Report Overview

Application Security Market Report, Highlights

Application Security Market Size:

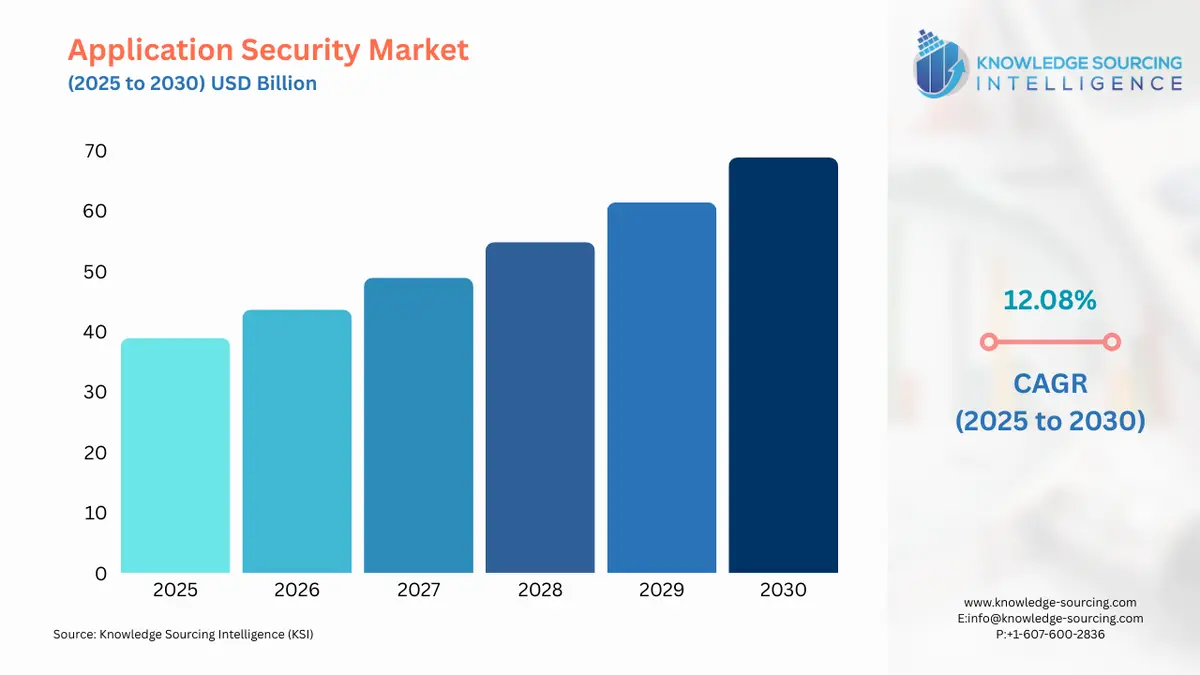

The Application Security Market is expected to grow from USD 38.928 billion in 2025 to USD 68.840 billion in 2030, at a CAGR of 12.08%.

Application security is a use of hardware, software, and procedural methods to protect application from external threats. The safety and security of information of customers is the primary concerns for organization which are investing heavily to secure the confidential information. Security systems for application operations including web and mobile applications, reduce the risks of security breaches. Nowadays, software applications are integral parts of any business environment, irrespective of the company's primary business operation. Every day, hackers hack an average of 30,000 websites. About 64 percent of corporations have been victimized by a cyber-attack. There is an attack somewhere on the Internet every 39 seconds. Malware is spread via email about 94% of the time. The Internet blocks an average of 24,000 malicious mobile apps every day. (Source: Comita.org). Because these software applications are frequently accessed by the network and thus susceptible to a variety of security threats, they have been a big concern to different organizations. As a countermeasure against threats from the outside, organizations secure the software used to run their business operations in order to safeguard their critical data, boosting the application security market growth.

Application Security Market Drivers:

- Growth in retail

Since the advent of e-commerce over two decades ago, retailers have come into contact with more information about their customers and can collect this information. Businesses that engage in retail and e-commerce manage large volumes of sensitive information, including credit card numbers and personal data. The volume of bad bot traffic to retail websites increased by 788% in October 2020 in connection with the launch of popular new gaming consoles and Black Friday sales. An attempt was made to promote a new criminal marketplace by leaking 1 million stolen credit card numbers on hacking forums recently. There are serious implications for online retailers. (Source: Compita.org). Hackers are increasingly targeting this data, which makes it more important to protect it. Due to the proliferation of connected devices including kiosks, point-of-sale (POS) systems, and handheld devices in physical stores, a vast amount of customer information has been generated. Software applications and services are evolving to deal with these threats so that retail businesses can keep their networks, data, applications, and endpoints secure (from malware or breaches). Cyber-attacks have caused huge revenue losses at nearly one out of three retailers, according to the Cisco 2017 Annual Cyber Security Report.

- Rising incidence of data breach

The global integration is complementing the growing era of digitalization where business of all sizes are increasingly reliant on digital data, cloud computing, and workforce mobility. In fact, the sensitive data is stored on local machines, enterprise database, and cloud servers where the possibility of breaching a company’s data has become relatively easier. Moreover, the number of mobile applications is also increasing rapidly on account of their ability to provide fast and effective communication and the growing ecommerce industry. The rising number of applications increases possibility of potential attacks. Thus, the application security has become absolute necessity for the organization as they expand their penetration in the market with increasing number of companies developing their own application, and as such the safety and security of confidential information and to maintain the reputation of the company is driving the global application security market.

Application Security Market Restraints:

- Return on investments and budget constraints are keeping companies from investing

Many enterprises leave thousands of applications susceptible because they do not extend their applications beyond business-critical functions, such as payment processing or ordering goods and services. Updates of unused, non-business-critical applications are not performed frequently enough, resulting in problems. Small and medium-sized businesses believe investing in these applications will be detrimental. This is because unutilized applications can lead to long-term security threats since they can be cracked easily and gain access to the IT infrastructure, irrespective of whether they are business-critical or rarely used. Additionally, 66% of internally developed applications are not tested for critical vulnerabilities due to low budgets or ignorance of the organizations, according to Veracode, a UK company. The application security market has been restrained by budget constraints and ROI.

Application Security Market Segmentation Analysis:

- The government sector will grow significantly in the market

By industry vertical, the application security market is segmented as government, communication and technology, retail, education, healthcare, BFSI, military and defense, and others. The rise in the velocity and aggressiveness of cyber-attacks in the government sector has increased the need to adopt application security solutions in order to protect privacy and maintain national security. The growth of e-commerce and the increased role of the Internet of Things (IOT) have further escalated the complexities in managing and securing vast amounts of data, multiple cloud environments, and internet-connected devices. The need for cybersecurity ranges from assessment of initial risk to emergency backup and recovery as the large set of information becomes susceptible to internal threats, such as disgruntled employees, and external threats such as malware, identity theft rings, hacktivists, and others. Several programs are being launched by the government to combat the increasing number of cybercrimes. For instance, the Cybersecurity National Plan (CNAP) adopted by the US aims to develop strategies to enhance cybersecurity awareness and protections, protect privacy, maintain public safety, as well as national and economic security.

The growth of electronic health care data and healthcare portals has increased the rate of cybercrimes in the healthcare sector, thereby increasing the demand for application security solutions. Additionally, the application security solutions are extensively used in other sectors like government agencies, retail, financial organizations, and education, among others. Thus, the mounting new threats to various industries are expected to drive the market growth during the forecast period. Various government regulations are being launched globally to safeguard the integrity and availability of data, networks, and systems.

Application Security Market Geographical Outlook:

- North America will witness significant growth in the application security market

North America is one of the leading regions in the number of breaches. This region suffered 772 incidents of data breaches, accounting for nearly 79% of the total breaches globally. With 728 incidents of data breach in the United States, 40 in Canada, 2 in Mexico, and 2 in Panama, about 389 million records were exposed, which was nearly 70% of the total records breached worldwide. The presence of a large number of data centers in this region and stringent regulations regarding data security are two of the major factors driving the demand for application security solutions.

The U.S has the Health Insurance Portability and Accountability Act (HIPAA), which aims at the protection of health-related data, and the Sarbanes-Oxley Act, which governs the protection of financial data, and many other regulations for the protection of various types of data managed by organizations. Depending on the market, the companies are required to meet certain security standards to avoid any legal and financial consequences. For instance, the Payment Card Industry Data Security Standard (PCI DSS) governs the transactions and the storage and handling of financial data of the customers. This scenario is fueling the adoption of advanced application security solutions among organizations in this region. Rise in industries like BFSI, healthcare, aerospace and defense, and many others in this region is also supporting the growth of this market by fueling the adoption of these solutions by the companies to gain customer trust and prevent any loss due to data breach. As the demand for these solutions continues to increase, many new players are expected to enter the market. Availability of a good number of solutions and service providers, and increasing expenditure by the government on cybersecurity will continue to fuel the market growth of application security solutions in this region over the projected period.

Application Security Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 38.928 billion |

| Total Market Size in 2031 | USD 68.840 billion |

| Growth Rate | 12.08% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Deployment Model, Solution, Industry Vertical, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Application Security Market Segmentation:

- By Deployment Model

- On-Premise

- Cloud

- By Solution

- Web Security

- Anti-Virus

- Anti-Theft

- Data Backup and Recovery

- IAM and Authentication

- Others

- By Industry Vertical

- Government

- Communication and Technology

- Retail

- Education

- Healthcare

- BFSI

- Military and Defense

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Others

- Middle East and Africa

- Turkey

- Egypt

- South Africa

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- Others

- North America