Report Overview

Artificial Intelligence (AI) In Highlights

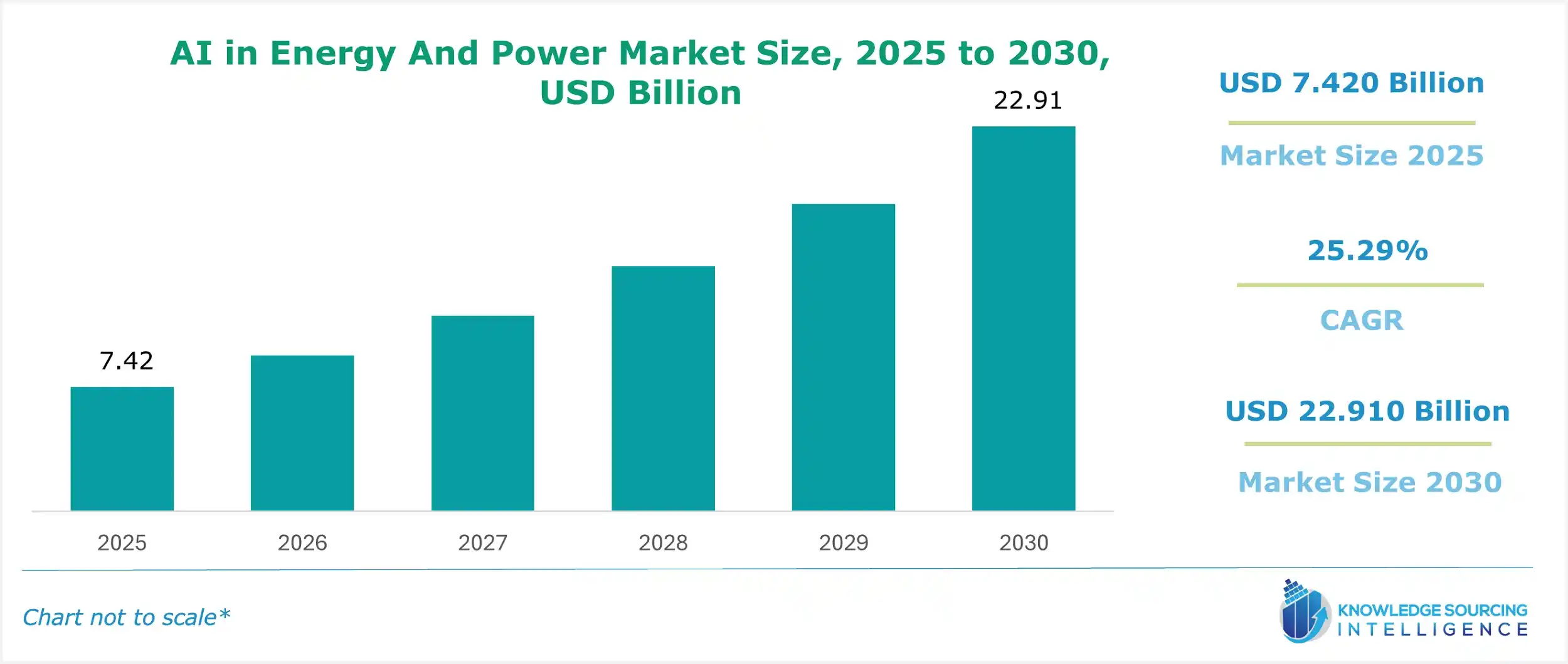

AI in Energy And Power Market Size:

Artificial Intelligence (AI) in energy and power market is projected to witness a CAGR of 25.29% during the forecast period to reach USD 22.910 billion by 2030, up from USD 7.420 billion in 2025.

Artificial intelligence (AI) has become increasingly becoming a significant tool in the energy and power markets. It can automate and improve energy-related processes and provide more efficient operation at a lower cost by providing better energy management. Additionally, it reduces adverse environmental impacts and fully initiates better enhancements. In the energy sector, AI is used mainly for demand forecasting.

Moreover, by analyzing the wealth of data available on consumer behavior, weather patterns, and other variables, AI systems can give a much more accurate idea of how energy is used, allowing utility companies to manage their resources better. AI is used to create more cost-effective energy production and distribution systems. For example, machine learning algorithms can analyze solar or wind energy systems data to detect patterns and predict how much power will be generated.

Additionally, AI-powered systems can monitor and analyze energy-consuming processes in buildings, identify where it is being wasted or used inefficiently, and how it can be replaced with an energy-saving solution. This has the potential to reduce greenhouse gas emissions as well as achieve capital cost savings for building owners and tenants. However, insufficient or outdated data could result in wrong AI models, leading to poor operationalization, financial loss, and safety danger. Hence, the system must be effectively dealt with for the market to grow without any hindrances.

AI in Energy and Power Market Overview & Scope:

The AI in energy and power market is segmented by:

- Technology: By technology, the market is segmented into machine learning, natural language processing, computer vision, and others. The machine learning segment is expected to hold the largest share, while computer vision archiving is the fastest-growing segment. The utilization of machine learning algorithms for providing grid optimizations and predictive maintenance for energy production is one of the major attributes driving the segment's growth.

- Application: By application, the market is divided into demand forecasting, energy production and distribution optimization, energy management, smart grids, smart meters, and others. Demand forecasting segment dominates the current market, due to the rising need by utility and grid companies for accurate forecasting to balance their supply and demand, particularly due to the rise in energy consumption globally.

- End User: By end-user, the AI in the energy and power market is divided into commercial and industrial, and residential. The commercial and industrial segment holds a major share in the end user associated with growing energy demand and stricter energy regulation to reduce emissions in the commercial and industrial sectors.

- Region: Geography-wise, Asia Pacific is expected to hold a considerable share of the AI in the power and energy market because ongoing investment in smart grids and energy optimization has provided new growth prospects for the market. Moreover, the growing integration of renewable energy through government initiatives will also lead to demand for AI-enabled solutions in the region during the projected period.

Top Trends Shaping the AI in Energy and Power Market

- Supportive Policies in the Adoption of AI

The implementation of policies and initiatives to bolster the integration of Artificial Intelligence (AI) with energy management such as the launching of the “AI Energy Task Force” by the Bipartisan Policy Center in April 2025 followed by investment by major market players such as Schnieder Electric in the development of AI-Native ecosystem that bolster energy management and automation has also paved the way for future market expansion.

AI in Energy and Power Market Growth Drivers vs. Challenges:

Drivers:

- Growing Energy Demand: AI tools such as machine learning, natural language processing, and computer vision can help utility businesses in several areas, including demand estimation, energy production optimization & distribution improvement, and quicker identification & rectification of equipment issues. Facilities can significantly improve the reliability of services and process quality as well as reduce costs, leading to growth in demand for AI in the power and energy sector during the projected period.

Furthermore, this market growth is made possible by the growing energy demand. Utilities must proactively generate power or manage electricity to handle the increasing demand while ensuring their systems remain reliable and cost-effective. This creates significant opportunities for businesses that offer AI and machine learning solutions. In addition, Our World In Data reported a consistent rise in the world's energy consumption from 179.819 TWh in 2022 to a value of 183,230 TWh in 2023, which is a rise of 2.02%. Moreover, global energy consumption is expected to grow at an average rate of at least 1%-2% annually, as per the same source.

Additionally, AI can improve how energy-related problems are solved by estimating the output of renewable energy in advance, enabling more renewable power to be integrated into power generation and governing energy transmission & distribution. This would enable cost-effective and sustainable energy generation, increasing reliability and stability in the power system. Consequently, there is a need for and support for renewable energy in this market. The International Energy Agency (IEA) reported that an estimated 507 GW of renewable electricity capacity was added in 2023, nearly 50% more than the previous year, driven by supportive policies that enabled the upscaling of deployment in more than 130 countries.

- Increasing Smart Grid Deployment: One of the prominent applications is smart grids, where AI is employed in the energy and power sectors. Smart grids use advanced sensors, communication technologies, and automation systems while providing electricity to ensure an efficient delivery of these services. Comparing large volumes of data in real-time as they come to a decision helps the utility make decisions better with AI, which is applied for smoother execution and performance improvement.

For instance, in January 2024, Spain's Iberdrola España is teaming with BCAM on the AI Innovation Data Space project targeting grid optimization. The initiative is part of the Global Smart Grids Innovation Hub, an interoperable workspace aimed at enhancing the access and quality of grid services in terms of distribution capacity and efficiency, especially for renewable integration and economic electrification.

In addition, these energy and power utilities lead to a necessity to either generate electricity or manage it to meet demand while retaining a reliable and cost-effective system, such as a smart grid. This provides a potential opportunity for businesses that provide AI and ML solutions to help energy and grid operators in energy optimization and management.

Challenges:

- Infrastructure and Grid Constraints: The rapid growth of AI data centers necessitates substantial upgrades to aging energy infrastructure, including transmission lines and grid capacity, which could hinder market growth during the forecast period.

AI in Energy and Power Market Regional Analysis:

- North America: North America is expected to experience one of the fastest growth rates in the AI energy and power market due to high incremental changes in renewable energy adoption and smart grid technologies, dominantly across countries such as the United States. The growth in the use of renewable energy sources by the United States government has facilitated an increase in AI applications across its power and energy industry.

The U.S. Energy Information Administration reported that renewable energy generated approximately 13 percent of the entire U.S. electricity supply in 2022. Additionally, about 61% of all U.S. renewable energy consumption in 2022 was in the electric power sector, and renewables accounted for more than a fifth, i.e., 21% of U.S. electricity generation last year. Additionally, this region boasts some of the top utilities and AI technology providers, with a vertical focus on smart grid and green energy technologies, leading to regional market growth in the years ahead.

In addition, the adoption of modern approaches, followed by technological advancements, has shown tremendous progression in the United States, with new technologies, inclusive of Artificial Intelligence (AI), providing a new framework for optimizing resources. Moreover, the country is witnessing a constant urban population growth, which has accelerated energy consumption, thereby propelling the overall energy demand as well. The Population Reference Bureau states that by mid-2024, the urban population will constitute 83% of the total US population of 336.6 million.

AI in Energy and Power Market Competitive Landscape:

The market is fragmented, with many notable players, including General Electric Company, Siemens Energy, Schneider Electric, ABB Ltd., Honeywell International Inc., C3.ai Inc., Eaton Corporation Plc, IBM Corporation, Oracle, and Enel X Italia Srl, among others.

- Collaboration: In June 2025, Uniper collaborated with Microsoft to develop the energy industry by integrating AI into all key business processes. The partnership aims to incorporate AI in energy trading optimization, plant maintenance improvements, and customer service for an energy system that will be volatile, decentralized, and sustainable energy system.

- Collaboration: In October 2024, Honeywell collaborated with Qualcomm Technologies to design AI-enabled energy sector solutions. This collaboration focuses on integrating Qualcomm's connectivity and AI capabilities into Honeywell's existing applications, which enables enhancing connectivity and data capture in remote energy plants and manufacturing facilities.

- Product Launch: In June 2024, ABB Ability™ OPTIMAX 6.4 announced an upgrade to its AI module for energy management and optimization. It provides for better forecasting and the coordinated control of assets of various categories at industrial sites and hybrid power plants. This digital energy management system works to keep costs low while reducing emissions to ensure enough income for the decarbonization process. In addition, the AI module plays a major role in reducing any day-ahead and intra-day nomination errors that bring about increasing penalty payments to the operators.

List of Top AI in Energy And Power Companies:

- General Electric Company

- Siemens Energy

- Schneider Electric

- ABB Ltd.

- Honeywell International Inc.

AI in Energy And Power Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI in Energy and Power Market Size in 2025 |

US$7.420 billion |

|

AI in Energy and Power Market Size in 2030 |

US$22.910 billion |

| Growth Rate | CAGR of 25.29% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI in Energy and Power Market |

|

| Customization Scope | Free report customization with purchase |

The Artificial Intelligence (AI) in Energy and Power Market is segmented and analyzed as below:

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Others

By Application

- Demand Forecasting

- Energy Production and Distribution Optimization

- Energy Management

- Smart Grids

- Smart Meter

- Others

By End User

- Commercial and Industrial

- Residential

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Vietnam

- Indonesia

- Others

Our Best-Performing Industry Reports:

- Energy And Power Electric Capacitor Market

- Clean Energy Technology Market

- Artificial Intelligence (AI) In Life Sciences Market

Navigation

- AI in Energy And Power Market Size:

- AI in Energy And Power Market Key Highlights:

- AI in Energy and Power Market Overview & Scope:

- AI in Energy and Power Market Growth Drivers vs. Challenges:

- AI in Energy and Power Market Regional Analysis:

- AI in Energy and Power Market Competitive Landscape:

- List of Top AI in Energy And Power Companies:

- AI in Energy And Power Market Scope:

- Our Best-Performing Industry Reports: