Report Overview

Battery Monitoring Market - Highlights

Battery Monitoring Market Size:

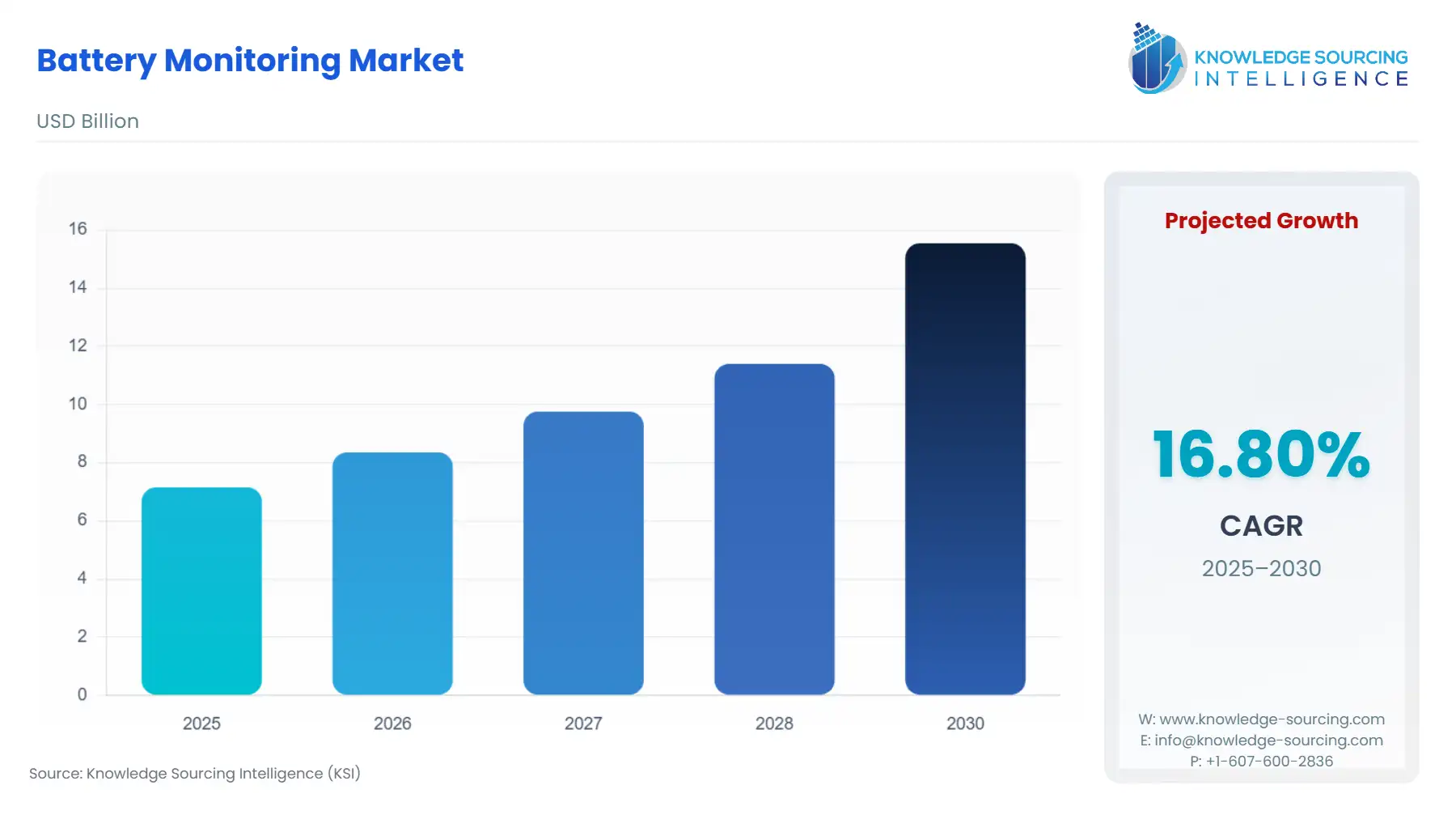

The Battery Monitoring Market is expected to grow from US$7.153 billion in 2025 to US$15.549 billion in 2030, at a CAGR of 16.80%.

The Battery Monitoring Market is characterized by a foundational shift from a simple safety accessory to a mission-critical component integral to energy management, system resilience, and asset valuation. The proliferation of lithium-ion batteries across the automotive and grid sectors imposes a dual mandate on monitoring systems: ensuring absolute safety, particularly preventing thermal runaway incidents, and maximizing the economic life of costly battery assets. Consequently, the demand for high-fidelity, highly integrated monitoring solutions—ranging from dedicated monitoring ICs to enterprise-level software platforms—is directly proportional to the accelerating pace of global electrification. The market's structural growth is therefore less about generalized technological expansion and more about a precise and legally required response to energy density challenges and functional safety requirements imposed by regulatory bodies worldwide.

Battery Monitoring Market Analysis

- Growth Drivers

Strict governmental safety regulations serve as the foremost, non-negotiable catalyst propelling market demand. The implementation of standards like the new Chinese GB 38031-2025 and the international UNECE R100 mandates, which require robust overtemperature and overcharge protection for Electric Vehicle (EV) batteries, compel automotive OEMs to procure advanced monitoring hardware and software to ensure thermal runaway detection and mitigation. Simultaneously, the accelerating deployment of utility-scale Battery Energy Storage Systems (BESS) for grid stability directly drives demand by requiring sophisticated monitoring platforms. These platforms enable utilities and grid operators to maximize energy arbitrage revenue and adhere to grid-level frequency regulation standards, framing the monitoring system not as a cost but as an economic necessity for asset performance.

- Challenges and Opportunities

The primary market challenge is the inherent cost and technical complexity of integrating high-accuracy, multi-cell monitoring ICs, a challenge amplified by the US tariffs imposed on key China-sourced semiconductors and microcontrollers essential for the monitoring hardware. This tariff barrier introduces manufacturing cost volatility and supply chain diversification pressure. Conversely, a significant opportunity exists in the transition to wireless monitoring technology, particularly within the nascent BESS segment. Wireless systems drastically reduce complex wiring harnesses, lowering installation time and material costs for large-scale energy storage projects. This technological shift enables the adoption of Battery Monitoring-as-a-Service (BMaaS) business models, providing service providers with a recurring revenue stream centered on predictive data analytics and remote diagnostic capabilities.

- Raw Material and Pricing Analysis

The essential physical components of a Battery Monitoring System (BMS) are the specialized integrated circuits (ICs), including the cell monitoring ICs (CMICs) and the high-performance microcontrollers (MCUs) that process the voltage, current, and temperature data. These components are fabricated using high-purity silicon wafers and rely heavily on the global semiconductor supply chain for manufacturing and packaging. The pricing of the final hardware module is directly correlated with the prevailing costs and availability of these automotive-grade and high-reliability industrial MCUs. The imposition of escalating US tariffs, specifically a combined rate of over 50% on certain Chinese lithium-ion batteries and related electronic components by 2025, has introduced a substantial structural price increase for manufacturers reliant on these supply chains, thereby driving up the cost of monitoring hardware in the North American and related markets.

- Supply Chain Analysis

The global battery monitoring supply chain is segmented into a three-tiered structure. Tier 2 is dominated by pure-play semiconductor manufacturers like Texas Instruments and NXP, concentrated in Asia-Pacific and North America, which produce the highly specialized monitoring ICs. Tier 1 system integrators, such as ABB and Schneider Electric, procure these chips and integrate them with current sensors, communication modules, and proprietary software to create the final BMS/BMS module. The ultimate end-users are OEMs (Automotive, Energy). A critical logistical bottleneck is the dependence on a limited number of foundries for high-volume, high-reliability IC production. This reliance makes the supply chain highly susceptible to geopolitical trade frictions and manufacturing capacity constraints, forcing Tier 1 suppliers to accelerate localization and dual-sourcing strategies to maintain OEM and BESS project schedules globally.

- Government Regulations: Impact on Market Demand and US Tariff Overview

Regulatory actions, particularly those focused on safety and grid stability, are the singular most powerful driver of demand for battery monitoring solutions. By legally mandating precise thermal and electrical state monitoring, governments globally convert battery monitoring from an optional feature into a critical, non-negotiable safety system. The US tariff environment, which has placed significant duties (e.g., up to 58% on certain EV lithium-ion batteries by 2025) on Chinese-manufactured electronic components, indirectly impacts the monitoring market by raising the baseline cost of the final battery pack, thereby increasing the economic incentive for maximizing the lifespan of the highly tariffed asset through advanced monitoring systems.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

China |

GB 38031-2025 (Safety Requirements for Power Batteries for Electric Vehicles) |

Creates absolute demand for advanced thermal monitoring. The mandate for an alarm within 5 minutes of a thermal event and "No Fire, No Explosion" for 2 hours necessitates highly accurate, redundant voltage and temperature monitoring systems to ensure compliance and occupant safety. |

|

United Nations/EU |

UN ECE R100 (Revision 2) (Safety requirements for Rechargeable Electrical Energy Storage System - REESS) |

Establishes a harmonized, global baseline for battery safety, including requirements for overcharge, over-discharge, and over-temperature protection. This universally drives OEM demand for functionally safe (ISO 26262-compliant) monitoring ICs in all international vehicle platforms. |

|

Germany/EU |

Grid Integration and Frequency Control Directives (e.g., Requirements for FCR/aFRR provision) |

Drives utility-scale demand by requiring Battery Energy Storage Systems (BESS) to provide high-speed ancillary services like frequency regulation. This capability relies entirely on precise, real-time SOC/SOH data from monitoring systems to ensure maximum utilization and financial return. |

|

United States |

US Tariffs on Chinese Lithium-Ion Batteries and Microchips (Section 301) |

Tariffs directly increase the cost of imported battery components and necessary electronic ICs. This cost pressure reinforces the demand for monitoring systems that can reliably extend battery life and validate warranty performance, justifying the higher asset cost. |

Battery Monitoring Market Segment Analysis

- By Type: Wireless

The Wireless battery monitoring segment represents the industry's clear technological evolution, with demand propelled by the rapid scale-up of utility-scale and commercial Battery Energy Storage Systems (BESS). Traditional wired systems require extensive, failure-prone, and labor-intensive wiring harnesses to measure and communicate cell data across large battery racks, adding significant material cost and complexity. Wireless monitoring eliminates these complex harnesses, reducing installation time by up to 80% and mitigating common mode failure points. For a utility implementing a 100MW BESS project, this simplicity is a powerful economic catalyst. The demand is further amplified by the inherent scalability of wireless solutions, allowing grid operators to quickly expand or reconfigure battery stacks without expensive rewiring. Furthermore, wireless protocols enable higher data sampling rates and faster system commissioning, directly enhancing the profitability of BESS by maximizing uptime and ensuring instantaneous response capabilities required for lucrative grid-support ancillary services like frequency regulation. This efficiency and cost reduction directly drive demand over legacy wired systems in all new large-scale deployments.

- By End-User Industry: Automotive

The Automotive end-user segment maintains its position as the largest demand vector, fundamentally driven by the global legislative consensus on Electric Vehicle (EV) safety and the critical role of battery performance in consumer acceptance. The transition from internal combustion engines imposes an unprecedented safety and functional requirement on the battery pack, which is centrally managed by the Battery Monitoring System (BMS). The demand here is not merely for monitoring, but for functional safety. Compliance with standards like China's GB 38031-2025 mandates "no fire, no explosion" for a specified duration after a thermal event, requiring advanced monitoring ICs capable of sub-millivolt accuracy and rapid thermal gradient detection. This necessity for redundancy and precision drives up the demand for multi-cell monitoring ICs and specialized MCUs per vehicle. Additionally, the consumer's dependence on accurate driving range prediction (State of Charge) and the manufacturer’s need for long-term warranty validation (State of Health) ensure that high-fidelity monitoring, supported by complex predictive software algorithms, remains a non-negotiable component procurement for every EV produced globally.

Battery Monitoring Market Geographical Analysis

The global Battery Monitoring Market's geographical distribution is inherently linked to the deployment density of both Electric Vehicles (EVs) and grid-level Energy Storage Systems (ESS), driven by localized energy policies and safety regulations.

- United States Market Analysis (North America)

The US market is experiencing a significant duality in demand. Automotive demand is robust, fueled by OEM investment in domestic EV manufacturing capacity. However, the most dynamic catalyst is the aggressive scale-up of utility-scale and distributed Battery Energy Storage Systems (BESS), particularly in states with high renewable penetration. Federal and state-level incentives, coupled with the need to stabilize grids against extreme weather, generate massive demand for high-end, networked monitoring systems. A critical local factor impacting hardware procurement costs is the complex US tariff regime on Chinese electronic components, which necessitates supply chain diversification and drives a premium on US-assembled or non-tariff-affected monitoring solutions. This cost pressure reinforces the business case for adopting highly accurate monitoring software that maximizes the efficiency and return on the expensive battery assets.

- Brazil Market Analysis (South America)

The Brazilian market is an emerging hub, with demand concentrated in utility-scale energy storage and regulated industrial applications. The primary demand vector is the structural reform of the electric sector, notably the publication of Law No. 15,269/2025, which explicitly regulates and encourages electric energy storage activities. This regulatory clarity, coupled with public consultations for future storage capacity auctions (e.g., the 2026 auction to contract at least 30MW systems), creates tangible, future-guaranteed demand for high-reliability monitoring solutions required to manage these utility assets. EV adoption is nascent but growing, while grid modernization and the necessity to manage generation curtailment from renewables are the more immediate and powerful demand catalysts for advanced ESS monitoring platforms.

- Germany Market Analysis (Europe)

Germany's market demand is characterized by high technological sophistication and grid necessity. The market's stability is driven by EU safety mandates for automotive batteries (UN ECE R100) and the critical role of battery storage in the national Energiewende (energy transition). Demand is intensely focused on large-scale BESS that provide ancillary services like Frequency Containment Reserve (FCR). Regulatory clarifications, such as the German Parliament's move to ease planning rules for battery storage systems outside urban zones (November 2025), directly accelerate BESS deployment. Furthermore, the high degree of industrial automation and decentralized renewable generation creates sustained demand for highly accurate, multi-use monitoring systems capable of managing both grid-connected energy arbitrage and local facility energy optimization.

- South Africa Market Analysis (Middle East & Africa)

The South African market is a key demand nexus in the region, driven primarily by severe power supply instability and the urgent need for backup power solutions. Persistent load shedding creates powerful, non-discretionary demand for industrial and residential battery backup systems, including lithium-ion and traditional lead-acid solutions. This high-frequency cycling and high-stress operation environment necessitates robust monitoring systems to prevent premature battery failure, making the monitoring component an essential investment for asset protection. Demand is bifurcated between high-end, centralized monitoring for telecom tower and data center applications, and a burgeoning, cost-sensitive market for simple monitoring in residential solar-plus-storage installations aimed at ensuring basic energy continuity.

- China Market Analysis (Asia-Pacific)

China commands the world's largest volume demand for battery monitoring, driven by its unparalleled scale in both EV manufacturing and battery production. The regulatory environment acts as the primary demand engine, notably the enforcement of the rigorous GB 38031-2025 safety standard for EV batteries. This "No Fire, No Explosion" rule specifically mandates enhanced thermal monitoring and early warning systems, forcing all domestic and international OEMs to incorporate next-generation, high-performance monitoring ICs. Beyond automotive, the scale of China’s BESS deployment for grid integration and solar/wind power stabilization generates massive, price-competitive demand for modular, highly reliable monitoring hardware, positioning the country as the definitive global benchmark for high-volume supply and technological safety standards.

Battery Monitoring Market Competitive Environment and Analysis

The Battery Monitoring Market exhibits a complex competitive structure. At the component level, it is an oligopoly dominated by large semiconductor firms providing the core ICs. At the system level, it is fragmented, featuring industrial conglomerates, pure-play battery monitoring specialists, and dedicated software firms. Key competitive differentiation revolves around IC accuracy, functional safety compliance, data analytics capabilities, and global distribution logistics.

- Texas Instruments Incorporated

Texas Instruments (TI) maintains a foundational strategic position as a dominant Tier 2 supplier of the core semiconductor hardware—the Battery Management ICs (BMICs) and microcontrollers—that form the central intelligence of all monitoring systems. TI’s competitive edge is rooted in its extensive portfolio, featuring highly specialized components such as the BQ41Z90 and BQ41Z50 fuel gauges with their patented Dynamic Z-Track™ algorithm. This innovation, which was introduced in a product announcement in July 2025, enables precise State of Charge (SOC) and State of Health (SOH) accuracy within 1% error, directly addressing the critical demand for maximizing battery run time and lifespan in high-stress applications like e-mobility and advanced electronics. TI’s strategy is to deliver the highest-accuracy silicon solutions that simplify integration for Tier 1 partners and meet the stringent functional safety requirements (e.g., ISO 26262) mandated by automotive and industrial customers.

- ABB Ltd.

ABB Ltd. competes primarily at the system and solution level within the Energy and Power end-user industry, leveraging its vast expertise in electrification and automation. Their strategy centers on providing end-to-end Battery Energy Storage Systems (BESS) solutions, where the monitoring and control software are key differentiators. In May 2025, ABB introduced its Battery Energy Storage Systems-as-a-Service (BESS-as-a-Service) offering. This strategic launch shifts the customer value proposition from capital expenditure (CapEx) to operational expenditure (OpEx). The BESS-as-a-Service model includes all hardware, software, maintenance, and optimization, underpinned by the company's advanced monitoring software that manages deployment and energy trading. This directly drives demand for their integrated monitoring platform by removing the financial barriers for industrial and commercial businesses seeking energy resilience and participation in ancillary grid services.

- Schneider Electric SE

Schneider Electric SE is a major player in industrial and commercial energy management, and its battery monitoring strategy is deeply integrated into its broader EcoStruxure platform. The company targets the energy and power and industrial segments, focusing on providing intelligent, scalable battery storage and monitoring solutions for microgrids and commercial buildings. A key verifiable product launch is the Schneider Boost Pro Battery Energy Storage Solution, announced in October 2025. This solution is specifically designed for buildings, scalable from 200 kWh to 2 MWh, and includes certified cybersecurity and AI-driven insights that integrate with their EcoStruxure Microgrid Advisor software. This offering directly creates demand by providing commercial and industrial customers with the tools for self-consumption optimization and peak tariff management, all of which rely on the high-fidelity data provided by the integrated battery monitoring and analytics.

Battery Monitoring Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Battery Monitoring Market Size in 2025 | US$7.153 billion |

| Battery Monitoring Market Size in 2030 | US$15.549 billion |

| Growth Rate | CAGR of 16.80% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Battery Monitoring Market |

|

| Customization Scope | Free report customization with purchase |

Battery Monitoring Market Segmentation

By Type:

- Wired

- Wireless

By Component:

- Hardware

- Software

By Battery Type:

- Lithium Ion

- Lead Acid

- Others

By End-Users Industry:

- Automotive

- Consumer Electronics

- Energy and Power

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others