Report Overview

Global Fuel Filters Market Highlights

Fuel Filters Market Size:

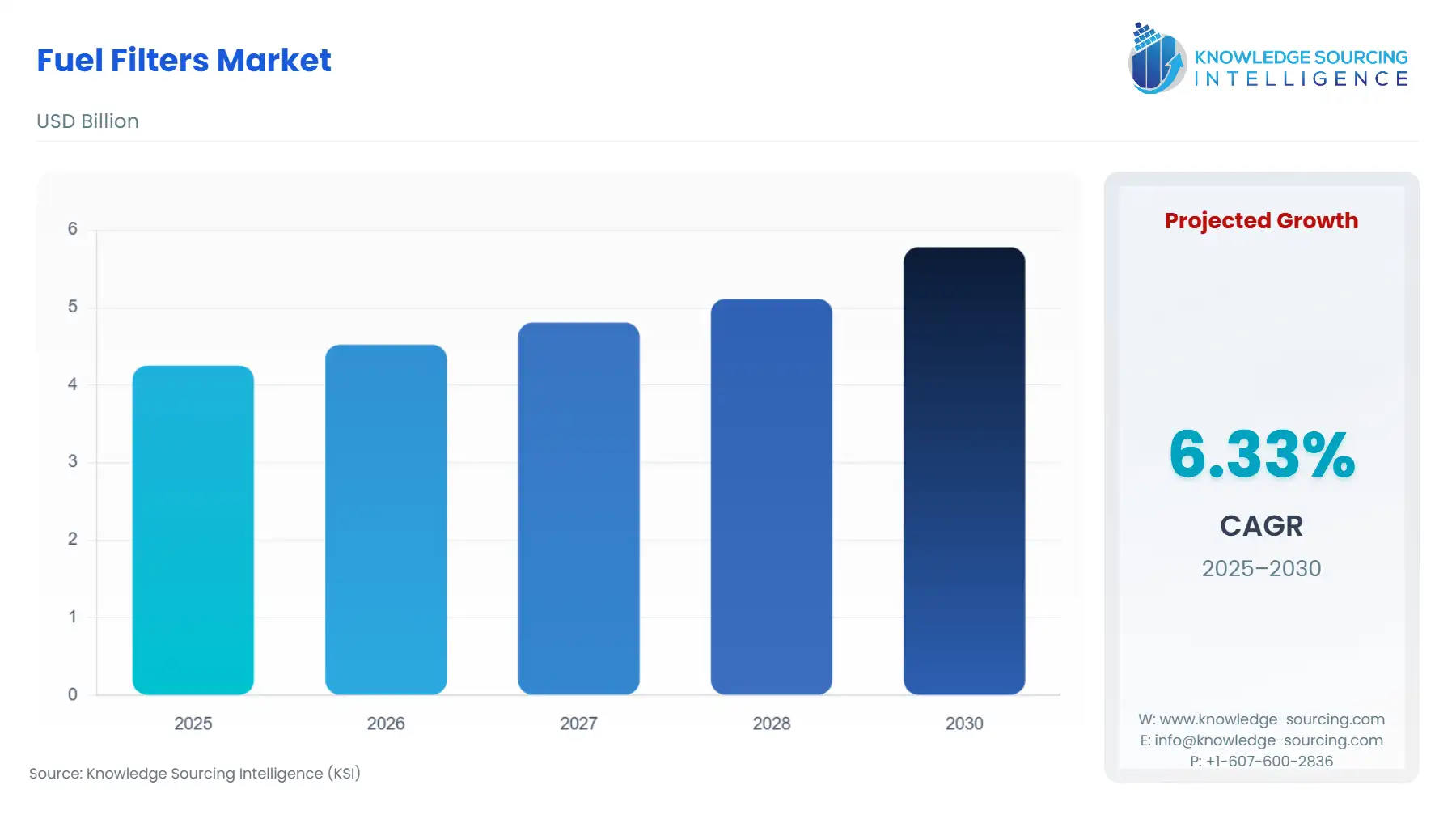

Global Fuel Filters Market, with a 6.33% CAGR, is projected to increase from USD 4.253 billion in 2025 to USD 5.780 billion in 2030.

A fuel filter is a filter that helps to remove foreign materials from a fuel, such as any liquids or particles. The fuel filter is used to safeguard the parts of the fuel system, most internal combustion engines use a fuel filter. The fuel filter market will experience growth due to the significant expansion of the automotive industry and industrial manufacturing machinery. Additionally, regulatory agencies’ strict emission standards that apply to the automotive sector and growing environmental concerns are anticipated to fuel demand for fuel filters. The technological advancements and increased use of contemporary equipment and heavy engines necessitate the use of fuel filters for smooth operation which is boosting the fuel filter market growth during the forecasted period.

Fuel Filters Market Growth Drivers:

- The growing automotive industry will boost the market growth

In order to check for contaminants and particles in the fuel and remove them, fuel filters are utilized in automotive and manufacturing machinery applications. A fuel filter protects the engine's essential components by filtering out extraneous particles that could damage a fuel injector. Petrol and diesel are the most prevalent oils used in all sorts of cars, and they all require the use of a fuel filter to detect and remove pollutants so that the oil does not impact motor vehicles. The global fuel filter market will expand as motor vehicle manufacturing increases. According to the International Organization of Motor Vehicle Manufacturers OICA data, the world’s motor vehicle production has increased from 77,650,152 units in 2020 to 80,145,988 in 2021 which has shown a rise of 10% in the production rate. Furthermore, as per the same source, the world’s motor vehicle sales have increased from 78,774,320 units in 2020 to 82,684,788 in 2021 which has shown a rise of 5% in sales. Such a rise in production and sales in the automotive sector is expected to increase the use of fuel filters for purification which will boost the overall market growth.

The need for industrial fuel filters is a growing requirement for improving machinery effectiveness. Manufacturing industries are using industrial fuel filters more and more because they clean the fuel source. Additionally, fuel filters eliminate dust components like rust, pollen, and liquid droplets. In addition to cleaning, it improves efficiency and enhances motor performance. The increasing manufacturing industry production which uses machinery running on fuel requires fuel filters which will boost the overall market growth. According to the World Bank, China's manufacturing production in 2021 increased by 26.04% over the previous year to $4,865.83 billion China's manufacturing production in 2020 increased by 0.97% from 2019 to $3,860.68 billion. Rising production by industry leads to an increased usage of fuel for machinery which will boost the fuel filter market growth during the forecasted period.

Fuel Filters Market Geographical Outlook:

- During the forecast period, the Asia Pacific region will dominate the market

The global fuel filter market share will be dominated by the North American region. The aircraft fuel systems, injectors, and pumps need high-quality fuel for optimal combustion, and reduced emissions fuel filters are applied in the aerospace industry. The rising aircraft and automobile production will boost the market growth for fuel filters in the Asia Pacific region. According to the International Organization of Motor Vehicle Manufacturers (OICA), motor vehicle production in the Asia Pacific region has increased from 44,276,549 in 2020 to 50,020,793 in 2022, which shows an increase of 13% in vehicle production. In January 2023, according to the Civil Aviation Administration of China the Commercial Aviation Corp of China Ltd (COMAC), plans to establish an annual manufacturing capacity of 150 domestically made C919 planes in the next five years. The manufacturer of the C919 announced it has received over 1,200 orders for the plane. In April 2023, Airbus is working to increase production of its best-selling A320 single-aisle jet and boost sales in China. Airbus has agreed to create a second assembly line at its Chinese factory and has received approval from Beijing to proceed with 160 previously announced plane orders production. The increasing automotive production and development in the aerospace industry within the Asia Pacific region will boost the fuel filter market growth.

Fuel Filters Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.253 billion |

| Total Market Size in 2031 | USD 5.780 billion |

| Growth Rate | 6.33% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Fuel, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Fuel Filters Market Segmentation:

- GLOBAL FUEL FILTERS MARKET BY TYPE

- Inline Fuel Filter

- In-Tak Fuel Filter

- Spin-On Filter

- Cartridge Filter

- Others

- GLOBAL FUEL FILTERS MARKET BY FUEL

- Petrol

- Diesel

- GLOBAL FUEL FILTERS MARKET BY END-USER

- Automotive

- Aerospace

- Marine

- Others

- GLOBAL FUEL FILTERS MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America