Report Overview

Artificial Intelligence (AI) In Highlights

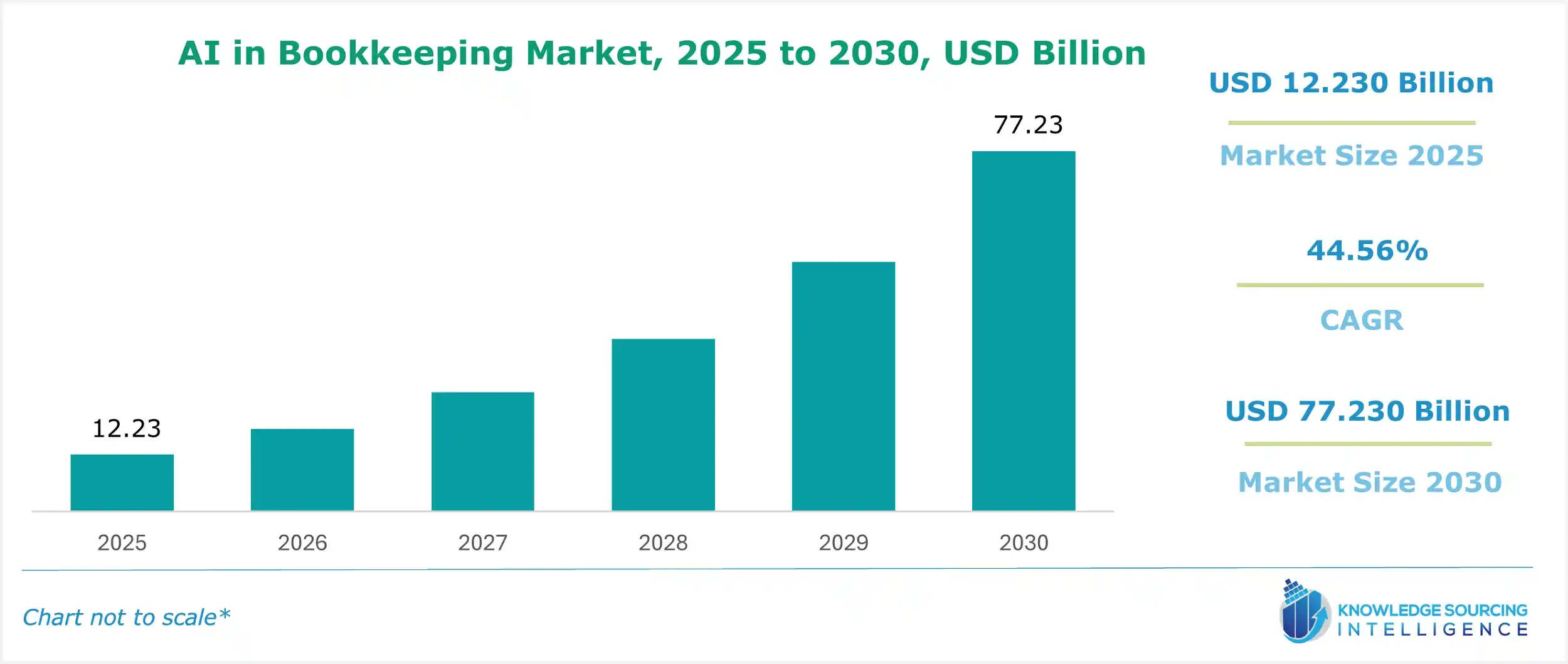

Artificial Intelligence (AI) in Bookkeeping Market Size:

The Artificial Intelligence (AI) in Bookkeeping Market is expected to grow at a CAGR of 44.56%, reaching a market size of US$77.230 billion in 2030 from US$12.230 billion in 2025.

Artificial Intelligence (AI) in Bookkeeping Market Trends:

The AI in bookkeeping market is witnessing rapid growth, driven by the adoption of artificial intelligence (AI) to streamline accounting and bookkeeping processes. AI technologies, including machine learning (ML) and natural language processing (NLP), automate tasks like financial data analysis, transaction categorization, account reconciliation, and report generation, reducing human involvement and enhancing efficiency.

AI-powered bookkeeping solutions excel in automated data entry, processing invoices, receipts, and other cost-related documents, eliminating manual input. These systems use NLP to extract relevant data and ML to classify expenditures, income, and other financial entries into appropriate categories, simplifying financial management. AI-driven reconciliation compares bank statements, billing records, and general ledgers, identifying discrepancies and ensuring accuracy.

Financial reporting is transformed by AI, which generates customized reports on cash flow, net income, and key financial ratios tailored to user needs. AI forecasting predicts financial trends, aiding business planning. These capabilities are particularly valuable in small businesses, universities, and enterprises, where financial accuracy and time savings are critical.

North America leads the market due to advanced technology adoption and robust financial sectors, while Asia-Pacific, including China and India, grows rapidly due to digital transformation and SME expansion. Challenges like data privacy and system integration persist, but secure AI frameworks and cloud-based solutions address these concerns. The AI in bookkeeping market is poised for growth, propelled by automation, ML, NLP, and financial innovation, revolutionizing modern bookkeeping practices.

Artificial Intelligence (AI) in Bookkeeping Market Growth Drivers:

- Increasing automation demand is contributing to AI in the bookkeeping market

Automation optimizes entry and bookkeeping procedures by reducing the extent of involvement by personnel in registering, sorting, and matching operations. AI-driven systems may perform repetitive tasks faster and more accurately than humans, saving time and increasing production. AP AUTONOMY increases team efficiency by enabling faster and more accurate invoice processing than traditional accounting automation products based on templates and rules. AI-based AP Autonomy transforms outdated Optical Character Recognition systems and rule-based methods to automate processes with a quicker and more precise solution.

In general, the increasing need for automation is leading to more applications of Artificial Intelligence in accounting as companies are looking for efficiency in processes, cost reduction, improved precision, and effective utilization of financial data.

- The emergence of cloud-based solutions is contributing to AI in the bookkeeping market.

AI-powered accounting software in the cloud enables users to access and utilize advanced features without the need for costly IT architecture, thus making higher-order bookkeeping functions within reach of a wider range of businesses.

One of the products is Zoho Books, which is an all-around platform for managing all accounting processes and transactions. This is where one can find all their company’s bills and invoices in one safe place, along with the tasks of bank reconciliation, tracking expenses, and managing project work.

Moreover, the emergence of cloud-based solutions has changed how organizations conduct bookkeeping and accounting practices, enabling them to have more flexibility, scalability, cost-efficiency, security, and integration options. Thus, cloud-based AI accounting solutions have experienced an upward trend in uptake by all types of corporations, aiding the sector's growth.

- Rising deployment of on-premise and cloud services is contributing to AI in the bookkeeping market.

Outsourced Accounting Services Software as a Service (SaaS) is generally hosted and managed by an external provider and accessed by users via the web. This policy encourages growth, adjusting the system's parameters to the firm’s requirements and lowering initial costs, as firms incur expenses for the services they use on a subscription basis. It also enables access from any location and updates without intervention.

When the AI-based accounting software is installed and run within a company’s servers and infrastructure, it is called on-premises deployment. It gives organizations more governance over their information and possibilities for customization, but it involves capital expenditure on purchasing hardware and ICT personnel.

Artificial Intelligence (AI) in Bookkeeping Market Restraints:

- Data privacy concerns are anticipated to hamper the market growth

Modern machine learning-focused accounting solutions utilize large structured data to teach their algorithms and make precise forecasts. Nevertheless, apprehensions about the confidentiality and safety of such information could hinder organizations from adopting these solutions, especially where there is a need to share sensitive financial data with other outsourced entities.

Artificial Intelligence (AI) in Bookkeeping Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

The region is acclaimed for technical advancements, especially in the United States. This is because of the region's numerous digital enterprises and research centers, and Vic.ai, Bill, Docyt AI, and Zoho’s subsidiaries - DORA, rent, and outsource- which provide a wide array of bookkeeping solutions.

However, most North American corporations, especially large companies and modern startups, are the first to implement the technologies, including Artificial Intelligence. They understand the possible advantages of AI in attaining high efficiency, accuracy, and cost-effectiveness in bookkeeping processes, hence the increase in investment aimed at AI-enhanced solutions. It is important to note that this region holds a significant share of the AI bookkeeping market because it effectively leverages the technology. Additionally, this area is a hub for most innovations in financial processes.

Artificial Intelligence (AI) in Bookkeeping Market Key Developments:

- November 2025: Wolters Kluwer Showcases AI-Powered Solutions at 2025 CCH Connections Conference. Wolters Kluwer highlighted new AI capabilities enabling firms to automate routine tasks, accelerate compliance, and unlock actionable insights through AI powered by Wolters Kluwer, focusing on bookkeeping and tax automation.

- November 2025: Thomson Reuters Advances AI Market Leadership with New Agentic AI Solutions. Thomson Reuters launched agentic AI solutions delivering significant time savings through automation of repetitive tasks in finance and accounting, including bookkeeping processes like invoice handling and reconciliation.

- October 2025: Intuit Unveils Revolutionary System of Intelligence to Help Businesses Grow in the AI Era. Intuit introduced a new AI-powered bank feed that saves 45% of customers 12 hours monthly on bookkeeping, enhancing automation for categorization and reconciliation in QuickBooks.

- September 2024, FloQast announced the beginning of a new era of accounting operational excellence, fueled by the launch of its all-new Accounting Transformation Platform, designed by accountants for accountants. The Accounting Transformation Platform introduces new AI workflows to provide value at every stage of the accounting process by integrating the full FloQastTM solution portfolio, which includes FloQast Close, FloQast Compliance Management, and FloQast Ops.

- August 2024, ReInvestWealth launched AI accounting software in the USA. They are offering American entrepreneurs, small business owners, independent contractors, and solopreneurs their user-friendly and reasonably priced accounting solutions. Their software maximizes tax credits, reduces errors, and saves time by automating repetitive accounting tasks using unique AI algorithms. Their platform, which was created with the modern entrepreneur in mind, is simple to use and intuitive, even for people who don't know much about accounting.

List of Top Artificial Intelligence (AI) in Bookkeeping Companies:

- Zeni

- Book.ai

- Clickup

- Vic.ai

- Bill

Artificial Intelligence (AI) in Bookkeeping Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI in the Bookkeeping Market Size in 2025 |

US$12.230 billion |

|

AI in the Bookkeeping Market Size in 2030 |

US$77.230 billion |

| Growth Rate | CAGR of 44.56% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI in the Bookkeeping Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in Bookkeeping Market Segmentation:

- By Organizational Size

- Small-size organization

- Medium-size organization

- Large-size organization

- By Deployment

- Cloud

- On-Premise

- By Application

- Machine learning

- Invoice Classification and Approval Source

- Compare employee expense reports

- Track changes in prices

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America