Report Overview

Artificial Intelligence (AI) In Highlights

Artificial Intelligence (AI) in Retail Market Size:

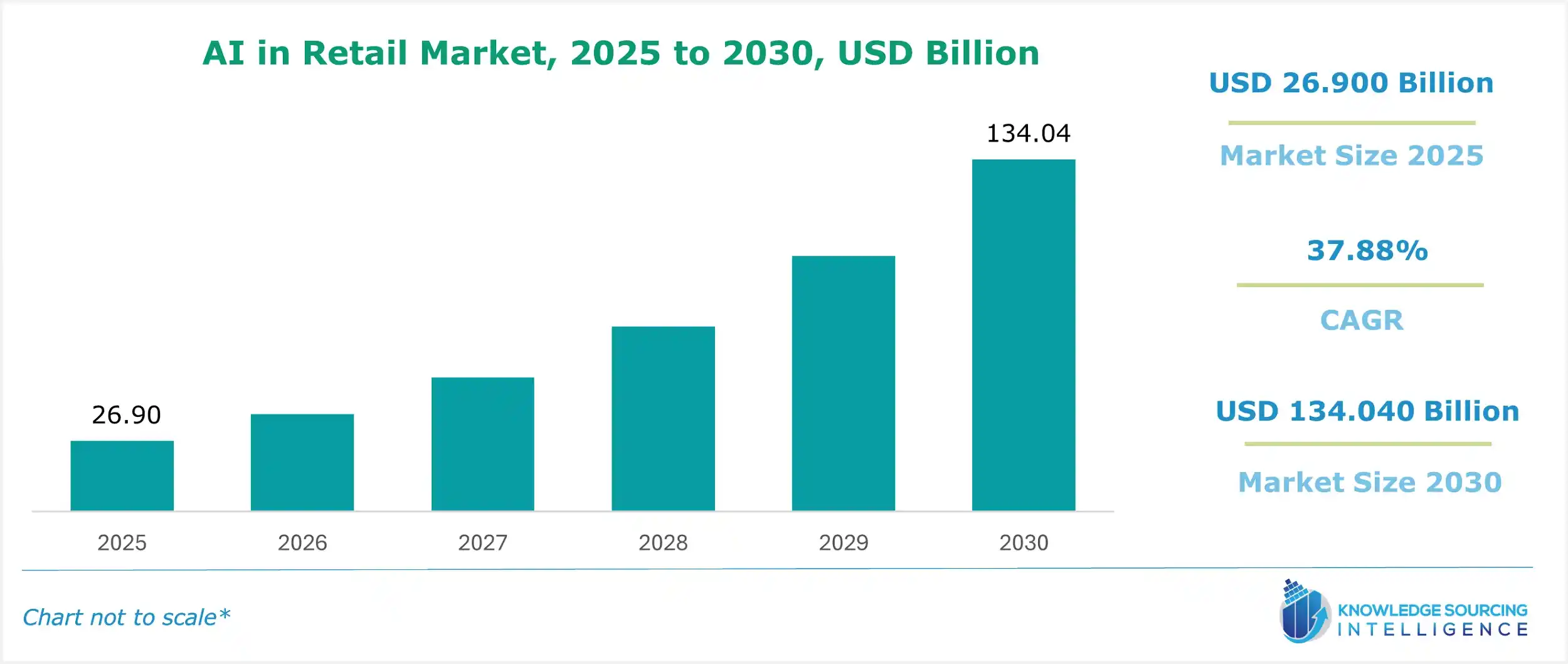

The Artificial Intelligence (AI) in Retail Market is expected to grow at a CAGR of 37.88%, reaching a market size of US$134.040 billion in 2030 from US$26.900 billion in 2025.

Artificial Intelligence (AI) in Retail Market Trends:

The AI in retail market is experiencing significant growth, driven by the rise of surveillance and monitoring in physical retail, the increasing internet users, and the widespread adoption of smart devices. Government initiatives promoting digitization further accelerate the integration of artificial intelligence (AI) in the retail industry, transforming operations and enhancing customer experiences.

AI and big data analytics are pivotal in modernizing retail operations. These technologies optimize supply chain management, inventory control, and customer service by analyzing vast datasets to uncover consumer behavior patterns. Machine learning algorithms enable personalized marketing, offering tailored product recommendations that boost sales and customer loyalty. For instance, AI-powered chatbots and virtual assistants enhance customer engagement by providing real-time support and seamless e-commerce experiences.

The proliferation of Internet of Things (IoT) devices and smart gadgets supports real-time data collection, enabling retailers to monitor store performance and customer preferences effectively. Surveillance systems powered by AI improve security and loss prevention in physical stores, while predictive analytics optimizes pricing strategies and demand forecasting. The growing adoption of mobile applications and smart devices further drives AI applications, facilitating omnichannel retail strategies.

North America leads the market, fueled by technological advancements and high consumer adoption of digital solutions. Asia-Pacific, particularly China and India, is rapidly growing due to urbanization, increasing internet penetration, and e-commerce expansion. Government policies supporting digital transformation and smart retail initiatives enhance market growth globally.

Artificial Intelligence (AI) in Retail Market Growth Drivers:

- E-commerce growth is contributing to the AI in retail market growth

With the boom of e-commerce and digital experiences, there has been a call for using Artificial Intelligence in the retail sector. Most online retailers use AI-based recommendation systems, chatbots, and virtual assistants to enhance the online shopping experience while engaging consumers to drive conversations. Additionally, even physical stores are enhancing their operations with artificial intelligence to bridge the gap left in the customers' shopping trips.

Moreover, Build Your Own Brain (BYOB) is an AI-supportive tool for all data and decision-making processes. It extends your analyst’s workload. It will unsystematically deep dive, curate, and develop a repository. It presents analytics and actionable insights in real time according to key metrics and statistical trends.

The growth of e-commerce also promotes the use of artificial intelligence in the retail sector. New markets are accompanied by a wealth of data, leading to expectations for improved service, greater operational efficiency, and enhanced security. This business environment creates opportunities for more effective use of AI in retail.

- Advancements in AI technologies are contributing to the AI in retail market

There is a significant correlation between AI in the retail market’s growth and the different components of artificial intelligence. For example, the increasing evolution of technologies such as machine learning, natural language processing, image recognition, deep learning, and a few others has made AIs more efficient, inexpensive, and scalable. Hence, retailers can implement advanced levels of artificial intelligence-based applications in automating processes, customer interaction, and improving business systems, among other functions.

For instance, KIQ Customer Assist employs advanced language models to give precise, conversational responses to client inquiries. Its code-free design enables simple deployment of chatbot routines, which transfer conversations to a dedicated human support staff for uninterrupted service.

Moreover, advances in AI technology enable retailers to provide personalized experiences, optimize processes, manage risks, and drive company development in a highly competitive retail environment. As AI evolves, its revolutionary influence on the retail business is projected to rise, resulting in more acceptance and innovation in the retail market.

- Rising use of AI-driven visual and voice search is contributing to the AI in retail market.

Virtual stores and e-commerce platforms are expanding quickly. Consumers can now search for new products using voice, video, and product images. Through query processing and metadata mining, AI in visual search maximizes its capabilities. The visual search engine improves the experience and engagement of customers by using AI features to analyze, track, and forecast emerging shopping trends.

Artificial Intelligence in retail can become more natural and impromptu with the growing use of digital tools. Retailers must now use AI-based search engines to improve customer service and increase revenue growth. Additionally, AI-powered searches help retailers make better business decisions by providing them with insightful information about consumer trends.

Artificial Intelligence (AI) in Retail Market Restraints:

- Lack of infrastructure and higher implementation costs hamper the market growth

To enhance customer interaction, major retail brand names spend significant amounts of money on the latest technology; nonetheless, certain factors are expected to hinder the market's growth. For instance, large corporations and global retailers such as Walmart have already deployed advanced AI technology to manage the operations of their online platforms and physical stores.

However, not all small and medium-sized enterprises and new business ventures can fully embrace the technology due to the lack of appropriate infrastructure and technical expertise. In addition, the high costs associated with implementing AI technology in retail solutions are another barrier that small businesses face. These factors are likely to slow the growth rate of artificial intelligence in the retail business.

Artificial Intelligence (AI) in Retail Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

North America is home to many leading technology companies and research institutions driving innovation in AI and retail, like Intel, Nvidia, and Accenture. These improvements aid in creating and using artificial intelligence in the retail industry.

Retailers in North America are employing AI technology to improve operations such as personalized advertising, customer service, inventory management, and price optimization. As this region is characterized by a buoyant retail industry, the presence of traditional retailers, e-commerce players, and brick-and-mortar shops, it offers a perfect ground for adopting AI to stay ahead of the competition in an ever-dynamic environment.

North America's vast customer data is critical for AI algorithms and predictive analytics, allowing merchants to create more personalized shopping experiences. The region's enabling environment, which includes venture capital investment, government initiatives, university research, and a trained workforce, fosters innovation and growth in the AI and retail industries.

Artificial Intelligence (AI) in Retail Market Key Developments:

- November 2025: Globant Releases Report on AI's Impact on Holiday Retail. Globant published "The Impact of AI on Holiday Retail in 2025," revealing how AI empowers intentional consumers by reshaping shopping habits, with recommendations to launch Q3 campaigns for early shopper engagement and value-driven content.

- November 2025: IGD Releases Global Retail Trends 2026 Report. IGD's report spotlights AI alongside retail media and waste reduction, noting AI's key role in the 2025 RTIH Innovation Awards for innovative developments in traditional and digital retail spaces.

- October 2025: BCG Discusses Agentic Commerce in Retail. BCG's report on "Agentic Commerce" notes that over half of consumers expect to use AI shopping assistants by end-2025, with GenAI traffic to US retail sites up 4,700% year-over-year, urging retailers to adapt to AI-controlled marketplaces.

- January 2024, Salesforce developed new customer-centric data and AI-based solutions to streamline the shopping experience. All retailers and marketing companies can understand customer behavior and preferences in real time by developing generative tools and integrating them into marketing and commerce clouds. They use this information to refine every customer interaction through AI.

- January 2024, in an attempt to enhance customer experience, drive more business, and minimize loss, Lenovo presented its fully open AI solutions for retailers and consumers across the board.

List of Top Artificial Intelligence (AI) In Retail Companies:

- Hitachi Solutions

- BYOB

- Intel

- Accenture

- Nvidia

Artificial Intelligence (AI) In Retail Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI In Retail Market Size in 2025 |

US$26.900 billion |

|

AI In Retail Market Size in 2030 |

US$134.040 billion |

| Growth Rate | CAGR of 37.88% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI In Retail Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in Retail Market Segmentation:

- By Deployment Type

- Cloud

- On-Premise

- By Technology

- Large language model

- Machine Learning

- Chatbots

- Others

- By Application

- Demand forecasting

- Recommendations

- Inventory management

- Sentiment analysis

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America