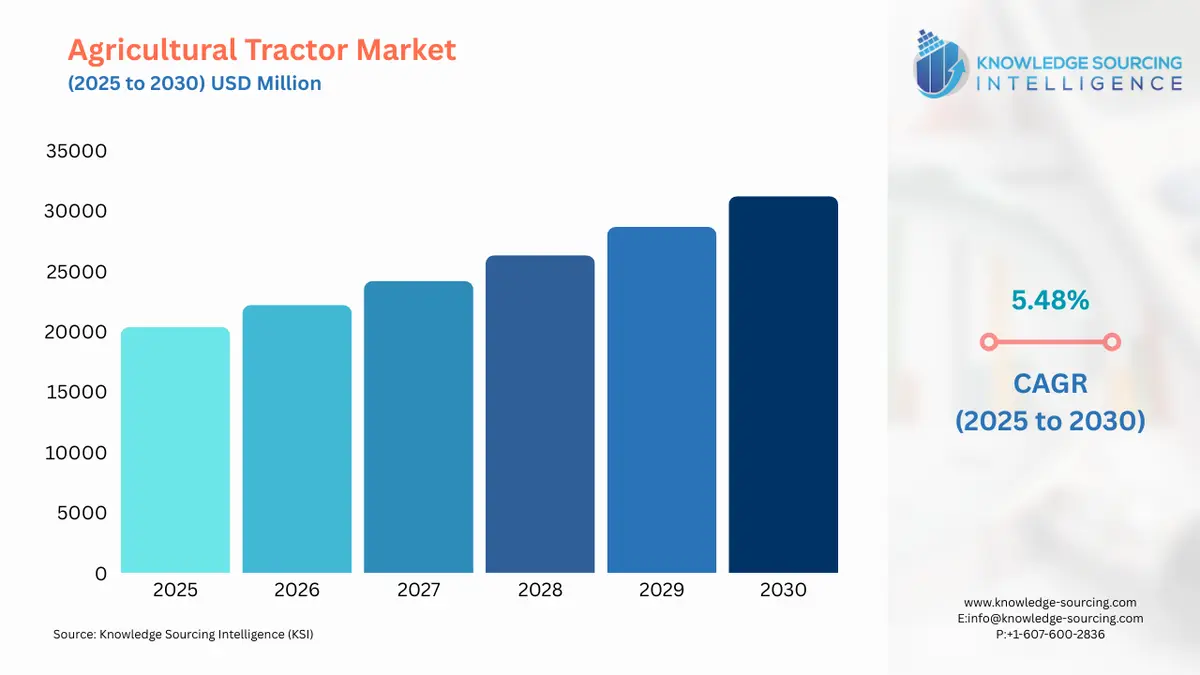

The agricultural tractor market is estimated to grow at a CAGR of 5.48%, to reach US$31,229.554 million in 2030 from US$20,386.565 million in 2025.

Agricultural Tractor Market Trends:

The market for agricultural tractors is growing due to the increase in precision farming and the growing demand for agricultural farm equipment, including agricultural tractors. Also, the government’s rising support for farm mechanization, through subsidies, incentives, and assistance for purchasing agricultural equipment, is significantly boosting agricultural tractor production. Moreover, the continuous technological advancements in tractor manufacturing enhance the efficiency of tractors, driving the growth of the agricultural tractor market by improving the performance and capabilities of these machines.

The global agricultural tractor market refers to the production and sales of agricultural tractors and related products like accessories, attachments, and parts of agricultural tractors, like engines. The market consists of various types of engines, such as less than 40 HP engines, between 41 HP to 100 HP, and more than 100 HP tractors for farms such as small and fragmented farms, mid-sized farms, and large farms. It is sold for its application in farming, livestock farming, specialized farming such as orchards, horticulture, growers, etc. The market consists of utility tractors, row crop tractors, orchard tractors, and other types of tractors. The market is dominated by manual tractors, particularly in regions of the Asia-Pacific, while autonomous tractors are significantly in demand in developed countries.

Some of the major players operating in the market are Mahindra & Mahindra Limited, Deere & Company, Tractors and Farm Equipment Limited, CNH Industrial N.V., and Kubota Corporation, among others.

Agricultural Tractor Market Growth Drivers:

- Increasing farm mechanization is driving market growth

There is a substantial rise in the demand for agricultural equipment, including agricultural tractors. The growing precision farming is giving a major boost to the use of agricultural technologies. The use of advanced technologies such as GPS, automated steering systems, sensors, and many others is significantly benefiting agriculture, driving demand for agricultural tractors. For instance, in August 2023, Mahindra OJA launched 7 revolutionary lightweight 4WD Tractors within the price range of Rs 5,64,500- Rs 7,35,000, offering advanced and easy agricultural tractors to the market.

Also, the government’s increasing support for creating awareness among farmers for using agricultural tractors is driving the growth of the market. This increasing demand is evident from the data released by the Tractor and Mechanization Association, stating that the total retail sales in India increased from 125,418 in October 2023 to 151,772 in October 2024. Thus, the increasing farm mechanization, along with continued government support, will be driving the market growth.

- Technological advancement is boosting the market

The growing technological advancements in the agricultural tractor market are offering a boost to market growth. The growing use of sensors, geo-mapping, remote sensing, automated steering, and high-powered engines is offering efficiency in the usage of agricultural tractors. For example, Kubota Corporation’s Grand L60’s engine lineup is redesigned for clearer emissions and to offer economical fuel. The company employed direct rail injection to save fuel. It also combines a Diesel Particulate Filter (DPF) Muffler and Exhaust Gas recirculation system (EGR) to reduce emissions. This highlights that technological development is a key area to be focused on.

Agricultural Tractor Market Segment Analysis:

- By engine power, the “Less than 40 HP” tractor will grow significantly

The agricultural tractor market based on engine power is segmented into less than 40 HP, 41 HP to 100 HPand More than 100 HP. During the forecast period, the “less than 40 HP” tractor will grow significantly.

The market for less than 40 HP tractors will be driven by demand from small to medium-sized farms. Expanding small-scale gardeners, orchard growers, hobby growers, and livestock farmers will offer a boost to the market demand. The rising small landholding due to the growing population is the major factor boosting its market demand, as less than 40 HP agricultural tractors are best suited for small and fragmented landholdings.

Additionally, stringent government regulations aimed at reducing carbon emissions are providing a substantial boost to the market, encouraging the adoption of these environmentally friendly products. Moreover, the major factor that drives this dominance is the growing prevalence of small and fragmented land holdings, particularly in the Asia-Pacific region.

Agricultural Tractor Market Geographical Outlook:

- Asia-Pacific market will be the fastest-growing market

Based on Geography, the Asia-Pacific market is estimated to grow at the fastest rate during the forecast period. The market will be driven by growing agricultural economies such as India and other economies like China, Japan, etc., where the demand for agricultural tractors is high. Also, the growing mechanization and government support will be driving the market. For example, India is one of the leading global economies where agriculture plays a major role in GDP contribution, and with the rapid population growth, the food demand and consumption scale have witnessed a significant jump in the nation.

On the other hand, the North American and European markets will hold a significant share of the market. The prevalence of large-scale farming, along with rising technological advancements, will be driving the region’s growth.

Agricultural Tractor Market Recent Developments:

- In September 2024, Mahindra Tractors, India’s leading tractor brand, showcased its first CBG-powered Yuvo Tech+ tractor in New Delhi, India. It uses compressed natural gas that will reduce pollutants and carbon emissions, representing a significant technological advancement. It also ensures operational power and performance with the capability of handling farming and haulage tasks.

- In February 2024, John Deere launched the 9RX and high-horsepower model that ranges between 400 to 830 HP, especially for today's higher demands in agricultural activities. With changing weather patterns, a shrinking labor pool, and rising costs of inputs, farmers increasingly require faster and more cost-effective alternatives for fieldwork. These new models are well enhanced for engine and hydraulic options, advanced technology packages, and modernized cabs for comfort and productivity improvement, promoting field preparation to planting to harvesting efficiencies at lower costs per acre.

List of Top Agricultural Tractor Companies:

- Mahindra & Mahindra Limited

- Deere & Company

- Tractors and Farm Equipment Limited

- CNH Industrial N.V.

- Kubota Corporation

Agricultural Tractor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Agricultural Tractor Market Size in 2025 | US$ 20,386.565 million |

| Agricultural Tractor Market Size in 2030 | US$31,229.554 million |

| Growth Rate | CAGR of 5.48% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Agricultural Tractor Market |

|

| Customization Scope | Free report customization with purchase |

Agricultural Tractor Market Segmentation:

- By Engine Power

- Less than 40 HP

- 41 HP to 100 HP

- More than 100 HP

- By Type

- Utility Tractors

- Row Crop Tractors

- Orchard Type

- Other Tractors

- By Vehicle Type

- Gasoline and Diesel

- Electric

- By Mode of Operation

- Manual Tractor

- Autonomous

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America