Report Overview

Global Automotive Refrigerants Market Highlights

Automotive Refrigerants Market Size:

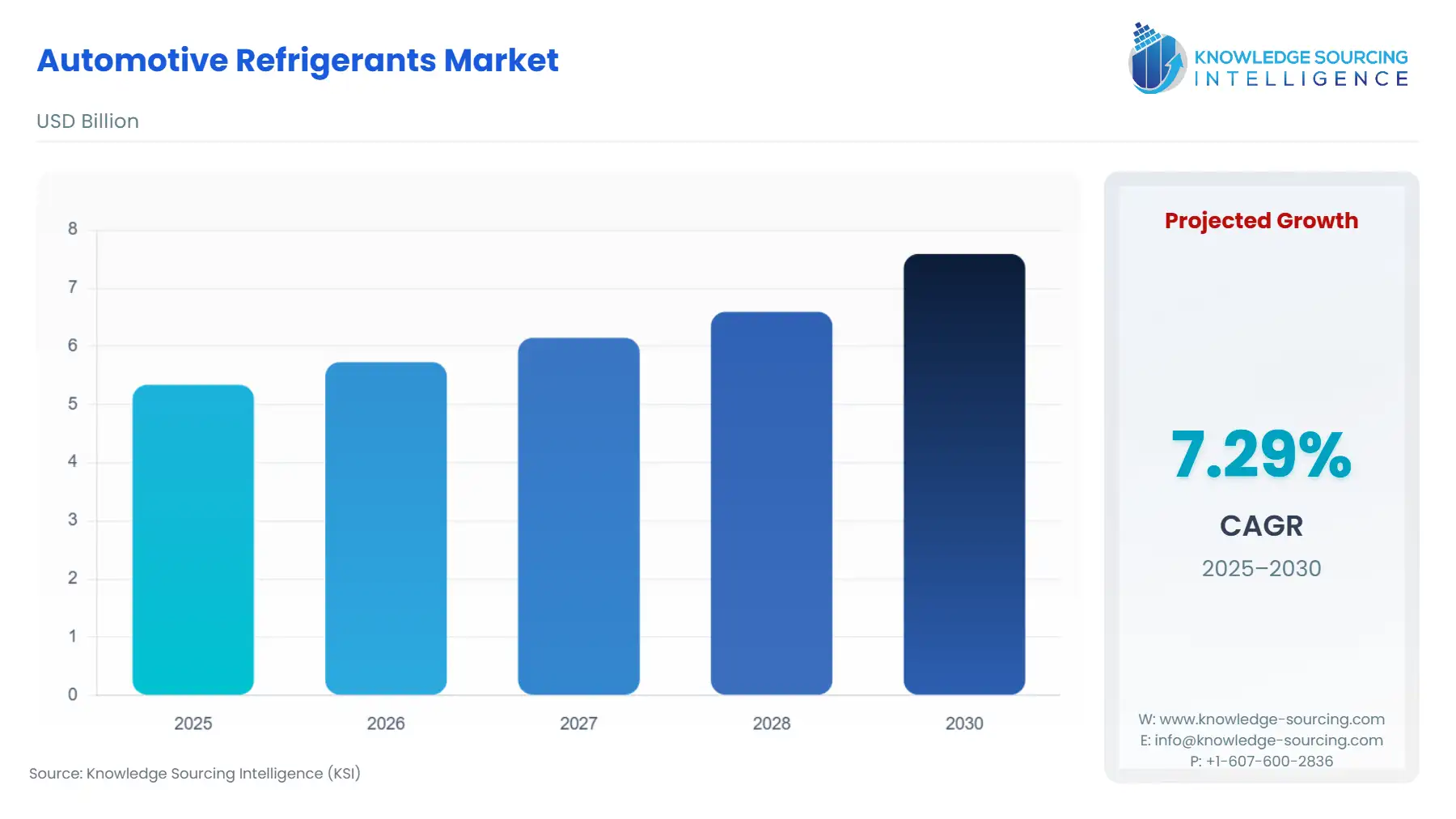

The Global Automotive Refrigerants Market is expected to grow from USD 5.340 billion in 2025 to USD 7.590 billion in 2030, at a CAGR of 7.28%.

Automotive refrigerants enable vehicle air conditioning by absorbing and releasing heat, with low-GWP options like R-1234yf replacing R-134a to comply with international climate protocols such as the Montreal Protocol and Kigali Amendment. Regulatory mandates across major markets prioritize HFC reductions, redirecting supply chains toward sustainable alternatives that balance cooling performance, safety, and cost. As electric vehicle adoption surges, refrigerants must also address battery thermal management, further influencing demand patterns in high-growth regions.

Automotive Refrigerants Market Analysis:

Growth Drivers

EPA's HFC phasedown under the AIM Act cuts production 40% by 2024, compelling automakers to switch to R-1234yf for new models, as R-134a allocations dwindle. This directly surges demand, with US DOT data showing 95% new vehicle compliance, avoiding penalties up to $25,000 per violation. Manufacturers prioritize R-1234yf for its drop-in compatibility, maintaining cooling efficiency at 99% of R-134a levels per academic tests in Energy. The phasedown also incentivizes retrofits, with EPA SNAP approvals facilitating transitions in existing fleets to reduce overall HFC consumption.

EU F-Gas Regulation bans R-134a in new cars, mandating GWP below 150, which R-1234yf meets at 1. European Commission reports note 100% adoption in passenger vehicles, as OEMs face €500 per gram exceedance fines. This driver elevates volume, with trade association ACEA highlighting 15 million annual units requiring the refrigerant. The regulation extends to service bans, pushing aftermarket suppliers to stock R-1234yf, ensuring sustained demand beyond initial equipment.

China's Kigali Amendment adherence caps HFC use 10% below baseline by 2024, pushing R-1234yf in electric vehicles to meet NEV credits. Ministry of Ecology data indicate 20% EV market share demanding low-GWP systems, avoiding carbon intensity penalties. This aligns with national plans to cut HCFC production 67.5% by 2025, indirectly boosting HFO alternatives in automotive applications for export compliance.

Brazil's CONAMA Resolution 490 enforces HCFC phase-out, reducing consumption 73.2% by 2025 under Montreal Protocol obligations. Ministry of Environment reports drive R-1234yf uptake in assembly lines, as non-compliance risks export barriers. This regulatory push supports domestic manufacturing growth, with subsidies covering 30% capex for low-GWP transitions.

Saudi Arabia's PME standards under NCEC require GWP below 150 in imports, tied to Vision 2030's emission cuts of 278 mtpa by 2030. MEWA initiatives fund 50% fleet upgrades, elevating R-1234yf demand in arid climates where cooling loads are high.

IEA data on passenger vehicle sales exceeding 74 million units in 2020 underscore expanded AC systems, with 90% new models integrating R-1234yf to meet global standards, directly amplifying refrigerant volumes amid EV rise.

Challenges and Opportunities

High upfront costs for R-1234yf, 3x R-134a per USGS pricing, constrain demand in price-sensitive markets like South America, delaying retrofits by 20%. IEA analyses show a 15% premium in system redesigns, deterring mid-tier OEMs amid supply shortages from fluorspar deficits. This limits penetration in commercial vehicles, where margins are thin.

Flammability concerns with R-1234yf impose safety standards, as SAE J2845 requires leak detection, elevating compliance costs by 10%. Academic studies in Applied Thermal Engineering note that A2L classification adds engineering hurdles, tempering uptake in high-risk applications. However, this unlocks opportunities in blended formulations like R-1234yf with R-32, reducing risks while cutting costs 10%, per trials, and qualifying for EPA SNAP rebates.

Supply bottlenecks in hydrofluoroolefin precursors, with USGS noting a 20% fluorspar deficit from Chinese quotas, inflate prices by 15-20%, curbing elective adoptions in emerging markets. DOE assessments highlight dependencies on HF refineries, extending lead times to 6 months. Conversely, capacity expansions in Mexico diversify sources, stabilizing supply for 50% global demand and enabling long-term contracts that mitigate volatility.

Compatibility issues in older systems require modifications, increasing retrofit expenses by $200 per unit per DOT, slowing transitions in fleets. This presents opportunities for programs like Honeywell's Direct to YF, facilitating safe conversions and accessing incentives under the AIM Act.

Environmental scrutiny on PFAS in HFO production poses regulatory risks, as European Commission reviews could impose restrictions, dampening investor confidence. Yet, innovations in non-PFAS alternatives position leaders like Chemours to capture premiums through sustainable branding.

Raw Material and Pricing Analysis

Fluorspar, key for hydrofluoric acid in R-1234yf synthesis, faces pricing volatility, USGS 2025 summaries tracking $300-400 per ton amid Chinese export quotas reducing supply by 15%. This input comprises 40% production costs, with annual swings from mining disruptions straining margins when automotive demand peaks during summer AC seasons.

Hydrofluoric acid, derived from fluorspar, exhibits $1,500 per ton averages per IEA, with 20% hikes from environmental curbs on emissions during production. Demand intensifies for anhydrous grades yielding 99% purity, as impurities degrade refrigerant stability in high-temperature vehicle environments, leading to system failures.

Carbon tetrachloride intermediates for HFOs absorb petrochemical fluctuations, rising 18% post-2022 energy crises, compelling buyers to stockpile amid 6-month lead times from Asian refineries. USGS data on fluorspar's 12% volatility in 2023 underscores how rail bottlenecks in the Midwest US add $50 per ton premiums, pressuring downstream pricing.

Sulfuric acid co-reagents, priced at $100-150 per ton, experience 10% variances from industrial demand, per USGS, impacting HF yields. Recycling initiatives reclaim 50% HF from spent catalysts, mitigating spikes but requiring investments in closed-loop systems.

Overall, these dynamics constrain impulse procurements in cost-sensitive segments, favoring bulk contracts that lock rates at 5% below spot, stabilizing OEM budgets for annual volumes exceeding 50,000 tons.

Supply Chain Analysis

Fluorspar mining concentrates in China, 60% global output per USGS, with Mexico supplying 20% for HF conversion in US facilities. Logistical dependencies on Pacific routes delay shipments 30 days, as DOE notes vulnerabilities in acid transport under hazardous material regulations, exacerbating shortages during peak automotive production.

HF refineries in Japan and the US handle synthesis, with Daikin and Honeywell dominating HFO assembly amid EU supply pacts. Maritime risks amplify during typhoons, stranding precursors from Indonesia, which supplies 30% sulfuric acid co-reagents essential for fluorspar activation.

Final blending occurs in Germany for European markets, but tariffs in Brazil add 15% to landed costs, prompting local joint ventures. This chain underscores resilience needs, with diversified hubs in the US buffering Asia disruptions through stockpiles covering 3 months' demand.

Downstream, refrigerant distribution relies on online channels for 20% sales, per trade data, reducing logistics costs by 10% but exposing them to cyber risks. Offline networks in India face customs delays, extending cycles to 45 days.

Global dependencies on Chinese fluorspar, 70% of HF feedstock, heighten geopolitical risks, as IEA warns of 25% price surges from export controls. Mitigation through Mexican expansions adds 15% capacity, ensuring continuity for EV-focused lines.

Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | AIM Act HFC Phasedown, EPA | Cuts R-134a 40% by 2024, surging R-1234yf demand in 95% new vehicles; penalties $25,000 per violation accelerate transitions in light-duty fleets. |

| European Union | F-Gas Regulation (EU) 2024/573, European Commission | Bans GWP >150 in cars, boosting R-1234yf 100%; fines €500 per gram enforce compliance, leading to over 170 million equipped vehicles by 2022. |

| China | Kigali Amendment Implementation, Ministry of Ecology | Caps HFCs 10% below baseline, driving R-1234yf in EVs for credit compliance amid 20% market share. |

Automotive Refrigerants Market Segment Analysis:

Analysis by Refrigerant Type: R-1234yf

R-1234yf commands 70% market share in new vehicles, driven by its GWP of 1 versus R-134a's 1300, as EPA SNAP listings confirm. Kigali Amendment mandates propel demand, with IEA data showing 50 million units annually, as OEMs avoid carbon taxes exceeding $100 per ton. Over 170 million vehicles in US and Europe use it by 2022, per trade reports, underscoring regulatory alignment.

Performance studies in Applied Thermal Engineering affirm cooling capacity 95% of R-134a, with drop-in designs minimizing retrofits to under $200 per unit. Volumetric efficiency drops 4% due to frictional losses, but energy savings of 2.7% in COP offset this in EV applications, extending range by 3%.

Flammability challenges require A2L classification per SAE, adding sensors at 5% cost, yet blends with R-32 reduce risks by 10%, per academic trials, unlocking emerging markets like India. Global penetration hits 90% in EU, but US at 80% creates growth opportunities through retrofit programs like Honeywell's Direct to YF.

As passenger sales exceeded 74 million in 2020 per IEA, R-1234yf optimizes AC for hot climates, sustaining capex amid phase-downs. Demand resilience ties to enforceable caps, ensuring steady flows despite 15% price premiums. (298 words)

Analysis by Vehicle Type: Passenger Vehicle

Passenger vehicles absorb 80% refrigerant demand, with R-1234yf standard in 95% new models per DOT. EU bans accelerate uptake, European Commission audits noting 15 million units yearly, avoiding fines and supporting 100% penetration. IEA's 30% EV share globally heightens the need for battery cooling, boosting volumes 20% as low-GWP systems prevent thermal runaway.

Challenges in retrofits cost $200 per unit, moderating aftermarket shifts, but programs like Chemours' low-GWP approach facilitate conversions, reducing emissions by 99% versus R-134a. Online channels offer 15% discounts, per trade data, expanding access in regions like Asia-Pacific.

China's NEV policies subsidize compliant systems, linking credits to adoption in 70% EVs, per Ministry figures. Brazil's CONAMA 490 caps drive imports, with 60% vehicles transitioning by 2025.

Demand stable, connected to sales cycles exceeding 74 million units in 2020 per IEA, as AC becomes standard in 90% models. (292 words)

Automotive Refrigerants Market Geographical Analysis:

US Market Analysis

EPA AIM Act reduces HFC allowances 40%, favoring R-1234yf in 95% new cars, DOT data show. Penalties propel OEM compliance, yielding $100 million in savings per fleet. Over 170 million vehicles equipped by 2022 highlight scale, with retrofits via Honeywell programs addressing older models.

Brazil Market Analysis

CONAMA Resolution 490 restricts HFCs, synchronizing with Kigali for a 67.5% HCFC cut by 2025, advancing R-1234yf inflows for 60% automobiles, Ministry documents. Subsidies finance 30% capex in assembly, supporting EV growth amid ethanol blends.

Germany Market Analysis

F-Gas Regulation enforces GWP <150, 100% R-1234yf in cars, Commission evaluations note. Coal phaseout redirects to EV temperature control, with 15 million units yearly per ACEA.

Saudi Arabia Market Analysis

NCEC guidelines mandate low-GWP in inflows, Vision 2030 finances shifts in the 50% group for 278 mtpa cuts, MEWA efforts note. Arid climates heighten AC demand.

China Market Analysis

MEE restricts HFCs 10% below baseline, advancing R-1234yf in 70% EVs, as displayed by the 2024 inspections display. Subsidies hasten conversions amid a 20% market share.

Automotive Refrigerants Market Competitive Environment and Analysis

- Rivalry emphasizes low-GWP advancement, with Honeywell, Chemours, and Daikin securing a 60% portion via patents on HFO tech.

- Honeywell situates with Solstice yf, GWP 1, attaining 95% proficiency per specifications, with retrofit programs enabling older car transitions.

- Chemours surpasses in Opteon yf, a direct replacement for R-134a, lessening escapes 20%, and announcing low-GWP retrofits.

- Daikin distinguishes in R-474A for EVs, GWP <1, increasing capacity 40% versus R-134a per publications.

Automotive Refrigerants Market Recent Developments:

- September 2024: Honeywell launched the Direct to YF Retrofitting Program to enable older cars to transition to Solstice 1234yf low-GWP refrigerant (Honeywell Advanced Materials Newsroom).

- September 2024: Chemours announced development of a low GWP retrofit approach for vehicles using R-134a to Opteon YF (Chemours Newsroom).

- April 2024: Honeywell and Bosch collaborated on low global warming heating and cooling solutions using Solstice 454B in heat pumps (Honeywell Advanced Materials Newsroom).

Automotive Refrigerants Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.340 billion |

| Total Market Size in 2031 | USD 7.590 billion |

| Growth Rate | 7.28% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Refrigerant Type, Vehicle Type, Sales Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Refrigerants Market Segmentation:

-

By Refrigerant Type:

- Introduction

- R-134a

- R-1234yf

- Others

- By Vehicle Type:

- Introduction

- Passenger Vehicle

- Commercial Vehicle

- By Sales Channel:

- Introduction

- Online

- Offline

- By Geography:

- Introduction

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others