Report Overview

Agriculture IoT Market - Highlights

Agriculture IoT Market:

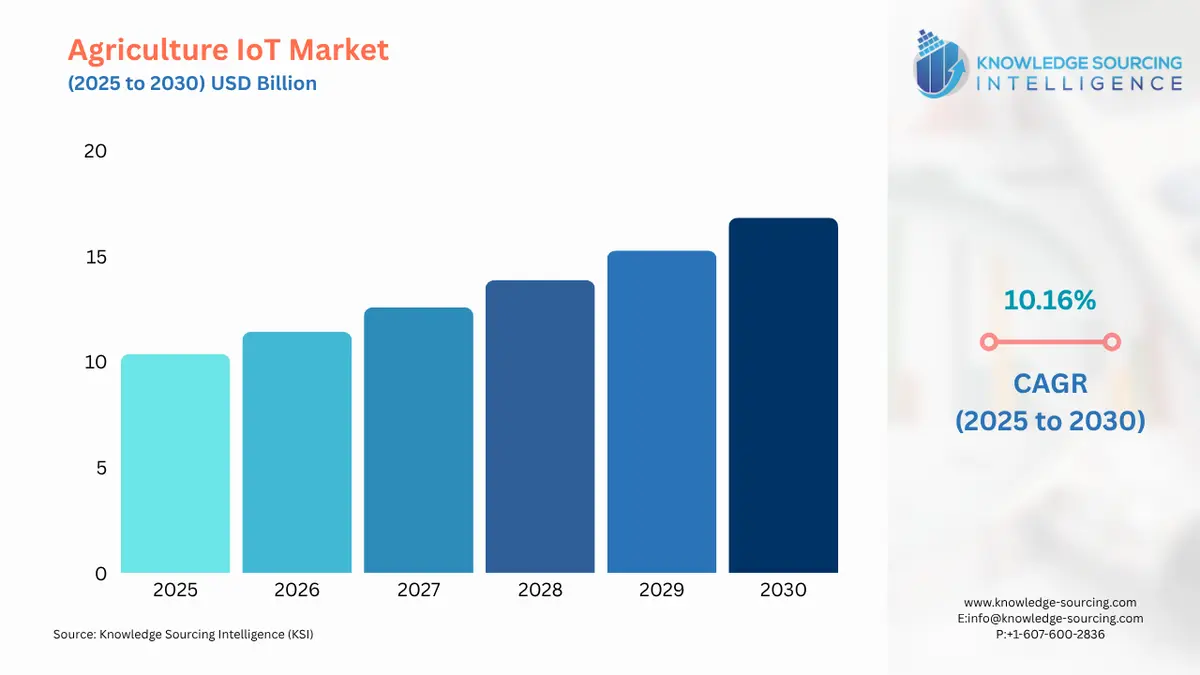

The Agriculture IoT Market is expected to grow at a CAGR of 10.16%, reaching USD 16.820 billion in 2030 from USD 10.367 billion in 2025.

The Agriculture Internet of Things (IoT) market is fundamentally transforming the agricultural sector by integrating a diverse range of digital technologies into farming operations. This transformation is driven by a global need to produce more food with fewer resources while managing the complexities of a changing climate. Agriculture IoT encompasses a suite of interconnected devices and systems, from in-field sensors and drones to advanced data analytics software, all designed to provide farmers with actionable intelligence. The adoption of these technologies moves agriculture beyond traditional, reactive methods to a proactive, data-centric approach.

Agriculture IoT Market Analysis:

- Growth Drivers

The primary growth drivers for the Agriculture IoT market are rooted in the global challenges of food security and resource management. A growing world population necessitates a substantial increase in food production, while arable land and water resources face immense pressure. This dual imperative directly drives demand for technologies that can enhance yield and efficiency. Precision farming, a key application of IoT, provides a direct solution to this challenge. By deploying soil moisture sensors, weather stations, and drone-based imaging, farmers can collect granular, real-time data. This data directly propels demand for IoT hardware and the accompanying data management software, as it enables the precise application of inputs like water and fertilizer. This targeted approach minimizes waste and increases crop yields, making the technology a compelling economic proposition for producers.

Furthermore, labor shortages in many agricultural regions, coupled with rising operational costs, are accelerating the adoption of automation and robotics. This trend creates a strong demand for IoT-enabled autonomous machinery, such as self-driving tractors and robotic harvesters. These systems rely on a network of sensors, GPS technology, and data processing capabilities to operate with precision. The demand for these advanced machines is not just a matter of convenience; it is a necessity for maintaining profitability in an environment of escalating labor and input costs. The need to meet stringent sustainability and environmental regulations also acts as a catalyst. Farmers are increasingly required to demonstrate efficient resource use to comply with environmental standards. IoT technologies provide the data and control mechanisms to meet these demands, thereby creating a necessity for systems that can monitor and report on environmental impact.

- Challenges and Opportunities

The Agriculture IoT market faces significant challenges, primarily related to the high initial investment cost and the complexity of technology adoption. For many small and medium-sized farms, the capital expenditure required for sensors, GPS equipment, and data platforms represents a substantial financial barrier. This challenge is compounded by a lack of technical expertise among some farmers, who may lack the training to effectively integrate and utilize complex digital systems. Connectivity is another major headwind, particularly in rural and remote agricultural areas where reliable internet and cellular service are often limited or non-existent. Without robust connectivity, the real-time data collection and analysis that underpin Agriculture IoT's value proposition are severely constrained.

These challenges, however, also create significant opportunities. The high capital cost has given rise to new business models, such as "IoT as a Service" and subscription-based offerings, which lower the financial entry barrier and make the technology more accessible. This model, where farmers pay a recurring fee for access to hardware, software, and support, creates a new and stable revenue stream for providers and encourages broader market adoption. The issue of technical expertise presents an opportunity for companies to offer comprehensive training and support services, establishing themselves as trusted partners rather than just product vendors. Furthermore, the lack of traditional connectivity in rural areas is fueling innovation in alternative network technologies, such as LoRaWAN and satellite-based IoT, which are specifically designed for low-power, long-range communication. Companies that can provide reliable, off-grid connectivity solutions are uniquely positioned to address a critical market need and unlock demand in previously underserved regions.

- Supply Chain Analysis

The supply chain for Agriculture IoT is a multi-layered ecosystem that begins with the manufacturing of electronic components and software. The hardware segment, which includes sensors, GPS receivers, and telematics units, relies on the global electronics supply chain for components like semiconductors and microprocessors. These components are then integrated into finished products by technology companies, which are often located in major electronics manufacturing hubs in Asia. The software component, which provides data analytics and farm management platforms, is developed globally by a diverse group of companies, from established technology firms to specialized agricultural software startups.

Logistical complexities arise from the need to distribute a wide array of physical devices to farms in often remote locations. This requires a robust distribution network and partnerships with agricultural equipment dealers. A key dependency within this supply chain is the availability of semiconductors, as a shortage can directly impact the production of IoT hardware. The supply chain is also becoming more complex due to the integration of data. The data generated by sensors must be securely transmitted, stored, and processed, which requires a reliable and scalable cloud infrastructure. This creates a parallel "data supply chain" that is just as critical as the physical one.

- Government Regulations

Government regulations and policy initiatives are a powerful catalyst for the adoption of Agriculture IoT, primarily by creating financial incentives and establishing a framework for digital agriculture. These policies often align with national goals of food security, climate change mitigation, and economic stability in the agricultural sector.

- United States: USDA National Institute of Food and Agriculture (NIFA) and Agricultural Technology Grants

The USDA's NIFA provides funding and grants for research and implementation of agricultural technology. These grants directly lower the financial barrier for farmers to invest in IoT solutions, thereby creating a government-subsidized demand for new technologies. The focus on research also spurs innovation in areas like soil health and water management, which require IoT systems. - European Union: Common Agricultural Policy (CAP) and Digitalisation of Agriculture Strategy

The EU's CAP provides financial support to farmers, with a growing emphasis on sustainable practices and eco-schemes. This framework encourages the adoption of precision farming technologies that can prove efficient resource use and reduce environmental impact. The EU's strategic initiatives for digital agriculture, like the Common European Agricultural Data Space, promote the development of a data-sharing ecosystem, which fuels demand for interoperable IoT platforms and data services. - India: Digital Agriculture Mission and "Agri-Stack"

India's Digital Agriculture Mission is designed to establish a comprehensive digital ecosystem for farmers. The mission's key components, such as the "Agri-Stack," which includes farmer registries, geo-referenced village maps, and a digital crop survey, create a foundational data infrastructure. This state-sponsored effort directly generates demand for digital tools and services that can integrate with this ecosystem, from sensors for crop surveys to data analytics software for decision support systems (Krishi-DSS).

Agriculture IoT Market Segment Analysis:

- By Application: Precision Farming

Precision farming is the most prominent application driving demand in the Agriculture IoT market. This segment is characterized by the use of data-driven technologies to manage and optimize agricultural inputs. The demand for precision farming solutions is directly fueled by a clear economic value proposition: maximizing yield while minimizing costs. Farmers are facing increased pressure from rising prices for seeds, fertilizers, and water. IoT sensors placed in fields collect real-time data on soil moisture, nutrient levels, and crop health. This information, when analyzed by a farm management software platform, enables farmers to apply inputs with unprecedented accuracy through Variable Rate Technology (VRT). For example, rather than uniformly spraying an entire field, a VRT-enabled sprayer uses data from remote sensors and GPS to apply pesticides only to specific areas where pests or weeds are detected. This targeted approach reduces chemical usage, lowers input costs, and decreases environmental runoff. The demand for these integrated systems, which combine hardware like sensors and GPS with analytical software, is a direct response to the economic imperative for greater efficiency and sustainability in modern agriculture.

- By Technology: Automation & Robotics

The Automation & Robotics segment is a powerful growth catalyst within the Agriculture IoT market, representing the physical manifestation of digital control and data-driven decision-making. The necessity for autonomous tractors, drones, and robotic milking systems is driven by the acute need to address labor shortages, improve operational efficiency, and perform tasks with a level of precision that is unachievable with manual labor. For instance, in dairy farming, IoT-enabled milking robots like the DeLaval VMS V300 provide a fully automated milking process, which is a direct response to the persistent difficulty of finding and retaining skilled farmhands. These robots collect data on milk yield, udder health, and cow behavior, which then drives demand for the corresponding software that analyzes this information and helps farmers make informed decisions about herd management. Similarly, autonomous tractors and seeding machines, which utilize GPS and remote sensing technology, are in high demand because they allow for 24/7 operation and a level of planting accuracy that can significantly increase crop yield. This segment's expansion is a direct result of the agricultural industry's ongoing evolution towards more capital-intensive, technology-driven operations to ensure long-term viability.

Agriculture IoT Market Geographical Analysis:

- US Market Analysis: The US market for Agriculture IoT is characterized by a high degree of technological adoption, driven by large-scale commercial farming operations and a robust ecosystem of technology providers and research institutions. The market is heavily concentrated in the precision farming segment, with a strong focus on GPS-enabled equipment and data management software. US farmers are motivated by the economic benefits of increased efficiency and yield. The availability of private-sector funding and government support through USDA initiatives further stimulates demand. A key driver is the consolidation of farming operations, which favors the adoption of expensive but highly efficient technology. The challenge of integrating different systems from multiple vendors is being addressed by the development of open-source platforms and data-sharing standards.

- Brazil Market Analysis: Brazil's Agriculture IoT market is rapidly expanding, propelled by its status as a global agricultural powerhouse. The country's vast crop production, particularly of soybeans and corn, and its large livestock sector create a massive demand base. The market is driven by the need to manage large-scale farms and to optimize operations in a country with diverse climates and terrains. The adoption of IoT in Brazilian agriculture is also a response to the need to improve productivity and meet global export demands. Challenges include the connectivity issue in remote rural areas and the need for government policies that can support the adoption of new technologies. However, the market is seeing a rise in specialized technology providers and a growing interest from international companies.

- Germany Market Analysis: Germany’s Agriculture IoT market is mature and highly sophisticated, with a strong emphasis on automation, robotics, and high-tech solutions. The market is driven by the country's focus on sustainable and high-value agriculture, as well as a need to overcome labor costs. The German market is a leader in smart farming technology, with a focus on precision machinery and sensor-based systems that can reduce the environmental footprint of farming. The government's policies, which encourage digitalization and sustainability, provide a favorable environment for the market. A key market driver is the need for highly efficient and precise tools that can be integrated into the country's small-to-medium-sized family farms.

- Saudi Arabia Market Analysis: The Agriculture IoT market in Saudi Arabia is a nascent but rapidly growing sector, driven by the government's strategic imperative to enhance food security and diversify its economy away from oil. The primary market driver is the need to optimize water usage in a water-scarce environment. IoT technologies, such as smart irrigation systems and soil moisture sensors, are in high demand as they provide a direct solution to this critical challenge. Government initiatives and large-scale projects, such as those related to vertical farming and smart greenhouses, are creating significant opportunities for technology providers. The market's growth is heavily dependent on public sector investment and the transfer of technology from international partners.

- Japan Market Analysis: Japan's Agriculture IoT market is highly advanced but faces unique demographic and structural challenges. The demand for technology is driven by the aging farming population and the resulting labor shortages, which make automation an absolute necessity for survival. Japanese farmers require compact, precise, and highly automated solutions that are suitable for the country's smaller, fragmented land plots. The market's focus is on robotics, drones for crop spraying, and data analytics to optimize yields in controlled environments. Government support and subsidies for technology adoption are key to overcoming the high cost of implementation. The market is also a leader in the development of indoor vertical farms and smart greenhouses, which are heavily reliant on IoT to control environmental variables with precision.

Agriculture IoT Market Competitive Analysis:

The competitive landscape of the Agriculture IoT market is a mix of established agricultural machinery giants and specialized technology companies. The major players are leveraging their existing distribution channels and customer relationships to integrate new IoT solutions into their product portfolios. This strategy positions them as a one-stop shop for farmers seeking a comprehensive digital transformation.

- John Deere: A global leader in agricultural machinery, John Deere's strategy is centered on creating an integrated ecosystem of hardware and software. The company's strategy is driven by its extensive installed base of tractors and equipment, which it retrofits with IoT sensors and GPS technology. The John Deere Operations Center is a key product that collects data from this connected hardware, offering farmers a centralized platform for farm management, which in turn fuels the demand for their digital services and subscriptions. Their acquisition strategy focuses on integrating technology that complements their core machinery business, solidifying their position as a full-service provider.

- Trimble Inc.: Trimble's strategic positioning is focused on providing a comprehensive suite of precision agriculture solutions that can be integrated into a wide range of farm equipment, regardless of the brand. This vendor-agnostic approach is a key growth driver, as it allows farmers with mixed fleets to adopt a single, unified technology platform. Trimble’s products, which include GPS guidance systems, steering and flow control, and farm management software, are in high demand because they offer a modular and scalable solution. Their continuous partnerships and product development focus on expanding their reach and enhancing data integration capabilities.

- DeLaval: As a leader in the dairy farming industry, DeLaval's competitive advantage lies in its specialized focus on livestock monitoring and milking automation. The company's products, such as the VMS milking robots, are highly popular because they offer a complete solution for dairy farmers, from milking to health monitoring. The demand for DeLaval's IoT solutions is a direct result of the need for improved animal welfare, increased milk yield, and reduced labor costs. The data collected by their systems on individual cows' health and milk production creates a new revenue stream for the company through data analytics and advisory services.

Agriculture IoT Market Developments:

- June 2025: John Deere unveiled its new F8 and F9 Self-Propelled Forage Harvesters. These machines are designed for increased efficiency and are equipped with advanced sensors and control systems for real-time analysis of moisture and nutrients in forage. This product launch directly stimulates demand for high-tech harvesting equipment that provides data-driven insights.

- March 2025: Trimble announced a partnership with PTx Trimble to expand innovative technology for precision agriculture. The collaboration focuses on enhancing precision and continuous operations in the agriculture industry, thereby driving demand for Trimble's technology and demonstrating a strategic effort to strengthen its position in the market.

- April 2024: DeLaval entered into a partnership with SERAP, a global leader in milk cooling tanks. Under the new agreement, SERAP assumes full ownership of the product development and manufacturing of DeLaval's milk cooling tanks. This strategic move allows DeLaval to boost its production of core products, particularly its VMS robotic milking machines, in response to a significant rise in demand.

Agriculture IoT Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Agriculture IoT Market Size in 2025 | USD 10.367 billion |

| Agriculture IoT Market Size in 2030 | USD 16.820 billion |

| Growth Rate | 10.16% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Agriculture IoT Market |

|

| Customization Scope | Free report customization with purchase |

Agriculture IoT Market Segmentation:

- By Component

- Hardware

- Software

- Services

- By Application

- Precision Farming

- Livestock Monitoring

- Smart Greenhouses

- Precision Forestry

- Supply Chain Management

- Others

- By Technology

- GPS

- Remote Sensing

- Variable Rate Technology (VRT)

- GIS

- Automation & Robotics

- Data Management Software

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa