Report Overview

Automotive Backup Camera Market Highlights

Automotive Backup Camera Market Size:

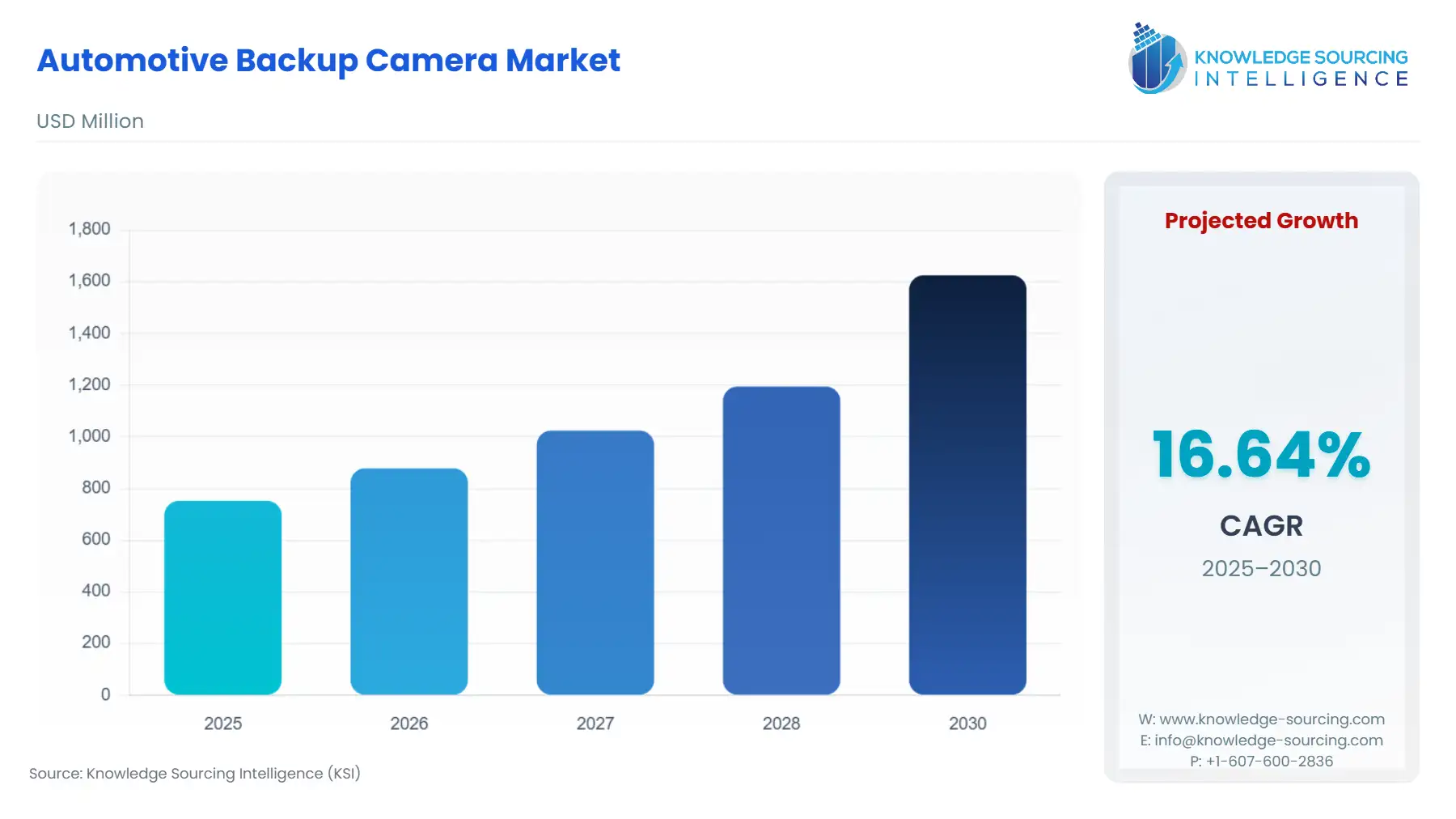

Automotive Backup Camera Market is forecasted to achieve a 16.14% CAGR, reaching USD 1847.517 million in 2031 from USD 752.800 million in 2025.

Automotive Backup Camera Market Trends:

A video camera fastened to the back of a car is referred to as an automotive backup camera, sometimes known as a rear-view camera. It is made primarily to avoid backup collisions and let the driver reverse the car safely. When the car is in reverse gear, it is linked to a display screen that automatically comes on and plays real-time footage of the area behind the vehicle. Automotive backup surveillance systems have been more popular recently since they improve vision and reduce mishaps and accidents by reducing the rear blind areas.

Automotive Backup Camera Market Growth Drivers:

Increasing number of fatalities

According to the World Health Organisation, road traffic accidents, which include accidents caused by reversing a car, are the main cause of mortality for people between the ages of 5 and 29. Each year, 1.3 million people die as a result of road accidents. Additionally, even though low- and middle-income countries have about 60% of the world's vehicles, 93% of road fatalities occur in these nations. Additionally, vehicle accidents cost the majority of the world's economies 3% of their GDP. Due to these issues, there is a greater need for cars with backup cameras for the sake of the driver, passengers, and vehicle safety and security when reversing.

Rising demand for passenger vehicles

The automotive industry is rapidly integrating optical parts for driverless vehicles and advanced driver assistance systems (ADAS). The use of optical isolators can be crucial in guaranteeing dependable interaction among various sensors and control systems, providing enormous market expansion potential. The market for optical isolators has attractive potential due to the rising infrastructure development spending, particularly in emerging economies. The need for optical isolators is being driven by the increasing usage of fiber optic networks and the expansion of telecommunications services in these areas which is increasing the automotive backup camera market share.

Increase in the use of advanced driving systems

Systems and implementations of cutting-edge technology capabilities for cars, trucks, and buses make up autonomous vehicles. Systems like the advanced driving system include several functions including rear blind spot recognition, vehicle guiding while parking, and others that use cameras and sensors to prevent accidents and artificial intelligence to analyze data in real-time. Additionally, deep learning systems and high-performance computation are used to adapt to changing conditions using 3D high-definition maps. To execute the choice regarding the movement, speed, and trajectory of the vehicles, which must be determined during the reversing of the vehicle, the computers are additionally integrated with several sensors, lasers, and cameras.

Rising government regulations

Government legislation from all over the world has mandated the installation of backup cameras in vehicles, which has aided in the expansion of automobile backup cameras globally. Tow trucks and huge trailers, which cover more area on the road when going and require assistance when parking and reversing the vehicle, have wider applicability for backup cameras. Additionally, backup cameras are far more effective and efficient since they prevent accidents brought on by rear blind zones that are invisible to the driver when the car is being reversed.

Automotive Backup Camera Market Restraint:

High installation cost

Automotive backup cameras are expensive to install in pre-existing vehicles. Additionally, newer technologies like advanced driving assistance systems (ADAS) call for pricey cameras for several uses including rear blind spot detection and others. Therefore, it is anticipated that the high cost of installing rear cameras will restrain the market's expansion for car backup cameras, which may impede the automotive backup camera market size.

Automotive Backup Camera Market Geographical Outlook:

North America is projected to have a significant share of the automotive backup camera market

The North American region is anticipated to experience a notable CAGR of the automotive backup camera market during the projected period. The use of autonomous automobiles and other vehicles is increasing quickly across the region as the trend toward automation continues to make deeper inroads into the automotive sector. This is leading to a significant increase in the demand for assisting equipment like cameras and sensors. In addition, several automakers are placing a strong emphasis on the introduction of new autonomous vehicles to meet the rising demand. Autonomous vehicle sales are expected to grow quickly in North America, which will fuel demand for automotive backup cameras, which are essential in these modern cars.

Automotive Backup Camera Companies:

Continental Aktiengesellschaft

DENSO Corporation

HELLA GmbH & Co. KGaA (Hella Stiftung GmbH)

Magna International Inc

Omnivision Technologies Inc.

Automotive Backup Camera Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Automotive Backup Camera Market Size in 2025 | USD 752.800 million |

Automotive Backup Camera Market Size in 2030 | USD 1,625.434 million |

Growth Rate | CAGR of 16.64% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Automotive Backup Camera Market |

|

Customization Scope | Free report customization with purchase |

Key Segment:

By Type

Passenger

Commercial

By Position

Surface Mounted

Flush Mounted

License Mounted

By Sales Channel

OEM

Aftermarket

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others