Report Overview

Automotive Fabric Market - Highlights

Automotive Fabric Market Size:

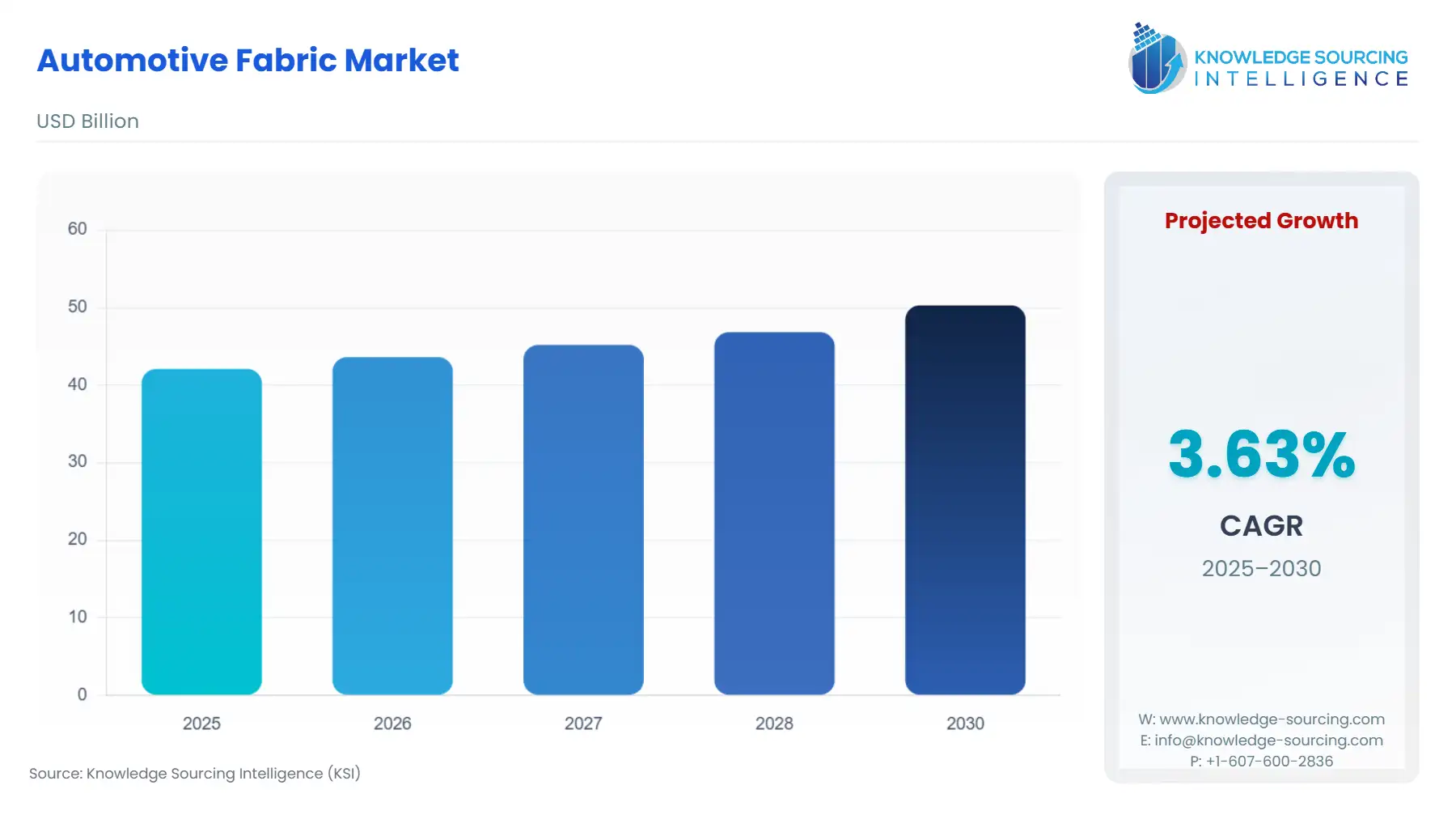

The automotive fabric market is forecasted to rise at a 3.52% CAGR, reaching USD 51.803 billion in 2031 from USD 42.090 billion in 2025.

The global automotive fabric market constitutes a fundamental component of the automotive interior ecosystem, encompassing all textile materials used in seating, headliners, carpeting, side panels, and safety components. This mature but technologically evolving market is currently undergoing a profound transformation, moving beyond traditional requirements of durability and aesthetics to address the complex imperatives of vehicle electrification (lightweighting) and evolving regulatory standards (Vehicle Interior Air Quality, or VIAQ). The demand dynamic is no longer solely tied to the volume of vehicle production but is increasingly dependent on the mix of vehicle types, specifically the surging adoption of Electric Vehicles (EVs) and the concurrent rise of sophisticated digital cabin experiences. This shift mandates a focus on next-generation materials that offer high recyclability, superior acoustic performance, and enhanced comfort features, compelling the value chain—from fiber producers to Tier 1 interior suppliers—to engage in rapid material innovation and regional capacity adjustments.

Automotive Fabric Market Analysis:

Growth Drivers

The primary factor propelling the market is the automotive industry’s lightweighting imperative, a direct consequence of the electric vehicle transition. To maximize EV battery range, manufacturers require interior components—including all fabrics, liners, and carpets—to demonstrate superior strength-to-weight ratios. This creates substantial demand for non-woven materials and technical textiles, which offer reduced mass compared to traditional woven structures for applications like NVH insulation and trunk liners. Simultaneously, the global adoption of increasingly strict government standards on Vehicle Interior Air Quality (VIAQ), which limit Volatile Organic Compound (VOC) emissions, drives a demand for low-monomer and water-based finished fabrics, forcing a technological upgrade across the synthetic fabric supply chain. Finally, the strategic impact of US tariffs on chemical and textile imports inadvertently acts as a catalyst for regional growth by incentivizing major Tier 1 and fabric manufacturers to establish or expand production capacity in North American and European free trade zones to stabilize the supply of cost-effective, tariff-neutral interior materials for local automakers.

Challenges and Opportunities

The primary constraint facing the market is the volatility of petrochemical feedstocks, directly impacting the pricing and supply of key raw materials like Polyester and Nylon fibers, which introduces pricing instability for end-product manufacturers. Furthermore, meeting the evolving global flammability and safety standards (e.g., FMVSS 302 and stricter EV-related fire-resistance norms) presents a technical challenge, requiring significant investment in specialized polymer blends and chemical finishes. This challenge, however, concurrently creates a clear opportunity for companies specialising in sustainable and recycled fabrics. The demand for certified, recycled polyester (rPET) derived textiles is experiencing exponential growth, driven by automaker commitments to circular economy models. This allows manufacturers to capture a premium for materials that demonstrably reduce a vehicle’s carbon footprint while satisfying stringent performance and durability specifications required for heavy-use, ride-sharing, and autonomous vehicle fleets.

Raw Material and Pricing Analysis

The cost structure of automotive fabric is critically dependent on the price movements of key synthetic commodity fibres: Polyethene Terephthalate (PET) for Polyester and Caprolactam for Nylon 6. These raw materials are direct derivatives of the global petrochemical market, meaning price fluctuations are immediately transmitted through the value chain. Polyester dominates the market due to its cost-effectiveness, durability, and versatility. The cost of finished fabric is further defined by speciality chemicals for dyeing, fire retardancy, and antimicrobial treatments. The shift toward sustainable materials introduces a bifurcated pricing dynamic; recycled PET (rPET) and bio-based fibres command a premium due to their complex sourcing, higher processing costs, and the need for certified traceability, which offsets the inherent price advantages of commodity-grade virgin fibres. The necessity to adhere to low-VOC standards limits the use of cheaper, solvent-based finishes, effectively increasing the overall material cost for regulatory compliance.

Supply Chain Analysis

The automotive fabric supply chain is vertically integrated and globally distributed, characterised by three major tiers. Tier 3 encompasses the commodity suppliers of polymer chips (PET, Nylon) and speciality chemical producers. Tier 2 consists of fibre extrusion, weaving/knitting/non-woven production, dyeing, and finishing operations, heavily concentrated in cost-competitive regions like Asia-Pacific (China, India, and Vietnam) and Turkey. Tier 1 fabric suppliers, such as Lear’s Guilford Performance Textiles or Seiren, procure bulk materials, conduct final processing, and deliver cut-and-sewn covers and integrated components to the Original Equipment Manufacturers (OEMs). Logistical complexities stem from the JIT (Just-In-Time) delivery model required by OEMs and the sensitivity of textile materials to shipping conditions. The pronounced dependence on Asian production for base materials creates a significant dependency, making the supply chain vulnerable to geopolitical trade friction and shipping rate volatility.

Automotive Fabric Market Government Regulations

Key government regulations are fundamentally altering the chemical composition and performance specifications for automotive fabrics globally.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | FMVSS 302 (Flammability of Interior Materials) | Mandatory baseline for all interior fabric burn resistance. Drives consistent demand for flame-retardant finishes and materials across all vehicle types, particularly non-woven backings and carpet materials. |

China | GB/T 27630 (Guide for Air Quality Assessment of Passenger Cars) | Sets strict limits on eight specific Volatile Organic Compounds (VOCs), including formaldehyde and acetaldehyde. This mandates a direct shift in material demand toward low-emission synthetic fibers and solvent-free adhesive systems for lamination, severely penalizing traditional, higher-VOC materials. |

European Union | REACH Regulation (Registration, Evaluation, Authorisation and Restriction of Chemicals) | Controls the use of hazardous substances in all materials, including chemical dyes and finish additives. Forces suppliers to reformulate products, leading to a long-term demand for less toxic, certified chemical treatments and bio-based alternatives. |

Automotive Fabric Market Segment Analysis

Woven Fabric Segment Analysis

The Woven fabric segment remains foundational, driven primarily by its application in highly visible interior areas such as seating upholstery, which demands superior tensile strength, abrasion resistance, and aesthetic versatility. Unlike non-woven structures, the inherent complexity of woven patterns allows for sophisticated three-dimensional designs and diverse haptic qualities that are critical for premium and luxury vehicle segments. The demand for woven materials is further compounded by the introduction of intelligent textiles, where conductive yarns are interwoven to create smart surfaces for functions like capacitive sensing, heating, and ambient lighting, particularly in next-generation electric and autonomous vehicles. This trend directly increases the per-vehicle fabric value, as the material must satisfy both traditional durability requirements (e.g., pilling and crocking standards) and complex electrical integration specifications. Manufacturers who leverage advanced weaving techniques like jacquard or dobby looms to create integrated aesthetic and functional features are best positioned to capture this high-value demand.

Upholstery Application Segment Analysis

The demand for fabrics in the Upholstery application is experiencing a qualitative pivot, shifting from a focus on cost efficiency to a premium on experiential quality, largely due to the convergence of electrification and autonomy. As the vehicle transforms into a third-living-space, the primary driver is the demand for Enhanced Cabin Durability and Hygiene. High-mileage fleets, ride-sharing services, and family vehicles require upholstery that can withstand intensive use cycles, necessitating a higher specification for tear strength and stain-release finishes. This creates a specific demand for technical synthetics and artificial leathers (like Seiren’s QUOLE®) offering superior cleanability and chemical resistance. Furthermore, the absence of engine noise in EVs amplifies the need for acoustically optimised upholstery to improve perceived comfort and sound quality, stimulating demand for multi-layer textile composites with integrated acoustic backing foams and high-loft non-woven layers to mitigate residual road noise transfer.

Automotive Fabric Market Geographical Analysis

US Market Analysis (North America)

The US market for automotive fabrics is characterised by a dual-pronged demand profile: a strong, sustained need for high-volume, cost-effective fabrics for high-selling Light Duty Trucks and SUVs, and a rapidly escalating demand for specialised materials for domestic EV production. The CAFE standards (Corporate Average Fuel Economy) push all OEMs to favour lightweight materials, directly boosting demand for acoustic nonwovens and lightweight Polyester yarn technology. The key local factor is the regulatory environment: state-level environmental mandates, sometimes stricter than federal, enforce rigorous VIAQ compliance, making low-VOC-certified products an absolute market entry requirement. The geopolitical trade environment also matters: recent US tariffs on textile and chemical imports from specific regions create a cost disadvantage for non-local production, stimulating investment and demand for local US-Mexico-Canada (USMCA) supply chain fabrics.

Brazil Market Analysis (South America)

Demand in the Brazilian automotive fabric market is primarily anchored to the cost-sensitive Passenger Vehicle segment and the robust local production of flexible-fuel vehicles. The local factor driving demand is the need for durability in extreme climates. High-heat and high-humidity conditions necessitate fabrics with enhanced UV resistance, colourfastness, and anti-mildew treatments, which often elevate the specification for Polyester and Nylon. Furthermore, a focus on localised supply chains, supported by government initiatives for domestic content, creates a preference for fabric manufacturers who operate local manufacturing and finishing plants. Demand for premium materials remains concentrated in the limited but expanding luxury import segment, while the mass-market prioritises basic, durable woven or vinyl materials.

German Market Analysis (Europe)

The German market is defined by a relentless demand for premiumization and functional integration, driven by the high concentration of luxury and performance vehicle OEMs. Local demand is critically influenced by the EU’s Green Deal policies and the stringent VDA-278 standard for non-metallic automotive materials, which severely restricts the chemical composition to ensure ultra-low VOC emissions. This regulatory pressure generates a specific demand for high-value technical fabrics: natural fibres (e.g., wool blends), certified recycled materials (rPET), and highly engineered synthetic textiles that are non-toxic, lightweight, and demonstrably sustainable, enabling German automakers to meet their self-imposed sustainability and luxury quality benchmarks.

South Africa Market Analysis (Middle East & Africa)

The South African automotive fabric market serves as a critical export hub for global OEMs leveraging the Africa Growth and Opportunity Act (AGOA) trade benefits. Local demand is characterised by a strong emphasis on economic durability and vehicle utility. Fabrics must perform under severe road conditions and high temperatures, leading to a baseline demand for rugged, easily maintained materials like Vinyl and robust Nylon-based weaves, particularly for the Commercial Vehicle sector. The main local factor influencing fabric demand is the significant presence of manufacturing and assembly plants that require reliable, quality-certified fabric suppliers who can adhere to the global manufacturing standards of international car groups while maintaining competitive localised pricing.

China Market Analysis (Asia-Pacific)

China represents the world’s largest and most dynamic automotive fabric market, with demand driven by its enormous domestic vehicle production and the global-leading penetration of New Energy Vehicles (NEVs), including Battery Electric Vehicles (BEVs). The dominant demand factor is the strict enforcement of the GB/T 27630 VIAQ standard, which has effectively accelerated the adoption of low-VOC materials across all vehicle platforms, surpassing the speed of adoption in other regions. This mandate compels all suppliers to invest in advanced finishing processes. Furthermore, the intense competition among local EV manufacturers is generating a massive demand for visually and technologically advanced fabrics that offer aesthetic differentiation, such as high-definition digital printing (Viscotecs® technology) and integrated smart functionality, pushing the rapid commercialisation of premium woven and technical non-woven textiles.

Automotive Fabric Market Competitive Environment and Analysis

The global automotive fabric market exhibits moderate concentration, with Tier 1 suppliers controlling a significant share of the value-added (cutting, sewing, and assembly) and working closely with OEMs, while a fragmented group of specialised textile mills and chemical companies forms the upstream base. Key competitive differentiators include vertical integration (from yarn to final seat cover), intellectual property in digital printing and surface finishing, and a globally decentralised manufacturing footprint that mitigates geopolitical risks. The competitive landscape is shifting from pure cost rivalry to one centred on material innovation in sustainability (rPET, bio-based), lightweighting, and functional intelligence (integrated sensors).

Company Profile: Lear Corporation

Lear Corporation, a global technology leader in Seating and E-Systems, strategically leverages its Guilford Performance Textiles subsidiary to maintain a vertically integrated material supply. This allows Lear to exercise rigorous control over fabric quality, design, and cost, directly translating to superior performance in its main product: complete seating systems. Lear's strategic positioning is focused on sustainable innovation and thermal comfort. Key products and verifiable details include its innovative ReNewKnit, a premium, fully recyclable warp-knitted fabric designed to reduce the component’s end-of-life environmental impact. Another core product is its advanced seating technology portfolio, including ComfortMax Seat™, which integrates thermal comfort features directly into the fabric trim cover, a verifiable technology launching in select General Motors (GM) vehicles during the second quarter of 2025. This vertical and functional integration provides a competitive moat against pure-play textile suppliers.

Company Profile: Seiren Co. Ltd

Seiren Co., ltd, a Japanese textile and chemical processing specialist, differentiates itself through proprietary, high-value-added finishing technologies. Its strategic positioning focuses on transferring its textile expertise to create high-performance automotive interior surfaces that directly address the premium and functional needs of next-generation vehicles. The core of Seiren's competitive advantage lies in its Viscotecs® digital production system, which enables small-lot, quick-delivery, and inventory-free customisation of surfaces, a critical capability for personalised and limited-edition vehicle lines. A key verifiable product is QUOLE®, an advanced artificial leather surface material designed to surpass genuine leather in terms of durability, sustainability, and aesthetic versatility while mitigating the volatile organic compound (VOC) emissions associated with traditional synthetics. Seiren's sustained investment over the next three years, including a total investment of 30 billion yen for seat materials for next-generation vehicle models (BEV, HEV, and PHEV) and integrated airbag production, validates their commitment to functional fabric growth.

Company Profile: AUNDE Group SE

AUNDE Group SE, headquartered in Germany, is a globally active systems supplier for textile surfaces, seating systems (Isringhausen), and interior modules (Fehrer). AUNDE's strategic positioning emphasises vertical depth and sustainability leadership, controlling the entire process from in-house yarn production to the finished seat cover assembly. This integrated approach ensures consistent quality and fast response times for major European and global OEMs. The company's verifiable product focus centres on sustainability, with product lines like TexBlue (recycled material) and TexGreen (textiles made from renewable raw materials) already in series production. A significant strategic development underscoring this focus is the contractual agreement signed in October 2025 with PreZero for the joint development of an innovative textile recycling plant aimed at producing high-quality recycled polyester granules from polyester-containing textile waste, securing a closed-loop supply for their European operations.

Automotive Fabric Market Developments

October 2025: AUNDE Group and PreZero Partner on Recycling

AUNDE Group SE and PreZero, a major environmental service provider, signed a contractual agreement in October 2025 to jointly develop and operate a state-of-the-art textile recycling plant. The core purpose of this cooperation is to establish a closed-loop system for polyester-containing textile waste, specifically generating high-quality recycled polyester granules. This development directly addresses the automotive industry’s imperative to incorporate traceable, circular-economy-compliant materials into vehicle interiors, securing AUNDE’s supply of sustainable raw materials and further establishing its position as a vertical integration leader in Europe.

February 2025: Lear Corporation Launches ComfortMax Integration

Lear Corporation reported on February 6, 2025, that it is integrating its innovative ComfortMax Seat™ technology into select General Motors (GM) vehicles, with the launch scheduled for the second quarter of 2025. This commercial application is significant as it represents the industry’s first incorporation of thermal comfort technologies—beyond simple heating—directly into Lear’s trim covers (the automotive fabric component). This product launch demonstrates the tangible shift toward functional fabrics, where the textile surface becomes an active part of the vehicle’s E-Systems, driving a demand for textiles that can withstand integrated electronic components and specialised thermal laminates.

Automotive Fabric Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 42.090 billion |

| Total Market Size in 2031 | USD 50.295 billion |

| Growth Rate | 3.63% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Fabric Type, Vehicle Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Fabric Market Segmentation:

By Product Type

Woven

Non-Woven

Others

By Fabric Type

Synthetic

Polyester

Nylon

Vinyl

Others

Natural

By Vehicle Type

Passenger Vehicles

Commercial Vehicles

Light Duty

Heavy Duty

By Application

Upholstery

Flooring

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others