Report Overview

Brazil Electric Commercial Vehicles Highlights

Brazil Electric Commercial Vehicles Market Size:

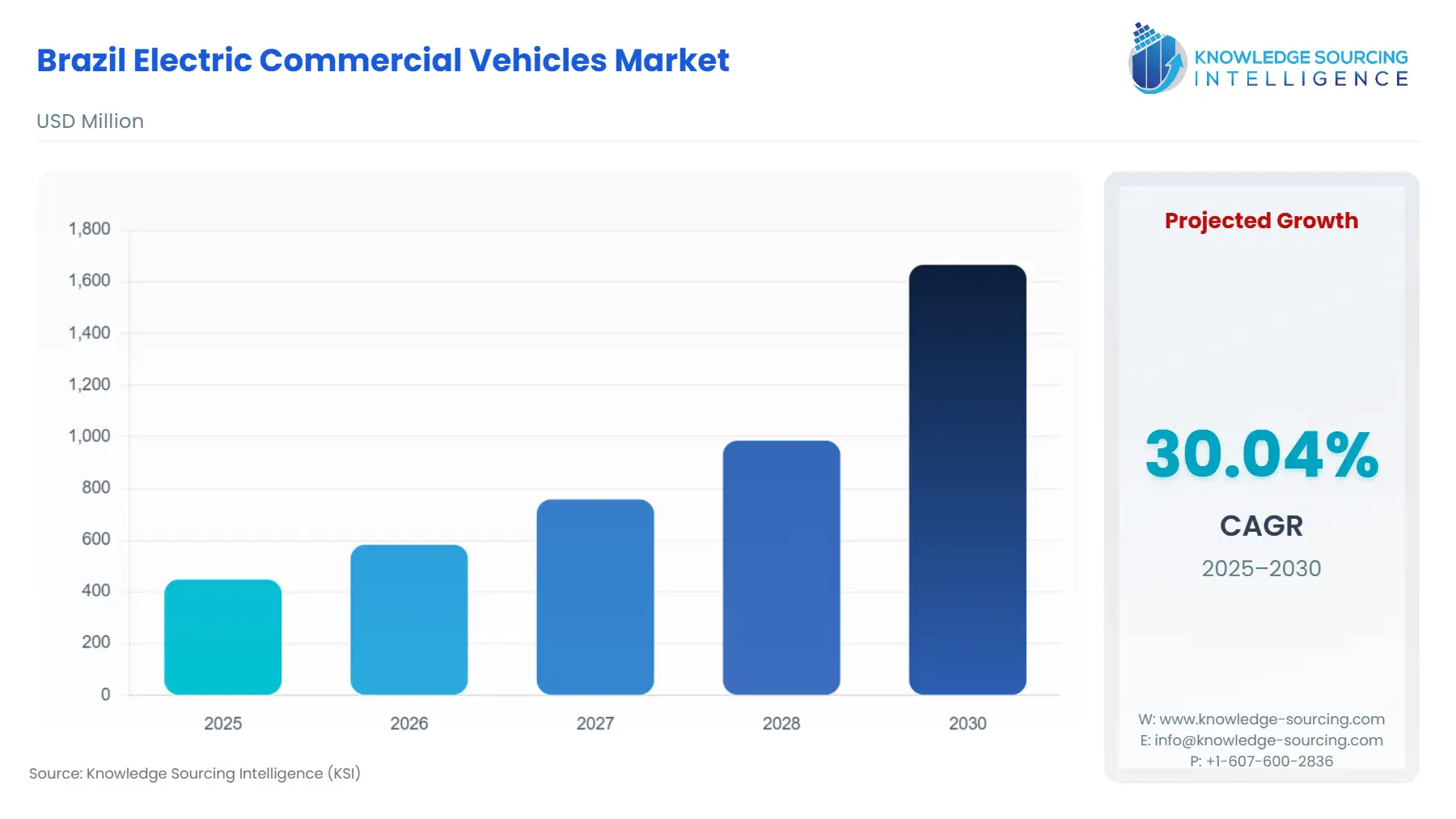

The Brazil Electric Commercial Vehicles Market is anticipated to expand at a CAGR of 30.04%, reaching USD 1.666 billion in 2030 from USD 0.448 billion in 2025.

The Brazilian Electric Commercial Vehicles (eCV) market is in an accelerated phase of transition, moving decisively past the pilot stage and into scaled commercial deployment. This shift is characterized by record sales growth in the broader electric vehicle category and strategic national policies aimed at domestic industrialization. The market's current dynamic reflects a convergence of private capital, driven by original equipment manufacturers (OEMs) and logistics operators, with supportive regulatory frameworks. This confluence establishes a critical demand floor, particularly within urban logistics and public transit sectors, where zero-emission mandates and total cost of ownership (TCO) advantages for electric fleets are becoming undeniable.

Brazil Electric Commercial Vehicles Market Analysis:

- Growth Drivers

The mandate for sustainable urban transport acts as a direct growth catalyst. The potential for electric bus adoption across major metropolitan areas to displace over 14,000 existing diesel units provides a substantial, measurable demand reservoir for the Buses and Coaches segment. This replacement imperative is driven by local air quality objectives and the economic viability of e-buses, which offer significantly lower energy consumption, as much as 28% of a diesel bus's consumption in some city simulations, creating a compelling TCO proposition that increases procurement requirements from concessionaires. Furthermore, the expansion of the recharging infrastructure, which exceeded 12,000 public charging stations as of late 2024, alleviates operational range anxiety for logistics companies, directly increasing the addressable market and thus the demand for Light-Duty Trucks and Vans in urban delivery cycles.

- Challenges and Opportunities

A primary challenge facing the eCV market is the high initial acquisition cost of electric vehicles compared to their conventional diesel counterparts. This cost differential creates a significant capital constraint, temporarily depressing demand, particularly among smaller fleet operators. The opportunity lies in leveraging financing and public-private partnerships. Coordinated public procurement initiatives are crucial to provide the scale and predictability necessary to lower unit costs and stimulate the national industry, transforming current high-cost barriers into future economies of scale. Another opportunity is in strengthening domestic manufacturing: industrial policies that stimulate local production capacity for key EV components, such as batteries, would mitigate import dependency risks and solidify long-term demand by stabilizing component pricing.

- Raw Material and Pricing Analysis

The electric commercial vehicle market, being a physical product market, is intrinsically linked to the supply chain of critical battery raw materials. The high cost of batteries, driven by materials like lithium, nickel, and cobalt, currently constitutes a substantial portion of the vehicle's final price. Brazil holds significant nickel reserves (an estimated 89,000 tonnes produced in 2023) and is a potential player in lithium mining, which offers an opportunity for supply chain localization. Investments by major OEMs in Brazilian nickel operations aim to de-risk the supply chain and stabilize long-term input costs. While the cathode active material (CAM) remains the single most expensive battery component, the concentration of domestic sourcing for key minerals provides a future lever to manage and eventually reduce overall ECV pricing, thereby stimulating mass-market adoption and greater fleet demand.

- Supply Chain Analysis

The eCV supply chain in Brazil is characterized by a reliance on global imports for core electric powertrain components, predominantly from Asia, creating logistical and geopolitical dependencies. The main domestic production hubs for eCVs are situated in the Southeast, notably São Paulo state, where major assembly plants and battery production facilities have been established or announced. Logistical complexities stem from the long-distance transport of battery cells and modules. The key dependency is on the midstream battery manufacturing segment. To mitigate this, companies are forming consortia (such as the VW e-Consórcio) to integrate logistics, charging infrastructure, and battery management, aiming to establish a localized, full-cycle e-mobility ecosystem.

Brazil Electric Commercial Vehicles Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Federal |

Programa Mobilidade Verde e Inovação (MOVER) (Law ? 14.902, June 2024) |

Regulates vehicle emissions and provides production incentives for low-emission vehicles. Directly drives OEM investment toward ECV production, accelerating the introduction of new models and increasing supply to meet latent commercial demand. |

|

Municipal (e.g., São Paulo) |

Urban Mobility Plans / Fleet Renewal Mandates |

Requires bus concessionaires to gradually replace older, high-emission diesel fleets with zero-emission alternatives. Creates a mandatory, phased demand for electric buses in the Public Transportation application segment. |

|

State (e.g., Bahia, São Paulo) |

Tax Incentives (IPVA Exemptions/Reductions) |

State-level tax benefits on the annual vehicle tax (IPVA) lower the operating cost of electric vehicles. This fiscal advantage reduces the TCO gap, making ECVs a more financially appealing option for fleet managers and thus boosting demand. |

Brazil Electric Commercial Vehicles Market Segment Analysis:

- By Application: Public Transportation

The Public Transportation segment is positioned as a primary growth epicenter for the Brazil ECV market. This necessity is not merely opportunistic; it is structurally driven by municipal legislation and an economic imperative to reduce long-term operational costs. City halls across Brazil, particularly in densely populated metropolitan areas, are implementing fleet renewal mandates aimed at improving local air quality, which directly translates into a non-negotiable demand for zero-emission buses. Electric buses, despite their high initial capital outlay, generate significant annual savings due to lower energy consumption (aided by Brazil's renewable energy matrix) and reduced maintenance requirements compared to Euro V and older diesel fleets. The sheer scale of the potential replacement market—over 14,000 compatible diesel buses identified in major systems—ensures sustained procurement demand over the next decade. Major cities have closed partnerships with energy providers (e.g., ENEL in São Paulo) to finance acquisitions and charging infrastructure, de-risking the transition for concessionaires and providing a clear path for large-scale electric bus chassis orders.

- By Vehicle Type: Trucks

The Truck segment, particularly the Light-Duty and Medium-Duty categories, is experiencing rising demand, primarily catalyzed by the accelerating electrification of Logistics and Transportation in urban centers. This shift is driven by large retail and logistics corporations, who possess stringent internal sustainability goals and require last-mile delivery vehicles compliant with potential future low-emission urban zones. Volkswagen Caminhões e Ônibus's pioneering launch of the 100% electric VW e-Delivery, which was fully developed and manufactured in Brazil, validates the market and creates a domestic supply source, directly stimulating demand from corporate fleet buyers like Coca-Cola FEMSA Brasil. The e-Consórcio model, which bundles the vehicle, charging infrastructure, and full lifecycle services, significantly lowers the complexity barrier for fleet adoption. This integrated solution de-risks the transition and propels demand for electric light-duty and medium-duty trucks used in metropolitan distribution.

Brazil Electric Commercial Vehicles Market Competitive Analysis:

The Brazilian eCV competitive landscape is rapidly evolving, shifting from a primarily import-driven model to one with significant local manufacturing presence. Competition is intensifying between established domestic manufacturers and global players, particularly those from Asia who are making major investment announcements.

- Volkswagen Caminhões e Ônibus (VWCO): VWCO is strategically positioned as a pioneer in domestic ECV production, leveraging its well-established local manufacturing base in Resende, Rio de Janeiro. Their key product, the VW e-Delivery, is the first 100% electric truck to be developed, tested, and manufactured entirely in Brazil. This vehicle, offered in 11- and 14-ton Gross Vehicle Weight versions, is backed by the innovative e-Consórcio, an ecosystem that integrates the supply chain, charging infrastructure (with partners like ABB and Siemens), and battery lifecycle management. This comprehensive, de-risked approach is designed to capture corporate fleet demand.

- BYD Company Ltd.: BYD’s strategy is built on deep integration and local manufacturing capacity. With a factory in Campinas, São Paulo, operational since 2015 for bus chassis and battery packs, and a massive new investment announced for three factories in Bahia in 2023, BYD is moving to a significant localization model. Key products include electric bus chassis and plans for electric truck manufacturing. Their control over battery technology (Iron-Phosphate, LiFePO4) and local production capacity positions them to offer competitive pricing and stable supply, making them a formidable competitor in the Buses and Coaches segment, with major deliveries already committed to cities like São Paulo.

Brazil Electric Commercial Vehicles Market Developments:

- August 2025: Volvo Buses secured a landmark order to supply a fleet of 21 electric buses, including 16 articulated and five bi-articulated models, for the BRT system in Goiânia. The bi-articulated chassis, designated the Volvo BZRT, is particularly significant as the city is set to become the first in the world to operate this 28-meter-long, 100% electric model in regular service, capable of carrying up to 250 passengers with zero CO2 emissions and low noise levels. The vehicles are part of the initial batch produced at Volvo's industrial complex in Curitiba, Brazil, marking a key milestone in localized electric bus manufacturing and high-capacity sustainable urban transport solutions.

- July 2025: BYD officially rolled its first 100% electric vehicle off the production line at its massive new manufacturing complex in Camaçari, Bahia, which is being built on a former Ford site. While this first vehicle was a passenger car (Dolphin Mini), the R$5.5 billion complex is set to include three facilities, with one specifically focusing on chassis production for electric buses and trucks, indicating a significant commitment to localizing commercial EV supply chains. This move, which began in the first half of 2025, positions BYD to scale its commercial vehicle offerings across Brazil and mitigate future import tariffs, with the plant expected to reach an initial annual capacity of 150,000 vehicles.

- October 2023: Iberdrola, through Neoenergia, deployed electric trucks for network maintenance work in Brazil. The vehicles, based on the BYD T7 truck, were specially fitted with electro-hydraulic overhead baskets and an opportunity recharging system that connects to the distributor’s electrical network. This R&D and innovation project marks a new application for medium-duty ECVs in the utility sector.

Brazil Electric Commercial Vehicles Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 0.448 billion |

| Total Market Size in 2031 | USD 1.666 billion |

| Growth Rate | 30.04% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Vehicle Type, Propulsion Type, Power Output, Application |

| Companies |

|

Brazil Electric Commercial Vehicles Market Segmentation:

- BY VEHICLE TYPE

- Buses and Coaches

- Trucks

- Light-Duty Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

- Vans

- BY PROPULSION TYPE

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicles (FCEV)

- BY POWER OUTPUT

- Up to 150 kW

- 150-250 kW

- Above 250 kW

- BY APPLICATION

- Logistics and Transportation

- Public Transportation

- Construction (Excavators, Loaders, Others)

- Mining

- Agriculture (Tractors, Harvesters, Others)

- Others