Report Overview

Artificial Intelligence (AI) Processor Highlights

Artificial Intelligence (AI) Processor Market Size:

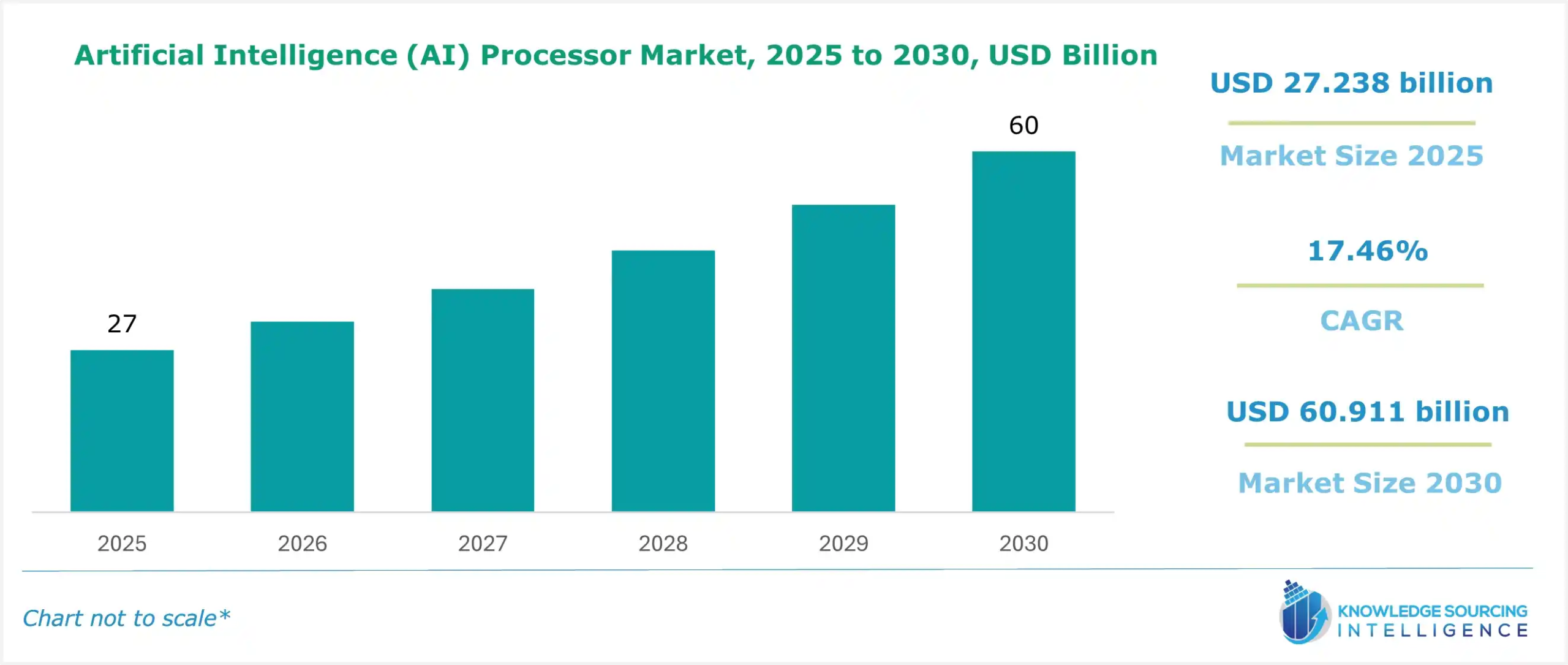

The artificial intelligence (AI) processor market is estimated to reach US$60.911 billion by 2030, growing at a CAGR of 17.46% from US$27.238 billion in 2025.

An AI processor is a type of specially developed processing unit that is used in various types of computing devices, like smartphones and personal computers. These processors help increase the computing devices' efficiency, utilizing AI and ML functions. AI processors offer multiple advantages compared to other types of processors, as they offer faster computing capabilities and more accurate results. This processor also enables lower latency results.

Artificial Intelligence (AI) Processor Market Trends:

The global AI processor market is experiencing significant growth, driven by increasing investments in smart cities across various regions. This trend creates substantial opportunities for market players to innovate and expand. Additionally, the rise in funding for AI startups, supported by venture capitalists, is fueling market expansion. The growing integration of AI into video surveillance and increased government spending on cybersecurity solutions that leverage real-time analytics and AI are further boosting demand. As AI technologies evolve, ethical considerations are becoming critical, with the Responsible AI Market offering insights into how companies are addressing transparency and accountability in AI development. Moreover, the emergence of quantum computing is poised to revolutionize the AI processor landscape during the forecast period.

The increasing demand for AI-based applications worldwide is expected to propel the global AI processors market. Similarly, the introduction of new policies and investment opportunities in the AI technology sector by the governments of multiple countries, such as India, China, the UK, Japan, and the USA, is also forecasted to boost the AI processor market during the forecasted timeline.

Artificial Intelligence (AI) Processor Market Growth Drivers:

- Increasing demand for AI applications

The growing need for AI applications is an important factor influencing the artificial intelligence (AI) processor industry. Integrating AI technologies into several industries, including healthcare, finance, technology, and the automotive sector, has led to an increasing demand for specialized hardware that can manage the intricate processing demands of AI workloads. AI processors that effectively carry out activities linked to machine learning, deep learning, and other AI applications are essential to satisfy these expectations. With companies looking to use AI for activities like image recognition, natural language processing, and data analysis, the speed and efficiency provided by specialized AI processors become critical. For instance, the growing adoption of edge computing is enhancing on-device AI capabilities, as detailed in the On-Device Intelligence Market report, which explores how processors are enabling real-time AI processing in compact devices.

- Growth strategies of key market players

Leading companies are employing strategies like acquisitions, partnerships, collaborations, and product launches to strengthen their AI processor portfolios and expand their market presence. For example, in May 2022, Intel Corp. launched its AI Gaudi2 chip, 4th generation Xeon Scalable processors, and a new GPU solution, alongside other initiatives like the Project Apollo AI program with Accenture. These efforts are driving demand for AI processors across various industries. To meet the growing need for transparency in AI systems, companies are also focusing on explainable AI, as explored in the Explainable AI Market report, which highlights how processors are being designed to provide clearer insights into AI decision-making processes. Such advancements are expected to further accelerate market growth.

For example, Elon Musk, the founder of Tesla, launched the tech startup Neuralink to develop implants that use AI to connect brains with computer interfaces. AI processor manufacturers also use growth strategies, including product launches, investments, partnerships, and collaborations, to meet the emerging demand and expand their global market share.

Artificial Intelligence (AI) Processor Market Geographical Outlook:

- Artificial Intelligence (AI) Processor Market is segmented into five regions worldwide

The global artificial intelligence (AI) processor market is segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Geographically, the AI processor market is segmented into North America, South America, Europe, the Middle East, Africa (MEA), and Asia Pacific (APAC). North America accounted for the major market share in 2025 and is anticipated to remain in its position during the forecast period. Early adoption of new advanced technologies and the presence of major market players support the regional market growth. Increasing investments in artificial intelligence in countries such as the United States and Canada are also driving regional market expansion.

The APAC market is also projected to witness a substantial CAGR during the forecast period due to the presence of major AI processor makers such as Samsung and Huawei in the region. Growing adoption of AI technology across various industry verticals, such as automotive and transportation, healthcare, BFSI, and retail in countries such as South Korea, India, and China, is significantly augmenting regional demand for these processors. Increasing investments in 5G and IoT technology are also spurring the regional market growth.

Artificial Intelligence (AI) Processor Market Product Offerings by Key Players:

- MediaTek is among the leading global manufacturers of semiconductors. The company offers a wide range of technologies, which include 5G, artificial intelligence, Wi-Fi, display, and CorePiots, among others. The company's products include smartphones, smart homes, networking & connectivity, IoT, automotive, and ASIC. The company offers MediaTek Neural Processing Units (NPU) for the global AI processor market, which offer multiple AI capabilities.

- Nvidia Corporation is among the leading technological solution providers based in the USA. The company offers products and solutions for multiple industries, such as cybersecurity, consumer internet, manufacturing, financial services, and automotive, among others. The company offers AI solutions, data center & cloud computing, design simulation, robotics & edge computing, and self-driving vehicles. The company provides GeForce RTX™ GPUs for the global AI processors market, which deliver 30 times faster AI model training with 13 times faster image generation.

Artificial Intelligence (AI) Processor Market Key Development:

- November 2025: AMD Unveils Aggressive Roadmap to $1 Trillion AI Data Center Market. At its Financial Analyst Day, AMD showcased its long-term strategy, projecting annual revenue growth of over 35% driven by AI processors. The company raised its total addressable market forecast for AI data center components to $1 trillion by 2030. AMD also announced its next-generation Instinct™ MI450 Series and MI500 Series GPUs, scheduled for launch in 2026 and 2027, respectively, cementing its plan to lead the high-performance AI compute segment.

- November 2025: Intel's Chief AI Executive Joins OpenAI. Intel’s Chief Technology Officer and top artificial intelligence executive, Sachin Katti, left the chipmaker to join OpenAI. At OpenAI, he will focus on designing and building the company's next-generation compute infrastructure to support its Artificial General Intelligence (AGI) research. This high-profile move underscores the intense competition for top hardware talent as major AI developers build their own custom computing solutions.

- November 2025: Google Launches Mass Availability of TPU "Ironwood" AI Chip. Google made its seventh-generation Tensor Processing Unit (TPU), internally known as "Ironwood," widely available to Google Cloud customers. The custom-built chip is designed for large-scale AI training and features high-density interconnects, positioning it as a dedicated solution to compete with NVIDIA in cloud-based AI infrastructure. AI models, including Anthropic's Claude, are slated to use up to 1 million of these new chips.

- January 2025: AMD announced new Ryzen™ AI Max Series processors, further answering the demands of high-performance computing in premium thin and light notebooks; new Ryzen™ AI 300 Series "Zen-5"-based processors to round out the stack with additional models; and to continue the legacy of AMD "Zen 4" architecture, Ryzen™ 200 Series processors for everyday productivity.

List of Top Artificial Intelligence (AI) Processor Market Companies:

- Apple Inc.

- Huawei Technologies Co., Ltd.

- MediaTek Inc.

- SAMSUNG

- Qualcomm Technologies, Inc.

Artificial Intelligence (AI) Processor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Artificial Intelligence (AI) Processor Market Size in 2025 | US$27.238 billion |

| Artificial Intelligence (AI) Processor Market Size in 2030 | US$60.911 billion |

| Growth Rate | CAGR of 17.46% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Artificial Intelligence (AI) Processor Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) Processor Market Segmentation:

- By Processor Type

- GPU

- ASIC

- FPGA

- Others

- By Technology

- System-on-Chip

- Multi-Chip Module

- System-in-Package

- Others

- By Processing Type

- Cloud

- Edge

- By Industry Vertical

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Media and Entertainment

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

- Artificial Intelligence Engineering Market

- Artificial Intelligence (AI) In Social Media Market

- Adaptive AI Market