Report Overview

Antimony Mining Technology Market Highlights

Antimony Mining Technology Market Size:

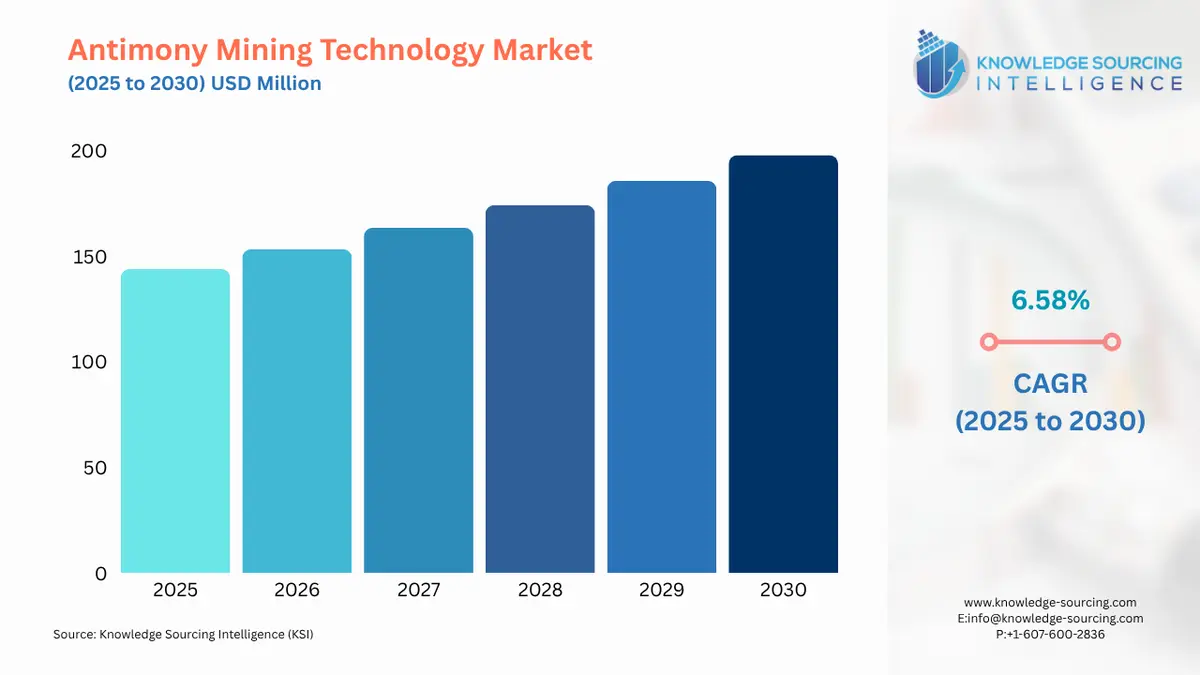

The Antimony Mining Technology Market is anticipated to grow at a CAGR of 6.58%, increasing to USD 197.836 million in 2030 from USD 143.869 million in 2025.

The antimony mining technology market develops as the global consumption of antimony for flame retardants, lead-acid batteries, semiconductors, and specialty alloys increases, so does the demand for more advanced, sustainable mining solutions. Therefore, apart from traditional extraction and smelting methods, these are gradually being replaced or complemented by modern technologies with a high emphasis on efficiency, environmental compliance, and cost optimization. Some of these key innovations include automation in drilling and blasting operations, as well as advanced mineral sorting systems supported by artificial intelligence and machine learning technologies. Other innovations include hydrometallurgical processes that significantly increase recovery rates but lower ecological footprints.

Antimony Mining Technology Market Overview & Scope:

- Technology Type: Artificial Intelligence and Digital Mining Solutions are the highest transformation sector the mining industry has seen. The implementation of digital techniques in mining is changing the whole industry with methods such as AI-powered mineral sorting that maximizes ore recovery and predictive maintenance that saves downtime. The use of machine learning algorithms to handle geological data is not only efficient but also profitable because it improves mine planning and lowers operational costs considerably.

- Application: Governments and international bodies are taking more stringent measures regarding water consumption, carbon emissions, and the handling of toxic waste. Therefore, Environmental Management is progressively given priority. Organizations implementing sustainable measures are turning to various technological solutions, such as water recycling, the use of tailings for management, the installation of a closed-loop system, and the use of emission control equipment to comply with the tightening regulations. These technologies are experiencing a rapid expansion in their use.

- Deployment Mode: Cloud-based and remote solutions utilize IoT, digital twins, and centralized monitoring systems to keep stakeholders updated about the state of the operations in real-time. These not only enable the prevention of breakdowns, better mine planning, as well as remote problem solving, but also save the trouble of being physically present at the site all the time. The move towards the cloud is gaining pace as it is more scalable, cost-effective, and has a major role in cutting down downtime.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East, Africa, and Asia-Pacific. Asia-Pacific is anticipated to hold the largest share of the market, and it will be growing at the fastest CAGR.

Top Trends Shaping the Antimony Mining Technology Market:

-

Transition to AI Integration and Digital Mining

- The most notable trend is the increasing use of artificial intelligence, machine learning, and digital platforms in antimony mining. The application of AI in mineral sorting, digital mine designing, and the use of predictive maintenance tools have made it possible for mining corporations to maximize the recovery of ore whilst maintaining the operations at a lower downtime. Besides this, the industry is turning to digital twins and cutting-edge data analytics for mining simulations, resource estimations, and risk minimization.

-

Utilizing Cutting-Edge Prospecting Technologies to Explore Untapped Reserves

- Mining companies are now looking into geophysical surveys, remote sensing, and satellite-based tools to find new antimony reserves in Africa and Latin America, as the easily accessible antimony reserves are running out. These modern prospecting methods are not only cutting down exploration costs but also making it possible to find reserves in the areas that were once considered inaccessible.

Antimony Mining Technology Market Growth Drivers vs. Challenges:

Drivers:

- Cooperation Between Technology Providers and Mining Companies: Another developing trend is the connection between mining companies, equipment makers, and technology firms. Mining companies are teaming up with providers of digital solutions, manufacturers of robots, and environmental engineers to produce mining solutions. The cooperation between these different industries is facilitating the pace of the use of technology in the antimony mining sector.

- Robotics and Automation in Mining Activities: Among the factors that contribute to the rapid growth in the adoption of robotics and automation are increasing shortages of labor, rising safety concerns, and the need for efficiency. The use of automation in the mining industry has led to a significant reduction in human risk as robots replace humans in dangerous underground areas. At the same time, operational speed and accuracy are being improved. Such a trend also alleviates the company from the potential, i.e., labor costs over a long period, and moreover, increases production stability.

Challenges:

- High Operating and Capital Expenses for Advanced Mining Technologies: One of the greatest issues with the implementation of modern technologies in mining is the big initial investment that is necessary for all kinds of mining, such as automation, AI sorting systems, IoT-enabled equipment, and cloud integration. A majority of small and medium mining enterprises, notably those situated in less developed areas, find it hard to upgrade their equipment with such technologies. Besides that, there are operational costs that accompany the use of sophisticated equipment, which include paying for the staff, training, and the transportation of the technology that puts additional strain on the finances of the company. Such a scenario limits the extent to which the company can be used, especially in a market highly sensitive to cost.

- Insufficiently Skilled Personnel for Cutting-Edge Technologies: The change to digital mining, automation, and AI has to do with the workforce, which should be very skilled in carrying out, supporting, and solving the problems of advanced technologies. Nevertheless, in many mining areas, especially in those of the developing countries, there is a big lack of qualified people for the mining industry. This lack of skilled workers is a brake on moving from mining with traditional methods to technology-based mining and creates a need for more external consultants or global technology partners.

Antimony Mining Technology Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific area is crucial to the global antimony mining technology market because it not only controls production but also fuels demand from important downstream sectors like energy storage systems, alloys, flame retardants, and semiconductors.

- China: China's mining industry has been allocating resources towards the use of digital ore sorting technologies, environmentally friendly smelting procedures, and more stringent adherence to environmental regulations with the aim of cutting emissions and, at the same time, ensuring the continuity of the supply.

- Russia: Despite being largely linked with Europe, Russia is still a major player because of its natural resources in Siberia, and the company is slowly changing its way of doing things through technology and the use of hydrometallurgical processes.

Antimony Mining Technology Market Competitive Landscape

The market is fragmented, with many notable players, including Sandvik Mining and Rock Technology, Epiroc AB, Caterpillar Inc., Komatsu Mining Corp, Hitachi Construction Machinery, Liebherr Group, Metso Outotec, FLSmidth, Tenova S.p.A., and Weir Group.

- New Product Launch: In August 2025, the next-generation bolter miner from Sandvik will be unveiled for longwall mining. Sandvik MB672 has the newest bolting technologies to lower the total cost of ownership, boost productivity, and enhance operator safety and ergonomics.

- Collaboration: In October 2024, AIM Intelligent Machines Inc. (AIM), a technology company that specializes in AI-enabled safety, productivity, and analytics for mining equipment, extended its partnership with Minerals Technologies Inc., a global specialty minerals company.

Antimony Mining Technology Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 143.869 million |

| Total Market Size in 2031 | USD 197.836 million |

| Growth Rate | 6.58% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology Type, Application, Deployment Mode, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Antimony Mining Technology Market Segmentation:

By Technology Type:

The market is analyzed by type into the following:

- Traditional Mining Techniques

- Hydrometallurgical Processes

- Automation & Robotics

- AI & Digital Mining Solutions

By Application:

The market is analyzed by application into the following:

- Ore Extraction

- Ore Processing & Refining

- Environmental Management

- Safety & Monitoring

By Deployment Mode:

The market is analyzed by deployment mode into the following:

- On-Site Mining Technology

- Cloud-Based & Remote Solutions

By Geography:

The study also analysed the global touch screen switches market into the following regions, with country level forecasts and analysis as below:

- North America (United States, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (United Kingdom, Germany, France, Italy, and Others)

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (Japan, China, India, South Korea, Taiwan, Thailand, Indonesia, and Others)