Report Overview

Global Indoor Air Quality Highlights

Indoor Air Quality Monitor Market Size:

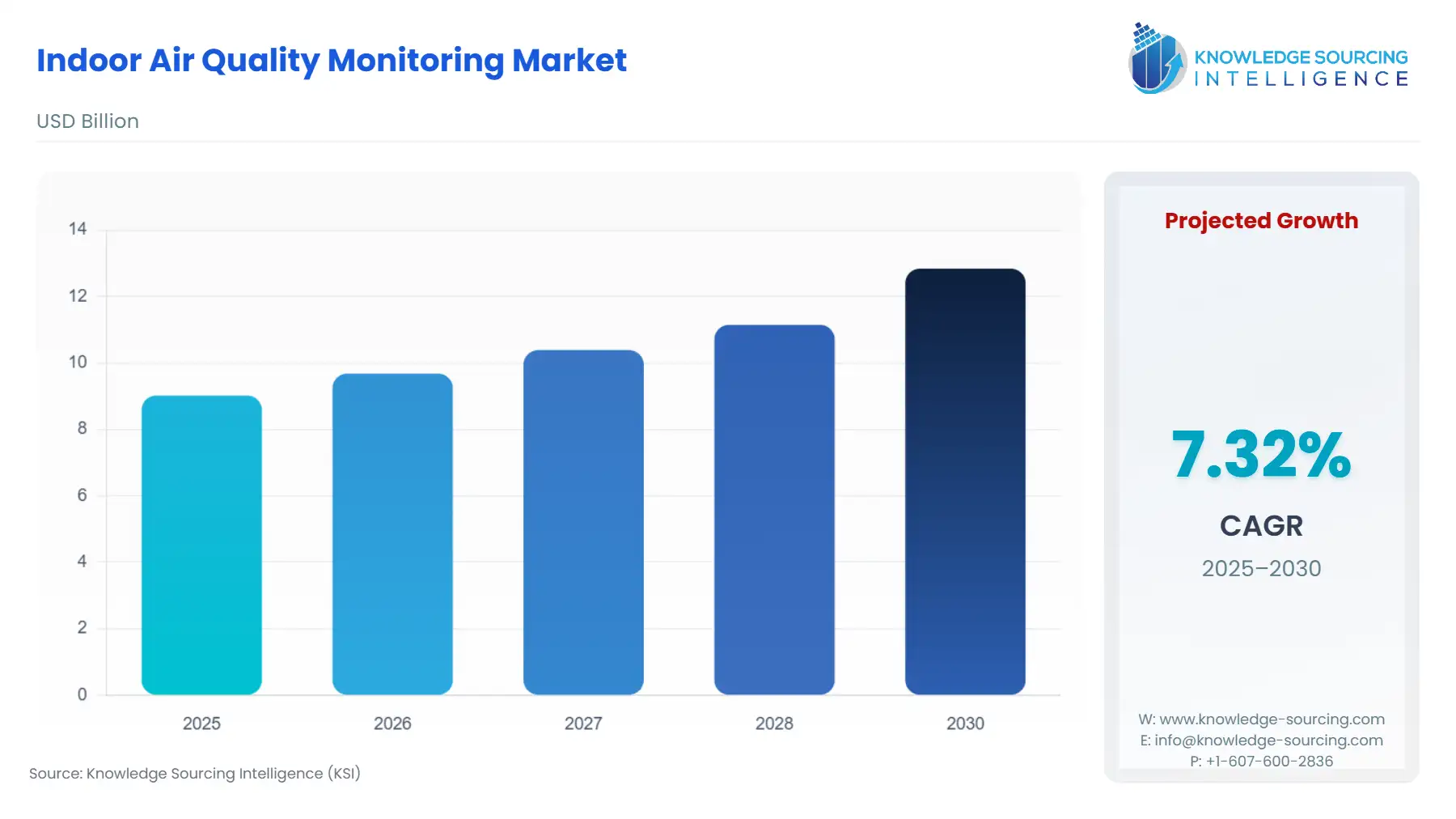

The Indoor Air Quality Monitoring Market will grow at a CAGR of 7.32% to reach US$12.84 billion in 2030 from US$9.02 billion in 2025.

The Indoor Air Quality (IAQ) monitor market consists of hardware systems—fixed and portable devices—designed to measure particulate, chemical, and biological pollutants. Demand originates from residential users, commercial operators, and industrial hygiene teams that rely on instrument-grade monitoring for compliance, operational resilience, and occupant safety. Regulatory tightening, episodic air-quality crises, and building-certification requirements continue to expand the installed base of devices. The analysis below examines demand conditions using only government, academic, trade-association, and official company newsroom information.

Global Indoor Air Quality Monitor Market Analysis

Growth Drivers

Demand grows primarily because regulatory and institutional frameworks increasingly require continuous verification of IAQ conditions. ASHRAE ventilation standards and U.S. EPA IAQ guidance push commercial and public facilities toward fixed monitoring systems that provide logged evidence of compliance. WHO air-quality guidance and national frameworks such as China’s GB/T standard raise expectations for pollutant measurement, encouraging developers and property managers to install monitors at handover and during occupancy. Wildfire smoke episodes and post-pandemic attention to airborne transmission have normalized the use of both portable and fixed devices for quick assessments and HVAC optimization. These drivers convert awareness into sustained procurement, particularly across commercial, healthcare, and education facilities.

Challenges and Opportunities

U.S. tariff treatment plays a limited but non-negligible role in procurement economics for indoor air-quality monitors. Most complete IAQ instruments and high-precision sensor modules enter under analytical-instrument tariff categories that historically have carried low or zero tariffs; consequently, import duty usually represents a small fraction of landed cost compared with sensors, optics, and calibration services. Tariff exposure therefore rarely suppresses overall demand directly, but classification risk and country-of-origin rules can shift cost competitiveness between overseas module suppliers and domestic assemblers. Procurement teams respond by optimizing bill-of-materials sourcing, qualifying alternate sensor vendors, and, where feasible, favoring assembly or final calibration domestically to reduce duty uncertainty and shorten lead times—measures that sustain demand for enterprise-grade fixed systems despite periodic component-market pressure.

Supply-chain constraints for MEMS, optical PM sensors, and electrochemical gas modules raise device manufacturing costs, creating procurement headwinds for price-sensitive buyers. Fragmented standards across jurisdictions—different guide values, pollutant lists, and testing methods—complicate vendor certification strategies and slow decision cycles. However, these constraints also generate opportunities: manufacturers that offer modular platforms and field-replaceable sensor heads can mitigate cost pressure and create recurring revenue from calibration and sensor replacement. Demand for enterprise data services—central dashboards, automated compliance reporting, and cloud-based diagnostics—is rising faster than device volumes, favoring companies capable of integrating hardware with validated analytics and regulatory reporting features.

Raw Material and Pricing Analysis

IAQ monitors rely heavily on optical particle counters (laser diodes, photodiodes, and optics), NDIR sensors, electrochemical gas cells, PCB assemblies, and specialized housings. Global tightening in the availability of laser diodes and precision optical components since 2023 has produced higher bill-of-materials costs and longer lead times, especially for PM2.5/PM10 modules. Manufacturers have responded by dual-sourcing components and emphasizing modular sensor cartridges to protect installed-base uptime while stabilizing pricing. Calibration gases and traceable laboratory reference instruments represent another recurring cost, typically internalized by large OEMs such as TSI and HORIBA. Pricing pressures encourage manufacturers to shift more value into calibration contracts and analytics subscriptions.

Supply Chain Analysis

The IAQ monitor supply chain spans sensor fabrication (primarily in East Asia and Europe), electronics assembly, and software integration. Logistics complexity arises from transporting calibrated optical assemblies, which require careful handling and customs clearance. Dependence on a limited number of sensor chip vendors introduces single-point vulnerabilities; OEMs mitigate this risk through buffer inventories and multi-vendor qualification. Certification demands—such as those governed by ASHRAE, UBA, or national standards—require local testing access, influencing where final assembly and calibration occur. Increasingly, the supply chain also includes cloud infrastructure and regional data-sovereignty compliance, which affect vendor selection in Europe, China, and the Middle East.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

ASHRAE Standards 62.1 / 62.2; U.S. EPA Indoor Air Quality guidance; OSHA guidance |

These frameworks push schools, healthcare facilities, and commercial buildings to use continuous IAQ monitoring to validate ventilation effectiveness and manage pollutant exposure. |

|

China |

GB/T 18883 Indoor Air Quality Standard; Ministry of Ecology and Environment |

National standards define pollutant thresholds and measurement parameters, driving procurement by developers and large property operators who must demonstrate IAQ compliance. |

|

Germany (EU) |

Umweltbundesamt Indoor Air Guide Values (AIR Committee) |

Strict occupational and public-health expectations compel buyers to use calibrated, reference-grade monitors, boosting demand for high-accuracy fixed systems. |

In-Depth Segment Analysis

Fixed (Product Segment)

Fixed IAQ monitors are installed in ceilings, walls, or HVAC systems to provide continuous pollutant measurement and building-level data integration. Demand for this segment is strongest in markets where compliance documentation and ventilation verification are mandatory or institutionally expected. ASHRAE-aligned building certifications, hospital environmental-control requirements, and commercial building ESG reporting all depend on persistent, timestamped IAQ data, which only fixed monitors can supply at scale. Buyers prioritize devices with robust calibration histories, high-accuracy NDIR and electrochemical sensors, and strong integration capabilities with building-management systems through BACnet or Modbus. These requirements favor established manufacturers with proven calibration chains and enterprise cloud platforms. Enterprise buyers also seek remote firmware updates, over-the-air diagnostics, and automated compliance reporting—features that reduce field maintenance and lower total cost of ownership. Fixed systems therefore play a central role in multi-building portfolios, supporting corporate risk management and tenant-health commitments. Vendors such as TSI and Honeywell have strengthened their competitiveness by offering modular multisensor platforms and integrated data reporting solutions.

Commercial (End-User Segment)

The commercial sector—including offices, hospitals, universities, retail, and hospitality—represents the largest structured demand base for IAQ monitors. These facilities face regulatory, reputational, and operational imperatives to maintain demonstrably safe indoor environments. Continuous IAQ data is essential for ventilation optimization, infection-control strategies, and meeting environmental health expectations tied to certifications. Hospitals procure high-accuracy units with validated calibration histories to support infection-prevention programs and HVAC validation. Large office owners use IAQ data to differentiate properties, retain tenants, and meet ESG disclosure requirements. Retail and hospitality operators adopt monitors to ensure compliance with local IAQ guidelines—particularly in markets such as the UAE and Germany where standards are explicit. Episodic hazards like wildfire smoke and urban smog increase demand for both fixed verification systems and portable units used to validate filtration efficiency, making commercial buyers repeat purchasers. This segment rewards vendors offering interoperable solutions, enterprise dashboards, and strong service packages.

Geographical Analysis

United States

Demand is shaped by ASHRAE ventilation standards, EPA IAQ guidance, and increased awareness of wildfire smoke infiltration. Compliance-driven institutions—schools, federal buildings, hospitals—favor calibrated fixed monitors integrated with reporting dashboards. Procurement increasingly prioritizes proven calibration chains and compatibility with U.S. building-automation standards.

Brazil

Brazil’s Ministry of Health Ordinance 3,523 establishes IAQ obligations for public and large air-conditioned environments, creating steady demand among hospitals, universities, and commercial buildings. Budget sensitivity shifts purchasing toward selective deployment in high-risk areas, though healthcare facilities maintain stronger demand for certified devices.

Germany

The German Environment Agency’s indoor-air guide values and occupational health expectations push buyers toward high-accuracy, reference-grade systems. Industrial facilities, public institutions, and advanced commercial buildings favor devices with strong calibration documentation and local service support.

United Arab Emirates (Dubai)

Dubai Municipality’s IAQ Technical Guidelines, combined with intensive HVAC use due to climate conditions, drive demand for continuous monitoring in hospitality, commercial real estate, and new development projects. Buyers emphasize real-time reporting and system integration for energy-IAQ balancing.

China

China’s GB/T IAQ standards influence procurement by developers, education institutions, and large property managers. Many new commercial and residential buildings integrate IAQ monitoring during construction or commissioning, increasing demand for fixed multi-pollutant systems and locally supported calibrations.

Competitive Environment and Analysis

The competitive landscape includes Honeywell International Inc., HORIBA Ltd., TSI Incorporated, Aeroqual, Teledyne Technologies, 3M, Thermo Fisher Scientific, and Testo SE & Co. KGaA. Differentiation is driven by sensor accuracy, calibration pedigree, modularity, software platforms, and cloud-reporting capabilities.

TSI Incorporated

TSI positions itself as a leader in precision environmental and occupational monitoring. Its OmniTrak Solution uses modular sensor cartridges—covering PM, CO?, VOCs, formaldehyde, ozone, and ammonia—and integrates with the TSI Link platform for enterprise reporting. TSI’s strategy emphasizes calibration traceability and field-replaceable sensor modules to support institutional buyers.

HORIBA Ltd.

HORIBA’s AP-380 analyzer series (released January 2024) serves laboratory and continuous monitoring applications requiring reference-grade performance. HORIBA’s competitive strength originates from its analytical instrumentation expertise, appealing to buyers needing high-accuracy pollutant characterization.

Aeroqual

Aeroqual focuses on modular real-time gas and particulate monitoring systems used in indoor, ambient, and industrial hygiene applications. Its Ranger portable devices and AQS fixed systems support replaceable sensor heads and cloud reporting, making the brand strong among environmental consultants, remediation firms, and commercial facilities.

Recent Market Developments

June 2024 — Teledyne completes acquisition of Adimec. Teledyne finalized its acquisition of Adimec, enhancing imaging and instrumentation capabilities relevant to air-quality measurement platforms. (Teledyne official press release.)

May 2024 — TSI releases six new sensor modules for the OmniTrak Solution. New modules—including formaldehyde, ozone, and ammonia sensors—expand multi-pollutant monitoring capability. (TSI official newsroom announcement.)

January 2024 — HORIBA launches AP-380 analyzer series. HORIBA introduced the AP-380 series to address diverse air-quality analysis needs in laboratory and continuous monitoring applications. (HORIBA official press release.)

Indoor Air Quality Monitor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Indoor Air Quality Monitor Market Size in 2025 | US$9.02 billion |

| Indoor Air Quality Monitor Market Size in 2030 | US$12.84 billion |

| Growth Rate | CAGR of 7.32% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Indoor Air Quality Monitor Market |

|

| Customization Scope | Free report customization with purchase |

Global Indoor Air Quality Monitor Market Segmentation:

By Product:

- Fixed

- Portable

By Pollutant Type:

- Physical

- Chemical

- Biological

By End-User:

- Residential

- Commercial

- Industrial

By Geography:

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others